This release corrects and replaces the release disseminated June 23, 2022 at 9:40am ET. The release contained incorrect numbers in the table. Please see the full corrected release below.

RooGold Inc. ("RooGold" or the "Issuer

RooGold is pleased to report that it has undertaken a preliminary rock chip sampling program at its 100% held Arthurs Seat Project Exploration Licence (EL) 9144 in the highly prospective New England Orogen in New South Wales, Australia.

Highlights

- Successful landowner negotiations and access agreement established over key prospects at Arthurs Seat including McDonalds, Coxs and Murrays Mine.

- A total of 274 rock chip samples were collected at historical prospects and along structural and geological contacts.

- Significant hydrothermal alteration identified with multiple generations of mineralised quartz veins visible.

- Visible silver-antimony mineralisation in quartz veins observed at Murrays and Co Mine and McDonalds Prospect.

- Assay results received to date from 159 samples indicate widespread, low-level mineralisation along greisen altered granite - metasediment contacts and confirms the presence of a large hydrothermal mineral system.

- 115 assays are still pending from other key prospects.

Carlos Espinosa, Chief Executive Officer and a Director of RooGold commented, "RooGold has completed a successful, first pass rock chip sampling program at the Arthurs Seat Project, New South Wales. Preliminary assay results have been received and confirm low-level, widespread silver-antinomy geochemical anomalism within the project. Our field geologists have identified multiple sets of quartz veins at key prospects containing silver-antimony minerals and we look forward to receiving further assay results in the near term."

Arthurs Seat Project

The Arthurs Seat Project, comprised of Exploration License 9144 ("EL 9144"), is approximately 42 km² in area and is located in the northwestern region of the New England Orogen. The New England Orogen comprises island-arc and continental-arc gold-silver mineralized belts, which host extensive intrusion related polymetallic deposits. In the Southern New England Orogen, where Roo Golds projects are based, include the historic Conrad Silver Mine which produced approximately 3.5Moz Ag1, Webbs Silver deposit that contains JORC (2012) Mineral Resource Estimate Indicated and Inferred of 2.2Mt at 205 g/t Ag2 and the Hillgrove Au-Sb-W Mine with historic production of 720koz Au3.

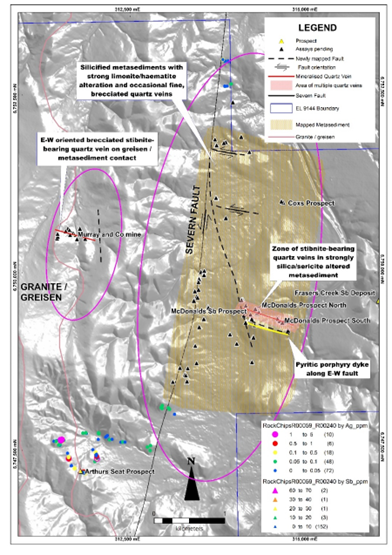

The Arthurs Seat project is centered on the regional Severn Thrust Fault and mineralized granitic/sandstone contact. The property includes 3 historical silver, tungsten and antimony mines and prospects. Mineralization is found in white quartz and tourmaline veins cutting the greisen altered granite - meta- sedimentary contact zone. This contact spans over 15 km strike length within the concession, historically mined for silver and tin ore. The contact target and associated mines remain unexplored in the subsurface since mining ended in 1890.

Elevated gold grades observed at the Cox gold/silver prospect are interpreted as related with the hanging wall of the deep-seated Severn Thrust Fault - potentially representing a robust 7 km long underexplored secondary target (Figure 1 and Figure 2).

The Murray and Co Mine is located on the western boundary of EL 9144 and was mined in the late 1890's including the development of underground adits and shafts driven into silver and tin rich quartz and tourmaline veins, which intrude metasediments along the greisen altered granite contact, (Figure 3). Historical sampling of mullock heaps at the prospect returned grades of 1,085 g/t Ag and 1,400 ppm Sb (source: Magnum Exploration NL, GS1971/217).

