May 26, 2025

WIN Metals Ltd (ASX: WIN) (“WIN” or “the Company”) is pleased to announce an Exploration Target for the high-grade Golden Crown gold deposit, part of the Company’s Butchers Creek.

Highlights

- WIN has defined an Exploration Target for Golden Crown of 400kt to 700kt tonnes between 2.4g/t to 3.2g/t Au for 23,000oz to 73,000oz of gold. This is in addition to the current Inferred Mineral Resource Estimate (MRE) of 400kt @ 3.1g/t Au for 38,000oz of gold1

- The Exploration Target is supported by the successful 2024 drilling campaign, which tested mineralisation below current Inferred Resource at Golden Crown including2:

- 24BCRC014 - 6m @ 10.85g/t Au (140m below MRE)

- 24BCRC012 - 5m @ 3.63g/t Au (95m below MRE)

- WIN remains focused on growing shareholder value through low-cost, high-impact drilling at the high-grade Golden Crown, complementing the recently announced 2025 Butchers Creek MRE update of 5.23Mt at 1.G1g/t Au for 321,000oz of gold

- Heritage clearance results for the 2025 field program have now been received with no impediments to proposed drilling activities

- Preparation work is underway to support a G,000m drilling program, with drilling scheduled to commence in July 2025

The potential quantity and grade of the Exploration Target is conceptual in nature and, as such, there has been insufficient exploration drilling conducted to estimate a Mineral Resource. At this stage it is uncertain if further exploration drilling will result in the estimation of a Mineral Resource. The Exploration Target has been prepared in accordance with the JORC Code (2012). This exploration target is exclusive of the 2021 Golden Crown Mineral resource estimate of 400kt at 3.10g/t Au for 38,000oz of gold.

Gold Project (“BCGP”) located in the East Kimberley region of Western Australia. The BCGP currently contains a global Mineral Resource of 5.63Mt @ 1.98g/t Au for 359,000oz of gold.

The Golden Crown Exploration Target, which lies below the current Inferred Resource, is estimated at between 400kt to 700kt @ 2.4g/t to 3.2g/t Au, representing an additional 23,000oz to 73,000oz of gold beyond the current MRE.

WIN Metals Managing Director and CEO, Mr Steve Norregaard, commented:

“The establishment of an Exploration Target at the high-grade Golden Crown gold deposit following our highly successful 4-hole drilling program late in 2024 marks another important milestone in WIN’s strategy to unlock value from the project. The potential for additional gold at Golden Crown represents a compelling resource growth opportunity that could see Golden Crown be a meaningful satellite producer complementing the main Butchers Creek body of mineralisation.

With a very targeted, low-cost exploration approach this supports our vision of becoming the next gold producer in Kimberley region of WA. The upcoming S,000m drill campaign is designed to test the potential and deliver further value to shareholders through disciplined, high-impact exploration. We’re suitably enthused by what lies ahead.”

Exploration Target Basis

During WIN’s 2024 drilling campaign, 4 holes for 873m were drilled at Golden Crown demonstrating the resource growth potential. In aggregate, 159 holes for 12,570m have been drilled at Golden Crown along the lightly tested 2km strike.

Highlights from WIN’s drilling included:

- 6m @ 10.85g/t Au from 253m in hole 24BCRC014 (140m below the Mineral Resource)

- 5m @ 3.63g/t Au from 222m in hole 24BCRC012 (95m below Mineral Resource)

- 2m @ 6.00g/t Au from 130m in hole 24BCRC013 (25m below Mineral Resource)

The Golden Crown Exploration Target was generated using the following parameters:

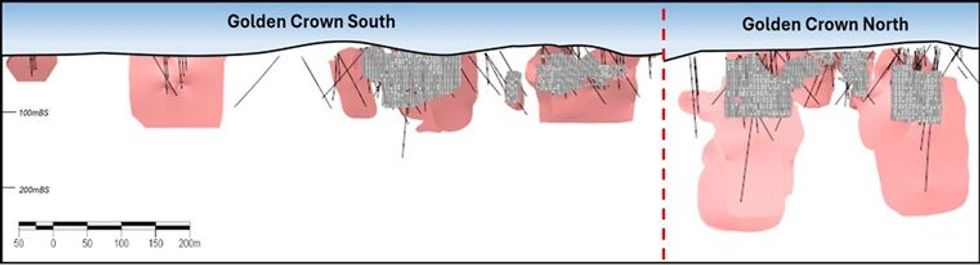

- Mineralised envelopes have been remodelled at Golden Crown using Micromine software, with the new intercepts included at Golden Crown North from all holes drilled at the deposit

- A 0.3g/t Au cut-off was applied to constrain the mineralisation envelopes

- Mineralisation envelopes have been extended up to 250m below surface (130m RL) and extended a maximum of 60m radii along strike from a mineralised intercept

- Volume of the mineralisation envelopes were converted to tonnage using a factor of 2.71t per cubic meter, consistent with the April 2025 MRE update for Butchers Creek

- Upper and lower grade ranges were calculated at ±15% of the current MRE for Golden Crown of 3.10g/t Au. The southern extension mineralisation envelope, which was not modelled nor reported in 2021 MRE, has been assigned the average composite grade

- Upper and lower tonnage ranges were calculated at ±15% of the updated mineralisation envelopes

- The Exploration Target output range was rounded to the nearest 1,000oz to reflect the conceptual nature of this calculation

Heritage Clearance for 2025 Drilling Programme

All drilling proposed in the 2025 heritage survey has been approved by the Koongie Elvire Traditional Owners Group following the completion of a heritage survey in April. This approval enables WIN to accelerate its 2025 drilling programme, focusing on growing the Golden Crown resource and testing the EIS co-funded exploration target, Ganymede3.

Future Work

The 2025 field season has commenced with reconnaissance work underway, now both heritage survey and the necessary clearances have been received. The drilling program will primarily focus on resource growth at the Golden Crown gold deposit, with 9,000m of drilling planned to commence in June/July 2025. An updated MRE for Golden Crown is expected later in 2025.

Location and Project History

The Golden Crown gold deposit is within exploration licence E80/4976, which is 4.5km north of the Butchers Creek gold mine and 30km southeast of Halls Creek in the Kimberley region of Western Australia. The project is accessible via the Duncan Road that connects the BCGP to the town of Halls Creek and the Great Northern Highway.

Click here for the full ASX Release

This article includes content from Win Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00