November 01, 2023

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to provide an update on the Daydream-2 appraisal well located in its 100% owned Grandis Gas Project (ATP 2044) in Queensland’s Taroom Trough.

HIGHLIGHTS

- Rig formally released to Elixir and mobilizing to site

- Spud date early next week

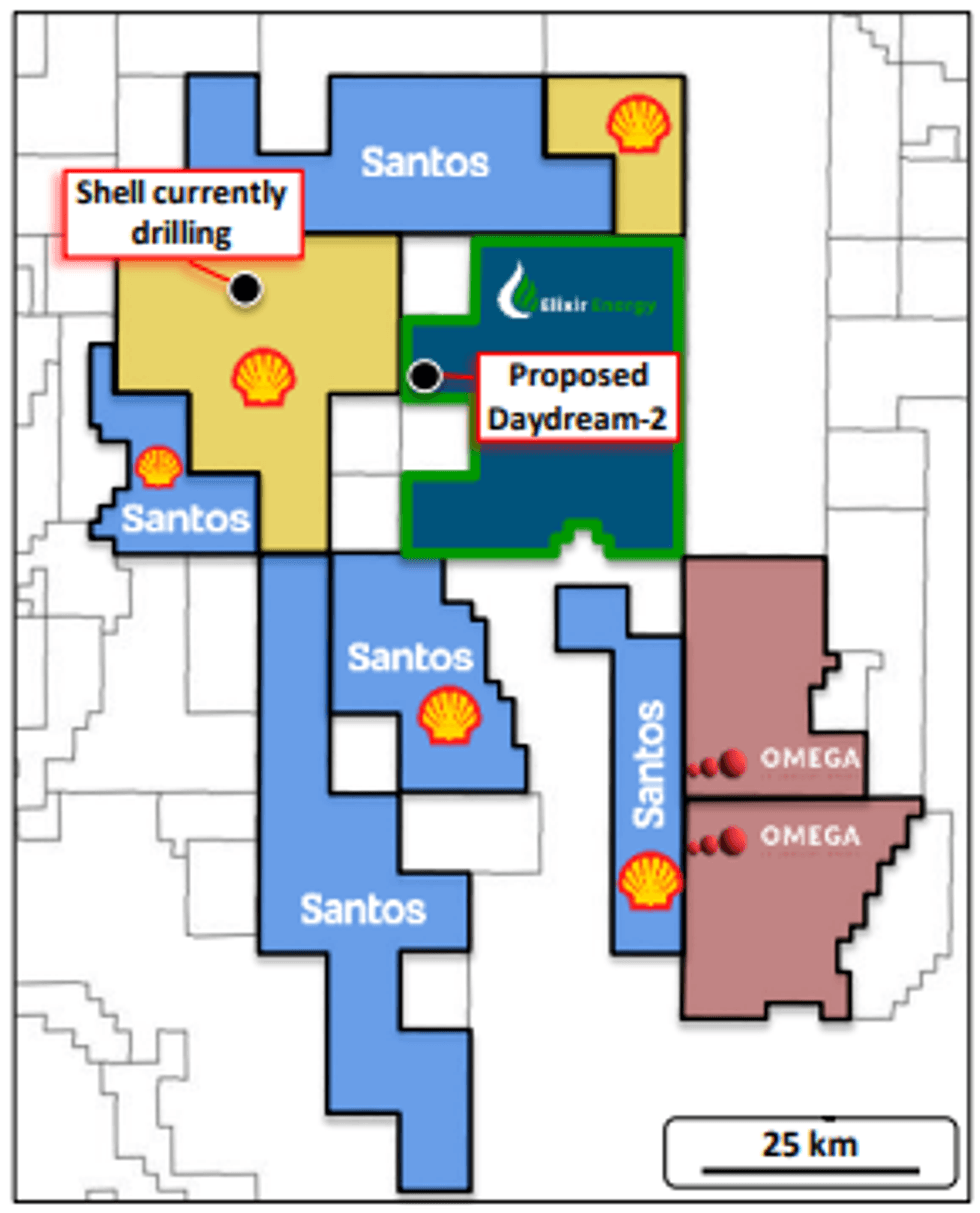

- Shell currently drilling in neighbouring tenement

Elixir’s drilling contractor SLB (previously known as Schlumberger) has formally advised that the contracted rig SLR 185 has been released by its current operator. The drilling unit and camp are currently mobilizing to the Daydream-2 well site and following acceptance testing the well will be due to spud early next week.

Elixir is encouraged to note that Shell is currently drilling in a tenement to the immediate West of ATP 2044 (https://geoscience.data.qld.gov.au/data/borehole/bh082431)

Elixir’s Managing Director, Mr Neil Young, said: “With the formal release of SLR 185 to Elixir the spud of Daydream-2 is now only a few days away. Two large rigs will then be drilling contemporaneously to further open up the Taroom Trough – a real sign of its potential importance for domestic and international markets.”

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Half Yearly Report and Accounts

BPH Energy (BPH:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00