Copper Fox Metals Inc. (TSXV: CUU,OTC:CPFXF) (OTCQX: CPFXF) (FSE: HPU) ("Copper Fox" or the "Company") is pleased to provide the analytical results for the five (5) drillholes completed at the Schaft Creek project in 2025. The Schaft Creek project is managed through the Schaft Creek Joint Venture ("SCJV"). Teck Resources Limited ("Teck") is the Operator of the SCJV and holds a 75% interest with Copper Fox holding the remaining 25% interest. The Schaft Creek deposit, located in northwestern British Columbia, is one of the largest undeveloped porphyry copper deposits in North America that contains significant gold-molybdenum-silver by-products.

In 2025, the SCJV approved a C$15.8 million budget to advance key project activities including the collection of geotechnical, geophysical, metallurgical, and environmental data, engineering studies and active community engagement. Four of the five drillholes intersected significant intervals of near surface copper and copper-gold mineralization.

The 2025 drilling program intersected significant intervals of copper and copper-gold mineralization over a distance of approximately 500 meters (m), in an area south of the Liard zone. Analytical highlights include:

- DDH SCK-25-478, intersected a 67.27m core interval (357.73 to 425.00m) that averaged 0.286% copper, trace molybdenum, 1.814g/t gold and 1.77g/t silver that included an 11.5m core interval (408.50 to 420.00m) that averaged 0.381% copper, trace molybdenum, 9.352g/t gold and 2.67g/t silver.

- DDH SCK-25-480, intersected a 181.50m core interval (21.00 to 202.50m) that averaged 0.299% copper, 0.006% molybdenum, 0.088g/t gold and 0.96g/t silver, that included a 15.00m core interval (110.90 to 125.90m) that averaged 0.562% copper, 0.009% molybdenum, 0.131g/t gold and 1.70g/t silver.

- Two additional drillholes intersected near surface copper mineralization with lower concentrations of gold, molybdenum and silver over core intervals ranging from 96.00 to 215.50m.

Elmer B. Stewart, President and CEO of Copper Fox, stated, "I am extremely pleased with the analytical results of the 2025 drilling program that appears to have expanded the footprint of the Schaft Creek porphyry deposit up to 500m south of the modelled Liard zone. The primary purpose of the 2025 drilling program was to test the area south of the Liard zone, designated as a potential rock storage facility, for porphyry style mineralization. These analytical results are being incorporated into the project database to assess the significance of these mineralized intervals on the overall Schaft Creek development plan."

2026 Program

The Company plans to provide the 2026 work program for the Schaft Creek project once the Schaft Creek Joint Venture has reviewed and approved the program proposed by Teck. This is expected during the current calendar Quarter.

Analytical Results from 2025 Drilling Program

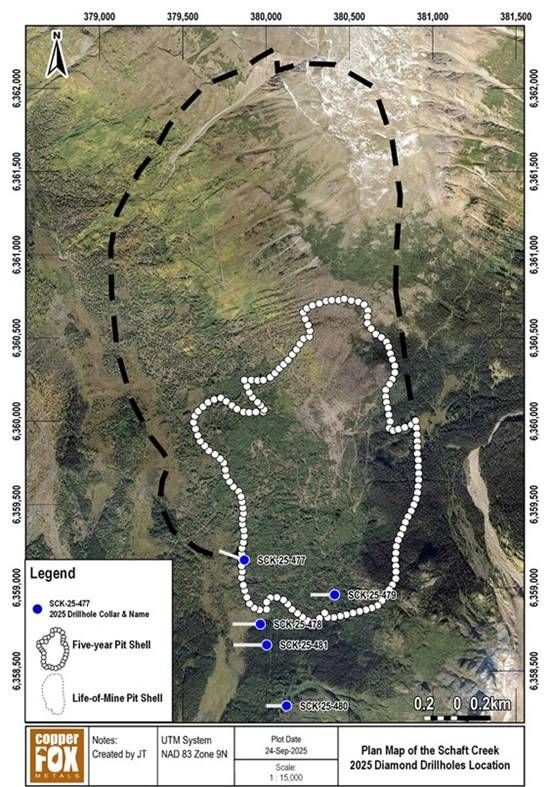

The mineralized intervals reported in this news release were calculated using a 0.10% copper cut-off. Sample intervals that averaged lower than the 0.10% Cu cut-off were included in the weighted average interval provided that the sampled interval below the cut-off did not exceed 10.0m in core length. Intervals of core lost at zero metal grade are included in the weighted average metal grades for the mineralized interval. Drill collar locations are shown in Figure-1. The weighted average grades of the mineralized intervals set out in Table-1. The drill collar data is set out in Table-2.

