(TheNewswire)

| |||||||||

Vancouver, Canada, June 23 2025 TheNewswire - Electrum Discovery Corp. (" Electrum " andor the " Company ") (TSX-V:ELY | FRA:R8N | OTC:ELDCF) is pleased to report results from its recent historic data review and field prospecting program at the Karamanica Prospect, part of its Novo Tlamino Project (" Novo Tlamino " andor the " Project "), in south Serbia.

Novo Tlamino is located on the Serbo-Macedonian Metallogenic Belt, one of the most prospective yet underexplored mineral belts in southeast Europe. This belt is renowned for hosting a diverse range of mineral deposit types, including epithermal gold systems, skarn and carbonate replacement deposits (" CRD" s), and porphyry copper-gold deposits.

| Highlights:

|

"Previous work across the Karamanica Prospect has highlighted a significant surface geochemical soil anomaly, with rock sample grades up to 11.10 g/t Au, 117 g/t Ag, 5.74% Cu, 5.18% Zn and 1.96% Pb, underlining the exceptional prospectivity of the broader Novo Tlamino Project'' said Dr. Elena Clarici, CEO of Electrum Discovery Corp. " Our ongoing work at Karamanica is providing a clearer geological model and highlighting the potential for both structurally controlled gold-base metal mineralised veins and skarn or carbonate replacement style mineralisation. We look forward to integrating the latest assay and petrological results to refine targets for the next phase of exploration at Novo Tlamino."

The Karamanica Prospect

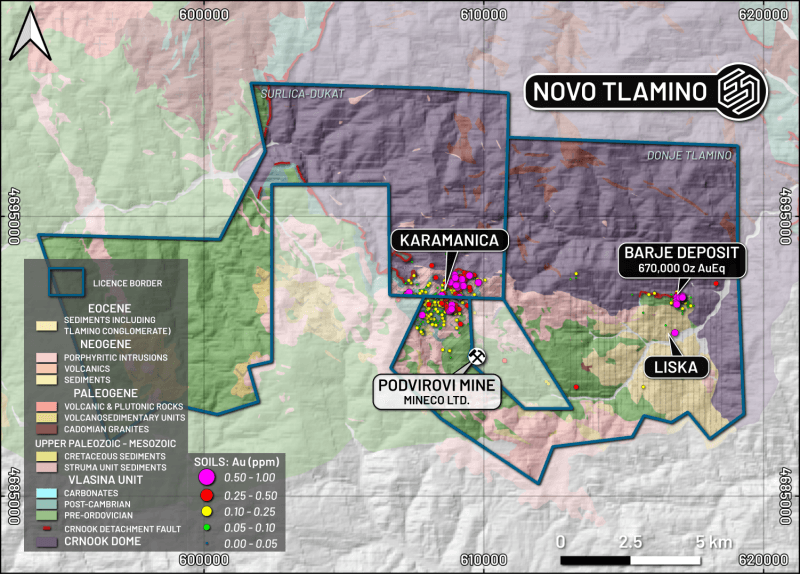

The Karamanica Prospect, part of the Novo Tlamino Project, is located approximately 8 kilometers to the west of Electrum's existing Barje deposit which contains an inferred mineral resource of 670,000 oz AuEq 2 (7.1 Mt at 2.5 g/t Au and 38 g/t Ag containing 570,000 oz Au and 8.8 Moz of Ag).

The prospect covers approximately 12 square kilometers on the southern flank of the Crnook Dome complex, a detachment fault which a key regional structure and a comparable geological setting to the Barje deposit (Figure 1).

Figure 1: Overview geological map of the Novo Tlamino project area, with key locations. (EPSG: 32634). (Contained AuEq at Barje from News Release dated 26 th January 2021; soil results from News Releases dated 2 nd October 2017 , and 11 th January 2018 ).