Rock Chip Sampling Program

Two field trips were undertaken with a total of 274 rock chip samples collected at the Arthurs Seat Project (EL 9144) to confirm the results of historical sampling. Initial sampling focused on the Arthurs Seat historical prospect that is defined by the contact between the Permian Graman Monzogranite of the S-type Bundarra Supersuite and the metasediments of the Carboniferous Texas Beds of the Central Block.

Of the 159 rock chip samples, 154 samples returned anomalous silver showing low-level, widespread silver mineralisation across the sampling area ranging from 0.01 ppm Ag to 4.0 ppm Ag, see Figure 1 and Figure 2. The highest grade results were concentrated in the greisen altered granite hosting quartz veins at Arthurs Seat. The highest assay result received was 3.99 ppm Ag, 8,210 ppm As, 4.93 ppm Sb. 3.80 ppm W and 223 ppm Bi (Sample Number R00148) from a greisen altered granite with iron-oxide filled vugs after sulfides. The highest gold result returned was 0.11 ppm Au, 5.03% As, 165 ppm Bi, 2.36 ppm Ag from a highly sheared mafic rock (Sample Number R00147).

Table 1: Significant assay results from rock chip sampling program (>0.98 ppm Ag) from (R00059 - R00241) Arthurs Seat prospect, EL 9144.

| Lithology | Sample ID | Easting MGA 94 | Northing MGA94 | RL | Au ppm | Ag ppm | As ppm | Bi ppm | Sb ppm | W ppm |

| Granite | R00148 | 311523 | 6747639 | 536 | 3.99 | 8210 | 223 | 4.93 | 3.80 | |

| Qtz vein in granite | R00193 | 312030 | 6747383 | 497 | 3.98 | 67.9 | 49 | 1.11 | 4.70 | |

| Qtz Vein | R00156 | 311519 | 6747646 | 536 | 3.90 | 31600 | 559 | 7.39 | 2.70 | |

| Qtz Vein | R00161 | 311528 | 6747646 | 534 | 0.01 | 2.58 | 10500 | 213 | 12.7 | 1.40 |

| Mafic / skarn mineralisation (?) | R00147 | 311522 | 6747636 | 536 | 0.11 | 2.36 | 50300 | 165 | 69.1 | 0.80 |

| Greisen / Granite | R00187 | 311632 | 6747384 | 529 | 2.34 | 2180 | 75.4 | 2.37 | 2.20 | |

| Qtz Vein | R00159 | 311522 | 6747641 | 536 | 0.01 | 2.18 | 14000 | 176 | 15.4 | 0.60 |

| Granite | R00150 | 311522 | 6747640 | 536 | 1.70 | 3700 | 219 | 2.81 | 3.50 | |

| Qtz Vein | R00162 | 311528 | 6747646 | 534 | 0.02 | 1.22 | 33400 | 39.2 | 67.2 | 1.30 |

| Qtz Vein | R00164 | 311536 | 6747649 | 533 | 0.04 | 1.05 | 25800 | 54.3 | 39.6 | 1.10 |

| Qtz Vein | R00158 | 311524 | 6747642 | 535 | 0.99 | 5660 | 98.9 | 7.24 | 0.90 | |

| Qtz Vein | R00152 | 311524 | 6747640 | 536 | 0.98 | 23200 | 309 | 7.48 | 0.30 |

The location of the rock chip samples and current assay results are indicated below in Figures 1 and 2.

The Murray and Co mine was mapped as a subvertical, E-W trending zone of silicified ferruginous metasediments in contact with silica flooded quartz veins in greisenised granite. A 1 m zone of fine, brecciated, smokey, and gossanous quartz veins carrying stibnite, arsenopyrite, and pyrite was observed. Significant silica, sericite, and chlorite alteration of metasedimentary host rocks confirm the presence of a hydrothermal mineralizing system, Figure 4. Multiple generations of quartz veins were observed with primary, coarse bucky quartz, and secondary fine, smokey quartz veins carrying stibnite, arsenopyrite, and pyrite mineralisation.

