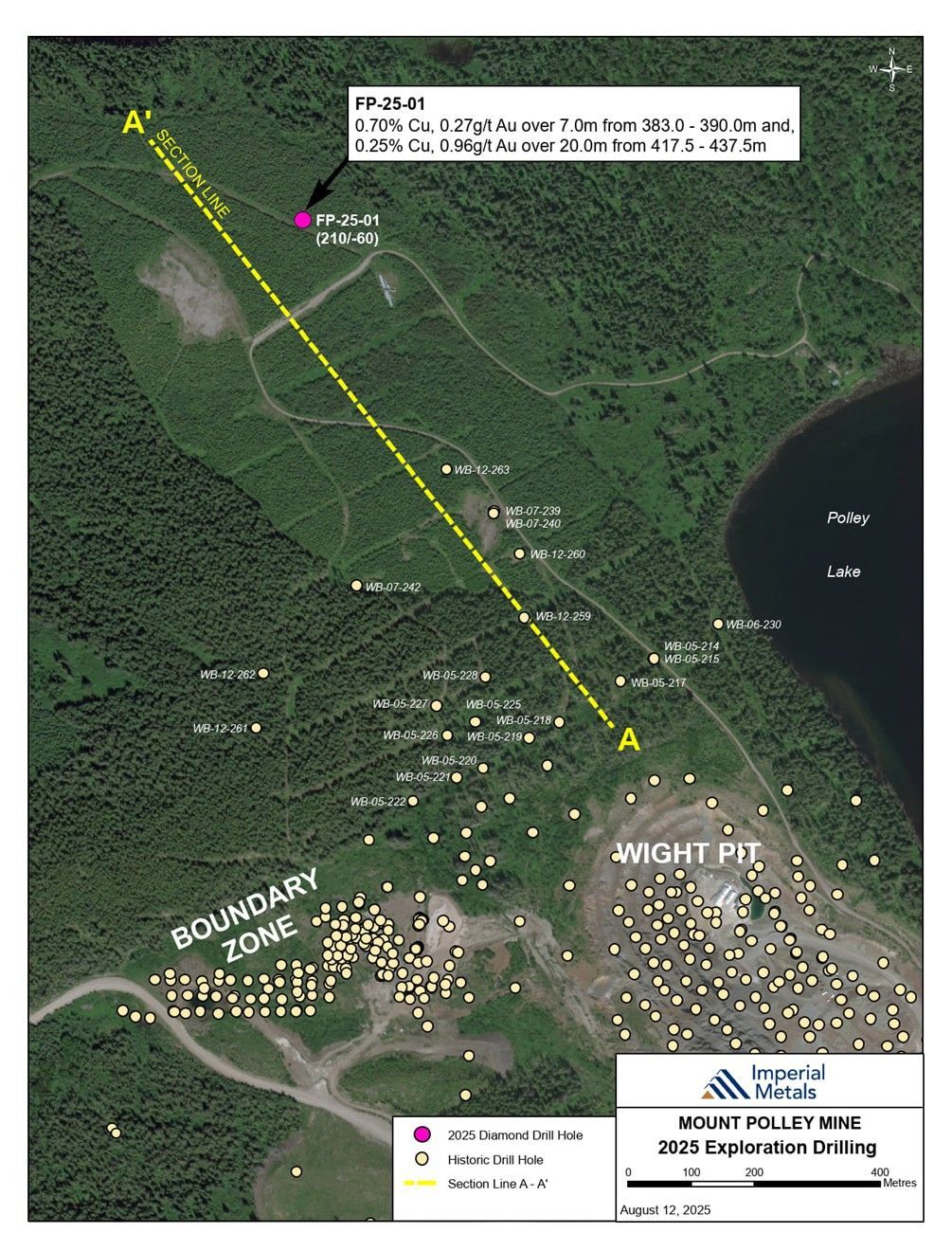

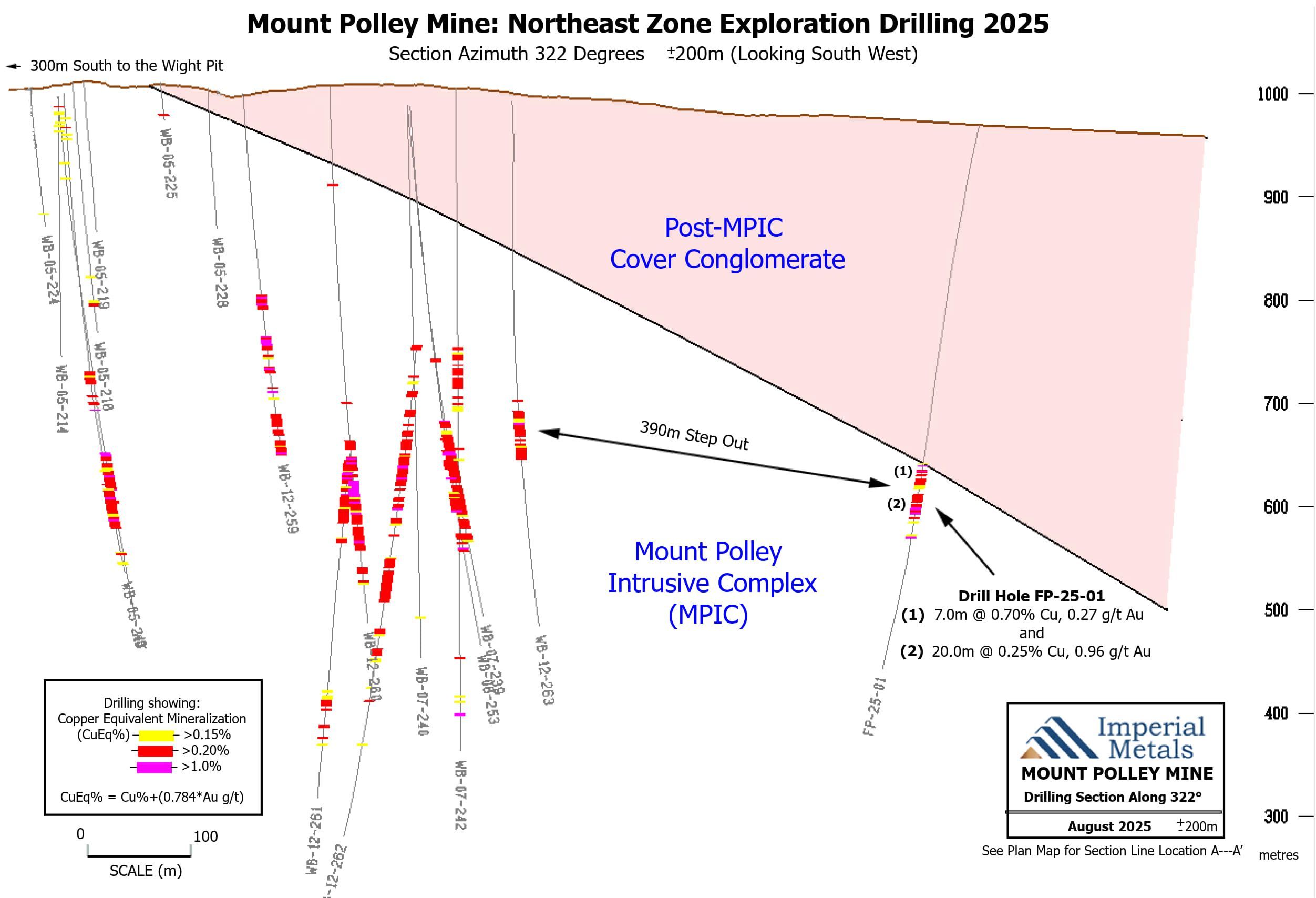

Imperial Metals Corporation ("Imperial" or the "Company") (TSX:III,OTC:IPMLF) reports that an exploration drill hole, drilling a blind target through clastic cover rocks, intercepted a hydrothermal breccia hosting significant visual native copper at the unconformity with the Mount Polley Intrusive Complex (MPIC). Two intercepts in diamond drill hole FP-25-01 of 7.0 metres grading 0.70% copper and 0.27 gt gold starting at 383.0 metres, and 20.0 metres grading 0.25% copper and 0.96 gt gold starting at 417.5 metres, mark the discovery of significant mineralization in a major step-out. The drill hole was collared 4.15 kilometres north of the operating Mount Polley mill (see Figure 1).

