First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) ("First Atlantic" or the "Company") is excited to report assay results from drill hole AN-24-05, the fourth and final hole of the Phase 1 drilling program at the RPM Zone, located within its 100%-owned Atlantic Nickel Project in central Newfoundland. This hole, positioned as a 400-meter step-out to the north of the initial discovery hole (AN-24-02), intersected 396 meters grading 0.23% nickel and 0.29% chromium, starting after 6 meters of overburden and continuing to the end of the hole. These results confirm an initial 400-meter north-south mineralized strike length of near surface mineralization.

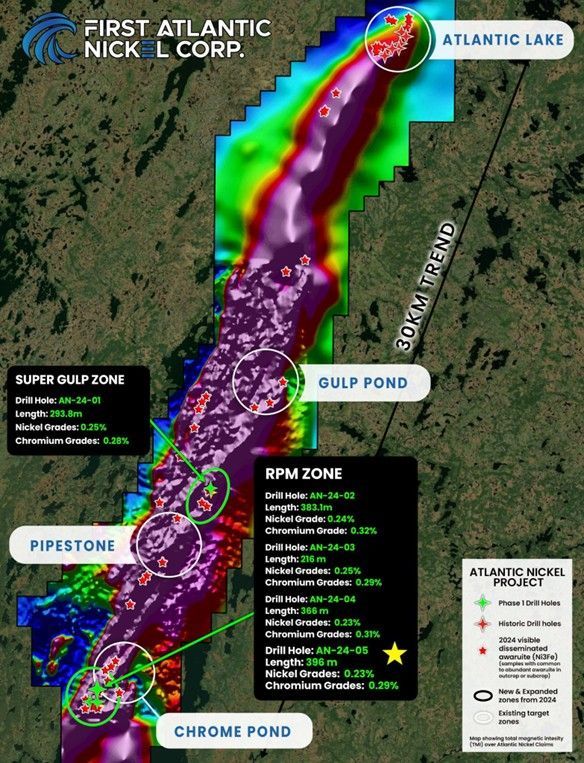

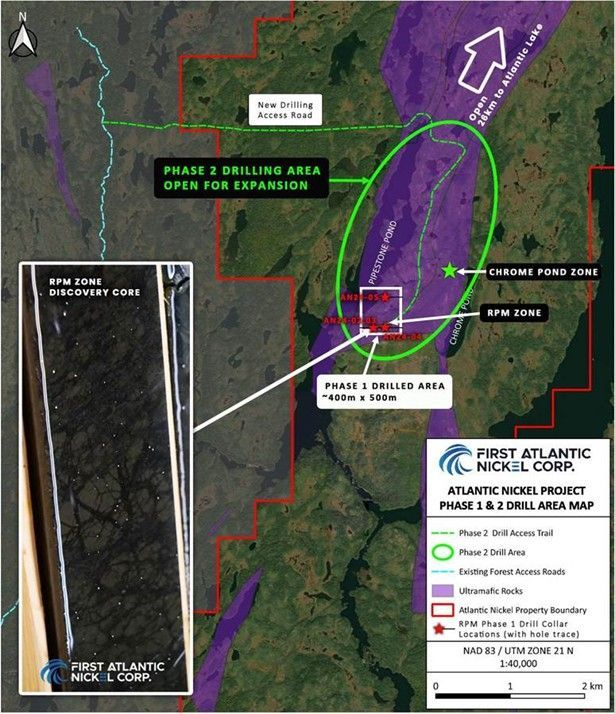

Together with the three prior Phase 1 holes, AN-24-05 delineates a 400-meter by 500-meter mineralized footprint at the RPM zone, averaging 0.23% nickel. Notably, all Phase 1 Drill holes ended in mineralization, indicating substantial potential for further expansion. Phase 2 drilling commenced on May 7, 2025, is currently underway, targeting extensions of the RPM Zone in multiple directions: northward toward Pipestone Pond, eastward toward Chrome Pond, and westward into a fault zone, where hole AN-24-03 intersected increasing nickel grades associated with a newly discovered fault zone. Davis Tube Recovery (DTR) metallurgical test results for holes AN-24-04 and AN-24-05 are pending. Situated within the Company's 30-kilometer ultramafic ophiolite nickel trend, the RPM Zone lies 12 km south of Super Gulp Zone and 26 km south of the Atlantic Lake Zone, reinforcing the broader district-scale potential for multiple nickel discoveries across this underexplored belt.

