Coppernico Metals Inc. (TSX: COPR, OTCQB: CPPMF, FSE: 9I3) ("Coppernico" or the "Company"), is pleased to announce that, through its wholly owned private Peruvian subsidiary, Sombrero Minerales SAC, it has expanded its concessions through an application covering 2,400 hectares over a newly identified lithocap-epithermal-porphyry target at its Sombrero Project in Peru.

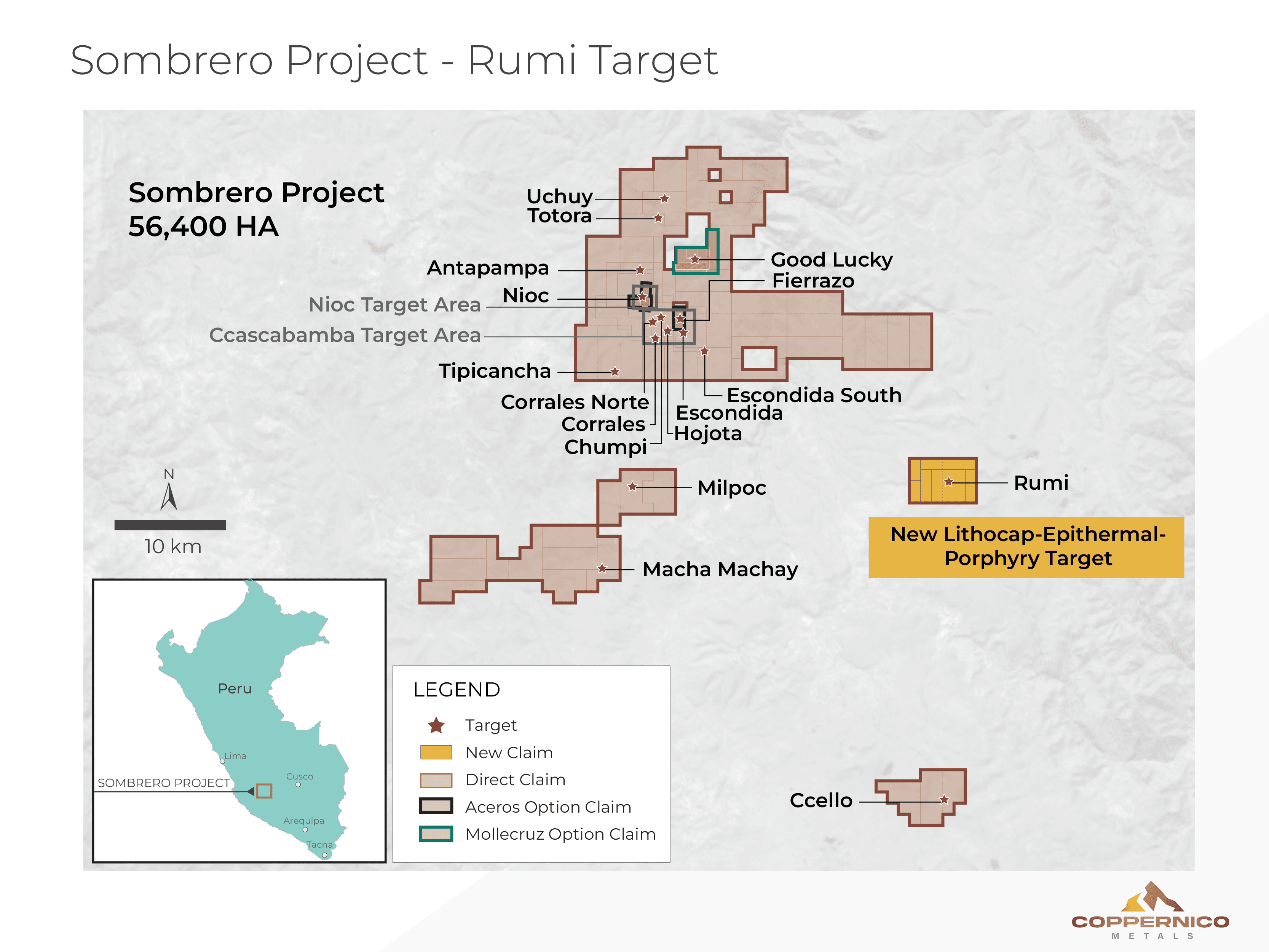

The concessions were pursued after receiving encouraging early-stage geological and geochemical sampling results from what the Company is referring to as the Rumi target, located east-southeast of the Tipicancha target within the general Sombrero Project area (Figure 1). Mapping and reconnaissance rock sampling have outlined a continuous footprint of approximately 2.3 kilometres (km) by 2.5 km of advanced argillic alteration developed within a Miocene or younger volcanic package, indicative of a potential high-sulphidation epithermal or lithocap-style system.

