February 28, 2023

Peruvian Ministry of Energy and Mines approves the Environmental Impact Statement, allowing for up to 120 holes to be drilled across multiple targets

Valor Resources Limited (Valor or the Company) (ASX: VAL) is pleased to advise that it has taken another key step towards commencing its maiden drilling program at the Picha Copper Project in Peru following receipt of approval for its Declaración de Impacto Ambiental (DIA) (an Environmental Impact Statement for Exploration) from the Peruvian Ministry of Energy and Mines (MEM).

HIGHLIGHTS

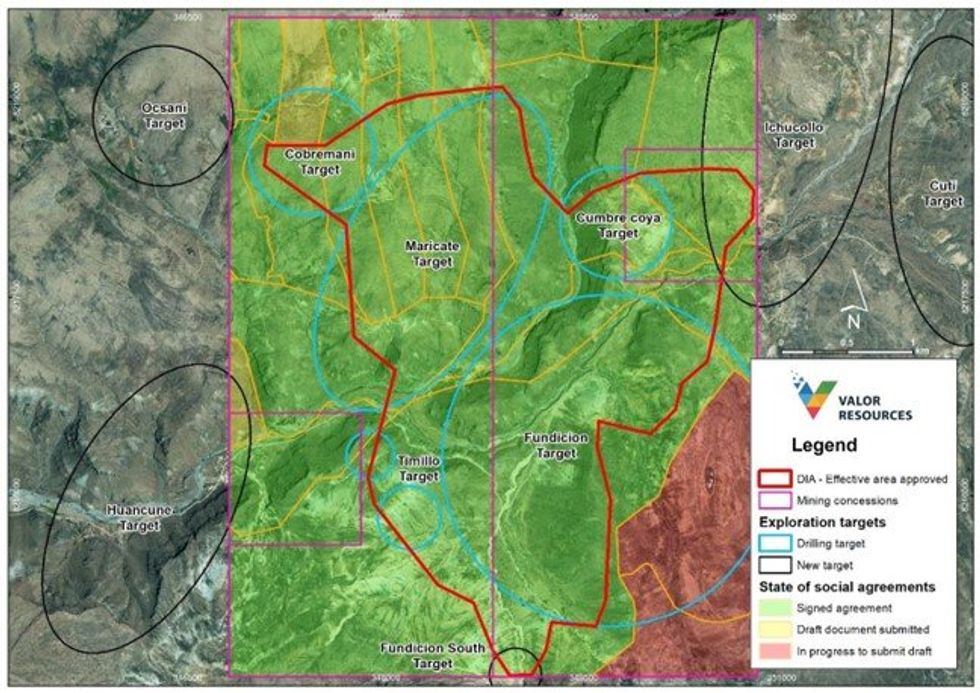

- Ministry issues the DIA – “Declaracion de Impacto Ambiental” (an Environmental Impact Statement for Exploration) for the Picha Copper Project in Peru, allowing for up to 120 holes to be drilled within the approved Effective Area, as illustrated in Figure 1 below.

- Agreements with local landowners are already in place for 100% of the DIA Effective Area for a period of five years, allowing the Company to access and drill the Effective Area within the Project.

- Valor’s maiden proposed drilling program, comprising 5,000m of diamond drilling, has been planned to initially test four key targets – Cobremani, Cumbre Coya, Maricate and Fundicion.

- Final drill program planning, including logistics and drilling contractor selection, set to commence shortly.

The DIA includes social stakeholder mapping as well as flora and fauna, anthropological and hydrological studies. All social agreements are already in place for a minimum of five years for 100% of the DIA approved Effective Area.

With DIA approval received, Valor will now apply for an “Autorización de Inicio de Actividades de Exploración” (Authorization to begin drilling), which is subject to a standard preliminary review by MEM on the possible presence of Indigenous communities within the exploration area.

A maiden diamond drilling program of around 5,000m is proposed to test four targets within the Effective Area – Cobremani, Cumbre Coya, Maricate and Fundicion. A short-list of drilling contractors has been determined and logistics planning is about to commence.

Valor Executive Chairman, George Bauk, said: “This is another exciting milestone for Valor in Peru with approval for the DIA marking another great achievement by our in-country team, reflecting the quality of the work that has been put in on the ground over the past 18 months. With social agreements already in place over the Effective Area, we can move ahead directly with an application for Authorization to Commence Drilling over 120 planned holes at the Central Picha Project.

“As mapped out in recent announcements, Valor has developed an incredible pipeline of large-scale, high- impact porphyry and epithermal targets across the Picha Project tenements. We can’t wait now to secure our final drilling permits, which will allow us to get on the ground and move ahead with our planned maiden 5,000m drill program. With up to 120 holes approved, the start of this program will signal the beginning of a transformational period for all of our key stakeholders.”

PICHA PROJECT

The Picha Project (100% owned by Valor) is a copper-silver exploration project, located in the Moquegua and Puno Departments of southern Peru. Picha is located approximately 17km ENE of Buenaventura’s (NYSE: BVN) San Gabriel Au-Cu-Ag Project, which hosts a reported Indicated and Inferred resource of 7.6 million ounces Au equivalent (132.7Mt @ 1.8 g/t AuEq).

Exploration work completed by the Company in 2021 comprising geochemical sampling, geological mapping and IP/Resistivity surveys has identified several exciting targets in the central part of the Project area. The Cobremani, Maricate, Cumbre Coya and Fundicion targets were identified as the highest priority targets.

The Company applied to the MEM for approval to drill within a portion of the Project area (the Effective Area) to test these priority targets.

The submission allows for up to 120 drillholes comprising 40 drilling platforms with up to three holes per platform. A maiden drilling program of around 5,000m is proposed, details of which are currently being finalised.

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00