Highlights

- Final Phase 1 RPM Hole : Drill hole AN-24-05, a 400-meter step-out north from discovery hole AN-24-02, intersected 396 meters grading 0.23% nickel and 0.29% chromium. Mineralization began just below 6 meters of overburden and continued through the end of the hole at 402 meters, ending in mineralization. These results confirm an initial 400-meter north-south mineralized strike length at the RPM Zone.

- Initial 400 x 500 Meter Zone Defined : Assay results from all four Phase 1 holes confirm a 400-meter by 500-meter mineralized footprint, averaging 0.23% nickel. Importantly, each hole ended in mineralization, highlighting the potential for expansion in all directions.

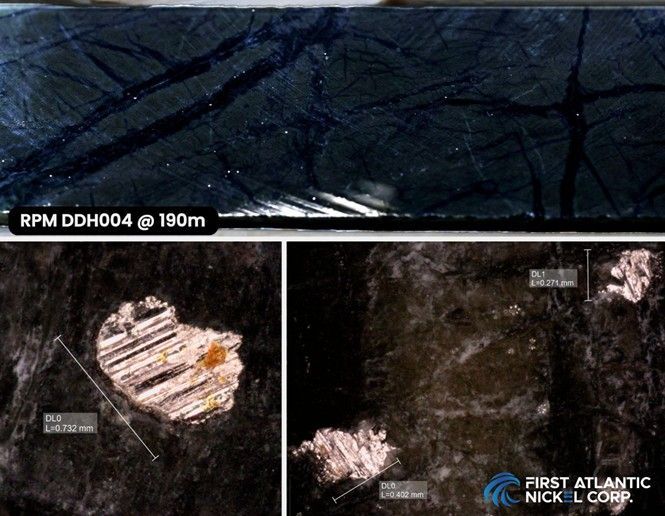

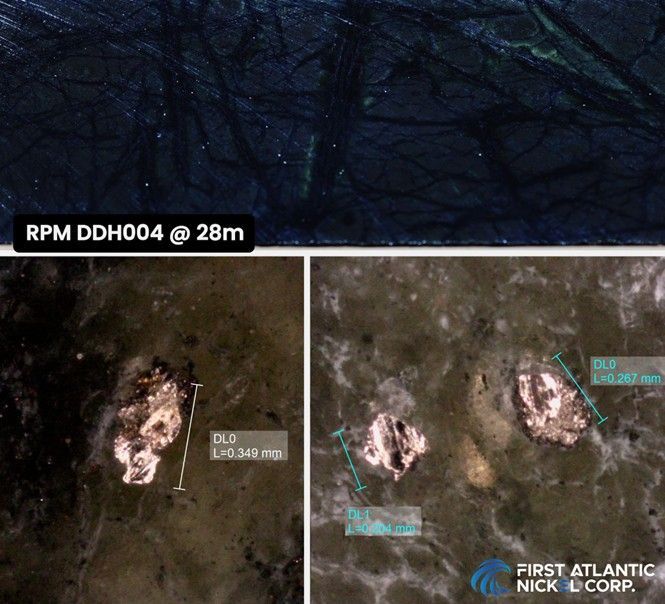

- Consistent Awaruite Nickel Mineralization : Large-grained, visibly disseminated awaruite was observed throughout drill hole AN-24-05, consistent with all Phase 1 holes at RPM Zone.