Highlights

- Large-scale lithocap: Approximately 4 square km of continuous kaolinite, alunite and silica alteration with a few occurrences of dickite and disseminated pyrite, mapped by field observations and Short-Wave Infrared (SWIR) spectroscopy verification.

- Pathfinder anomalism: Initial reconnaissance sampling shows elevated arsenic (As), bismuth (Bi) and antimony (Sb), with sporadic elevated values of molybdenum (Mo) up to 10 ppm and copper (Cu) up to 101 ppm. High sulfur (S) values, greater than 3%, are consistent with mapped pyrite rich zones, and acid sulphate alteration is consistent with high sulphidation systems.

- Multiple systems: Displays features similar to the Tipicancha and Ccello targets, suggesting a regionally significant younger magmatic-hydrothermal event superimposed over the Ccascabamba-Nioc skarn targets.

Ivan Bebek, Chair and CEO of Coppernico, commented, "As our exploration efforts are ongoing at various targets at our Sombrero Project, we continue to review opportunities in the region aiming to expand our pipeline of prospective discovery targets. The Rumi target is our 17th standalone target in our 56,400-hectare land position supporting our goal of pursuing multiple significant discoveries on the western side of the Andahuaylas-Yauri belt. Additional permitting updates and channel sampling results are expected in the coming weeks."