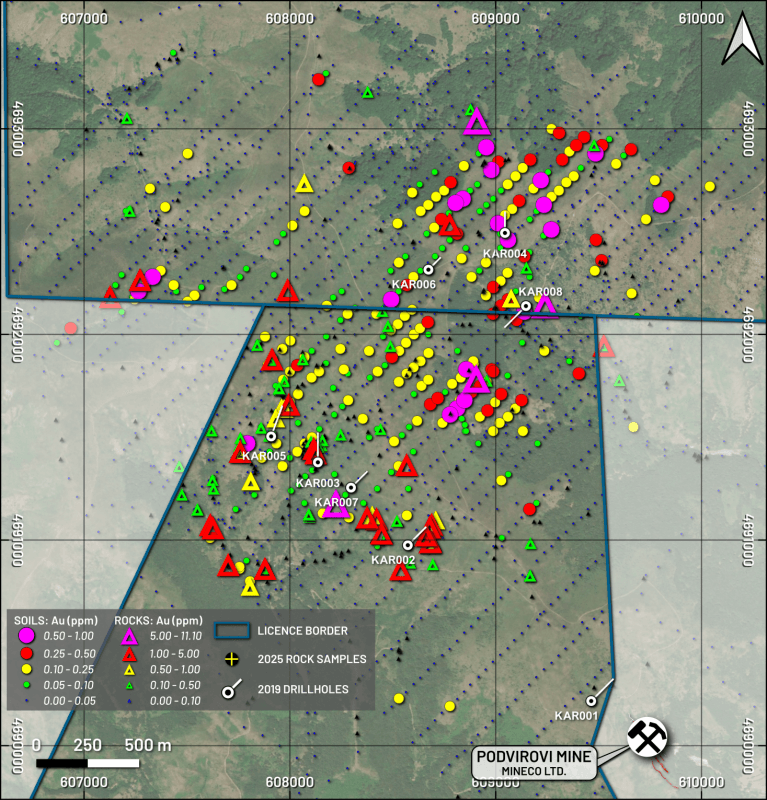

An extensive soil geochemical survey completed in 2019 delineated broad zones of multi-element anomalism, with a gold anomaly spanning approximately 3 square kilometers (Figure 2) 3 .

The anomaly occurs over Palaeozoic schists and calc-schists, intruded by younger porphyritic quartz latite intrusions. The geological framework is crosscut by a series of northwest-trending fault zones, commonly associated with breccia development and gossanous outcrop.

Electrum recently completed a detailed geochemical and field-based review of the Karamanica area to refine its exploration strategy, prioritize, and advance the most prospective targets toward future drill testing.

Figure 2: Distribution of gold grades in soil and rock samples at Karamanica. (EPSG: 32634). (Rock and soil results from News Releases dated 2 nd October 2017 , and 11 th January 2018 ).

