October 01, 2023

The Board of Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) advises on progress at its 60 per cent owned Makuutu Heavy Rare Earths Project (“Makuutu” or “the Project”) in Uganda.

- Phase 5 Rotary Air Blast (RAB) Tranche 2 assays received on Exploration Licence (EL) 00257 and Retention Licence (RL) 00007 reporting clay-hosted rare earth intersections achieved in 26 of 31 drill holes, including;

- 8 metres at 975 ppm TREO from 7 metres in RRMRB117;

- 20 metres at 865 ppm TREO from 6 metres in RRMRB115;

- 20 metres at 789 ppm TREO from 4 metres in RRMRB116;

- 24 metres at 781 ppm TREO from 4 metres in RRMRB129; and

- 20 metres at 756 ppm TREO from 4 metres in RRMRB120

- Completed Phase 5 RAB assays confirming clay-hosted rare earth intersections in 69 of 76 drill holes across EL 00147, EL00257, and RL00007;

- Metallurgical test work initiated on RAB samples from drill program, feeding into revised Makuutu Exploration Target expected late 2023;

- Makuutu’s basket contains 71% magnet and heavy rare earths content, and is one of the most advanced heavy rare earth projects globally available as a source for new supply chains emerging across Europe, the US, and Asia; and

- Diamond drilling is continuing infill drilling at Retention Licence (RL) 00007, aiming to increase resource classification to Indicated Resource, with 103 holes completed (2,032 metres) to date.

The Company is progressing the development at the Makuutu Heavy Rare Earths Project through local Ugandan operating entity Rwenzori Rare Metals Limited (“RRM”).

IonicRE’s Managing Director Mr Tim Harrison said the Phase 5 RAB Tranche 2 assay results confirmed the expected potential of the northwest tenement to provide additional growth potential for a much larger Makuutu Project in years to come.

“EL00257 has now confirmed clay-hosted rare earth mineralisation in 21 of 26 RAB holes drilled in this program.

“The Project now moves to metallurgical test work on a selection of sample intervals to map the potential of this tenement and EL00147, expected to add significantly to the Makuutu Project development plan.

“Our focus on the delivery of the Makuutu Heavy Rare Earths Project in Uganda positions us to provide a secure, sustainable, and traceable supply of magnet rare earth oxides. Along with our Belfast recycling facility, Makuutu is key to us harnessing our technology to accelerate mining, refining, and recycling of magnets and heavy rare earths that are critical for the energy transition, advanced manufacturing, and defence,” Mr Harrison said.

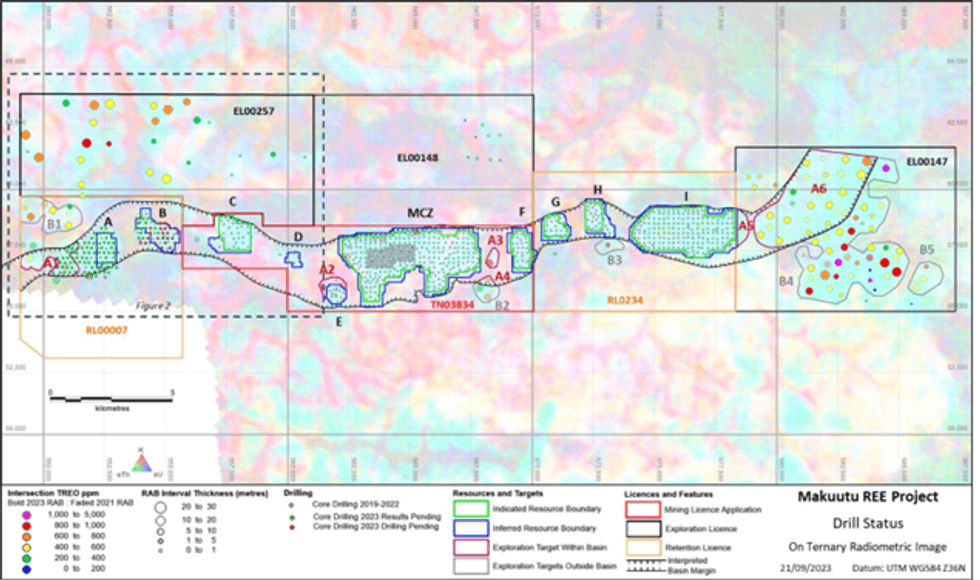

The Tranche 2 results are from drilling located on Exploration Licence EL00257 (26 holes) and Retention Licence (RL) 00007 (5 holes), located at the western end of the extensive licence holding at Makuutu (see Figure 1).