- Phase 2 Drilling Commenced : The fully funded Phase 2 program, announced on May 7, 2025, is designed to test extensions of the RPM Zone in multiple directions, northward toward Pipestone Pond, eastward toward Chrome Pond, and westward into a fault zone, where drill hole AN-24-03 returned 0.27% nickel and 0.15% DTR Ni% over the final 21 meters.

- Metallurgical Testing Underway : Davis Tube Recovery (DTR) testing is currently underway for drill holes AN-24-04 and AN-24-05 to evaluate magnetically recoverable nickel content and assess the material's suitability for commercial-scale magnetic separation processing.

- District-Scale Potential: The RPM Zone lies within a 30-kilometer-long nickel trend hosted within the Pipestone Ophiolite Complex. Historic drilling at Atlantic Lake, combined with recent discoveries at Super Gulp and the RPM Zone, has confirmed the presence of awaruite mineralization in drill core across a 26-kilometer strike length within the Atlantic Nickel Project. These results underscore the significant exploration upside across the 30 km district scale system.

RPM Zone: Drill Hole AN-24-05 Overview

Drill hole AN-24-05, the fourth and final hole of the RPM Zone Phase 1 program, was drilled in an eastward direction, approximately 400 meters north of the initial discovery hole AN-24-02, targeting the northward extension of mineralization toward Pipestone Pond. The hole reached a depth of 402 meters, intersecting serpentinized peridotite hosting disseminated awaruite nickel mineralization after 6 meters of overburden to the end of the drill hole. Assay results returned an average of 0.23% nickel and 0.29% chromium over 396 meters, with peak values reaching 0.29% nickel and 0.55% chromium. Importantly, the hole ended in mineralization, indicating further expansion potential eastward and at depth, towards Chrome Pond.

Large, visible awaruite grains were disseminated throughout AN-24-05, consistent with observations from the prior three Phase 1 holes at the RPM Zone. Collectively, Phase 1 drilling has defined a 400-meter by 500-meter mineralized zone, averaging 0.23% nickel, with continuous awaruite mineralization intersected in all four holes. As each Phase 1 hole ended in mineralization, the RPM Zone presents considerable opportunity for further expansion in all directions as part of the ongoing Phase 2 drilling program.

Table 1: AN-24-05 Drilling Assay Results

| Hole ID | From (m) | To (m) | Interval (m) | Ni (%) | Cr (%) |

| AN-24-05 | 6 | 402 | 396 | 0.23 | 0.29 |

| including | 6 | 87 | 81 | 0.23 | 0.30 |

| including | 87 | 192 | 105 | 0.24 | 0.30 |

| including | 192 | 297 | 105 | 0.24 | 0.28 |

| including | 297 | 402 | 105 | 0.22 | 0.28 |

| including "up to" | 0.29 | 0.55 |

Table 2: AN-24-05 Drill Hole Collar Location Information

| Hole ID | Easting (UTM) | Northing (UTM) | Elevation (m) | Azimuth (°) | Dip (°) | Depth (m) |

| AN-24-05 | 567322 | 5357995 | 230 | 90 | -60 | 402 |

Figure 1: Map of the 30-kilometer-long nickel trend within the Pipestone Ophiolite Complex, illustrating the locations of Phase 1 drill holes (AN-24-01 through AN-24-05) and corresponding nickel and chromium assay results. The map highlights the spatial distribution of mineralized intercepts and outlines key target areas for ongoing Phase 2 drilling, including Pipestone Pond, Chrome Pond, and the RPM Zone.

Phase 2 Program

First Atlantic launched its fully funded Phase 2 program on May 7, 2025, employing a high-powered drill rig with NQ/HQ core capabilities to boost efficiency and depth capacity.

The Phase 2 program is designed to achieve the following key objectives:

- Extend the 400-meter by 500-meter mineralized footprint through step-out drilling northward toward Pipestone Pond, eastward toward Chrome Pond, and westward into the fault zone, where AN-24-03 intersected 0.27% nickel and 0.15% DTR Ni% over its final 21 meters.