Geochemical Zonation and Target Styles

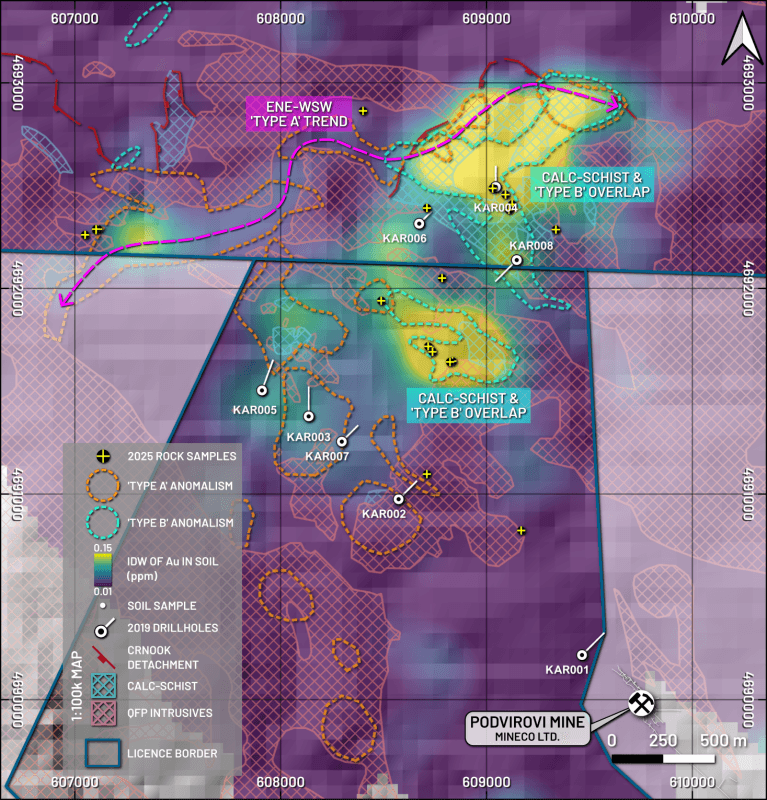

Electrum's analysis and reinterpretation of geochemical data delineated two spatially and geochemically distinct gold associations:

-

Type A Anomalous Trend: Au-As-Sb-Ag-Tl

-

Type B Anomalous Trend: Au-Pb-Zn-Cu

The primary Type A anomalous trend defines a >2 kilometers NW-striking corridor that may represent the upper levels of a continuation of the base-metal mineralised vein system at the nearby polymetallic Pb-Zn-Cu Podvirovi Mine owned by Mineco Limited (Source: www.minecogroup.com). A secondary ENE-striking Type A anomalous trend coincides with the Crnook detachment fault, a structural setting potentially analogous to the Barje deposit, and a high-priority for follow up exploration (Figure 3).

Type B anomalism is concentrated across two main zones in the northeast of Karamanica and spatially correlates with mapped units of calc-schists. The Pb-Zn-Cu-Au signature and identification of outcropping gossan and breccia zones suggests the potential for vein-hosted mineralisation similar to the Podvirovi mine, but also suggests prospectivity for skarn or carbonate replacement style mineralisation where the anomalies overlie carbonate bearing lithologies (Figure 3).

Figure 3: Key geological features and the ‘Type A' and ‘Type B' anomaly trends at Karamanica, overlain onto gridded values of Au-in-soil. (EPSG: 32634). (Soil results from news Releases dated 2 nd October 2017 , and 11 th January 2018 ).

