(TheNewswire)

| |||||||||

Vancouver, Canada, August 25, 2025 TheNewswire - Electrum Discovery Corp. (" Electrum " andor the " Company ") (TSX-V:ELY | FRA:R8N | OTC:ELDCF) is pleased to provide an operational update, refined corporate strategy and strategic growth objectives. The Company also announces the grant of incentive stock options to its new directors.

| Highlights:

|

Key Assets and Positioning

Electrum Discovery Corp. fully owns two projects: copper-gold Timok East and gold-silver Novo Tlamino , both located in well-known mineralized districts within the prolific Western Tethyan Belt in the Republic of Serbia.

To date, the Company's principal focus was on copper-gold exploration at its Timok East Project. Electrum remains fully committed to copper exploration and will continue with disciplined and systematic exploration and drill targeting within the Timok East Project. However, with the continued strengthening of precious metals' markets, the Company believes that advancing its gold-silver portfolio will provide its shareholders with more readily available returns.

The Company's sharpened focus on gold leverages Novo Tlamino's near ‑ surface, breccia ‑ hosted gold ‑ silver resource and district ‑ scale land position.

Dr. Elena Clarici, CEO of Electrum Discovery, commented: "With precious metals markets gaining strength, we believe now is the right time to bring forward our gold strategy. Novo Tlamino offers both near-term growth potential through resource expansion and longer-term district-scale discovery opportunities. At the same time, we remain committed to advancing Timok East, where upcoming geophysical surveys will refine high-priority drill targets. This balanced approach positions Electrum to unlock value from both gold and copper assets."

Novo Tlamino

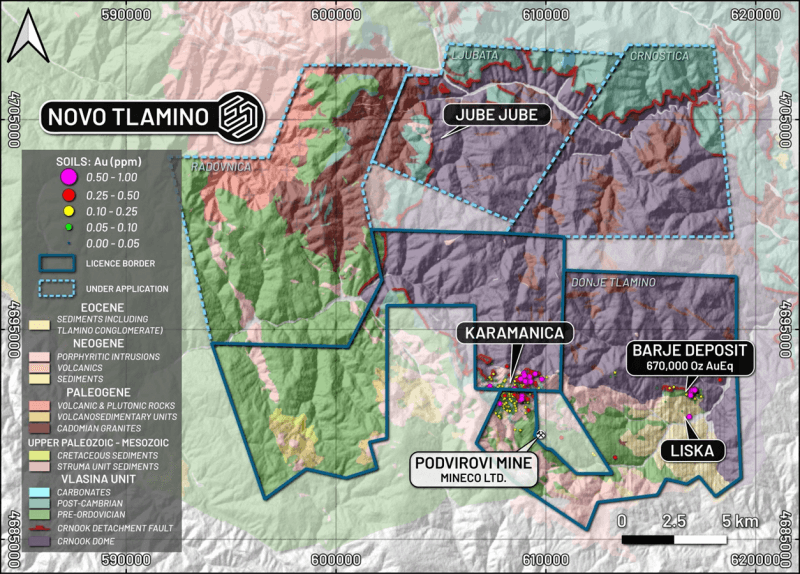

Located in southern Serbia, close to the borders of both Bulgaria and Northern Macedonia, and within the Serbo-Macedonian Metallogenic Belt, the Novo Tlamino Project hosts the Barje gold-silver deposit ( " Barje " ).

Barje contains an inferred resource of 7.1 Mt grading 2.5 g/t Au and 38 g/t Ag, for 670,000 ounces AuEq, as defined in a 2021 Preliminary Economic Assessment (the " 2021 PEA " ) and a mineral resource estimate 1 prepared under NI 43-101.

