Coppernico Metals Inc. (TSX: COPR, OTCQB: CPPMF, FSE: 9I3) ("Coppernico" or the "Company"), through its wholly owned Peruvian subsidiary, Sombrero Minerales SAC, is pleased to announce initial surface channel sampling results from the Nioc target area at its flagship Sombrero copper-gold Project in Peru (Figure 1), including 52 metres ("m") of 1.06% copper ("Cu"), 0.19 gt gold ("Au") and 1.20 gt silver ("Ag"), and 36 m of 1.10% Cu, 0.32 gt Au and 3.44 gt Ag . These results provide an initial view of the high-grade copper-gold mineralization at Nioc and highlight the potential scale of a second major skarn system within the Project, with a continued record of incident-free exploration since inception.

The Company further notes that Ivan Bebek, Chair and CEO, will present at the upcoming Precious Metals Summit Beaver Creek Conference on Thursday, September 11, 2025, at 10:30 a.m., followed by a series of additional conferences through early 2026, providing opportunities for investors to meet directly with management.

Highlights:

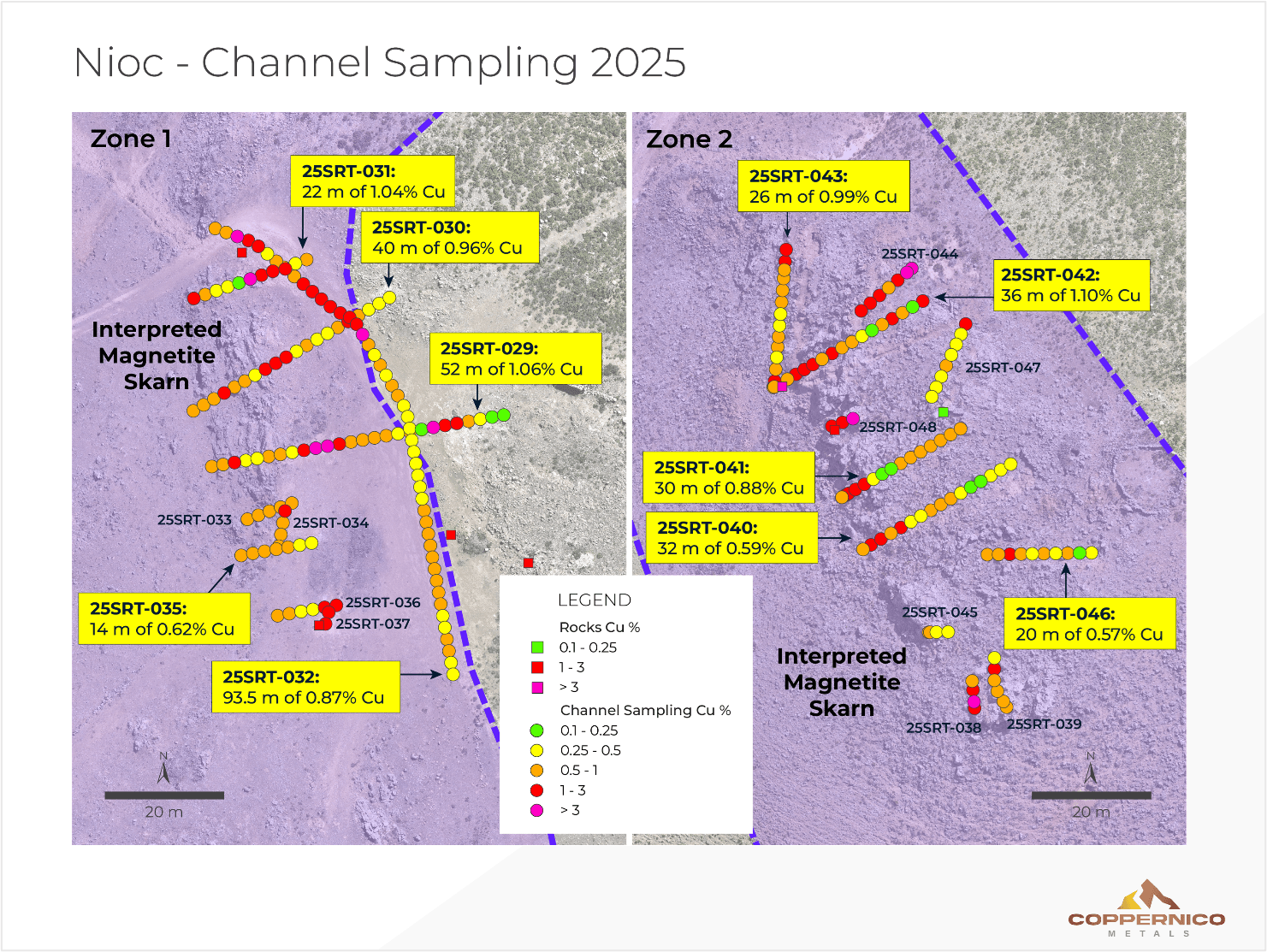

- Zone 1:

- 25SRT029: 52 m of 1.06% Cu, 0.19 g/t Au, and 1.20 g/t Ag

- 25SRT030: 40 m of 0.96% Cu, 0.13 g/t Au, and 0.96 g/t Ag

- 25SRT032: 93.5 m of 0.87% Cu, 0.19 g/t Au, and 0.60 g/t Ag

- Zone 2:

- 25SRT040: 32 m of 0.59% Cu, 0.23 g/t Au, and 1.44 g/t Ag

- 25SRT042: 36 m of 1.10% Cu, 0.32 g/t Au, and 3.44 g/t Ag

- 25SRT043: 26 m of 0.99% Cu, 0.40 g/t Au, and 3.11 g/t Ag

True widths currently unknown, results are summarized in Table 1. These are composites of the entire channel sample length, no portion of the channel was excluded.

- Mineralization remains open, with limits in all directions not yet defined . Similarly, the structural control on mineralization is yet to be assessed.

- These channel samples directly overlie a large 1.8 km x 1.4 km chargeability anomaly 1 , suggesting continued sulphide mineralization at depth.

Mr. Bebek commented, "Sombrero is unique both in its large scale and grade and represents numerous tier one exploration opportunities as we continue to receive new impressive results across multiple targets within our significant claim holdings. The results announced today were limited only to hard rock - outcropping rocks and the channel samples are open for considerable expansion over the multi square kilometer underlaying geophysical footprint.

These positive results not only significantly benefit our targeting and increase opportunities for discovery, but they also validate our ongoing community relations activities which are planned to include additional agricultural and employment opportunities.

As we advance our pending permits, we are developing a pipeline of tier one copper-gold skarn exploration targets. We are looking forward to providing updates on permit and additional partnership with the communities in the region in the near term."

