October 01, 2024

Hydration solutions company The Hydration Pharmaceuticals Company Limited (ASX: HPC) (“Hydralyte North America” or “the Company”) is pleased to announce that it has entered into an Intellectual Property Sales Agreement (the ‘Agreement’) with Prestige Consumer Healthcare Inc. and associated subsidiaries (together, ‘Prestige’). Pursuant to the Agreement and associated arrangements, the Company will assign and transfer the exclusive right to sell Hydralyte products, and associated intellectual property rights, to Prestige in all relevant jurisdictions other than the United States of America.1

HIGHLIGHTS

- Divestiture of Hydralyte’s non-US assets to Prestige Consumer Healthcare Inc and associated subsidiaries.

- Total proceeds of ~US$9.5m includes US$8.3m for all non-US territories plus US$1.2m for stock and inventory (subject to final adjustments).

- The sale price of ~A$13.7m represents a significant premium over HPC’s market capitalisation of A$2.7m at 30 September 2024.

- Company retains full ownership of US-based operations, which are achieving annualised revenue of US$3.8m (unaudited, based on Q2 FY24 annualised) – US assets have considerable scope to grow.

- Divesture allows for the full repayment of debt and provides new capital to drive sales and margin growth from continuing US operations.

- Near-term US market growth strategy will focus on scalable ecommerce channels and products – follows recent momentum on Amazon USA, which has generated five consecutive months of positive net contribution margin.

- Divesting the non-US territories greatly simplifies the business structure and allows for a significantly reduced cost base with a deleveraged balance sheet.

- Additional cost efficiencies will be implemented with a focus on achieving cashflow breakeven.

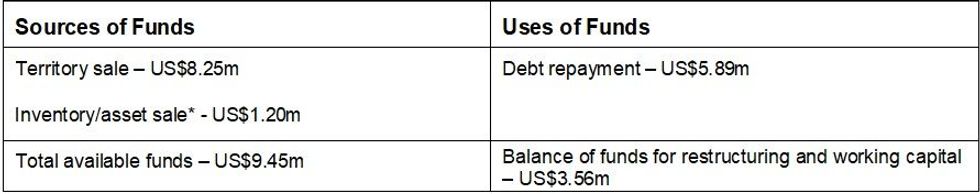

Under the terms of the Agreement (which is dated 1 October 2024), Hydralyte US will receive consideration of US$8.25m plus the value of stock and prepaid inventory in the relevant jurisdictions, valued at approximately US$1.2m (subject to post-completion adjustments). The final cash consideration, including stock and prepaid inventory, is expected to be approximately US$9.5m (A$13.7m).

All conditions precedent to completion of the Agreement have been satisfied and the Agreement will complete in the coming days.

The Company has also agreed a Transition Services Agreement with Prestige, which covers the period of operational transition, and certain other related agreements.

With the funds received from the sale, the Company will repay its existing A$8.2m debt facility owed to Pure Asset Management (refer ASX announcement: 27 March 2024), with the remaining cash at bank to be used towards closing and restructure costs and advancing operations in the US market. The Company is focussed on achieving scale and cashflow breakeven in the US, targeting profitability in the future.

Use of Funds:

Rationale:

On 27 March 2024 the Company announced that it intended to seek a sale transaction. Since that time, the Board has considered a range of options to divest part or all of the Company’s business.

The Board considers that the Prestige transaction will effectively deleverage the Company’s balance sheet and provide Hydralyte US with an opportunity to pursue its growth strategy in the potentially lucrative US market for the benefit of shareholders. This US growth strategy will be underpinned by a significant increase in balance sheet strength, with no debt and a stronger cash position to flexibly pursue targeted opportunities for sales and margin growth.

Streamlined operations:

Hydralyte US will focus on driving growth and unlocking value from its US-based assets. At present, Hydralyte US’s operations are annualising net revenues of approximately US$3.8m on an unaudited basis based on Q2 FY24.

The Company will maintain a presence with American bricks and mortar retail outlets but its targeted growth strategy in the US market will focus on ecommerce channels, where it already has an established footprint.

Most recently, the Company has achieved considerable net margin growth since Q1 CY23. Further, Amazon USA has achieved five consecutive months of positive net contributions and margin growth.

Click here for the full ASX Release

This article includes content from The Hydration Pharmaceuticals Company Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HPC:AU

The Conversation (0)

30 May 2024

Hydralyte International

Leveraging a Rapidly Expanding Hydration Market in North America

Leveraging a Rapidly Expanding Hydration Market in North America Keep Reading...

28 February 2025

FY24 Appendix 4E

Hydralyte International (HPC:AU) has announced FY24 Appendix 4EDownload the PDF here. Keep Reading...

31 January 2025

Q4 FY24 Quarterly Activities Report (App 4C)

Hydralyte International (HPC:AU) has announced Q4 FY24 Quarterly Activities Report (App 4C)Download the PDF here. Keep Reading...

28 November 2024

US Operations Update

Hydralyte International (HPC:AU) has announced US Operations UpdateDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00