- Explore deeper mineralization to increase the vertical extent and overall volume of the RPM Zone.

- Assess geological continuity between RPM, Pipestone, and Chrome Pond, with the aim of outlining a larger, interconnected mineralized system.

- Conduct systematic prospecting across the 30-kilometer ultramafic ophiolite trend to identify additional awaruite targets.

Phase 2 drilling aims to expand on the Phase 1 discovery at the RPM Zone, which established an initial mineralized area at-least 400 meters in strike length and 500 meters in lateral width. Strategic step-out drilling in all directions and targeting greater depths will test the expansion potential of the RPM Zone. Enhanced by full road access and a more powerful drill rig, Phase 2 is expected to achieve significant cost efficiencies and faster drilling times.

Figure 2: Phase 2 drilling plan map highlighting the RPM drilling zone area (circled in green), showing the Phase 1 discovery hole locations, which defined mineralization over at least a 400-meter by 500-meter area and remains open for expansion in multiple directions.

Figure 3: RPM Hole 4 Drill Core (AN-24-05) at 190 meters depth. Top image: Drill core showing disseminated awaruite (sulfur-free nickel alloy), in serpentinized ultramafic peridotite within the RPM Zone. Bottom images: Awaruite grains from 190 meters depth (up to 732 microns) under microscope, with saw blade streaks visible due to ductile, highly-magnetic nature of awaruite.

Figure 4: RPM Hole 4 (AN-24-05) drill core, at 28 meters depth. Top image: Disseminated awaruite (sulfur-free nickel alloy) in serpentinized peridotite with magnetite veins. Bottom images: Awaruite grains (up to 349 microns) under a microscope at 28 meters depth.

Figure 5: RPM Hole 4 Drill Core (AN-24-05) at 401 meters depth. Top image: Abundant, visibly disseminated awaruite grains (typically 50-100 microns, with some up to 323 microns). Bottom image: Awaruite grains from RPM DDH004 at 401 meters depth under a microscope, showing grains well above 10-micron size required for effective magnetic separation and recovery.

Metallurgical Program

Davis Tube Recovery (DTR) testing is underway for drill holes AN-24-04 and AN-24-05, the third and fourth RPM Zone holes, to quantify magnetically recoverable nickel and confirm suitability for commercial-scale magnetic separation. Initial DTR results from Phase 1 holes AN-24-02 and AN-24-03 produced magnetic concentrates averaging ~1.35% nickel with a ~9.5% mass pull and magnetically recoverable nickel grades averaging ~0.12% (ranging from 0.10% to 0.16%). These findings, paired with large-grain awaruite (up to 1,000 microns), support a low-energy, smelter-free processing flowsheet using magnetic separation, followed by flotation, to yield a high-grade nickel concentrate. Pending DTR results for AN-24-04 and AN-24-05 are expected to further refine the Company's metallurgical approach, aligning with sustainable development objectives and North America's critical minerals strategy.

Corporate Update

The Company also announces that all the resolutions considered at its Annual General and Special Meeting held on May 13, 2025 (the "Meeting") were approved by the Company's shareholders.

At the Meeting, the Company's shareholders approved the following resolutions:

- fixing the number of directors comprising the Company's board of directors (the "Board") for the ensuing year at three (3);

- electing Adrian Smith; Kostantinos Tsoutsis and Mike Collins as directors of the Company, each to hold office until the close of the next annual meeting of shareholders or until their successors are elected or appointed;

- re-appointing Dale Matheson Carr Hilton Labonte LLP, Chartered Professional Accountants as the auditor of the Company for the ensuing year and authorizing the Board to fix the auditors remuneration;

- approving certain amendments to the Company's Omnibus Long Term Incentive Plan to align with the policies of the TSX Venture Exchange.

