August 18, 2023

MTB Metals Corp. (TSXV: MTB) (OTCQB: MBYMF) (FSE: M9U) ("MTB" or the "Company") announces that drilling on the Telegraph porphyry project is anticipated to start around August 19. Currently pads are being built and the drills are being mobilized. The first phase of drilling will be testing three areas along 2.5 kilometres of the identified Dok trend.

The geological setting of the Telegraph property is similar to four world-class porphyry copper-gold deposits in the same region, all of which are being advanced by major mining companies. MTB consolidated a 310 square kilometer land package in 2021 and is now exploring this area for the first time on a consolidated basis.

Two holes drilled in 2014 confirmed the presence of a porphyry copper-gold system at Dok, but the holes are interpreted to be peripheral to the heart of the system. For the last 2 years the MTB geological team has been compiling the historic data and systematically exploring the various identified targets with geological alteration and structural mapping, prospecting, shortwave infrared spectroscopy (SWIR), rock sampling, spectral analysis and soil geochemistry. A Volterra 3D Induced Polarization (3DIP) ground survey was also conducted in 2022 over the Red Creek area within the Dok Trend. By evaluating the SWIR data, trace element geochemistry and identified alteration, the geological team is building a porphyry model for the area. Multiple porphyry targets have been identified within the broad zone of alteration identified in the area, including the Dok trend and Strata Mountain. This initial drill program will involve 2,000 to 3,000 meters of drilling from 3 drill pads, with the details of the program evolving based on observations as the drilling progresses.

2023 Field Program and Target Selection

For the 2023 field season, exploration has been focussed primarily on the Dok trend in preparation for drilling.

Field work has consisted of further geological alteration and structural mapping, spectral analysis, shortwave infrared spectroscopy (SWIR), assay rock sampling, and soil geochemistry. A portable X-Ray Fluorescence Spectrometer (pXRF) is on site which allows the team to instantaneously analyze the soil and rock samples without having to wait for assay results from the lab. Over 650 soil samples have been collected of which assay results have been received for the first 275 samples. The assay results for copper from the lab are consistently about 30% higher than the pXRF results, providing added confidence in the identified pXRF soil anomalies.

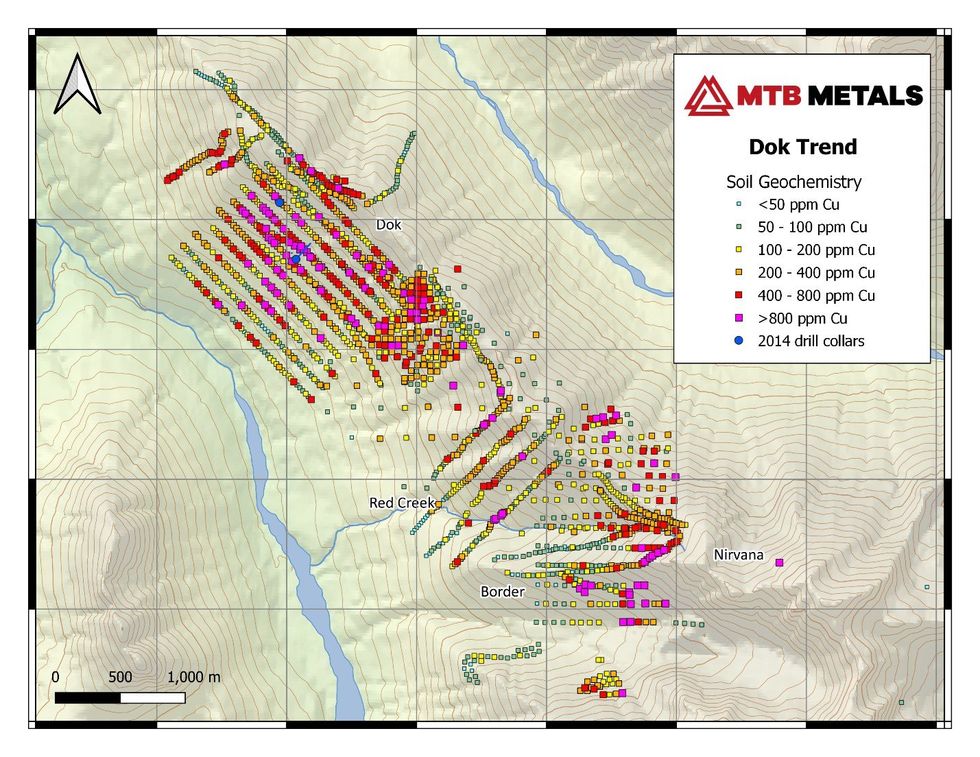

Numerous copper and gold in soil anomalies occur within Dok trend including a 1.2 km x 1 km anomaly, which includes 175 soil samples. The average concentration of copper in soils within this anomaly is 376 ppm, with a high of 3,860 ppm Cu and a low of 51 ppm. Values of up to 0.36 ppm gold also occur within this area.

Analysis of trace element geochemistry has demonstrated diagnostic zonation of metals comparable with current porphyry models. Additionally, SWIR data has identified alteration patterns, including white mica with high white mica crystallinity, a proxy for hotter temperatures and subsequently the centre of a porphyry hydrothermal system.

Figure 1- Current and Historic Soil Geochemistry for Copper on the Dok Trend

Currently, three styles of copper and gold mineralization have been identified. They include the following,

- High grade copper mineralization hosted within quartz and carbonate veins interpreted to be peripheral to a porphyry system.

- Disseminated and stockwork copper mineralization occurring with magnetite, k-feldspar, epidote and chlorite interpreted to be within the upper reaches of a porphyry system.