| Hole ID | From (m) | To (m) | Width (m) | Copper (%) | Gold (g/t) | Copper Oxide Ratio(% )* | |

| FP-25-01 | 383.0 | 390.0 | 7.0 | 0.70 | 0.27 | 9 % | |

| and | 417.5 | 437.5 | 20.0 | 0.25 | 0.96 | 9 % | |

*Copper Oxide Ratio % = (CuOx%/Total Cu%)*100

Hole FP-25-01 was drilled 1.2 kilometres north-northwest from the previously mined Wight Pit (Northeast Zone) where some of the highest copper grade ore has been mined at Mount Polley. FP-25-01 was oriented at an azimuth of 210 with a dip of -60 and collared into a conglomerate unit that lies over the MPIC (see Figure 2). The blind target was generated through interpretation of a structural corridor that extends north-northwest from the Northeast Zone and coincides with two geophysical anomalies. Geophysical surveys overlapping the structural corridor reveal a 3-Dimensional Induced Polarization chargeability response and overlapping magnetic high. Drilling through the post-MPIC cover conglomerate unit intersected an unconformable contact with the MPIC at 378.9 metres down hole (348 metres vertical depth from surface). The rock below 378.9 metres consisted of brecciated and carbonate healed MPIC monzonite-monzodiorite with native copper until 414.7 metres. This was followed by additional hydrothermal breccia displaying strong magnetite alteration and good chalcopyrite mineralization until 437.5 metres. The magnetite-rich breccia continued to 590 metres down hole.

The mineralization encountered in FP-25-01 is significant for the following reasons:

- Intercept is 390 metres away from the nearest known mineralized hit.

- The dominance of native copper in this intercept is unique and opens up the question of whether other, similar style mineralization is in the area.

- The high gold-copper ratio in the lower intercept starting at 417.5 metres, is distinctly different from metal ratios observed in other zones in this part of the property.

- The series of mineralized zones that occur along the interpreted structural corridor occur over a linear distance of over 1,500 metres. The link between mineralization and the structure will be further investigated.

- The extent of non-copper-gold bearing magnetite breccia below 437.5 metres is a clear sign of extensive hydrothermal activity well north of the exposed MPIC and provides support for further exploration targeting in the surrounding area.

Figure 1: Location Plan Map showing the area of Boundary Zone and Wight Pit relative to the new diamond drill hole FP-25-01. Also shown is the section line A – A' which controls the location of Figure 2.

Drilling continued after the drill results reported in the May 22, 2025 News Release with 16 additional drill holes designed to aid in expanding the resource in the gold-rich C2 Zone, and 2 holes in the pit to provide detailed information to support mine planning. Diamond drilling at Mount Polley has been suspended for now.

Figure 2 – Section A – A' showing the interpreted geology and closest Company drilling to the location of FP-25-01. Looking West

Jim Miller-Tait, P.Geo., Imperial's VP Exploration, has reviewed this news release as the designated Qualified Person as defined by National Instrument 43-101 for the Mount Polley exploration program. Samples reported were analyzed at Activation Laboratories Ltd. located in Kamloops. Due to the presence of native copper selected samples were analyzed by copper metallic screen method. A full QA/QC program using blanks, standards and duplicates was completed for all diamond drilling samples submitted to the labs. Significant assay intervals reported represent apparent widths. Insufficient geological information is available to confirm the geological model and true width of significant assay intervals.

About Imperial

Imperial is a Vancouver based exploration, mine development and operating company with holdings that include the Mount Polley mine (100%), the Huckleberry mine (100%), and the Red Chris mine (30%). Imperial also holds a portfolio of 23 exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President | 604.669.8959

Jim Miller-Tait | VP Exploration | jim.miller-tait@imperialmetals.com

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release are not statements of historical fact and are "forward-looking" statements. Forward-looking statements relate to future events or future performance and reflect the Company's management's expectations or beliefs regarding future events and include, but are not limited to, statements regarding the Company's expectations with respect to current and planned exploration drilling programs at Mount Polley and timing thereof, specifically with respect to the future plans to investigate the new mineralization encountered in FP-25-01 and the potential link to a structural corridor that extends north-northwest from the Northeast Zone; the potential for mineralization to be converted from resource to reserve; the potential for extension of mine life; and the impact of drilling on future pit designs and mine life schedule. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "outlook", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative of these terms or comparable terminology. By their very nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In making the forward-looking statements in this news release, the Company has applied certain factors and assumptions that are based on information currently available to the Company as well as the Company's current beliefs and assumptions. These factors and assumptions and beliefs and assumptions include the risk factors detailed from time to time in the Company's annual information form, interim and annual financial statements and management's discussion and analysis of those statements, all of which are filed and available for review on SEDAR+ at www.sedarplus.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended, many of which are beyond the Company's ability to control or predict. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and all forward-looking statements in this news release are qualified by these cautionary statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/96c75196-430e-4d3e-b53e-f4837f155816

https://www.globenewswire.com/NewsRoom/AttachmentNg/3599aaa7-f9f8-4023-81d3-dae7317ee555