Figure 1: Sombrero Project footprint

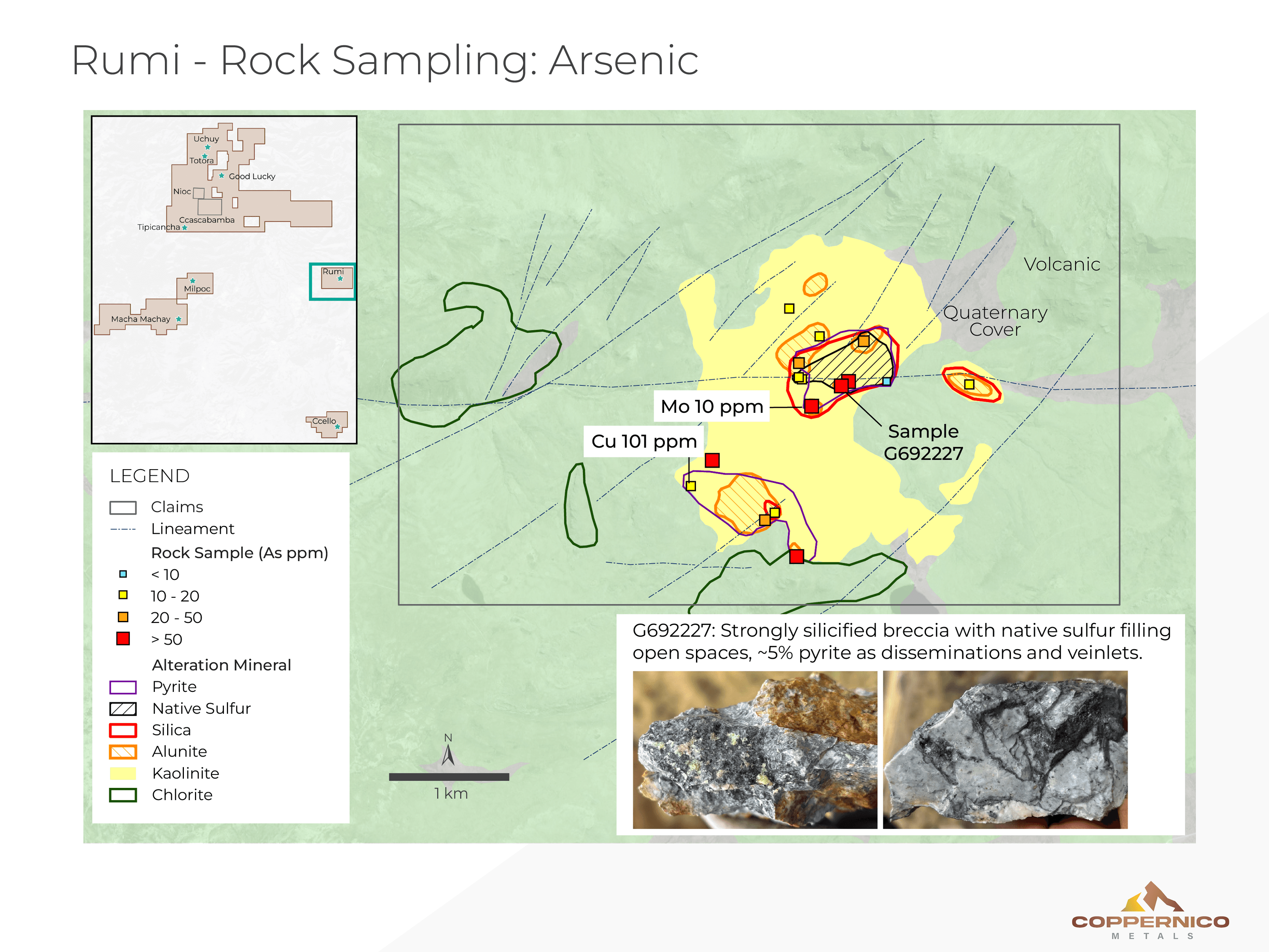

Reconnaissance mapping and initial sampling have outlined a large zone of advanced argillic alteration at the Rumi target, measuring approximately 2.3 km by 2.5 km. The alteration is characterized by kaolinite, alunite, and vuggy to residual silica, with dickite occurring locally. Disseminated pyrite and native sulfur are common throughout the area (Figure 2).

This distinctive mineral assemblage and texture point to an acid-sulfate environment, typical of high-sulfidation epithermal systems and lithocaps that often develop above porphyry copper-gold (Cu-Au) centers. Early geochemical results from sixteen samples collected, included elevated As, Bi and Sb, further supporting this interpretation. Samples also included sporadic elevated values of Mo up to 10 ppm and Cu up to 101 ppm (Figure 2).

Figure 2: Target scale geologic map showing contours of kaolinite, alunite and silica, with arsenic sample values.

Early structural mapping shows that the alteration coincides with intersections between northeast and east-west trending corridors. These structures and their intersections may have played an important role in focusing and channeling magmatic fluids. On the strength of these findings, Coppernico has staked approximately 2,400 hectares of new concessions. A follow-up mapping and sampling program is planned to better define the scale and context of this emerging system.

This new discovery expands Coppernico's growing pipeline of younger "lithocap" exploration targets within Peru's Miocene metallogenic belt, which now incorporates the Rumi, Tipicancha, Macha Machay, and Ccello targets:

- Tipicancha: 1 km by 2 km epithermal alteration with Cu-bearing zones returning up to 22 m of 0.65% Cu, including 10 m of 1.14% Cu (true widths unknown, see Coppernico press release dated May 21, 2025).

- Macha Machay: Newly mapped 4 km by 1 km alteration zone supported by broad geochemical anomalies (additional exploration results pending, see Company press release dated August 18, 2025).

- Ccello: Approximately 2 km by 1.5 km silver-kaolinite lithocap with silver mineralization associated with quartz-alunite alteration and massive silica structures (see press release dated September 30, 2019 by Auryn Resources, Coppernico's predecessor).

These Miocene-aged targets are superimposed over the westward extension of the older Eocene–Oligocene Andahuaylas-Yauri Belt, an established porphyry Cu-Au province hosting the Company's large-scale skarn-porphyry Ccascabamba and Nioc target areas and the Good Lucky target. These overlapping mineralizing events are likely indicating long-lived and multi-phase magmatic and hydrothermal activity, suggesting the presence of deep-seated, crustal-scale structures and potential for concealed porphyry centers at depth. Regionally, the Miocene Belt of Peru hosts numerous productive epithermal-porphyry systems. Notable examples include Morococha-Toromocho, located approximately 375 km to the north of Sombrero, and Inmaculada-Pallancata-Selene, nearly 150 km to the south.