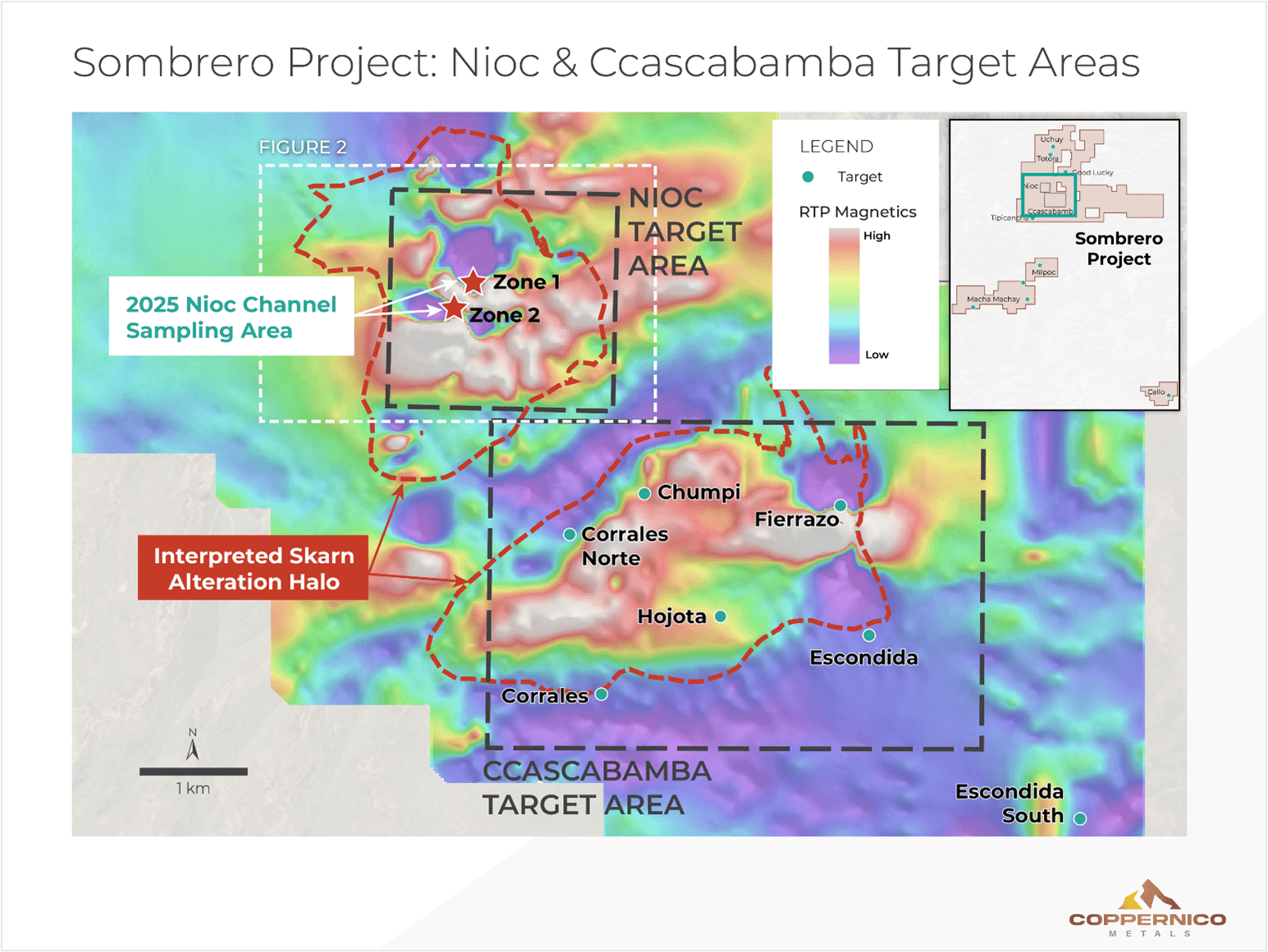

Figure 1: Map with location of Nioc target area, illustrating extensive skarn alteration and a clustered skarn environment with the adjacent Ccascabamba system.

Nioc Channel Sampling

The channel samples were collected across bodies of skarn-altered rock outcropping on surface. They represent the first systematic sampling completed by Coppernico within the Nioc target area, one of multiple mineralized centers within a broadly distributed skarn environment.