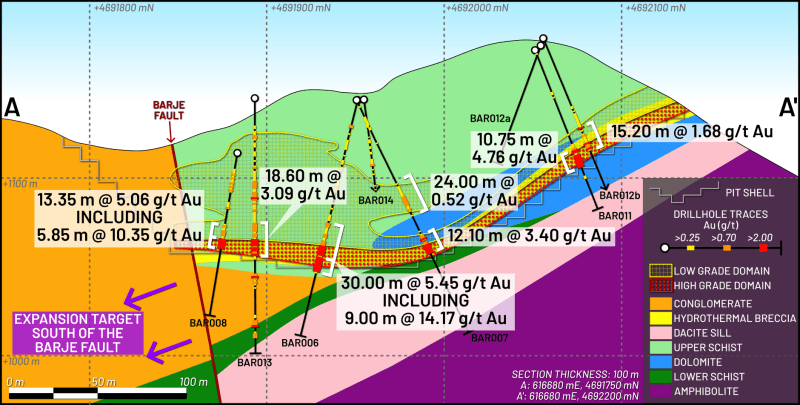

Mineralization is uniform, hosted in a shallow, outcropping, 5-20 meter thick, laterally extensive breccia horizon, and is amenable to conventional open-pit mining. Previous drilling by the Company has intersected multi-metre high-grade gold intercepts within wider zones and in some holes the mineralization started at surface.

Highlights from previous drilling at Barje include:

-

2 m of 23.88 g/t Au and 340g/t Ag in hole BAR002,

-

30 m of 5.45 g/t Au and 25g/t Ag in hole BAR006,

-

9 m of 14.17 g/t Au and 58g/t Ag in hole BAR006,

-

12 m of 3.37 g/t Au and 12g/t Ag in hole BAR007, and

-

6 m of 13.49 g/t Au and 788 g/t Ag in hole BAR010.

Figure 1 : Geological cross section through the Barje deposit. Drill results from News Releases dated March 21, 2019. Pit shell from the 2021 PEA.

2021 PEA

The 2021 PEA returned robust project economics, with a pre-tax NPV (8%) of US$101M and an IRR of 49%. These economics were modelled using a gold price of US$1,500/oz and a silver price of US$16.50/oz.

A revised resource estimate, updated geological modelling, together with additional metallurgical test-work and a revised resource estimate, is expected to notably add to the project's economic potential.

Barje Resource Upside

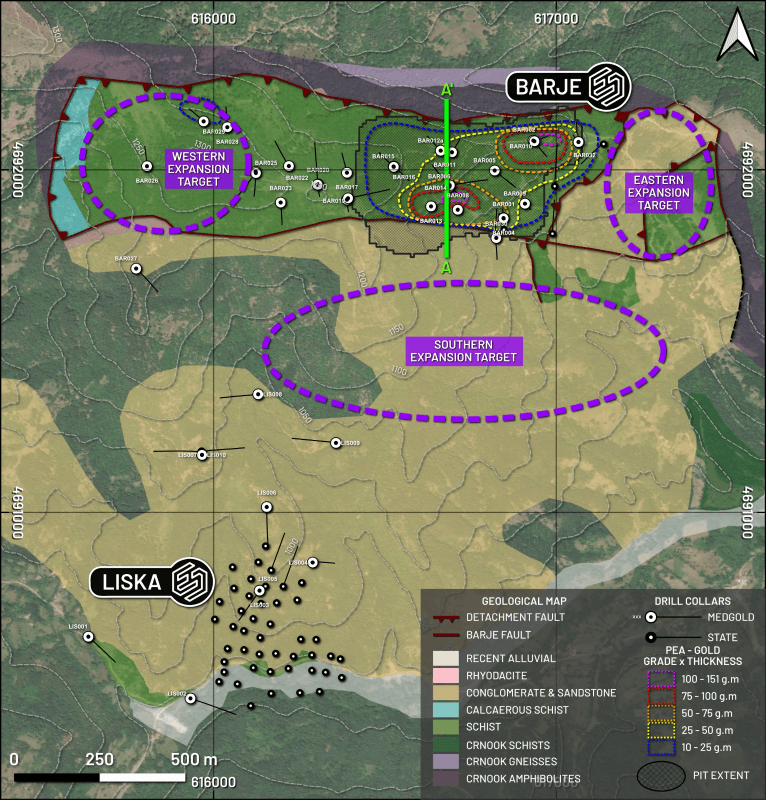

The current Barje resource is bounded to the south by a post ‑ mineral fault past which only limited drilling has been completed. To the east and west, surface channel sampling within upper ‑ zone schists – lithologically comparable to the upper mineralized zone at Barje – has highlighted the potential for parallel or offset zones beyond the current resource boundary. Planned electromagnetic ( " EM " ) surveying and structural interpretation will aim to identify offset extensions of the breccia ‑ hosted mineralization.