In connection with the application of these concessions, the Company paid the first year of annual concession validity fees equal to US$3 per hectare. Final granting of the concessions is expected to be completed within the coming months, subject to customary administrative proceedings, including a public notice period and confirmation from INGEMMET and filing with the public registry.

Tim Kingsley, VP Exploration commented, "Early fieldwork at the Rumi target has revealed a large, continuous alteration system with characteristics typical of high-sulphidation and lithocap environments, supporting the potential for a copper-gold porphyry system at depth. As we advance community partnerships toward drill permitting, we continue to refine our land position and prioritize high-impact drill targets across Sombrero."

The recognition of this new target strengthens Coppernico's district-scale exploration pipeline for the Sombrero Project. Systematic mapping and sampling continue to refine multiple Cu-Au prospects, with ongoing work aimed at defining drill-ready targets for the upcoming Phase 2 drill program.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Tim Kingsley, M.Sc., CPG, Coppernico's VP of Exploration, who is a "Qualified Person" (as defined in NI 43-101).

ON BEHALF OF THE BOARD OF DIRECTORS

Ivan Bebek

Chair & CEO

For further information, please contact:

Coppernico Metals Inc.

Phone: +1 778 729 0600

Email: info@coppernicometals.com

Website: www.coppernicometals.com

Twitter: @CoppernicoMetal

LinkedIn: www.linkedin.com/company/coppernico-metals/

About Coppernico

Coppernico is a mineral exploration company focused on creating value for shareholders and stakeholders through diligent project evaluation and exploration, in pursuit of the discovery of premier copper-gold deposits in the Americas. The Company's management and technical teams have a successful track record of raising capital, discovery and the monetization of exploration successes. The Company's objective is to become a leading advanced copper and gold explorer, and through its wholly owned private Peruvian subsidiary Sombrero Minerales S.A.C., is currently focused on the Ccascabamba (previously referred to as Sombrero Main) and Nioc target areas within the Sombrero Project in Peru, its flagship project, while regularly reviewing additional premium projects to consider for acquisition.

The Sombrero Project is a land package of approximately 56,400 hectares (564 square kilometres) located in the north-western margins of the world-renowned Andahuaylas-Yauri trend in Peru. It consists of a number of prospective exploration targets characterized by copper-gold skarn and porphyry systems and precious metal epithermal systems. The Company's NI 43-101 technical report, with an effective date of April 17, 2024, and as filed on SEDAR+ on May 23, 2024, focuses on the Ccascabamba and Nioc target areas of the Sombrero Project.

Coppernico Metals Inc. is currently listed on the Toronto Stock Exchange under the symbol "COPR", trades on the OTCQB Venture Market under symbol "CPPMF" and is quoted over the counter by certain dealers in the Unofficial Market of the Frankfurt Stock Exchange under the symbol "9I3". More information about Coppernico can be found on the Company's profile on SEDAR+ ( www.sedarplus.ca ).

Cautionary Note

No regulatory organization has approved the contents hereof.

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, " forward-looking statements "). Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expect", "intend" and similar expressions and include, but are not limited to, statements with respect to: the interpretation of geological mapping and sampling results, the prospective nature of identified targets for future exploration, the potential of the interpreted mineralized systems, the progress and approval of permits, the granting of concessions, and the Company's drill plans. No certainty can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. Readers should refer to the risks discussed in the Company's 2024 Annual Information Form and other continuous disclosure filings with the Canadian Securities Administrators, available at www.sedarplus.ca . These factors are not, and should not be construed as being, exhaustive. Accordingly, readers should not place heavy reliance on forward-looking statements. The forward-looking statements contained in this new release are expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this news release. The Company does not undertake any obligation to publicly update or revise any forward-looking information after the date of this news release to conform such information to actual results or to changes in the Company's expectations except as otherwise required by applicable legislation.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/7dd77fc9-14c1-4b8e-99ad-5c1b42e5cd7f

https://www.globenewswire.com/NewsRoom/AttachmentNg/b51985ae-ea59-4247-a702-0f0fc6fe22f3