Reconnaissance Fieldwork

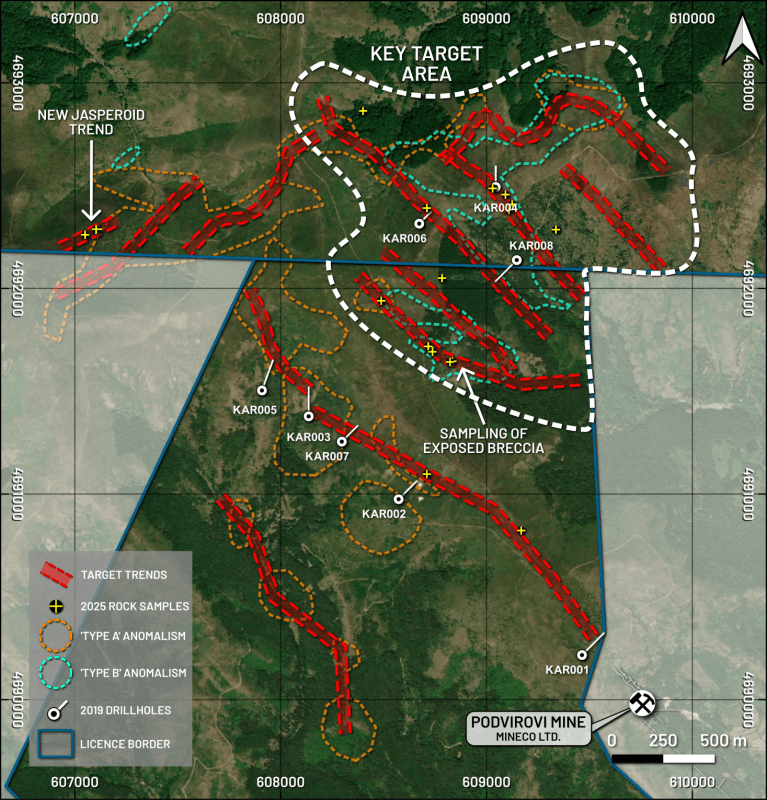

Recent field mapping confirmed that the Type B anomalous trend corresponds with a series of NW-SE trending gossan zones or brecciated fault structures hosted within outcropping calc-schists. These features, coupled with evidence of porphyritic quartz latite intrusive activity, support a model for vein or carbonate replacement mineralisation.

In the western portion of the licence, a previously unrecognised ENE-WSW trending zone with jasperoid quartz and gossan was identified, coinciding with the Type A anomalous trend parallel to the mapped Crnook Detachment surface. Rock chip samples collected along this structure aim to assess its potential for significant mineralisation and to confirm the source of the surrounding Au-in-soil anomalism.

Twenty rock chip samples were submitted for assay and 8 additional specimens were selected for petrological analysis to characterise breccias and altered intrusive observed in the field.

Core Review and Petrology

In support of ongoing target refinement, Electrum's geological team reassessed drill core from the 2019 drilling campaign. Thirteen core specimens were collected and submitted to the University of Belgrade for petrological analysis. Specimens were selected from altered intrusive, sulphide-bearing veins, and calc-schists to investigate the relationship between intrusive phases, alteration styles, gold and lead-zinc-silver mineralisation.

Historic mine records from the nearby Podvirovi deposit, along with local mapping, suggest that the contact zones between intrusive phases and their host units represent zones of high prospectivity. Improved understanding of these relationships will help refine future drill targets.

Particular attention was given to calc-schist intervals of drill core coinciding with Type B base metal anomalism in the northeast of the prospect, where surface geochemistry suggests potential for skarn or carbonate-replacement mineralisation. An interval from 77 meters to 81 meters in hole KAR008 displayed distinct visual and geochemical changes within the calc-schist sequence; select specimens of core were submitted for petrological analysis to test for skarn mineral assemblages. Confirmation of skarn formation would represent a significant advancement in the project's exploration model and targeting strategy.

Ongoing and Planned Exploration Work at Karamanica

Current and upcoming exploration activities at the Karamanica Prospect are focused on:

-

Refining the geometry of key structural corridors (Figure 4) that may control mineralisation and evaluating the potential of gossanous and brecciated outcrops along these trends to host significant gold and base-metal mineralisation.

-

Mapping the interaction of the structural corridors with carbonate-bearing lithologies in areas of surface geochemical anomalies to delineate zones of favourable fluid-rock interaction prospective for skarn or CRD style mineralisation. Of particular interest is the Crnook Detachment fault zone, where Type A and Type B soil anomalies converge near mapped calc-schist exposures.

Results from rock chip samples and ongoing petrological work will be integrated into the evolving geological model to support the definition and ranking of future targets, and to identify potential gold and base metal mineralisation linked to skarn, CRD, or structurally controlled vein systems across Karamanica.

Figure 4: Defined target trends at Karamanica. A key target area (~2 square kilometers) for future exploration, covering multiple prospective structural features, soil anomalies and outcropping calc-schists, is outlined in white. (EPSG: 32634).

Qualified Person

The scientific and technical contents of this news release have been reviewed and approved by Mr. Thomas Sant BSc, FGS, CGeol, EurGeol. Mr. Sant is a non-independent Qualified Person as defined by NI 43-101 and the VP, Operations, of the Company.

About Electrum Discovery Corp.

Electrum Discovery Corp. is an emerging mineral exploration and development company focused on the prolific Western Tethyan Belt with two main projects spanning 645 square kilometers of prospective exploration ground in the Republic of Serbia.

-

Timok East extends over 123 square kilometers across the Timok copper-gold region, includes multiple copper-gold targets and mineralized trends, and is located less than five kilometers from the Bor Mining Complex.

