August 02, 2023

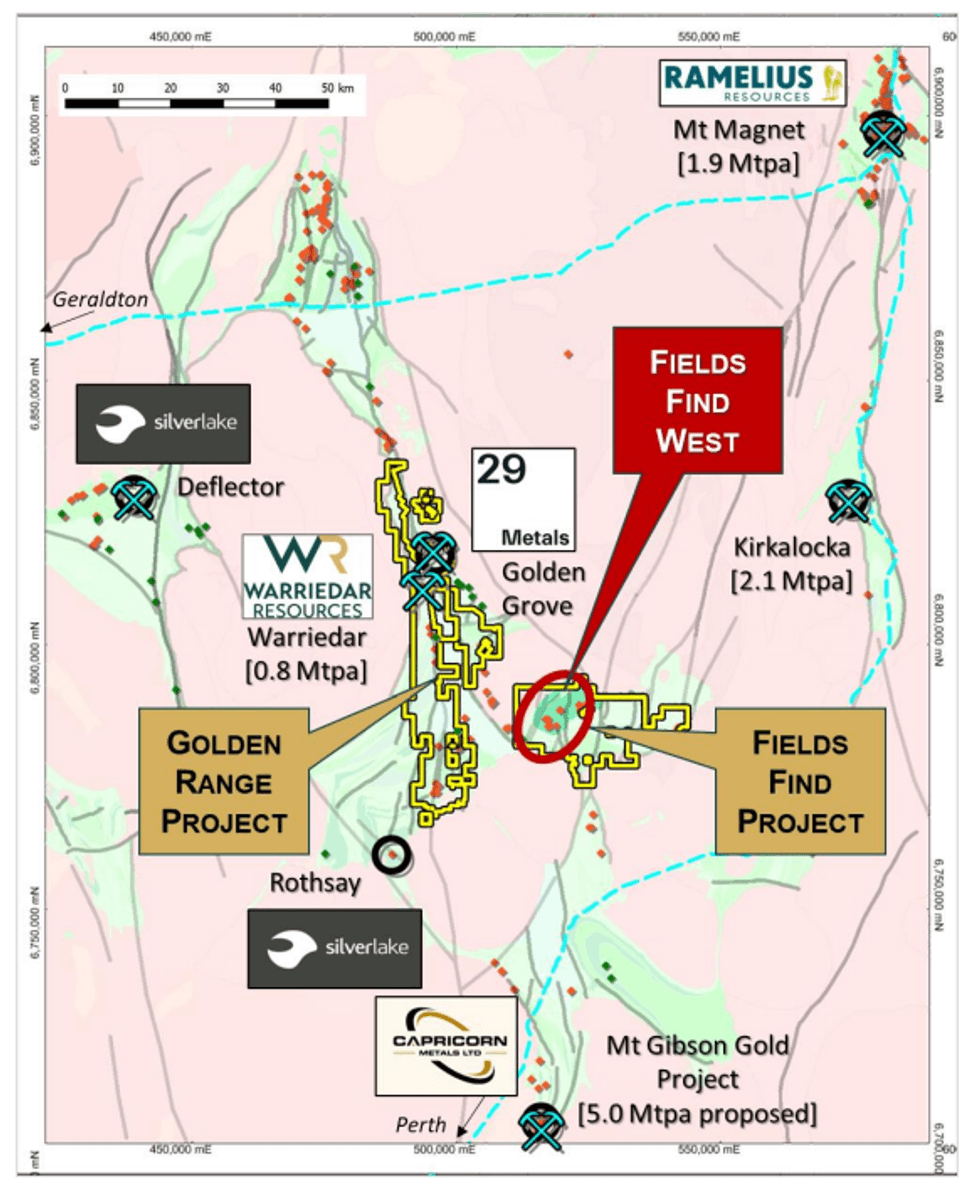

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to advise that drilling of high priority base metal (and gold) targets in the Fields Find West area is set to commence this quarter. Fields Find West is part of Warriedar’s broader Golden Range and Fields Find Projects located in the Murchison province of Western Australia (see Figure 1).

HIGHLIGHTS:

- Drilling of high priority copper and nickel targets set to commence at the Fields Find Project (Fields Find West) this quarter.

- Exceptional, initial exploration results by previous owners demonstrate the potential of Fields Find West: 1

- Falcon Prospect: 2m @ 4.4% Ni from 122m, and 1m @ 1.3% Cu & 6.3 g/t Au from 98m

- Sandpiper Prospect: 4m @ 36.9 g/t Au from 104m, and 1m @ 2.5% Cu & 24.5 g/t Au from 96m

- Surface rock chip sampling by Warriedar at the historic Warriedar Copper Mine, located within Fields Find West, returned:

- MGRX003134: 20.1% Cu, 63 g/t Ag, Au pending

- MGRX003135: 17.8% Cu, 157 g/t Ag, Au pending

- Programs of Work (POWs) approved to commence drilling at three of the Stage 1 high-priority areas at Fields Find West.

- Stage 1 program of 5,600m of RC drilling to commence this quarter.

- Comprehensive drill program planned to test all 10 separate target areas through the remainder of H2 2023.

- Fields Find West offers a strong pipeline of further high-potential targets for significant base metal (and gold) discoveries.

The Company has been seeking to drill key copper targets in this area since completing the acquisition of the Fields Find (and Golden Range) Projects earlier this year. Three POWs have now been approved to drill high-priority geophysical (“EM”) and geological targets at Fields Find West. The approved POW’s cover the target areas at the historic Warriedar Copper Mine and the Falcon Prospect (see Figure 2).

Warriedar’s strategic consolidation of tenure at the Fields Find Project has enabled the project to be explored in a cohesive, systematic, and prioritised manner, allowing a robust pipeline of targets to be established ahead of drill testing.

Fields Find West offers some of the best brownfield and geophysical targets for both base metals and gold from across the Fields Find and Golden Range projects.

The planned drilling program at Fields Find West is designed to test 10 specific target areas (as outlined in Table 1). This drilling is set to be undertaken through H2 CY2023, with the first stage being approximately 5,600m of RC drilling. This Stage 1 program includes the drill testing of the historic Warriedar Copper Mine and the high priority EM targets identified at the Falcon Prospect (see Figure 2 for locations).

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00