An infill drilling program of ~3200 m of drilling is planned within the current area of the inferred resource with the aim of upgrading the resource category. Additional ~1,000 m of step-out drilling will be allocated to test potential extensions of the mineralization in these target areas.

Figure 2 : Plan view map of the Barje – Liska Targets. Drill results from News Release dated March 21, 2019

Novo Tlamino Camp ‑ Scale Potential

Electrum holds licenses and applications over 400 km² contiguous land package within the Serbo-Macedonian Metallogenic Belt, an underexplored, highly prospective district that hosts epithermal gold, skarn, carbonate-replacement ( " CRD " ), and porphyry Cu-Au systems—offering district-scale discovery potential.

Within the broader Novo Tlamino area, priority targets include Karamanica, a 3×2km gold-in-soil anomaly with strong CRD/epithermal potential where only limited drilling has been completed, and Jube Jube, a 3 km gold-in-soil trend supported by gold-bearing rock chips in limonite stockworks that has seen no systematic exploration or historic drilling.

Figure 3 : Overview geological map of the Novo Tlamino project area, with key locations. (EPSG: 32634). Contained AuEq at Barje from News Release dated 26th January 2021; soil results from News Releases dated 2nd October 2017, and 11th January 2018.

Timok East Project Update

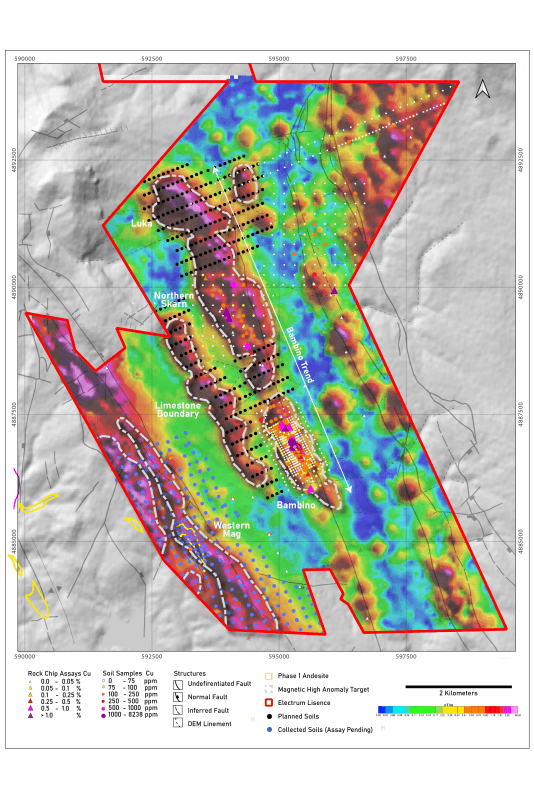

Electrum continues to advance exploration at its Timok East Project, located within the Western Tethyan Belt adjacent to several world-class porphyry Cu-Au deposits. Exploration to date has identified multiple geophysical and geochemical anomalies, including the Western Mag, Bambino Trend, and Limestone Contact targets. The Company has now completed initial soil sampling over those three targets and assay results are pending.

The Company plans to conduct follow-up surface geochemical surveying across new targets with targeted geophysical surveying to refine drill targeting, continuing a systematic approach to evaluating Timok East's porphyry and skarn potential.

Figure 4 : RTP Total Magnetic Intensity – Analytical Signal map of Timok East with Copper-in-soil and rock chip anomalies, showing Bambino Trend, Western Mag, and Limestone Contact target (EPSG:32634) planned soil grids and collected samples pending assay are also displayed. (rock and soil results from News Releases 30 th October 2024 , and April 16 th 2025 ).

Looking Ahead and Near ‑ Term Catalysts

-

Commencement of Barje infill drilling plus step out drilling to test southern and eastern extensions.

-

Additional metallurgical test-work for Barje ore types.

-

Revised Barje Mineral Resource Estimate.

-

Target advancement across the 400 km² Novo Tlamino land package (Karamanica, Jube Jube).

-

Timok East follow up geophysics and drill target prioritization.