-

Novo Tlamino , located in the south-east of the Republic of Serbia, covers 522 square kilometers and includes an inferred mineral resource estimate of 7.1 Mt at 2.9 g/t AuEq containing 670,000oz AuEq (7.1 Mt at 2.5 g/t Au and 38 g/t Ag containing 570,000 oz Au and 8.8 Moz of Ag ), PEA (January 7, 2021) 2

Electrum Discovery is looking to maximize the value of our mineral projects for all stakeholders including our shareholders, the local community and government. We have an open-door policy and encourage all stakeholders to contact us through our website. We have a strong environmental and ethics policy to complete all our work in line with regulations in an open and transparent process. Our projects are at an early stage, and we plan to continue our consultation with all stakeholders in a climate of mutual respect, while fostering sustainability, governance, and knowledge transfer in the region.

Additional information on Electrum can be found by reviewing the Company's page on SEDAR+ at www.sedarplus.ca

For more information contact:

Dr Elena Clarici, Chief Executive Officer and Director

T : +1 604 801 5432 | E : elena@electrumdiscovery.com | W : electrumdiscovery.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this news release constitute "forward-looking information" within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking information. Such statements include Company's expected achievement of specified milestones, results of operations, and expected financial results of the Company. Often, but not always, this forward-looking information can be identified by the use of words such as "estimate", "estimates", "estimated", "potential", "open", "future", "assumed", "projected", "used", "detailed", "has been", "gain", "upgraded", "offset", "limited", "contained", "reflecting", "containing", "remaining", "to be", "periodically", or statements that events, "could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Electrum, to be materially different from any results, performance or achievements expressed or implied by forward-looking information. Such uncertainties and factors include, among others, uncertainties inherent in the PEA and exploration results and the estimation of mineral resources; risks related to the failure to obtain adequate financing on a timely basis and on acceptable terms; changes in general economic conditions and financial markets; risks associated with the results of exploration and development activities, and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in Electrum's quarterly and annual filings with securities regulators and available under Electrum's profile on SEDAR+ at www.sedarplus.ca . Rock chips and surface results are early stage and there is no assurance that future exploration will find mineralization of further interest. Although Electrum has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained herein is based on the assumptions, beliefs, expectations and opinions of management. Forward-looking information has been made as of the date hereof and Electrum disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information.

1 Rock samples include grab samples of outcrop and float. Samples are selected samples and may not represent true underlying mineralization.

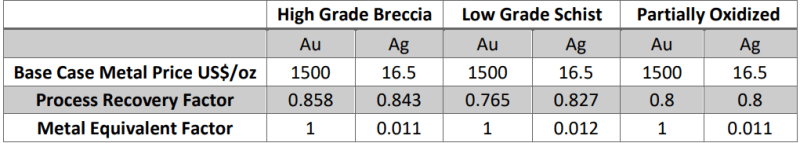

2 Preliminary Economic Assessment and NI43-101 Technical Report for the Medgold Tlamino Project, January 7, 2021, www.sedarplus.ca . The PEA is preliminary in nature, and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves, and there is no certainty that the PEA will be realised. A gold price of US$1500/oz and a silver price of US$16.5/oz were used for estimation of metal equivalents. Metal equivalent factors were calculated separately for the three main material types of the mineral resource as shown below:

A gold equivalent (AuEq) grade was calculated using the formula AuEq = ((Ag g/t) x 0.011)) + (Au g/t) for the High Grade Breccia and Partially Oxidized materials, and AuEq = ((Ag g/t) x 0.012)) + (Au g/t) for the Low Grade Schist.

3 Soil sampling surveys are not definitive, and the results are still at an early stage of interpretation, with no guarantee of a mineral discovery. Rock samples include grab samples of outcrop and float. Samples are selected samples and may not represent true underlying mineralization.

Copyright (c) 2025 TheNewswire - All rights reserved.