- WORLD EDITIONAustraliaNorth AmericaWorld

May 17, 2023

Charger Metals NL (ASX: CHR, ‘Charger’ or ‘the Company’) is pleased to announce that drilling has commenced at the Bynoe Lithium Project, Northern Territory.

- Maiden reverse circulation (RC) drill programme has commenced at the Bynoe Lithium Project, NT

- Initial ~2,000m programme has been designed as a first-pass test of high priority targets including the Megabucks, Old Bucks and Enterprise prospects

- The programme is expected to take approximately three weeks

Charger’s Managing Director, Aidan Platel, commented:

“We are thrilled to have commenced our maiden drill programme at our exciting Bynoe Lithium Project. The first-pass programme will drill test priority targets at the Old Bucks, Megabucks and Enterprise Prospects, all of which are located in a structural corridor directly along strike from Core Lithium Limited’s (ASX:CXO) operating Finniss Lithium Mine. 1

Samples will be submitted to a certified laboratory in Darwin on a regular basis and we look forward to updating the market as the assay results come to hand.”

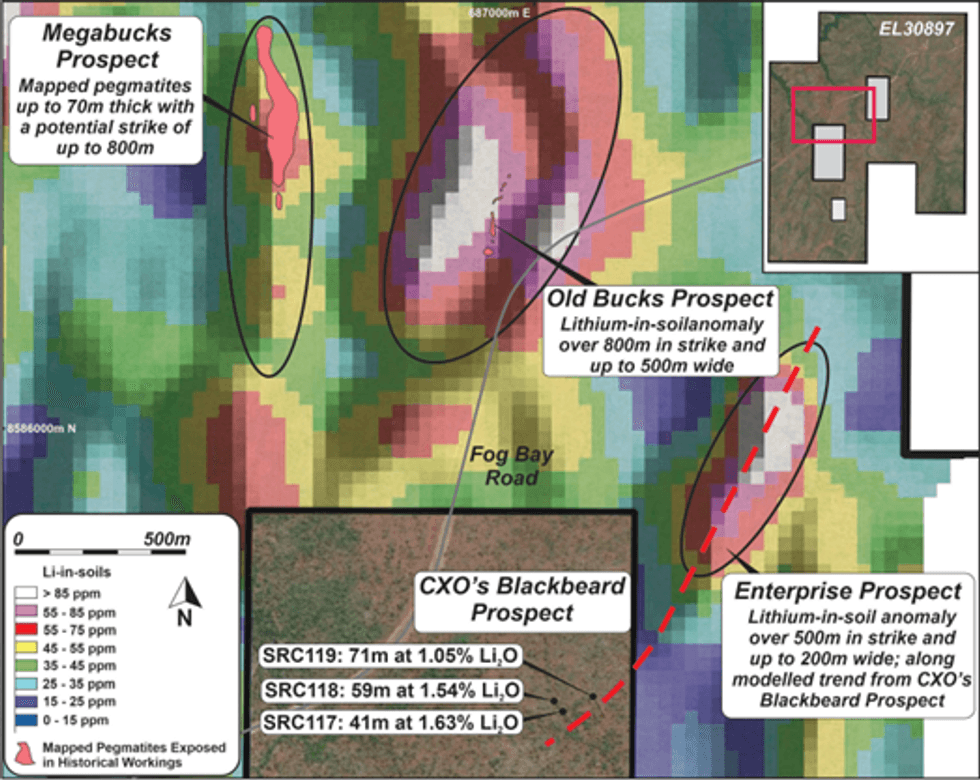

The first-pass RC drill programme will comprise approximately 2,000m and has been designed to test three priority target areas that the Company believes have high prospectivity for significant pegmatite-hosted lithium mineralisation. The Old Bucks Prospect comprises a strong lithium anomaly at surface that extends over 800m in strike and up to 500m wide, with pegmatites visible in historic artisanal tin workings (Figure 1).

The Megabucks Prospect also exhibits a lithium-in-soils anomaly up to 800m long, with a significant pegmatite up to 70m thick defined by historical deep trenching across the strike.

A third high priority target, the Enterprise Prospect, will also be tested. Enterprise too is characterised by a large lithium anomaly at surface, and is located along strike from Core Lithium Limited’s (ASX:CXO) Blackbeard Prospect, which includes the following recently-announced significant drill intersections:

- 41m @ 1.63% Li2O from 137m (SRC117)

- 59m @ 1.54% Li2O from 158m (SRC118) and

- 71m @ 1.05% Li2O from 101m (SRC119). 1

The drill programme is expected to take approximately three weeks. Over the coming weeks the Company will increase its exploration activities across the Bynoe Lithium Project as the area continues to become more accessible after the region’s “wet season”.

Authorised for release by the Board.

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00