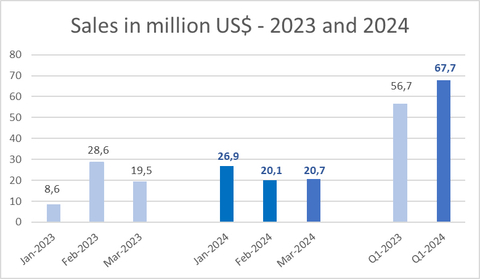

Dynacor Group Inc. (TSX-DNG) (Dynacor or the "Corporation"), an international gold ore industrial corporation servicing ASMs (artisanal and small-scale miners), today announced that it had recorded unaudited gold sales of US$20.7 million (C$28.0 million) (1) for March 2024, as the plant continued running at full capacity, processing just over 15,000 tonnes. In 2023, March sales amounted to US$19.5 million (C$26.7 million).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240417095404/en/

(Graphic: Business Wire)

First quarter sales amounted to US$67.7 million (C$91.3 million) in 2024, a quarterly sales record, compared to US$56.7 million (C$76.7 million) in Q1-2023, a 19.4% increase.

In 2023, second half of January planned exports had been postponed to February explaining the high sales level in February and lower sales in January.

In March, the average selling price of gold was US$2,187 per ounce, compared to US$1,918 per ounce in March 2023 as gold price continued its rise.

The Corporation recently announced its sales guidance for 2024 ranging between US$265-285 million using a market gold price ranging between US$2,000 and US$2,050 per ounce.

| (1) | Sales are converted using the monthly average exchange rate |

ABOUT DYNACOR

Dynacor is a dividend-paying industrial gold ore processor headquartered in Montreal, Canada. The corporation is engaged in gold production through the processing of ore purchased from the ASM (artisanal and small-scale mining) industry. At present, Dynacor operates in Peru, where its management and processing teams have decades of experience working with ASM miners. It also owns a gold exploration property (Tumipampa) in the Apurimac department.

The corporation intends to expand its processing operations in other jurisdictions as well.

Dynacor produces environmental and socially responsible gold through its PX IMPACT® gold program. A growing number of supportive firms from the fine luxury jewelry, watchmakers and investment sectors pay a small premium to our customer and strategic partner for this PX IMPACT® gold. The premium provides direct investment to develop health and education projects for our artisanal and small-scale miner's communities.

Dynacor is listed on the Toronto Stock Exchange (DNG).

FORWARD-LOOKING INFORMATION

Certain statements in the preceding may constitute forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of Dynacor, or industry results, to be materially different from any future result, performance or achievement expressed or implied by such forward-looking statements. These statements reflect management's current expectations regarding future events and operating performance as of the date of this news release.

Shares Outstanding: 36,523,356

Website: http://www.dynacor.com

Twitter: http://twitter.com/DynacorGold

View source version on businesswire.com: https://www.businesswire.com/news/home/20240417095404/en/

For more information, please contact:

Director, Shareholder Relations

Dale Nejmeldeen

Dynacor Group Inc.

T: 514-393-9000 #230

E: investors@dynacor.com