Endurance Gold Corporation (TSXV: EDG) (the "Company") is pleased to report the final results from the 2021 diamond drilling program completed at the Reliance Gold Property (the "Property") in southern British Columbia. The road accessible property is located 4 kilometres ("km") east of the village of Gold Bridge, and 10 km north of the historic Bralorne-Pioneer Gold Mining Camp which has produced over 4 million ounces of gold.

Assay results reported below are for the remaining nine (9) diamond drill holes at Eagle, Eagle South and the Imperial zones. Drilling program highlights include:

- Identification of significant gold intersections in sixteen (16) of the twenty-two (22) diamond drill holes completed in 2021.(see Table 1)

- At Eagle South, additional drill results confirm the recognition of a steeply dipping feeder zone target ("020 Target") with drill hole intersections including 5.71 grams per tone ("gpt") gold over 5.6 metres ("m") and 1.70 gpt gold over 62.1 m as the interpreted extensions of the high-grade intersection of 15.7 gpt gold over 24.8 m reported on January 12, 2022.

- At Eagle Zone, additional drill results have increased dimensions of the near-surface, shallow dipping zone to 250 m by 150 m in size with a weighted average grade of 5.13 gpt gold and average estimated true width of 11.2 m.

- At the Imperial Zone, located 750 m northwest of Eagle South, the horizontal dimensions of the steeply dipping mineralization have been increased in length and the Imperial Zone remains open to the northwest and at depth.

"Our maiden 2021 diamond drilling program at Reliance was very successful with 16 of our 22 drill holes returning significant gold intersections and four of these drill holes returning gold intersections exceeding 100 gram-metres", commented Robert T. Boyd, CEO of Endurance Gold. "This is an excellent success percentage for a maiden drilling program on an Orogenic gold system. These four top quality holes are distributed amongst three strong gold-bearing zones over 750 metres of trend along the Royal Shear. Additional holes reported today, together with drill hole DDH21-020 which returned the best intersection to date of 15.7 grams per tonne gold over 24.8 metres, collectively confirm a newly recognized steeply dipping structural target at Eagle South that will need to be followed up aggressively with drilling."

Eagle South

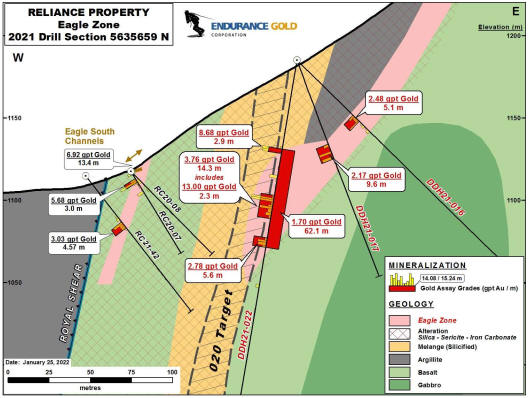

DDH21-022 was drilled west at minus 80 degrees and intersected gold mineralization in three different intervals of 3.76 gpt gold over 14.3 m including 13.0 gpt gold over 2.3 m, 8.68 gpt over 2.9 m, and 2.78 gpt gold over 5.6 m. All three intervals are in close proximity and average 1.70 gpt gold over 62.1 m, commencing at 53 m down hole. These combined intersections are oblique to the interpreted target and do not represent true width.

- The gold intersections in DDH21-022 are 60 m northwest of DDH21-020 which reported 15.7 gpt gold over 24.8 m on January 12, 2022 commencing at 33.3 m down hole. Both DDH21-022 and DDH21-020 intersected mineralization hosted within a mélange associated with the steeply southwest-dipping and southeast-striking Royal Shear. These drill intersects and the high-grade surface sampling at the E5 and E7 prospects as reported on January 5, 2022 provide evidence for a steeper feeder zone exploration target ("020 Target") hosted within the mélange. DDH21-022 is interpreted to have been drilled subparallel and on the outer margin of the 020 Target.

DDH21-021 was drilled at minus 70 degrees east from the same setup as DDH21-020 reported on January 12, 2022 and returned a near surface intersection of 1.9 gpt gold over 15 m (starting at 9 m) and a deeper gold intersection of 5.71 gpt gold over 5.6 m (starting at 115.4 m).

DDH21-014 & DDH21-015 were drilled from the same setup and are the furthest drill collar to the south. The best gold intersections were from DDH21-014 with 2.31 gpt gold over 4 m starting at 5 m and 5.71 gpt gold over 3.8 m starting at 94 m. Holes DDH21-014, DDH21-015 and DDH21-021 were designed to test for the southern extent of shallow dipping Eagle Zone mineralization, and thus not oriented to intersect the newly interpreted, steeply dipping 020 Target horizon.

Eagle Zone

DDH21-016 & DDH21-017 returned 2.48 gpt gold over 5.1 m and 2.17 gpt gold over 9.6 m, respectively, within a mineralized lithological contact interpreted to represent the southeastern extension of the Eagle Zone. These holes represent a 130 metre step out to the southeast from hole DDH21-006 that returned 8.62 gpt gold over 24.4 m reported on December 29, 2021.

- The shallow-dipping, near-surface Eagle Zone has now been expanded to 250 metres by 150 metres and has been defined by 31 reverse circulation and diamond drill intersections with a weighted average grade of 5.13 gpt gold and an average estimated true width of 11.2 m. The Eagle Zone remains open to expansion southeast for a minimum 200 m of strike.

- The Eagle South drill holes, including the best drill hole reported for the property are not included as part of the Eagle Zone.

