June 24, 2025

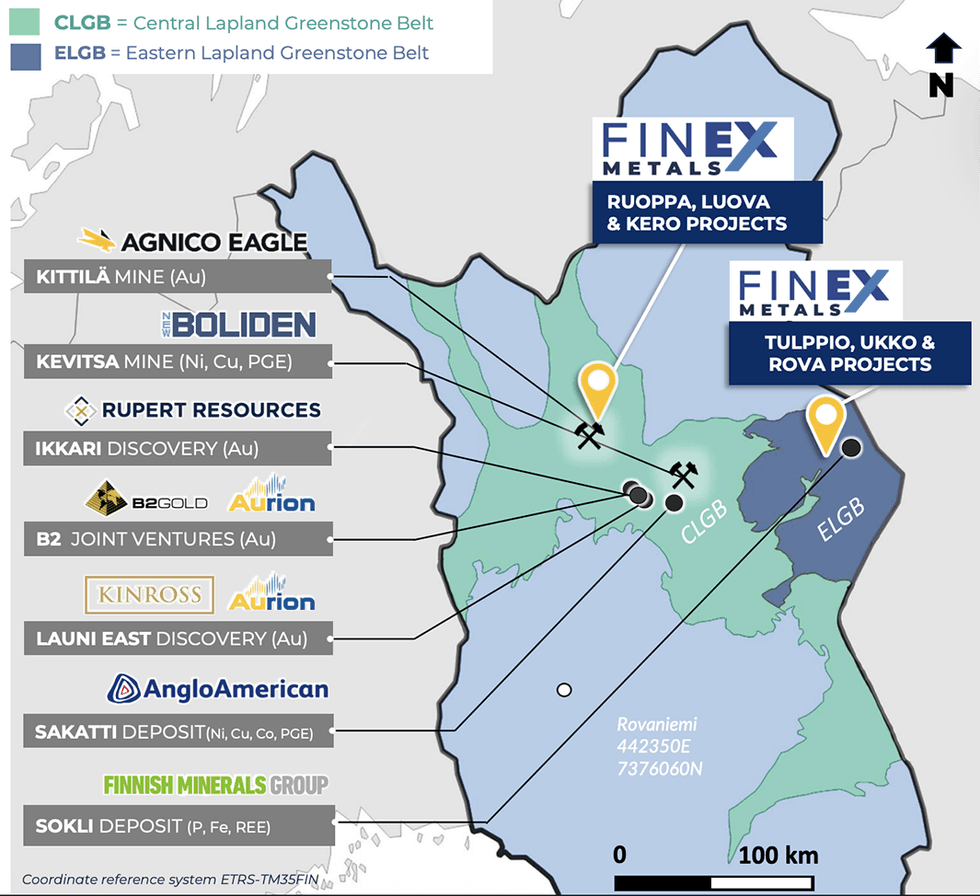

FinEx Metals (TSXV:FINX) is a Canadian exploration company dedicated to unlocking the untapped gold potential of Finland’s Central Lapland Greenstone Belt—one of the world’s most prospective yet underexplored gold terrains. Backed by the resource-focused NewQuest Capital Group, FinEx is advancing early-stage discoveries just 25 kilometers from Agnico Eagle’s world-class Kittilä Mine, Europe’s largest gold producer.

The company has outlined a 2.7-kilometer-long gold anomaly through trenching, rock sampling, and top-of-bedrock (ToB) drilling. Initial ToB results returned gold values ranging from 0.1 to 4.2 g/t across 29 samples, alongside strong pathfinder elements including tellurium, bismuth, silver, and arsenic—indicators of a potential orogenic gold system and a compelling vector for further exploration.

The Ruoppa Project is FinEx Metals’ flagship asset, located just 17 kilometers from Agnico Eagle’s Kittilä Mine — Europe’s largest primary gold producer. Situated within Finland’s highly prospective Central Lapland Greenstone Belt (CLGB), Ruoppa lies along the same structural corridor that hosts major discoveries such as Rupert Resources’ Ikkari deposit. Fully permitted and drill-ready, the project is set to launch its maiden diamond drill program in Q3 2025, targeting high-grade gold potential in one of Europe’s most underexplored gold districts.

Company Highlights

- High-grade Gold Focus in a Tier-one Address: Flagship Ruoppa project lies within 17 km of Agnico Eagle’s Kittilä Mine, the largest gold-producing mine in Europe.

- Large, 100 percent Owned Land Package: FinEx controls a 100 percent owned, royalty-free portfolio of projects across the Central and Eastern Lapland greenstone belts.

- Drill-ready Flagship Asset: The Ruoppa project is fully permitted and will commence its maiden diamond drill program in Q3 2025.

- Exceptional Gold Grades: Rock grab samples from Ruoppa returned up to 95.1 g/t gold, with 52 samples over 1 g/t gold and 19 samples exceeding 10 g/t gold.

- Strong Local Technical Team: Deep exploration experience in Finland with former Agnico Eagle, FQM and Anglo-American personnel leading geological efforts.

This Finex Metals profile is part of a paid investor education campaign.*

Click here to connect with Finex Metals (TSXV:FINX) to receive an Investor Presentation

FINX:CC

Sign up to get your FREE

FinEx Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

23 June 2025

FinEx Metals

High-grade gold exploration in Finland’s prolific Central Lapland Greenstone Belt

High-grade gold exploration in Finland’s prolific Central Lapland Greenstone Belt Keep Reading...

16h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

FinEx Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00