January 22, 2025

Eclipse Metals Ltd (ASX: EPM) (Eclipse Metals or the Company) is pleased to update shareholders on recent progress at its Grønnedal prospect, located within the Ivigtût Project in southwestern Greenland. Building on the October 2024 announcement, the Company has taken significant steps to expand its maiden JORC Code (2012) compliant Mineral Resource Estimate (MRE). The current MRE, comprising 1.18Mt grading 6,859ppmm Total Rare Earth Oxides (TREO) (Table 1, Appendix 1), is based on limited shallow drill testing of a small section amounting to less than approximately 5% of a larger carbonatite complex that is enriched in rare earths mineralisation.

HIGHLIGHTS:

- Calibrated Analysis in Progress: Samples from six historical Grønnedal drill holes are being used to refine and validate XRF results for precise resource estimation.

- Focus on Rare Earth Elements (REE): Analytical emphasis on REE geochemistry, with additional investigation into niobium (Nb) and gallium (Ga) mineralisation.

- Advanced Mineralogical Studies: Mineralogy using TIMA technology aims to correlate geochemical data with mineral phases.

- Results Timeline: Laboratory analyses are underway in Sweden, with outcomes anticipated in Q1 2025.

In 1950, Kryolitselskabet Øresund A/S, (Cryolite Miner), drilled six diamond holes in the vicinity of the Grønnedal resource to test for a potential iron ore deposit. This drilling extends to depths of up to 200m. During 2024 Eclipse completed XRF analyses of the core from these drillholes, which is stored in Gothenburg. The analysis comprised automated core-scanning using the Minalyze XRF TruScan technology developed by Veracio in Gothenburg, Sweden,

The XRF analysis confirmed the qualitative presence of REE mineralisation. Selected intervals of the core are currently being verified by laboratory analysis. This phase focuses on REE geochemistry, particularly neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb), which are pivotal for magnet applications.

Selected samples are also being analysed by TIMA (TESCAN Integrated Mineral Analyser) mineralogical analysis in order to align chemical analyses with specific mineralogical features, thus enhancing the understanding of resource quality and distribution.

