What Was the Highest Price for Gold?

Top 10 Central Bank Gold Reserves

Gold Price 2025 Year-End Review

Overview

Element 25 (ASX:E25,OTCQX:ELMTF) is a manganese-focused company with 100 percent ownership of the largest onshore manganese deposit in Australia, which is currently producing high-quality manganese concentrate. The company’s Butcherbird Mine in Western Australia is currently producing around 365,000 tons per annum. The company is advancing towards 1 million tons (Mt) per annum by optimizing its engineering processes. Element 25 (E25) has set the pace by getting up and running quickly.

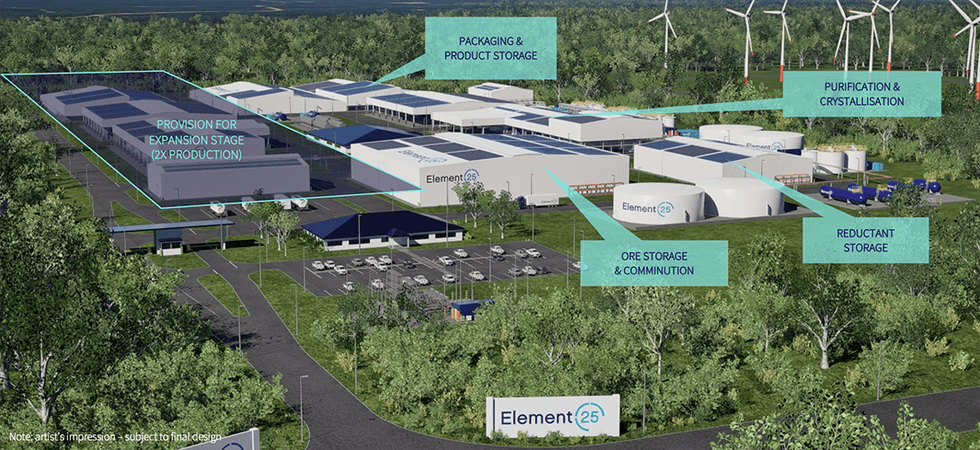

Element 25 has also moved quickly to progress its ambitions to be a globally significant producer of ethical high-purity manganese sulphate monohydrate (HPMSM) for supply to the fast growing EV battery raw material supply chains. The company has signed a binding agreement with Stellantis NV (NYSE:STLA) to supply battery-grade HPMSM from E25’s proposed USA-based HPMSM processing facility. Stellantis has further completed its first US$15-million equity investment in E25 in July 2023 towards the development of a battery-grade HPMSM facility in the USA.

Element 25 has also entered an off-take deal with General Motors (GM) to supply the car manufacturer up to 32,500 metric tons of manganese sulfate to support GMs annual production of more than 1 million electric vehicles in North America. Under this agreement, GM will provide an US$85-million loan to E25 to partially fund the construction of the new facility in Louisiana, USA, which will produce battery-grade manganese sulfate. Expected to be the first of its kind in the US, the facility will process manganese concentrate from E25’s mining operations in Western Australia to produce HPMSM.Manganese is Building Momentum

Sales of EVs have exceeded 10 million in 2022 with market analysts expecting the momentum to continue in 2023 and beyond. It’s clear that consumers and automakers are embracing EVs worldwide, with gigafactories springing up across the globe to support the EV transition. Yet, EVs require significant materials to support the increasing demand.

Manganese is essential in manufacturing the nickel-manganese-cobalt cathodes EVs require and is the cheapest and most abundant material available. Additionally, nickel and cobalt have significant supply constraints, while manganese does not. The relative abundance and high value in the use of manganese as a cathode material has prompted automakers such as Tesla, Volkswagen and Stellantis to turn to high-manganese cathodes to satisfy their supply chain requirements.

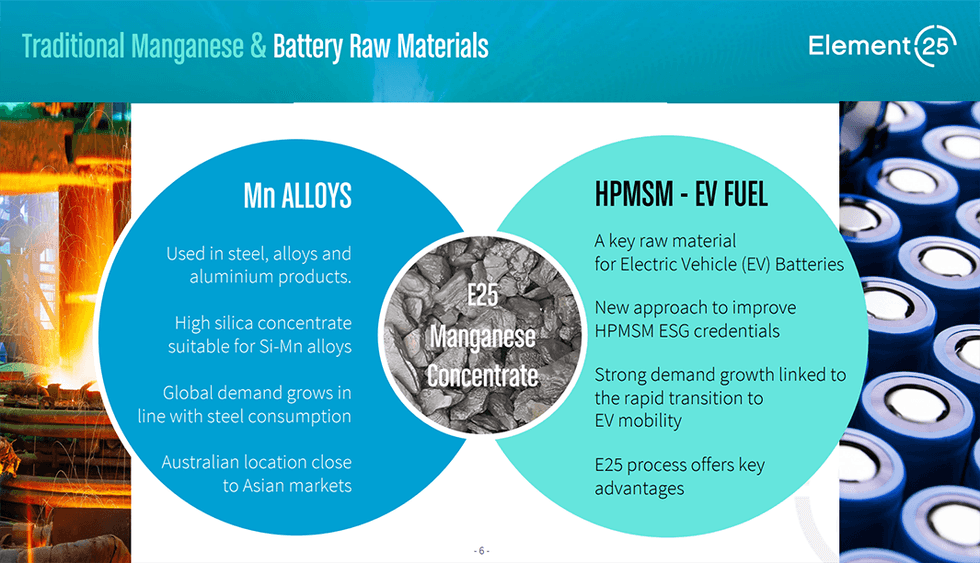

Manganese also has strong existing demand for usage in steel, aluminum products and specialty alloys. There is no substitute for the element in steel. Mining companies focusing on this vital element are uniquely positioned to serve both established and emerging industries.