The McDonalds North prospect was mapped as an E-W trending zone of fine (1-3 mm) gossanous and stibnite-silver bearing quartz veins within a highly silicified metasediment host rock, Figure 5. Sub-horizontal bedding contained minor sulfides along the bedding plane. McDonalds South prospect is faulted and juxtaposed against a quartz-eye porphyry dyke containing arsenopyrite and pyrite intruded into strongly silica flooded metasediments. A number of E-W sinistral faults were mapped and represent possible conduits for the deposition of mineralizing fluids, Figure 6.

The remaining 115 samples collected at Murrays and Co Mine and McDonalds prospects have assay results pending from the laboratory.

Quality Assurance and Quality Control (QAQC) and Assay Procedures

A minimum of 3 kg per rock chip sample collected in sealed calico bags by the RooGold field team. Five calicos containing rock chips placed in a green plastic bag and each zip tied to ensure security. A total of 34 green bags were placed on heavy duty pallet, wrapped in heavy duty plastic wrap to ensure security and sent to ALS Geochemistry Labs (ALS) in Perth, Australia for assay testing. ALS is independent of RooGold and is certified to international quality standards through ISO/IEC 17025:2017 including ISO 9001:2015 and ISO 9002 specifications.

At ALS, rock chips underwent coarse crushing before fine crushing to 70% less than 2mm then riffle split off 1kg, followed by a pulverise split to better than 85% passing

Data Verification

Alexandra Bonner has verified all scientific and technical data disclosed in this news release including the rock chip locations, sampling procedures, and analytical data underlying the technical information disclosed. Specifically, Alexandra Bonner reviewed the original certified assay results from ALS and verified the assay summary table produced for these rock chip samples. Alexandra Bonner noted no errors or omissions during the data verification process. RooGold and Alexandra Bonner do not recognize any significant factors of sampling or recovery that could materially affect the accuracy or reliability of the rock chip assay data disclosed in this news release.

Qualified Person Statement

The scientific and technical information contained in this news release has been prepared and approved by Alexandra Bonner, Vice President of Exploration, who is a Qualified Person as defined in NI 43-101.

About RooGold Inc.

ROOGOLD is a Canadian based junior venture mineral exploration issuer which is uniquely positioned to be a dominant player in New South Wales, Australia, through a growth strategy focused on the consolidation and exploration of high potential, mineralized precious metals properties in this prolific region of Australia. Through its announced acquisitions of Southern Precious Metals Ltd., RooGold Ltd. and Aussie Precious Metals Corp. properties, RooGold commands a portfolio of 14 high-grade potential gold (10) and silver (4) concessions covering 2,696 km2 which have 139 historic mines and prospects.

For further information please contact:

Carlos Espinosa, CEO

cespinosa@roogoldinc.com

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of applicable securities law. Forward-looking statements are frequently characterized by words such as "plan","expect", "project", "intend","believe", "anticipate", "estimate" and other similarwords, or statements that certain eventsor conditions "may" or "will" occur.

Although the Issuer believes that the expectations reflected in applicable forward-looking statements are reasonable, therecan be no assurance that such expectations will prove to be correct. Such forward-looking statements are subjectto risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

1https://www.thomsonresources.com.au/projects/webbs-and-conrad-silver-projects-new-south-wales/

2 Thomson Resources (ASX: TMZ), 9 June 2022

3 The Hillgrove Gold-Antimony-Tungsten District, NSW, Australia B. Hooper, P. Ashley and P. Shields

SOURCE: RooGold Inc.

View source version on accesswire.com:

https://www.accesswire.com/706453/CORRECTION-RooGold-Completes-Rock-Chip-Sampling-at-Arthurs-Seat-Silver-Antimony-Project-New-South-Wales