GEOLOGY

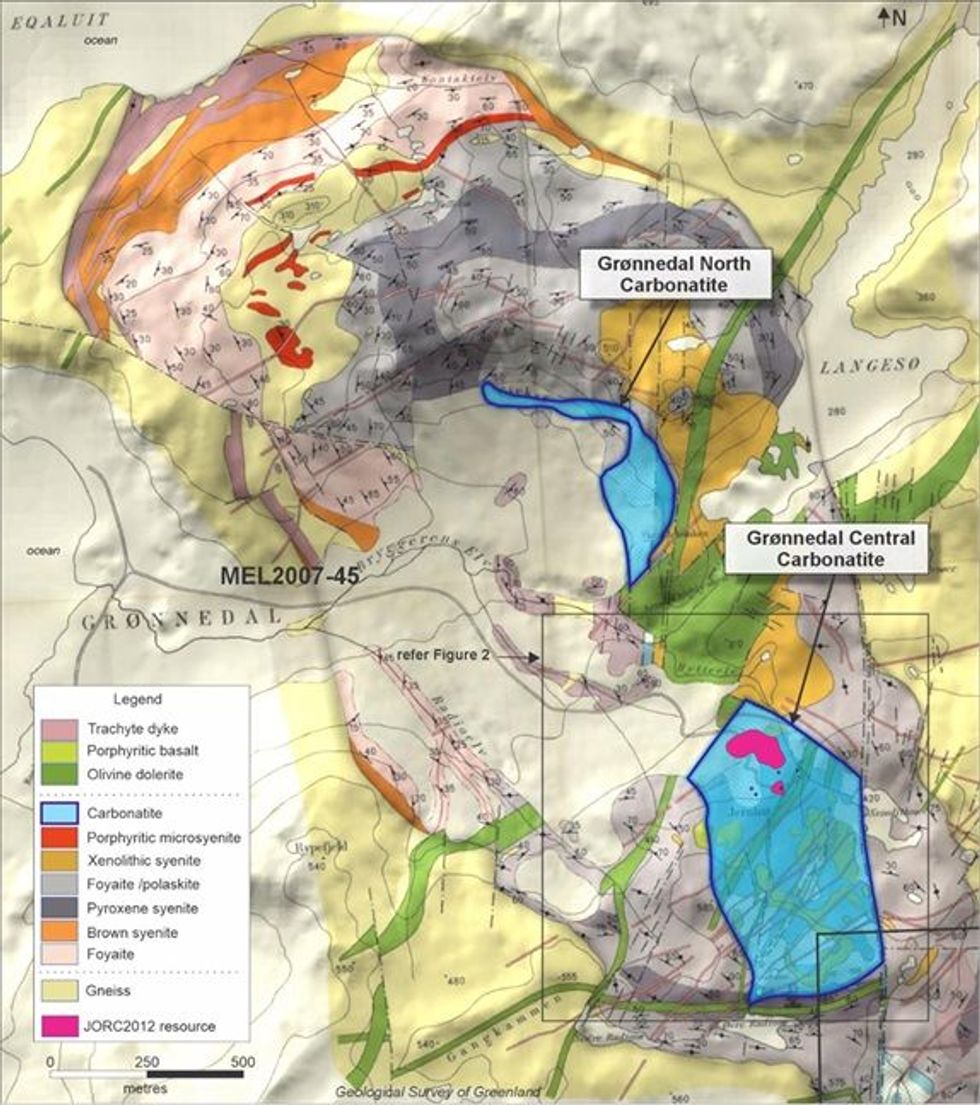

The Grønnedal MRE is located at the northern end of Central Carbonatite which covers an area of 1,400m by 750m (Figure 1). The Central Carbonatite forms part of a larger complex that includes the Northern Carbonatite that is yet to be tested for REE. The Central Carbonatite is enclosed within syenitic rocks and is intruded by a series of north-easterly trending dolerite, basaltic and trachytic dykes (Figure 2). The depth to which the carbonatite extends is yet to be determined. Data from the deeper historic diamond drillholes, all of which ended in mineralisation, reveal a minimum vertical extent of 170m.

The footprint of the current MRE is defined through shallow trenching and drilling over a 300m x150m area which represents a small fraction of the Central Carbonatite. The resource is open- ended in all directions and at depth. Confirmation of REE in the historic diamond holes, which were drilled outside of the resource envelope, is considered to be significant as it indicates continuation of mineralisation into areas that remain untested.

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EPM:AU

The Conversation (0)

25 March 2024

Eclipse Metals

Pursuing Multi-commodity Assets to Support Decarbonization

Pursuing Multi-commodity Assets to Support Decarbonization Keep Reading...

12h

Top Australian Mining Stocks This Week: OD6 Metals Shines on US Fluorspar Acquisition

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Critical minerals companies dominate this week’s list, with OD6 Metals emerging as the top gainer.The Northern Territory government... Keep Reading...

26 February

Top Australian Mining Stocks This Week: European Resources Soars on Rare Earth Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Gold, lithium and copper companies continue to dominate our top ASX stocks of the week. This week, the Northern Territory's Minister... Keep Reading...

25 February

China's Rare Earths Export Ban Hits Japanese Defense Sector

China has moved to freeze exports of rare earth magnets and other critical materials to dozens of major Japanese companies, with the measures to take effect immediately.China’s commerce ministry said Tuesday (February 24) that it will suspend shipments of so-called “dual-use” goods — referring... Keep Reading...

24 February

Application to Trade on OTCQB Market

Altona Rare Earths plc (LSE: REE), the critical raw materials exploration and development company focused on Africa, is pleased to announce that it has applied for its ordinary shares to be admitted to trading on the OTCQB Venture Market in the United States ( "OTCQB").The Company has submitted... Keep Reading...

24 February

Brazil, India Ink Rare Earths Pact to Expand Supply Chain Cooperation

Brazil and India have signed a new agreement to deepen cooperation on rare earths and critical minerals as both countries seek to strengthen supply chains and reduce reliance on trading partners.The non-binding memorandum of understanding, sealed on February 21 during Brazilian President Luiz... Keep Reading...

22 February

LKY Commences Diamond Drilling at Desert Antimony Mine

Locksley Resources (LKY:AU) has announced LKY Commences Diamond Drilling at Desert Antimony MineDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00