The Future has Always Been Electric

Element 25 is committed to delivering on its strategy of producing battery grade HPMSM for EV batteries to power the global transition away from fossil-fuel-powered mobility.

The advancement of EV batteries requires a vast amount of cathode materials. Put simply, nickel and cobalt supplies simply cannot meet projected demand for New Energy Vehicle (NEV) growth.

By 2040 it is estimated that 58 percent of new vehicles will be EV or hybrid.

As demand continues to rise, EV battery makers globally are choosing to adopt manganese-rich cathode designs for safer, more cost-effective battery solutions and E25’s high-purity manganese strategy is ideally placed to feed these surging markets.

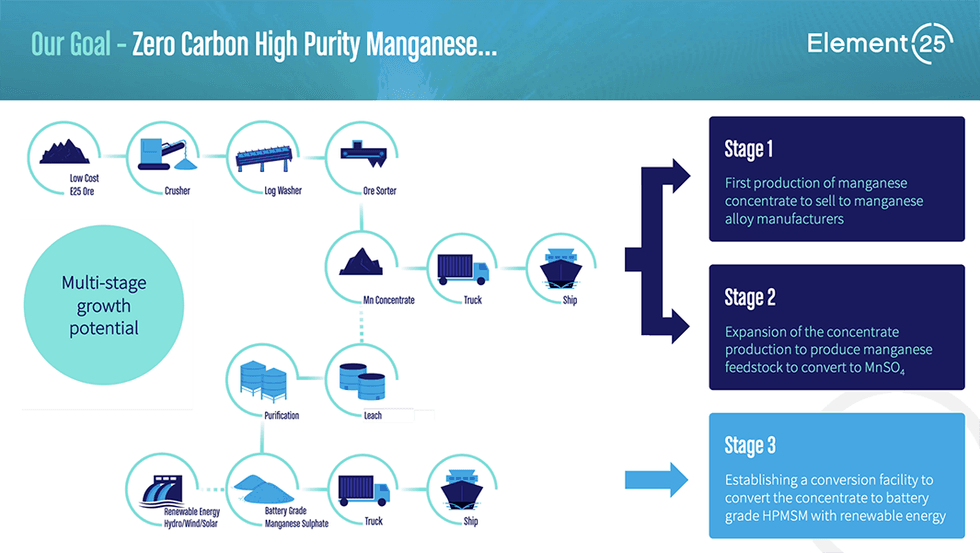

Advanced flowsheet development work undertaken in 2019 and 2020 has confirmed a simple, proprietary leach process for E25 ores which, when combined with offsets, will target the world’s first zero-carbon manganese for EV cathode manufacture. Flowsheet optimization for inclusion in upcoming feasibility studies is ongoing.

Strong ESG Credentials

Element 25 understands the importance of an excellent environmental, social and governance (ESG) rating for serving the EV market, as this rating directly reflects on the companies it supplies. The company is working towards producing zero-carbon, high-purity manganese by leveraging sustainable technologies at every step in its process through its Zero Carbon Manganese campaign. This campaign includes sustainable extraction, using renewable energy, low-carbon processing and carbon offsets. Element 25 has partnered with Circulor to provide real-time insights into its ESG status.

Element 25’s Butcherbird Mine has a Joint Ore Reserves Committee (JORC) compliant resource estimate indicating over 260 megatonnes of manganese ore. This significant deposit is Australia's largest onshore manganese deposit, with an estimated mine life of 42 years. The mine does not require blasting or dewatering, instead leveraging a simple mining and processing wash plant.

Importantly, Element 25’s board and management team has decades of experience across a range of key sectors including mining, legal expertise, mineral project development, corporate administration and operational excellence. The management team’s track record of success provides the company with a great platform to deliver on its planned milestones as E25 positions itself as a leading manganese player on the global stage.

Company Highlights

- 100-percent ownership of Australia's largest onshore manganese mine – the Butcherbird Manganese Deposit – comprising more than 260 million tons (Mt) of manganese ore in JORC resources.

- Long mine life of 42 years using only 20 percent of the global resource, significant potential to expand with further drilling.

- Currently producing high-quality manganese lump concentrate for the steel industry.

- Multi-staged expansion strategy to increase concentrate production and move into downstream processing to produce high-purity manganese sulphate monohydrate (HPMSM) as electric vehicle (EV) fuel for lithium-ion batteries.

- Expansion plans to increase ore production to 1 Mt per annum well advanced.

- Off-take and funding agreement with General Motors (GM) to supply the EV manufacturer up to 32,500 metric tons of HPMSM annually to support GM’s annual production of more than 1 million EVs in North America.

- GM to provide US$85 million in project finance for the HPMSM facility in Louisiana, USA.

- Offtake and funding agreement with global automaker Stellantis NV (NYSE/MTA/Euronext Paris:STLA) includes recently completed US$15-million equity investment to fund HPMSM short and medium term project execution costs.

- STLA is now Element 25’s largest shareholder with a 10.2-percent shareholding.

- STLA has committed to offtake for 15 percent of HPMSM production from the Louisiana facility.

- Element 25 is led by a management team with decades of experience in mineral project management, corporate administration and international law.

Get access to more exclusive Manganese Investing Stock profiles here