- Disseminated and stockwork copper mineralization with k-feldspar, biotite and sericite, interpreted to be within the hotter (deeper) parts of a porphyry system.

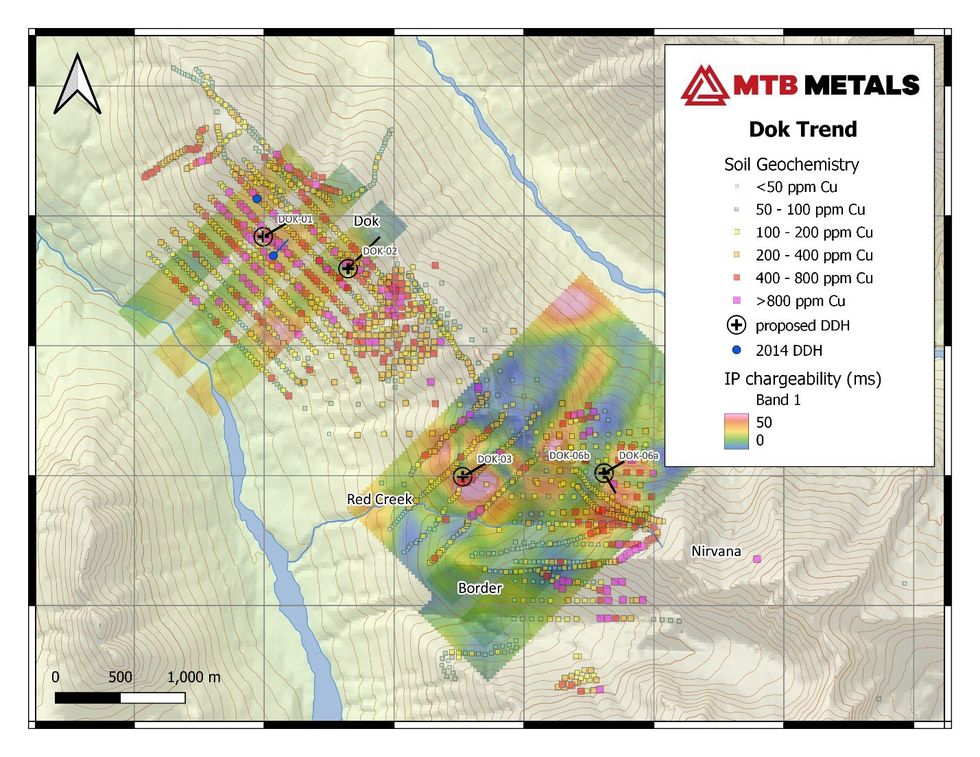

Targets along the Dok trend have been ranked based on their IP and 3DIP chargeability responses from the 2012 and 2022 ground surveys, the magnetic response from the 2012 airborne mag survey, soil geochemistry results, pXRF results, SWIR results and field observations from ground truthing of identified anomalies.

Lucia Theny, Vice President Exploration, stated: "The overlapping of multiple geological, geophysical and geochemical indicators is providing good confidence in our target selection and the team is excited to be able to test their hypothesis with the drill."

Figure 2 - Proposed Drill Holes for the Dok Trend on top of Copper Soil Geochemistry and Induced Polarization Chargeability

Lawrence Roulston, CEO, noted: "The geological team over the past two months carried out mapping, sampling and spectral analysis which confirmed the earlier information and filled in some gaps. These results provided a firm basis for selection of the initial drill targets. The team has worked methodically to advance the understanding of this huge geological system. This initial drill program will involve 2,000 to 3,000 meters of drilling from 3 drill pads, with the details of the program evolving based on observations as the drilling progresses. Use of the pXRF on the drill core will support the geological team's observations."

About MTB

MTB has six active projects spanning 670 square kilometres (67,587 hectares) in the prolific Golden Triangle of northern British Columbia. With the focus on the Telegraph project, discussions are now underway leading to joint ventures and/or spinouts of other projects.

- Telegraph is located in the vicinity of 4 world-class porphyry deposits being advanced by major mining companies: Galore (Teck / Newmont), Schaft (Teck), Saddle (Newmont) and the operating Red Chris copper-gold mine (Newcrest / Imperial Metals). Field work by MTB on its 310 square kilometre property, together with earlier results, provides compelling evidence for the presence of one or more porphyrys, similar to others in the area.

- The American Creek project is centered on the historic Mountain Boy silver mine. The project is road accessible and 20 km from the deep-water port of Stewart. There are multiple silver, gold and copper occurrences on the property, including a 2006 drill hole that encountered 5 kgs of silver over 5 metres.

- Red Cliff is a past producing gold and copper mine in which the Company holds a 35% interest. Recent drill results include 2 meters of 26 g/t gold.

- On the BA property, 182 drill holes have outlined a substantial zone of silver-lead-zinc mineralization located 4 km from the highway. Several targets with high-grade silver potential remain to be tested. Surprise Creek, to the north, hosts the same prospective stratigraphy.

- On the Theia project, work by MTB and previous explorers has outlined a silver bearing mineralized trend 500 metres long, highlighted by a 2020 grab sample that returned 39 kg per tonne silver (1,100 ounces per ton). Two other zones on the property produced copper values over 5%.

- Southmore is in the midst of some of the largest deposits in the Golden Triangle. It was explored in the 1980s through the early 1990s and was overlooked until MTB consolidated the property and carried out airborne geophysics and field work which confirmed several zones of gold and copper, with values up to 20% copper and 35 g/t gold.

On behalf of the Board of Directors:

Lawrence Roulston

President & CEO

For further information, contact:

Caroline Klukowski

info@mountainboyminerals.ca

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release may contain certain "forward looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

MTB:CA

The Conversation (0)

12h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

12h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

12h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00