Further details regarding the resolutions are available in the Company's management information circular, dated April 7, 2025, which can be found under the Company's SEDAR+ profile at www.sedarplus.ca .

The Company also announces that Mr. Sang Goo (Collin) Kim and Mr. Ken KM Chung did not stand for re-election to the Board. First Atlantic extends its sincere appreciation to Mr. Kim and Mr. Chung for their dedicated service and valuable contributions to the Company. We wish them continued success in all their future endeavors.

Awaruite (Nickel-iron alloy Ni₂Fe, Ni₃Fe)

Awaruite, a naturally occurring sulfur-free nickel-iron alloy composed of Ni₃Fe or Ni₂Fe with approximately ~75% nickel content, offers a proven and environmentally safe solution to enhance the resilience and security of North America's domestic critical minerals supply chain. Unlike conventional nickel sources, awaruite can be processed into high-grade concentrates exceeding 60% nickel content through magnetic processing and simple floatation without the need for smelting, roasting, or high-pressure acid leaching 1 . Beginning in 2025, the US Inflation Reduction Act's (IRA) $7,500 electric vehicle (EV) tax credit mandates that eligible clean vehicles must not contain any critical minerals processed by foreign entities of concern (FEOC) 2 . These entities include Russia and China, which currently dominate the global nickel smelting industry. Awaruite's smelter-free processing approach could potentially help North American electric vehicle manufacturers meet the IRA's stringent critical mineral requirements and reduce dependence on FEOCs for nickel processing.

The U.S. Geological Survey (USGS) highlighted awaruite's potential, stating, "The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel" 3 . Awaruite's unique properties enable cleaner and safer processing compared to conventional sulfide and laterite nickel sources, which often involve smelting, roasting, or high-pressure acid leaching that can release toxic sulfur dioxide, generate hazardous waste, and lead to acid mine drainage. Awaruite's simpler processing, facilitated by its amenability to magnetic processing and lack of sulfur, eliminates these harmful methods, reducing greenhouse gas emissions and risks associated with toxic chemical release, addressing concerns about the large carbon footprint and toxic emissions linked to nickel refining.

Figure 6: Quote from USGS on Awaruite Deposits in Canada

The development of awaruite resources is crucial, given China's control in the global nickel market. Chinese companies refine and smelt 68% to 80% of the world's nickel 4 and control an estimated 84% of Indonesia's nickel output, the largest worldwide supply 5 . Awaruite is a cleaner source of nickel that reduces dependence on foreign processing controlled by China, leading to a more secure and reliable supply for North America's stainless steel and electric vehicle industries.

Investor Information

The Company's common shares trade on the TSX Venture Exchange under the symbol " FAN ", the American OTCQB Exchange under the symbol " FANCF " and on several German exchanges, including Frankfurt and Tradegate, under the symbol " P21 ".

Investors can get updates about First Atlantic by signing up to receive news via email and SMS text at www.fanickel.com . Stay connected and learn more by following us on these social media platforms:

https://www.facebook.com/fanickelcorp

https://www.linkedin.com/company/firstatlanticnickel/

FOR MORE INFORMATION:

First Atlantic Investor Relations

Robert Guzman

Tel: +1 844 592 6337

rob@fanickel.com

Disclosure

Adrian Smith, P.Geo., a director and the Chief Executive Officer of the Company is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein.

Analytical Method & QAQC

Samples were split in half on site with one half remaining in the core box for future reference and one half packaged in secure bags. QAQC method included the use of blanks, duplicates and certified reference material (standards) with one being inserted once in every 20 samples in order to test the precision and accuracy of the lab. All results passed the QA/QC screening at the lab, and all company inserted standards and blanks returned results that were within acceptable limits.