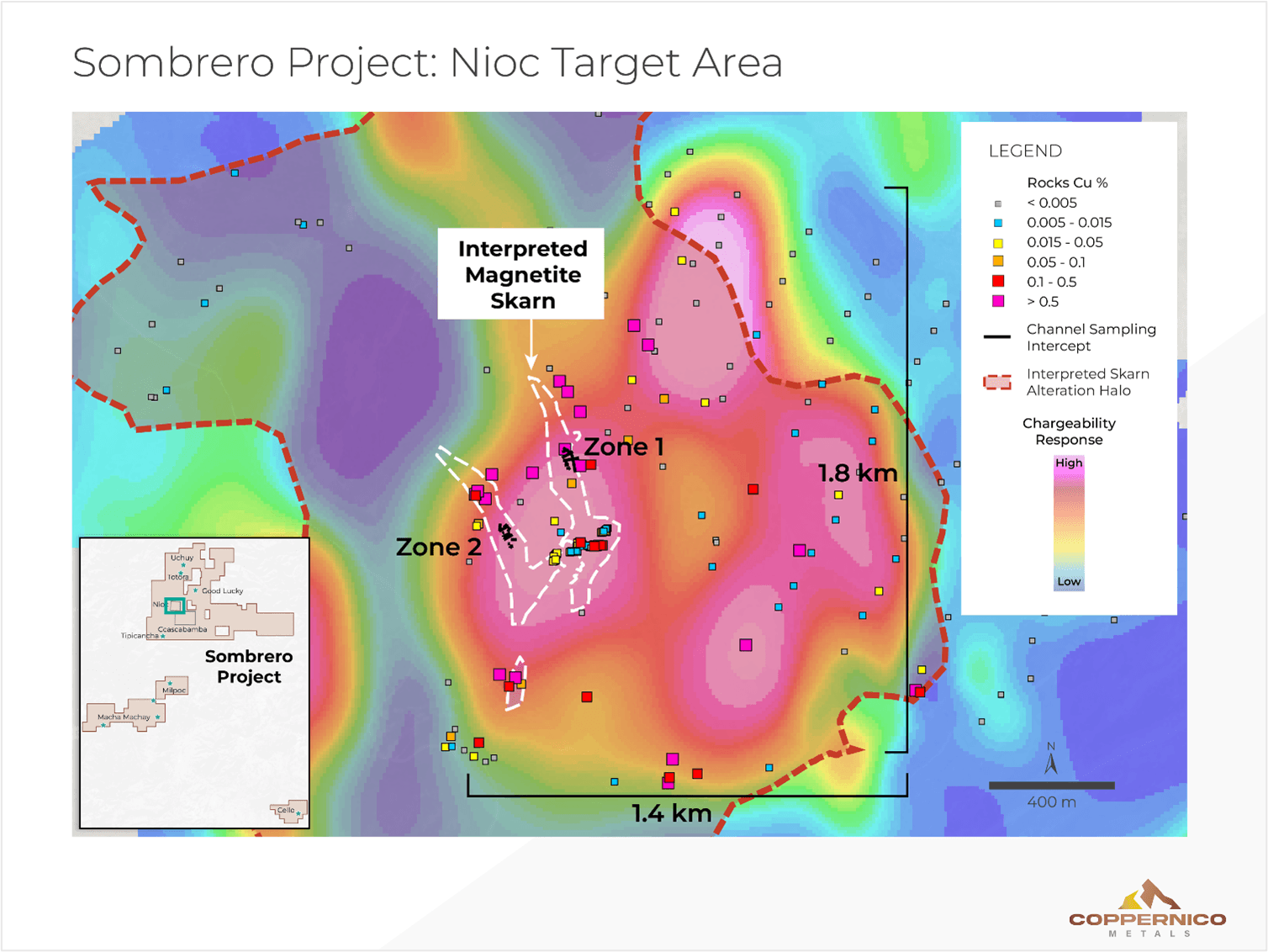

Coppernico geologists focused sampling on two zones of outcropping garnet and magnetite skarn (Figures 2 and 3), which carry visible copper oxides and trace sulphides, such features being directly comparable to mineralization observed at the Fierrazo target within the Ccascabamba target area located directly to the south.

The channel sampling program has reported multiple zones of copper-gold mineralization with yet to be defined limits, establishing Nioc as a compelling target for follow-up exploration. Significantly, these mineralized zones overlay a large (1.8 km by 1.4 km) chargeability anomaly (>20 mV/V), that has been modeled to at least 500 m below surface (see news release dated January 17, 2020, issued by predecessor Auryn Resources, now Fury Gold Mines), suggesting potential for broad areas of sulphide mineralization present at depth (Figures 1 and 2). This chargeability target itself is situated within a broader area of discontinuously mapped skarn alteration over an area of approximately 2 km by 3 km.

