October 23, 2023

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to advise shareholders with an update on the planned exploration program over its 100% owned Exploration Permit 127 in the Northern Territory.

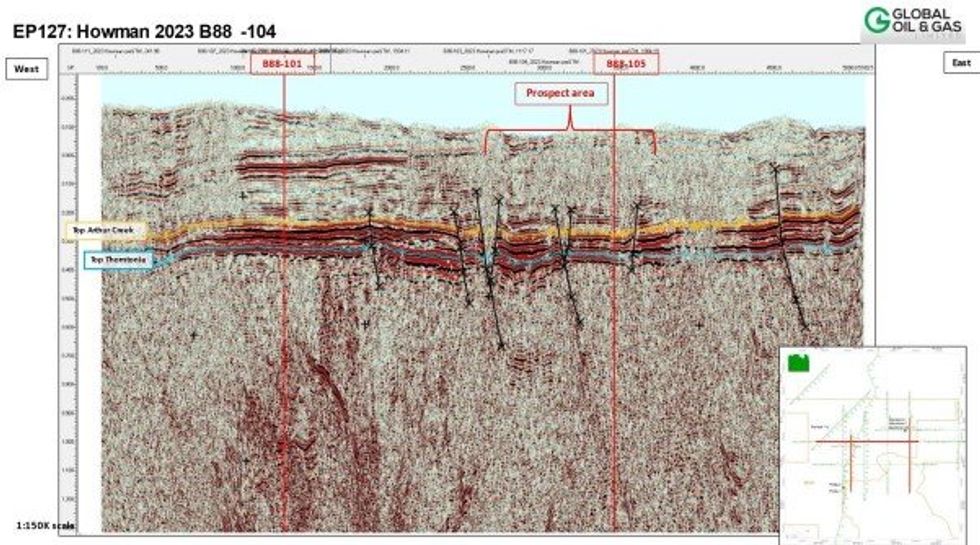

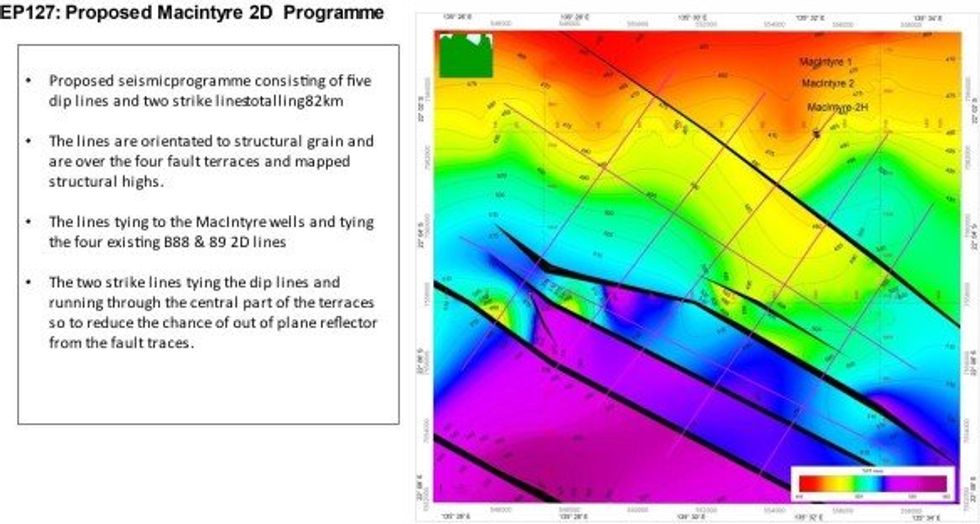

Following the successful 2D seismic reprocessing and subsequent interpretation studies in the permit, the Company is now planning a 2D seismic program that will be conducted in 2024 to further delineate potential targets.

Based on a considerable data quality uplift from the reprocessed seismic the geological interpretation has been refined and several leads identified. To upgrade the leads into drilling targets, an additional 82 km of new seismic is planned. The final line locations are subject to environmental and SSCC approval. Global is moving into the next phase and engaging with stakeholders for the approvals.

Following interpretation of the reprocessed seismic data, the Company has identified the terrace area southwest of the MacIntyre wells (MacIntyre-1, -2, and -2H) as being the most prospective. This area contains a number of structural closures up dip from the reservoir intersections of the MacIntyre wells. These structures require new 2D seismic to confirm closure, de-risk the leads and firm up drilling locations.

The primary reservoir target are the stromatolites in the Hagen Member (A). These exhibit good porosity and permeability and have good oil shows in nearby wells, Phillips- 2, MacIntyre-1 &-2 and Randall-1. A secondary target has been identified in the Thorntonia Limestone(B). his reservoir relies on proximity to faulting that likely enhances secondary fracture porosity. In addition, sabkha deposits forming reservoir seals have been intersected within the Hagen Member in offset wells. These are characterised by the presence of abundant anhydrite, with provides excellent inter- formational and top seal for the two reservoir units.

Click here for the full ASX Release

This article includes content from Global Oil and Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00