Samples were sent to SGS Canada in Lakefield, ON. SGS is an ISO 17025 certified lab, accredited and acting independently from First Atlantic Nickel Corp. Each sample is pulverized to 95% passing 74 microns (200 mesh). A 30g sub-sample is passed through a Davis Tube to separate the sub-sample into magnetic and non-magnetic fractions. Both the whole rock sample and the magnetic fraction are analyzed by sodium peroxide fusion with ICP-AES finish for major oxides and trace elements including nickel, chromium and cobalt. One in ten samples are tested for sulphur content.

True widths are currently unknown. However, the nickel bearing ultramafic ophiolite and peridotite rocks being targeted and sampled in the Phase 1 drilling program at the Atlantic Nickel Project are mapped as several hundred meters to over 1 kilometer wide and approximately 30 kilometers long.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company developing the 100%-owned Atlantic Nickel Project, a large-scale nickel project strategically located near existing infrastructure in Newfoundland, Canada. The Project's nickel occurs as awaruite, a natural nickel-iron alloy containing approximately 75% nickel with no-sulfur and no-sulfides. Awaruite's properties allow for smelter-free magnetic separation and concentration, which could strengthen North America's critical minerals supply chain by reducing foreign dependence on nickel smelting. This aligns with new US Electric Vehicle US IRA requirements, which stipulate that beginning in 2025, an eligible clean vehicle may not contain any critical minerals processed by a FEOC (Foreign Entities Of Concern) 6 .

First Atlantic aims to be a key input of a secure and reliable North American critical minerals supply chain for the stainless steel and electric vehicle industries in the USA and Canada. The company is positioned to meet the growing demand for responsibly sourced nickel that complies with the critical mineral requirements for eligible clean vehicles under the US IRA. With its commitment to responsible practices and experienced team, First Atlantic is poised to contribute significantly to the nickel industry's future, supporting the transition to a cleaner energy landscape. This mission gained importance when the US added nickel to its critical minerals list in 2022, recognizing it as a non-fuel mineral essential to economic and national security with a supply chain vulnerable to disruption.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to: expectations regarding the timing, scope, and results of the Company's Phase 1 and Phase 2 work and drilling programs; future project developments; the Company's objectives, goals, and future plans; statements and estimates of market conditions; the potential for Newfoundland and Labrador to emerge as a clean energy leader; the viability of magnetic separation as a low-impact processing method for awaruite; the strategic and economic implications of the province's geological features in supporting the clean energy transition, statements regarding the results of the Meeting; expectations regarding future developments and strategic plans; the composition and role of the board of directors. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining and clean energy industries. Additional factors and risks including various risk factors discussed in the Company's disclosure documents which can be found under the Company's profile on http://www.sedarplus.ca. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

___________________________

1 https://fpxnickel.com/projects-overview/what-is-awaruite/

2 https://home.treasury.gov/news/press-releases/jy1939

3 https://d9-wret.s3.us-west-2.amazonaws.com/assets/palladium/production/mineral-pubs/nickel/mcs-2012-nicke.pdf

4 https://www.brookings.edu/wp-content/uploads/2022/08/LTRC_ChinaSupplyChain.pdf

5 https://web.archive.org/web/20250417033842/https://www.airuniversity.af.edu/JIPA/Display/Article/3703867/the-rise-of-great-mineral-powers/

6 https://home.treasury.gov/news/press-releases/jy1939

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3d590854-7e13-413a-8e5d-8181655d1184

https://www.globenewswire.com/NewsRoom/AttachmentNg/d7f5ac48-6888-4732-b3a9-30aaf6e26a71

https://www.globenewswire.com/NewsRoom/AttachmentNg/5933e72f-7464-42c8-9a84-64e64fc675b1

https://www.globenewswire.com/NewsRoom/AttachmentNg/95ea01d0-d6bf-494f-b4bb-2fba9c7e2b32

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d29cfff-800c-47e0-b49b-5e4e59fc00c4

https://www.globenewswire.com/NewsRoom/AttachmentNg/c0ea9ee4-da21-433a-852e-b87eb7b45f7b