Figure 2: Location map of channel sampling and rock samples over chargeability data at 3,850 m elevation, ~200 m below surface, interpreted extent of magnetite skarn based on outcrop mapping.

Figure 3: Outcrop map showing location of channel samples at the Nioc target area

Table 1: Nioc Channel Sampling Composites

| Zone | Channel Sample ID | From (m) | To (m) | Interval (m) | Cu % | Au (g/t) | Ag (g/t) | |

| Zone 1 | 25SRT-029 | 0.00 | 52.00 | 52.00 | 1.06 | 0.19 | 1.23 | |

| Incl | 16.00 | 44.00 | 28.00 | 1.54 | 0.19 | 1.11 | ||

| 25SRT-030 | 0.00 | 40.00 | 40.00 | 0.96 | 0.13 | 0.96 | ||

| Incl | 4.00 | 20.00 | 16.00 | 1.44 | 0.20 | 1.53 | ||

| 25SRT-031 | 0.00 | 22.00 | 22.00 | 1.04 | 0.12 | 0.73 | ||

| Incl | 10.00 | 16.00 | 6.00 | 2.21 | 0.14 | 0.70 | ||

| 25SRT-032 | 0.00 | 93.50 | 93.50 | 0.87 | 0.19 | 0.60 | ||

| Incl | 4.00 | 35.50 | 31.50 | 1.72 | 0.12 | 1.25 | ||

| 25SRT-033 | 0.00 | 10.00 | 10.00 | 0.66 | 0.20 | 0.98 | ||

| 25SRT-034 | 0.00 | 8.00 | 8.00 | 0.80 | 0.09 | 0.77 | ||

| 25SRT-035 | 0.00 | 14.00 | 14.00 | 0.62 | 0.23 | 0.98 | ||

| 25SRT-036 | 0.00 | 12.00 | 12.00 | 1.03 | 0.12 | 0.68 | ||

| 25SRT-037 | 0.00 | 4.00 | 4.00 | 1.95 | 0.05 | 0.72 | ||

| Zone 2 | 25SRT-038 | 0.00 | 8.00 | 8.00 | 2.03 | 0.56 | 5.69 | |

| 25SRT-039 | 0.00 | 12.00 | 12.00 | 0.75 | 0.35 | 1.35 | ||

| 25SRT-040 | 0.00 | 32.00 | 32.00 | 0.59 | 0.23 | 1.44 | ||

| Incl | 0.00 | 10.00 | 10.00 | 0.97 | 0.52 | 1.91 | ||

| 25SRT-041 | 0.00 | 30.00 | 30.00 | 0.88 | 0.45 | 1.94 | ||

| Incl | 2.00 | 10.00 | 8.00 | 1.77 | 0.79 | 2.92 | ||

| 25SRT-042 | 0.00 | 36.00 | 36.00 | 1.10 | 0.32 | 3.44 | ||

| Incl | 0.00 | 18.00 | 18.00 | 1.27 | 0.39 | 4.83 | ||

| 25SRT-043 | 0.00 | 26.00 | 26.00 | 0.99 | 0.40 | 3.11 | ||

| Incl | 14.00 | 26.00 | 12.00 | 1.42 | 0.49 | 1.91 | ||

| 25SRT-044 | 0.00 | 14.00 | 14.00 | 2.43 | 0.73 | 4.23 | ||

| 25SRT-045 | 0.00 | 8.00 | 8.00 | 0.45 | 0.07 | 1.30 | ||

| 25SRT-046 | 0.00 | 20.00 | 20.00 | 0.57 | 0.24 | 2.24 | ||

| Incl | 0.00 | 8.00 | 8.00 | 0.82 | 0.45 | 3.94 | ||

| 25SRT-047 | 0.00 | 15.50 | 15.50 | 0.75 | 0.16 | 1.47 | ||

| 25SRT-048 | 0.00 | 6.00 | 6.00 | 2.98 | 1.51 | 12.38 |

Length and density weighted assay composites. True thickness is unknown, the highlighted channels are oriented generally perpendicular to rock outcrop and are considered most representative at time of reporting. Reported composites are for the entire length of each channel, no sample/interval was excluded from the composite calculation. No more than 6 m internal dilution (reported values below 0.2% Cu). Minimum reporting length of 6 m.