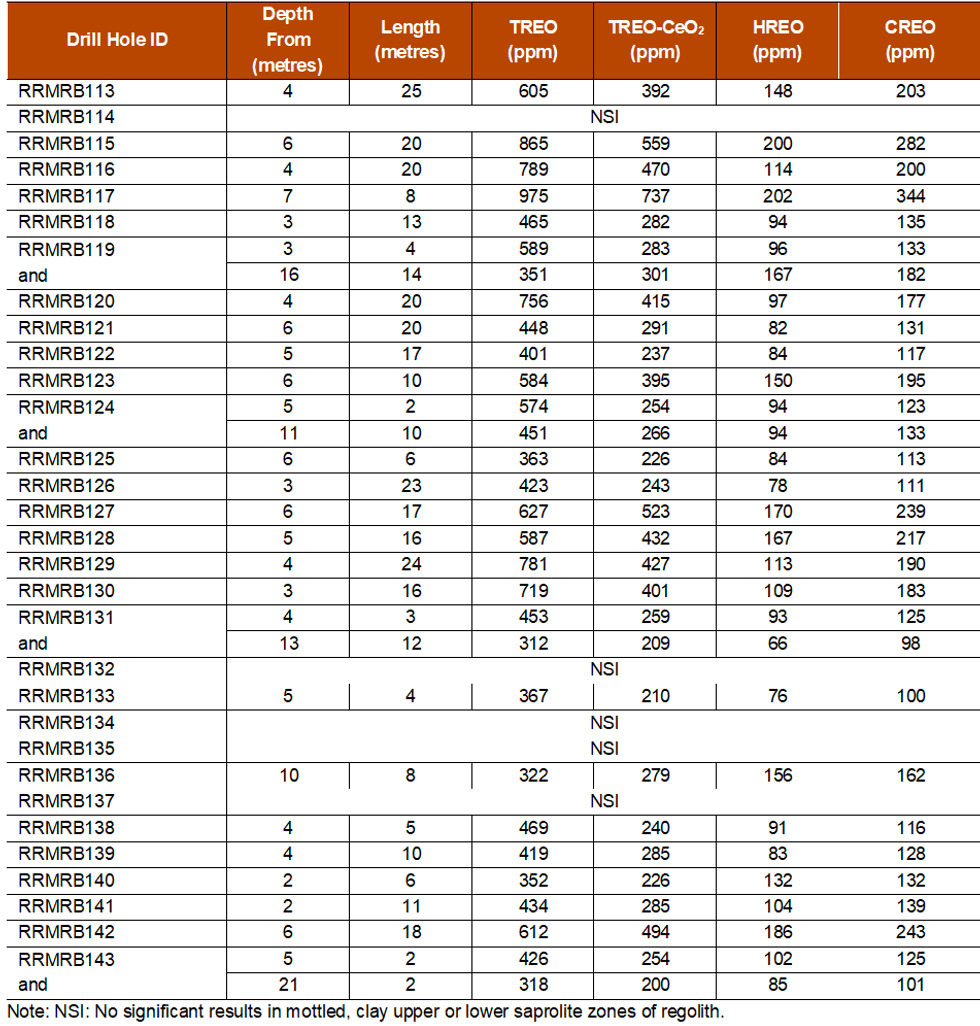

A total of 31 rotary air blast (RAB) holes were drilled across EL00257 and RL00007, with 26 holes recording intervals of regolith hosted rare earth mineralisation above the 2022 Mineral Resource Estimate (MRE) cut-off grade of 200 ppm Total Rare Earth Oxide minus Cerium oxide (TREO-CeO2). (ASX: 3 May 2022). Table 1 lists the intersection compilations and Figure 2 shows the location of the drill results.

EL00257 RAB Drilling

The RAB drilling on EL00257 is the first drilling to test this tenement. The aim of the drilling was to test the endowment of rare earth element (REE) in the regolith and determine the extent and thickness of mineralisation. This drilling has successfully confirmed zones of thick REE mineralisation on the northwestern half of the licence.

Results from the drilling (Figure 2) show the northwestern half of the area contains greater thickness of regolith under hardcap with significant intersections including;

- 8 metres at 975 ppm TREO from 7 metres in RRMRB117;

- 20 metres at 865 ppm TREO from 6 metres in RRMRB115;

- 20 metres at 789 ppm TREO from 4 metres in RRMRB116;

- 24 metres at 781 ppm TREO from 4 metres in RRMRB129; and

- 20 metres at 756 ppm TREO from 4 metres in RRMRB120.

This area is interpreted to be underlain by the Iganga Suite granite basement rocks, an older and different protolith from the Makuutu deposit hosted in a Karoo age sedimentary basin.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00