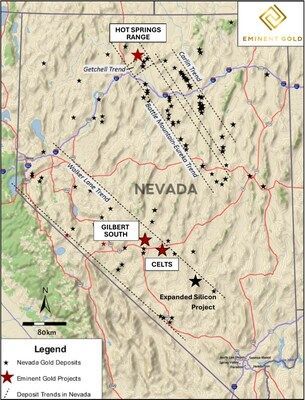

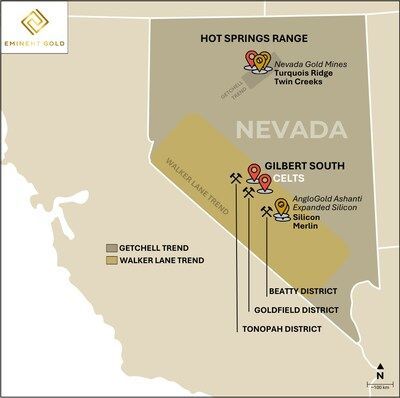

Eminent Gold Corp. (TSXV: EMNT,OTC:EMGDF) (OTCQB: EMGDF) (FSE: 7AB) is pleased to announce it has made the final payment on its acquisition of the Celts Project totaling 560 hectares within the prolific Walker Lane Trend of southwestern Nevada (see Figures 1 to 3). The project shares key geological features with the Silicon-Merlin 1 hydrothermal system—including host lithology, alteration style, and structural setting—making it a compelling analogue in terms of exploration potential. The Silicon-Merlin system was originally identified and optioned by Orogen Royalties Inc. to AngloGold Ashanti and is now recognized as one of Nevada's most significant recent gold discoveries.

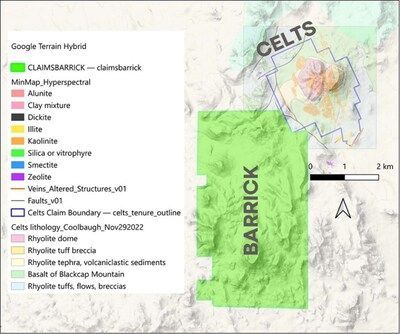

Notably, Barrick Gold has recently staked ground adjacent to Celts (see Figure 4), further highlighting the strategic significance of the area. Finalizing ownership of the Celts Project aligns with Eminent's strategy to maintain majority ownership across its portfolio and positions the Company in a highly prospective region with analogues to world-class gold systems.

This milestone follows Eminent's previously announced news releases dated December 12, 2024 , and February 12, 2025 , and underscores the Company's intent to aggressively advance the Celts Project—now recognized as a high-potential asset within its Nevada portfolio. With Celts joining Hot Springs Range (drilling to resume shortly) and Gilbert South , Eminent holds three 100%-owned, drill-ready projects across multiple prolific gold trends in Nevada . Celts is distinguished by its geological similarities to other high-sulfidation epithermal systems and is rapidly emerging as a priority target with near-term discovery potential. With increasing demand for new gold discoveries across Nevada's major trends, Eminent is advancing Celts as a technically robust and strategically timed opportunity.

Paul Sun , President and CEO of the Company, commented:

"Celts is a valuable part of our U.S. gold-focused portfolio of significant exploration opportunities, all of which host multiple targets. Our pipeline of high-impact, drill-ready opportunities is unique in both the scale each project represents and the stage defined by new concepts in areas that have not been previously considered.

We are preparing to resume drilling at Hot Springs Range, our flagship project, where initial drill results are supporting our thesis of a nearby, emerging potential new gold trend parallel to Getchell. As we prepare to enter the next leg up in the gold market, we are planning to explore across multiple discovery-driven projects in Nevada ."

Celts Project Highlights:

- Defined by a rhyolite dome complex intruding through thick basalt , capped by a steam-heated zone with extensive silica and advanced argillic alteration—hallmarks of high-sulfidation epithermal systems.

- Surface samples up to 33 grams per tonne (g/t) gold from peripheral veins suggest the presence of low-sulfidation mineralization beneath the steam cap and basalt cover.

- Recent Induced Polarization (IP) surveys have outlined a northeast-trending structure beneath the steam cap, interpreted as a potential conduit for mineralizing fluids and geologically analogous to structural controls at the Silicon deposit.

- Orogen Royalties Inc ., who originally identified and optioned the Silicon deposit prior to its discovery, has recognized striking geological similarities between Celts and the early-stage characteristics observed at Silicon 1 .

- The maiden drill program is planned to test structure beneath the steam cap.

- Barrick recently staked approximately 1,743 hectares contiguous to the Celts Project, underscoring the district's emerging potential and regional prospectivity.

Transaction Highlights:

- Final payment completed under the previously announced Purchase Agreement with Orogen Royalties Inc. and Altius Resources Inc.

- Remaining consideration of US$325,000 satisfied through the issuance of 1,364,752 common shares at a deemed price of CAD$0.3283 per share.

- The shares are subject to a statutory hold period expiring December 19, 2025 .

All scientific and technical information in this news release has been prepared by, or approved by, Michael Dufresne , P.Geo. Mr. Dufresne is an independent qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

For Reference:

- AngloGold Ashanti has filed a Technical Report Summary for the Merlin deposit within the Expanded Silicon project in Nevada , available through the U.S. Securities and Exchange Commission. While the Company does not rely on or quote the reported Mineral Resource, this public filing may offer useful context regarding regional exploration activity.

SEC Filing – Merlin Deposit Technical Report Summary

ON BEHALF OF THE BOARD OF DIRECTORS

Paul Sun

CEO & Director

Website: www.eminentgoldcorp.com

Twitter: @eminent_gold

LinkedIn: www.linkedin.com/company/eminent-gold-corp/

Instagram: www.instagram.com/eminent.gold.corp/

About Eminent Gold

Eminent Gold is a gold exploration company focused on creating shareholder value through the exploration and discovery of world-class gold deposits in Nevada . Its multidisciplinary team has had multiple successes in gold discoveries and brings expertise and new ideas to the Great Basin. The Company's exploration assets in the Great Basin include: Hot Springs Range Project, Gilbert South , and Celts.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed "forward-looking statements" with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements made in this news release include the anticipated completion of the private placement and the use of proceeds from the private placement. Although Eminent Gold Corp. believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, including the assumption that records and reports of historical work are accurate and correct, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company's ability to raise sufficient capital to fund its obligations under its property agreements going forward, to maintain its mineral tenures and concessions in good standing, to explore and develop the Company's projects or its other projects, to repay its debt and for general working capital purposes; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations, future prices of gold, silver and other metals, changes in general economic conditions, accuracy of mineral resource and reserve estimates, the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the Company's projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, aboriginal title claims and rights to consultation and accommodation, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/eminent-completes-final-celts-payment--strengthens-strategic-position-in-nevada-302537236.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/eminent-completes-final-celts-payment--strengthens-strategic-position-in-nevada-302537236.html

SOURCE Eminent Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/25/c3737.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2025/25/c3737.html