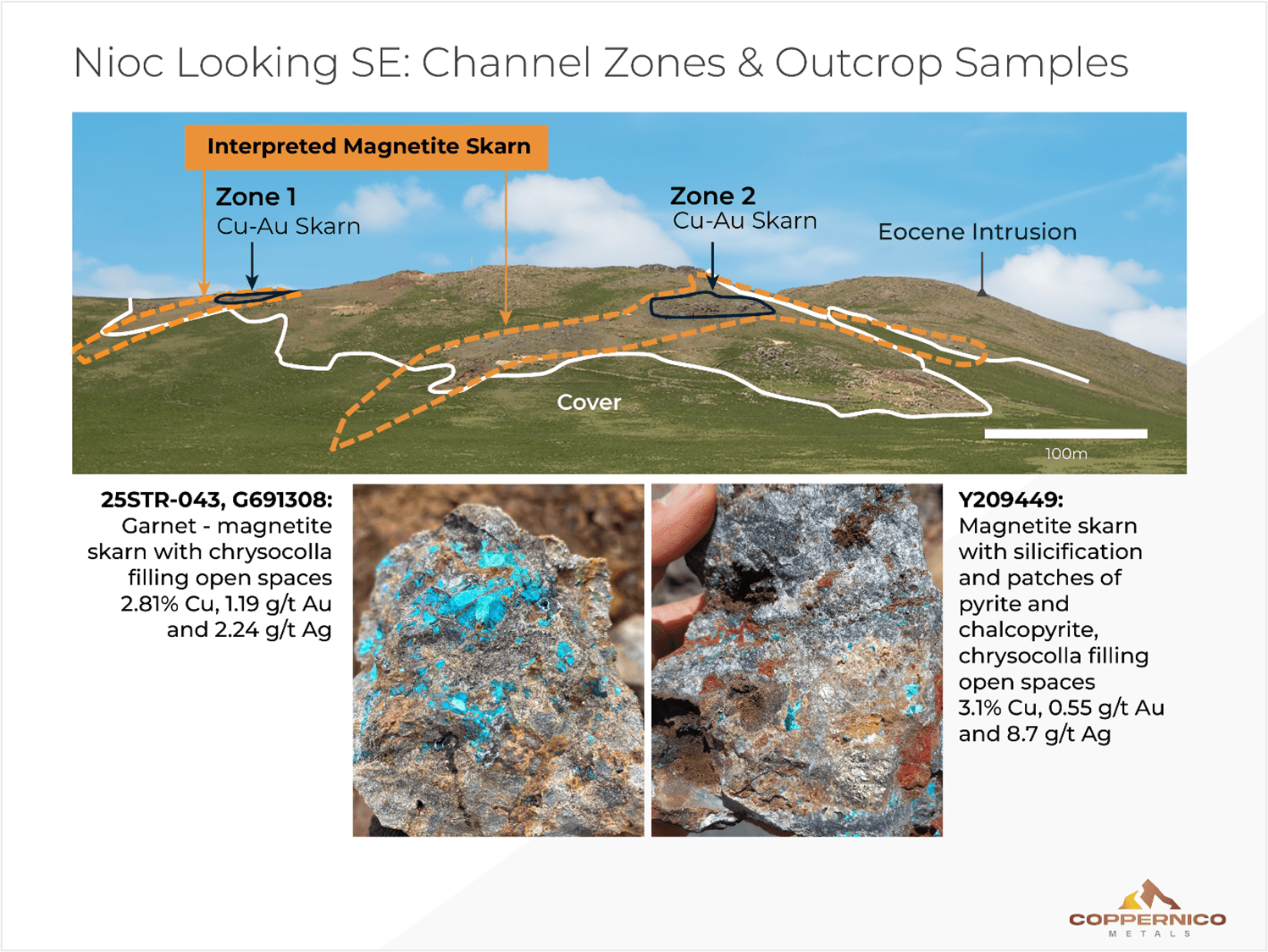

Figure 4: Nioc target view looking SE with delineations of channel sampling Zones 1 and 2, and garnet-magnetite skarn outcrop with visible copper oxides and trace sulphides.

