November 05, 2024

Basin Energy Limited (ASX:BSN) (‘Basin’ or the ‘Company’) is pleased to announce that work has commenced at the Virka project (the “Project” or “Virka”) following execution of a binding agreement (the “Agreement”) to acquire an exploration portfolio located within Scandinavia.

Key Highlights

- Historic data review identifies three areas for immediate field investigation

- Initial mapping and reconnaissance sampling underway

- Historic drill core located for relogging, and where possible, sampling:

- Evidence for both significant width and grade mineralisation at the Virka project from drilling which included 1,2

- 9 m at 1,087 ppm U3O8 from 24.5 m in drill hole 81-003

- within 17 m at 707ppm U3O8 from 23 metres depth

- Evidence for both significant width and grade mineralisation at the Virka project from drilling which included 1,2

- No modern systematic exploration undertaken with last significant exploration in 1980’s highlighting district scale potential

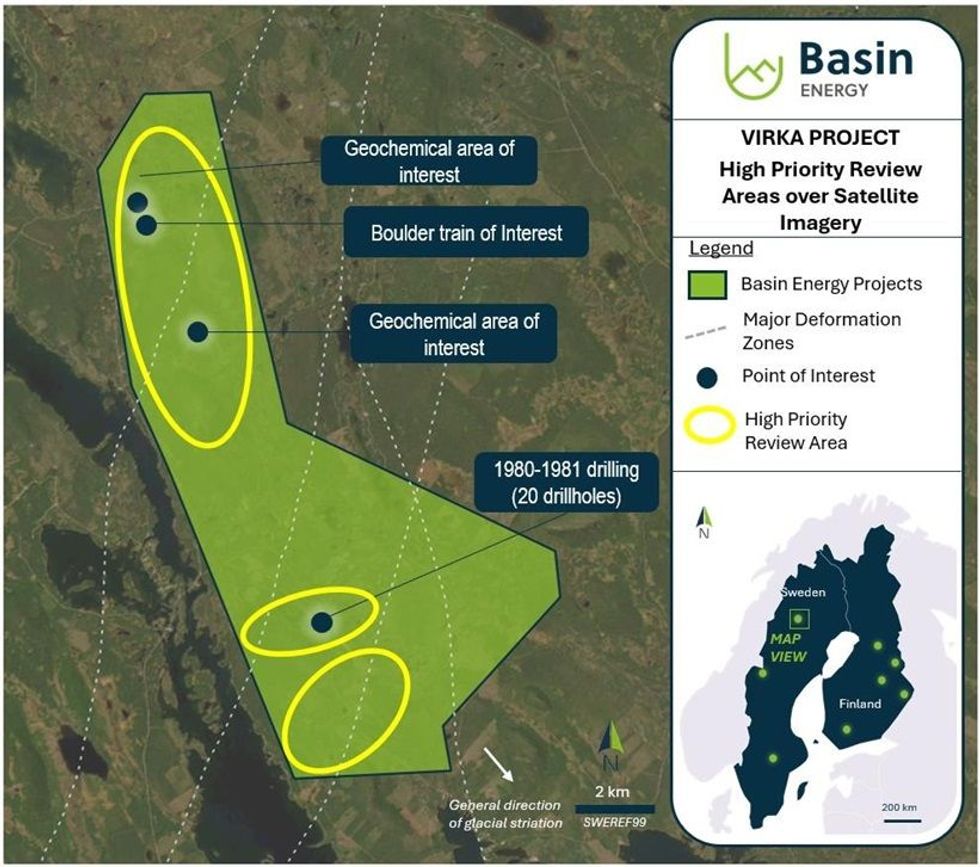

Initial work will focus on the assessment of three areas identified through reviewing historic reports. Limited exploration work was documented, but recorded anomalous base metals, silver and uranium. Exploration work at Virka focussed on North-NorthEast orientated structural features, which were interpreted to be a suitable structural conduit for potential mineralisation.

Basin’s Managing Director, Pete Moorhouse, commented:

“The team at Basin are extremely excited to commence work on the recently announced Scandinavian uranium and green energy metals portfolio. Initial review of the available historical data on the Virka project has provided areas for immediate groundwork. We know that the system is prospective for a variety of metals, with the historical drilling indicating favourable thickness of uranium mineralisation.

The team has commenced work immediately at Virka, conscious of the upcoming winter season. Initial work will focus on getting boots on the ground to assess rock outcrops and trace boulder trains. We will move to historic drill core review and additional literature compilation once the weather prohibits further ground activities.”

Virka Project Background 3

The Virka project is strategically positioned in the heart of the Arjeplog-Arvidsjaur shear-hosted uranium district in Sweden, and approximately 37 km southeast of Boliden’s (STO:BOL) Laisvall Pb-Zn-Ag former mine.

Previous drilling activities conducted in the 1980’s across all licenses targeted uranium mineralisation, with diamond drillholes gamma probed and in rare occasions sampled for geochemical analysis3. Additionally, historical regional geological mapping and boulder tracing records unveiled several surface anomalisms in lead, zinc, silver and gold associated with fault structures. Research indicates that these anomalies have not been adequately followed up with results not verified to JORC Code (2012), however using this data and Basin’s interpretations, three areas have been prioritised for immediate field reconnaissance (Figure 1). This program has commenced with the review of these anomalous features that were historically reported in the project area.

Click here for the full ASX Release

This article includes content from Basin Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSN:AU

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

31 August 2025

Basin Energy

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland.

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland. Keep Reading...

19h

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19h

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

17 December 2025

Completes phase one drilling and expands Sybella-Barkly

Basin Energy (BSN:AU) has announced Completes phase one drilling and expands Sybella-BarklyDownload the PDF here. Keep Reading...

30 November 2025

Expands REE and Uranium Footprint at Sybella-Barkly

Basin Energy (BSN:AU) has announced Expands REE and uranium footprint at Sybella-BarklyDownload the PDF here. Keep Reading...

11 November 2025

Drilling Commenced for Sybella-Barkly Uranium and Rare Earth

Basin Energy (BSN:AU) has announced Drilling commenced for Sybella-Barkly uranium and rare earthDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00