The structural intersection of the steeply dipping 020 Target and the shallower dipping Eagle Zone represent a priority exploration target for future drill testing.

Significant gold intersections have now been intersected in thirteen (13) of the sixteen (16) diamond drill holes completed at the Eagle Zone and Eagle South in 2021. Significant means those drill holes with an intersection in which the weighted average grade in grams multiplied by the length of intersection in metres ("gram-metres") is greater than 10.

Imperial Zone

Drill holes DDH21-008 and DDH21-010 were designed to test the southeastern strike extent of the Imperial Zone with 50 m and 85 m step outs, respectively from the gold intersection in DDH21-009 of 8.47 gpt gold over 24.9 m including 16.27 gpt gold over 10.5 m reported on December 9, 2021. Both DDH21-008 and DDH21-010 intersected the mineralized footwall horizon where expected. DDH21-008 intersected 2.08 gpt gold over 10.3 m, including 9.34 gpt gold over 1.3 m and successfully extended the strike of significant mineralization 50 m to the south. DDH21-010 intersected 1.37 gpt gold over 3.2 m indicating that the shoot narrows at about 85 metres to the south. The Imperial mineralized shoot is still open for expansion to the northwest and to depth.

- The Imperial Zone is interpreted to be a west plunging steeply dipping mineralized shoot located in the footwall of the Royal Shear and not exposed on surface. The mineralized shoot was confirmed down dip by previously reported holes DDH21-009 (8.47 gpt gold over 24.9 m) and confirmed further down-dip by hole DDH21-011 (2.10 gpt gold over 24.9 m) indicating a minimum 200 m depth potential to the Imperial Zone.

- Significant gold intersections of greater than ten (10) gram-metres have now been intersected in three (3) of the six (6) diamond drill holes completed at the Imperial Zone in 2021.

Drill hole DDH21-013 was designed to test a conceptual shallow-dipping mineralized structure near the Imperial North showing. The hole intersected weak shearing and alteration with anomalous gold.

All the Eagle Zone and Eagle South diamond drill holes are plotted on the 2021 Eagle area plan on Figure 1. Newly reported drill holes are displayed on the cross-section on Figure 2, and the Longitudinal Section on Figure 3. The Imperial Zone drill holes are plotted on the 2021 Imperial Zone area plan on Figure 4. The complete tabulation of 2021 diamond drill results are summarized in Table 1 below and on the Company website. Results reported in this release are highlighted in bold on Table 1.

Gold intersections in the Reliance Property drill cores observed to date are associated with intense iron-carbonate and sericite alteration, within structurally deformed sequences related to the Royal Shear. Gold mineralization is directly related to varying amounts of pyrite, stibnite, arsenopyrite and pyrrhotite as sulphide replacement and multigenerational breccias often with associated pervasive silicification, quartz stockwork and/or quartz breccia infill. Reliance is interpreted to represent a shallow-level (Epizonal) Orogenic gold system.

Endurance Gold Corporation is a company focused on the acquisition, exploration and development of highly prospective North American mineral properties with the potential to develop world-class deposits.

Robert T. Boyd

FOR FURTHER INFORMATION, PLEASE CONTACT

Endurance Gold Corporation

(604) 682-2707, info@endurancegold.com

www.endurancegold.com

Diamond drill core was logged and evaluated on the Property and samples designated for collection under the supervision of a geologist at the property. Drilling was completed using a skid mounted Hydracore 2000 equipped with NQ size tools capable of collecting 4.76 centimetre diameter core. Diamond drill core was cut using a diamond drill saw with one half of the core sent for analysis and the remaining kept for future studies. Sample intervals were typically 2 metre core length and intervals were shortened for lithology or alteration changes. For drilled and sampled intervals of poor average core recovery, the complete core was sampled and sent to the laboratory for assay analysis. Reverse Circulation ("RC") samples were collected under the supervision of a geologist at the drilling rig. Drilling was completed using a 3.5 inch hammer bit and rock chip samples were collected using a cyclone. Sample sizes were reduced to 1/8th size with a riffle splitter at the drilling rig. A second duplicate split and coarse chips were collected for reference material and stored. All RC chips and diamond drill core samples have been submitted to ALS Global in North Vancouver, BC, an ISO/IEC 17025:2017 accredited laboratory, where they are crushed to 70% ppm") gold are re-analyzed by Au-GRA21 methodology and over limit antimony returning greater than 10,000 ppm Sb are re-analyzed by Sb-AA08 methodology. Endurance Gold monitors QA/QC by inserting blanks, certified standards and pulp duplicates into the sample stream.

The 2020 and 2021 work programs were supervised by Darren O'Brien, P.Geo., an independent consultant and qualified person as defined in National Instrument 43-101. Mr. O'Brien has reviewed and approved this news release. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of factors beyond its control, and actual results may differ materially from the expected results.

Figure 1: Reliance Property, Eagle Area - 2021 Drill Plan

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/4976/111486_b4a27e0ad462dabe_002full.jpg

Figure 2: Reliance Property, Eagle Zone 5635659 N Cross Section

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4976/111486_endura2.jpg

Figure 3: Reliance Property, Eagle Zone and Eagle South Longitudinal Section

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/4976/111486_b4a27e0ad462dabe_004full.jpg

Figure 4: Reliance Property, Imperial Zone Drill Plan

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/4976/111486_b4a27e0ad462dabe_005full.jpg

Table 1: Reliance Property, 2021 Diamond Drill Results

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/4976/111486_b4a27e0ad462dabe_006full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/111486