Representative samples include: 25STR-043 (G691308): Garnet–magnetite skarn with chrysocolla filling open spaces, grading 2.81% Cu, 1.19 g/t Au, 2.24 g/t Ag; and Y209449: Magnetite skarn with silicification, pyrite, chalcopyrite, and chrysocolla filling open spaces, grading 3.1% Cu, 0.55 g/t Au, 8.7 g/t Ag.

Sampling Protocols: The composites include 100% of samples collected in each channel, no samples were excluded. The lowest grade sample collected was 0.1% Cu with the highest being 5% Cu. Channel samples were collected from discontinuous outcrops across areas approximately 100 m long and 20–50 m wide. Sampling was conducted where outcrop exposure allowed, with channels oriented to maximize continuity. Due to limited exposure and unknown mineralization geometry, not all channels are perpendicular to the outcrop. Channel sample spacing ranges from 5m to 20m apart. Nearly every channel started or ended elevated Cu grades. The scale of mineralization on surface has yet to be defined. Additional channel sampling and mapping will be required to better define the orientation and extent of mineralization.

Tim Kingsley, VP Exploration, commented, "These maiden results from Nioc are further validation of the thesis of extensive district-scale mineralization at Sombrero. With high-grade copper values directly above a large chargeability footprint, Nioc is shaping up to be a major target area alongside the adjacent Ccascabamba target area. The mineralization on surface at Nioc has similarities to that observed at Fierrazo, where historical drilling has already demonstrated continuity in the third dimension. This work at Nioc represents part of our ongoing efforts to advance a pipeline of large scale and high priority targets aiming to realize the full potential of the Sombrero Project."

Next Steps

Coppernico plans to expand surface exploration work at Nioc, including additional detailed mapping and channel sampling to further refine the geometry, scale, and continuity of mineralization and associated structures. These efforts will guide future drill targeting, which the Company intends to commence at the earliest opportunity once a community agreement is achieved, to support the broader exploration strategy across the Sombrero Project.

Marketing Update - Strengthening Investor Outreach

The Company is pleased to announce that Mr. Bebek, will be participating in several key industry conferences throughout the fall of 2025 and early 2026. Mr. Bebek will be available for one-on-one meetings with investors, analysts, and industry stakeholders during these events.

Upcoming Conferences:

- Precious Metals Summit Beaver Creek – September 9-12, 2025, Beaver Creek, Colorado, USA

- CEO Presentation: Thursday, September 11 at 10:30 a.m. MT in Heritage Room 2

- Nordic Funds and Mines Conference – October 8-9, 2025, Stockholm, Sweden

- New Orleans Investment Conference – November 2-5, 2025, New Orleans, USA

- Precious Metals Summit Zurich – November 10-11, 2025, Zurich, Switzerland

- CEO Presentation: Monday, November 10 at 12:15 p.m. in Room 1

- Vancouver Resource Investment Conference 2026 – January 25-26, 2026, Vancouver, Canada

- Swiss Mining Institute (SMI) March Conference – March 18-19, 2026, Zurich, Switzerland

The conference presentations will be posted on the Company's website at www.coppernicometals.com

On the back of these conferences, Mr. Bebek plans to embark on marketing roadshows across North America and Europe. These roadshows are part of Coppernico's strategy to increase visibility among global investors, showcase the Company's project pipeline to position it for broader institutional and retail support as it advances key corporate milestones. Interested parties are encouraged to contact the Company to arrange meetings at info@coppernicometals.com.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Tim Kingsley, M.Sc., CPG, Coppernico's VP of Exploration, who is a "Qualified Person" (as defined in NI 43-101).

