- WORLD EDITIONAustraliaNorth AmericaWorld

May 09, 2023

Redstone Resources Limited (ASX: RDS) (Redstone or the Company) is pleased to announce that it has acquired an additional 1,821 hectares comprising 4 claims, expanding the original tenure of its Attwood Lake Area Lithium Project (Attwood Lake or the Project) by 33% to 7,393 hectares.

HIGHLIGHTS

- Redstone expands the Attwood Lake Area Lithium Project (Attwood Lake or the Project) by 33% to 7,393 hectares.

- On 4 May 2023 Redstone announced that it had entered into an exclusive Option agreement to acquire a 100% interest in the Attwood Lake properties in northwestern Ontario, Canada, which are highly prospective for lithium (Li) and rare elements pegmatite hosted mineralisation.

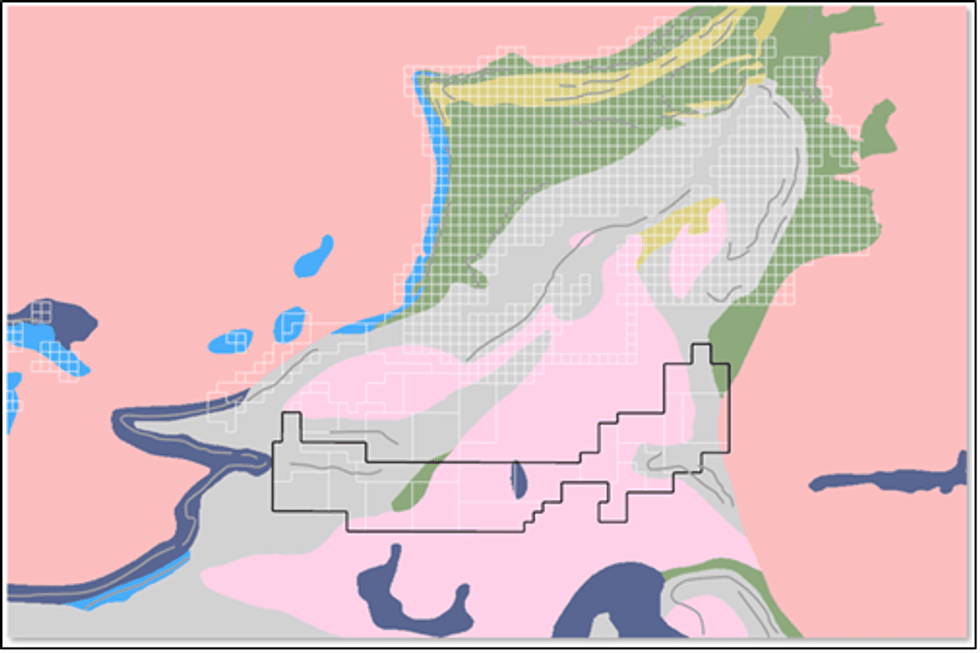

- Redstone has since expanded the Project 33% from the original two claim groups, Witchwood and Greenside, comprising 3,026 hectares (7 claims) and 2,546 hectares (6 claims) respectively, by staking an additional 1,821 hectares (4 claims) to merge the two original claim groups to comprise a single contiguous Project tenure of 7,393 hectares (refer Figure 1).

- Attwood Lake is located ~ 170km northwest of Nakina, in northwestern Ontario with good all‐ weather road, current and near‐future logging road access in a region that boasts several advanced lithium projects.

- Numerous deposits that host significant lithium oxide (Li2O) that have already been delineated in the region (Figure 2), include:

- Seymour Lake Lithium Deposit and Root Lake‐McCombe Lithium Deposit owned by Green Technology Metals (ASX: GT1);

- Deposits owned by Rock Tech Lithium and Infinite Ore in the Georgia Lake pegmatite field;

- Separation Rapids Lithium deposit owned by Avalon Advanced Materials Inc.; and

- PAK and Sparks deposits owned by Frontier Lithium.

- The structural complexity of the Attwood Lake area with numerous synclines and fault patterns in association with a subprovince terrane boundary provides excellent pathways and fracture systems for parental melts and deposition of pegmatite bodies.

- Planning underway for Phase 1 exploration program to commence as soon as practicable.

- The Attwood Lake Project acquisition complements the Company’s existing 100% owned West Musgrave copper‐nickel project, and its strategy to increase exposure to the growing global battery minerals and explore for minerals that are regarded as critical and in high demand.

- The Company has accepted oversubscriptions of $30,000 for a total Capital Raising of $1.28M. Additionally, the Board has, in consultation with the Lead Manager, resolved to re‐price the 1:3 free attaching option pertaining to the Placement from $0.04 to $0.025.

On 4 May 2023 the Company announced that it had entered into an exclusive Option agreement to acquire a 100% legal and beneficial interest in the Attwood Lake Properties, which are considered highly prospective for Li and/or rare element pegmatites. The Project is located in northwestern Ontario, Canada where numerous lithium deposits and advanced lithium projects have documented to host significant resources of Li20.

The Attwood Lake Project, which originally consisted of two claim groups, namely the Witchwood and Greenside Lithium properties comprising 3,026 hectares (7 claims) and 2,546 hectares (6 claims) respectively has now been expanded by 1,821 hectares to merge the two original group claims and expand the Project by 33% to comprise a single contiguous Project tenure of 7,393 hectares (17 claims) (Figure 1). The further 4 unpatented mining claims were included in the Option Agreement for an additional payment of C$4,500 to the vendors.

The Attwood Lake properties are located approximately 170km northwest of Nakina, Ontario. Access to the Project properties can be made by good all‐weather road as well as current and near‐ future logging road access.

REGIONAL GEOLOGY

The Project is hosted within the English River Subprovince in northwestern Ontario. The English River Subprovince is an 800 km long by 35– 190 km wide Neoarchean metasedimentary belt. Two intrusive suites predominate the English River Subprovince. province. The first is a suite of diorite– tonalite–granodiorite that has been dated at ca. 2698 Ma. The second intrusive suite is a peraluminous granite suite that has been dated at ca. 2691 Ma. These intrusions are related to the migmatization of the metasedimentary rocks and range from in situ leucosome to large peraluminous two‐mica or cordierite–biotite granite intrusions (Breaks 1991)2.

Click here for the full ASX Release

This article includes content from Redstone Resources Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Redstone Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

14 May 2025

Redstone Resources

Exploring Australia’s copper-rich West Musgrave region and prolific lithium and battery metals areas in Canada

Exploring Australia’s copper-rich West Musgrave region and prolific lithium and battery metals areas in Canada Keep Reading...

Latest News

Sign up to get your FREE

Redstone Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00