Electrum Discovery Issues Stock Options

The Company has granted 1,000,000 incentive stock options to its two new directors. Messrs. Michael Williams and John Anderson have each received 500,000 incentive stock options, which exercisable at $0.13 per common share, are subject to vesting requirements and have an expiry date of August 25, 2030.

The options were granted pursuant to the Company's rolling stock option plan, which has been approved by shareholders and TSX Venture Stock Exchange.

Qualified Person

The scientific and technical contents of this news release have been reviewed and approved by Mr. Thomas Sant BSc, FGS, CGeol, EurGeol. Mr. Sant is a non-independent Qualified Person as defined by NI 43-101 and the VP, Operations, of the Company.

About Electrum Discovery Corp.

Electrum Discovery Corp. is a Canadian based, growth-oriented company, committed to increasing shareholder value through advancement of our two projects: gold-silver Novo Tlamino and copper-gold Timok East , located in two known mineralized districts within the prolific Western Tethyan Belt in the Republic of Serbia.

Electrum Discovery is looking to maximize the value of our mineral projects for all stakeholders including our shareholders, the local community and government, while fostering sustainability, governance, and knowledge transfer in the region.

Additional information on Electrum can be found by reviewing the Company's page on SEDAR+ at www.sedarplus.ca .

For more information contact:

Dr Elena Clarici, Chief Executive Officer and Director

T : +1 604 801 5432 | E : elena@electrumdiscovery.com | W : electrumdiscovery.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this news release constitute "forward-looking information" within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking information. Such statements include Company's expected achievement of specified milestones, results of operations, and expected financial results of the Company. Often, but not always, this forward-looking information can be identified by the use of words such as "estimate", "estimates", "estimated", "potential", "open", "future", "assumed", "projected", "used", "detailed", "has been", "gain", "upgraded", "offset", "limited", "contained", "reflecting", "containing", "remaining", "to be", "periodically", or statements that events, "could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Electrum, to be materially different from any results, performance or achievements expressed or implied by forward-looking information. Such uncertainties and factors include, among others, uncertainties inherent in the PEA and exploration results and the estimation of mineral resources; risks related to the failure to obtain adequate financing on a timely basis and on acceptable terms; changes in general economic conditions and financial markets; risks associated with the results of exploration and development activities, and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in Electrum's quarterly and annual filings with securities regulators and available under Electrum's profile on SEDAR+ at www.sedarplus.ca . Rock chips and surface results are early stage and there is no assurance that future exploration will find mineralization of further interest. Although Electrum has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained herein is based on the assumptions, beliefs, expectations and opinions of management. Forward-looking information has been made as of the date hereof and Electrum disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information.

1 Preliminary Economic Assessment and NI43-101 Technical Report for the Medgold Tlamino Project, January 7, 2021, www.sedarplus.ca . The effective date of the resource estimate is January 7, 2021. Authors of the Reports are: Mr. Richard Siddle, MAIG, of Addison Mining Services Ltd for Mineral Resources; Dr. Matthew Randall, FIMMM, of Axe Valley Mining Consultants Ltd for Mining; Mr. Ian Jackson, FIMMM, of Bara Consulting for Mineral Processing, and Dr. Andrew Bamber, MCIM, of Bara Consulting Ltd for Economic Analysis.

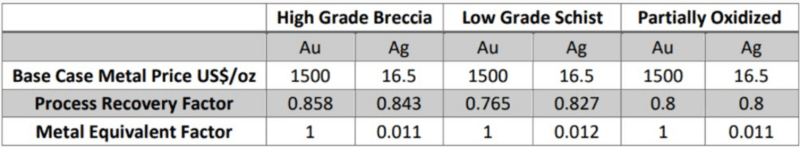

The PEA is preliminary in nature, and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves, and there is no certainty that the PEA will be realised. A gold price of US$1500/oz and a silver price of US$16.5/oz were used for estimations of metal equivalents. Metal equivalent factors were calculated separately for the three main material types of the mineral resource as shown below:

A gold equivalent (AuEq) grade was calculated using the formula AuEq = ((Ag g/t) x 0.011)) + (Au g/t) for the High Grade Breccia and Partially Oxidized materials, and AuEq = ((Ag g/t) x 0.012)) + (Au g/t) for the Low Grade Schist.

Copyright (c) 2025 TheNewswire - All rights reserved.