Quality Control

Analytical samples were taken by chisel and hammer in continuous horizontal lines, typically samples were composited over up to 2 metre lengths per sample, however this may be reduced to 0.5 metres where lithological or significant mineralogical changes were observed in order to accurately reflect the apparent width of mineralisation. Typical sample weights were 1 kg per metre. Samples were collected in plastic bags and given a unique reference number. Approximately 2-3 kg of material per sample was collected for analysis and sent to the ALS Lab in Lima, Peru for preparation and analysis. Preparation included crushing the sample to 90%

ON BEHALF OF THE BOARD OF DIRECTORS

Ivan Bebek

Chair & CEO

For further information, please contact:

Coppernico Metals Inc.

Phone: +1 778 729 0600

Email: info@coppernicometals.com

Website: www.coppernicometals.com

Twitter: @CoppernicoMetal

LinkedIn: www.linkedin.com/company/coppernico-metals/

About Coppernico

Coppernico is a mineral exploration company focused on creating value for shareholders and stakeholders through diligent project evaluation and exploration, in pursuit of the discovery of world-class copper-gold deposits in the Americas. The Company's management and technical teams have a successful track record of raising capital, discovery and the monetization of exploration successes. The Company's objective is to become a leading advanced copper and gold explorer, and through its wholly owned private Peruvian subsidiary Sombrero Minerales S.A.C., is currently focused on the Ccascabamba (previously referred to as Sombrero Main) and Nioc target areas within the Sombrero Project in Peru, its flagship project, while regularly reviewing additional premium projects to consider for acquisition.

The Sombrero Project is a land package of approximately 53,800 hectares (538 square kilometres) located in the north-western margins of the world-class Andahuaylas-Yauri trend in Peru. It consists of a number of prospective exploration targets characterized by copper-gold skarn and porphyry systems and precious metal epithermal systems. The Company's NI 43-101 technical report, with an effective date of April 17, 2024, and as filed on SEDAR+ on May 23, 2024, focuses on the Ccascabamba and Nioc target areas of the Sombrero Project.

Coppernico Metals Inc. is currently listed on the Toronto Stock Exchange under the symbol "COPR", trades on the OTCQB Venture Market under symbol "CPPMF" and is quoted over the counter by certain dealers in the Unofficial Market of the Frankfurt Stock Exchange under the symbol "9I3". More information about Coppernico can be found on the Company's profile on SEDAR+ ( www.sedarplus.ca ).

Cautionary Note

No regulatory organization has approved the contents hereof.

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, " forward-looking statements "). Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expect", "intend" and similar expressions and include, but are not limited to, statements with respect to: the interpretation of geological mapping and sampling results, the prospective nature of newly identified targets for future exploration, the potential of the interpreted mineralized systems, the progress and approval of permits and surface access agreements, the potential expansion of the mineralization beyond currently permitted areas, and the Company's drill plans. No certainty can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. Readers should refer to the risks discussed in the Company's 2024 Annual Information Form and other continuous disclosure filings with the Canadian Securities Administrators, available at www.sedarplus.ca . These factors are not, and should not be construed as being, exhaustive. Accordingly, readers should not place heavy reliance on forward-looking statements. The forward-looking statements contained in this new release are expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this news release. The Company does not undertake any obligation to publicly update or revise any forward-looking information after the date of this news release to conform such information to actual results or to changes in the Company's expectations except as otherwise required by applicable legislation.

1 See news release dated January 17, 2020, issued by predecessor Auryn Resources, now Fury Gold Mines

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/180ce7ab-4174-4417-b37a-83a8d799babb

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d23ceb1-843e-47dd-aa04-ed4ef437b27d

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb0d7981-44ed-4550-b126-44971949076c

https://www.globenewswire.com/NewsRoom/AttachmentNg/9a5be867-128a-4a67-838b-ba26bf4682e3