Figure 1: Plan map of the Schaft Creek deposit showing locations of the 2025 drillholes, the Five-Year pit shell and Life-of-Mine pit shell as set out in the "Schaft Creek Preliminary Economic Assessment (PEA), an NI 43-101 Technical Report", with an effective date of September 10, 2021, prepared by Tetra Tech Canada Inc., H. Ghaffari. M.A.Sc., P. Eng et. al. as Qualified Persons.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2177/281562_f940e4ccf48f7bda_001full.jpg

Table 1: Weighted average grades of mineralized intervals from the 2025 drilling program.

| DDH ID | From (m) | To (m) | Int. (m) | Cu (%) | Mo (%) | Au (g/t) | Ag (g/t) | CuEq(%) |

| SCK-25-477 | NSM | |||||||

| SCK-25-478 | 28.50 | 244.00 | 215.50 | 0.283 | 0.005 | 0.040 | 0.80 | 0.321 |

| includes | 68.50 | 84.00 | 15.50 | 0.673 | 0.005 | 0.101 | 1.25 | 0.753 |

| 357.73 | 425.00 | 67.27 | 0.286 | Tr. | 1.814 | 1.77 | 1.362 | |

| includes | 357.73 | 384.00 | 26.27 | 0.452 | Tr. | 0.031 | 2.55 | 0.480 |

| and | 357.73 | 363.00 | 5.27 | 1.174 | Tr. | 0.070 | 4.03 | 1.233 |

| includes | 384.00 | 425.00 | 41.00 | 0.180 | Tr. | 2.956 | 2.96 | 1.927 |

| includes | 408.50 | 420.00 | 11.50 | 0.381 | Tr. | 9.352 | 2.67 | 5.900 |

| SCK-25-479 | 26.50 | 122.50 | 96.00 | 0.186 | 0.008 | 0.056 | 0.58 | 0.247 |

| includes | 97.50 | 107.50 | 10.00 | 0.420 | 0.011 | 0.101 | 1.18 | 0.517 |

| 196.00 | 215.00 | 19.00 | 0.134 | Tr. | 0.067 | 0.72 | 0.177 | |

| 252.50 | 267.50 | 15.00 | 0.158 | Tr. | 0.026 | 0.85 | 0.178 | |

| SCK-25-480 | 21.00 | 202.50 | 181.50 | 0.299 | 0.006 | 0.088 | 0.96 | 0.374 |

| includes | 110.90 | 125.90 | 15.00 | 0.562 | 0.009 | 0.131 | 1.70 | 0.673 |

| and | 217.50 | 300.40 | 82.90 | 0.208 | Tr. | 0.039 | 0.76 | 0.237 |

| SCK-25-481 | 18.20 | 170.80 | 152.60 | 0.214 | 0.005 | 0.041 | 0.64 | 0.255 |

Notes: NSM = no significant mineralization. CuEq = copper equivalent, % = percent, g/t = grams per tonne, m = meters, Int. =core interval in meters. Copper equivalent grades are for comparative purposes only and based on calculating the CuEq for the weighted average grade of the mineralized interval using 100.0% of the copper content plus 71% of the gold content, 60.1% of the molybdenum content and 40.3% of the silver content. Metal prices used in the copper equivalent calculation are copper US$4.40/lb, gold US$2500/oz, molybdenum US$23.00/lb and silver US$27.00/oz. Mo concertation less than 0.003% and gold concentration less than 0.020 g/t are listed as trace.

The mineralized intervals listed in the above table are down hole drill core intervals. Drilling data is insufficient to determine the true width of the mineralized intervals.

Table 2: Collar information for the 2025 geotechnical drilling program.

| DDH-ID | Easting (m) | Northing (m) | Elev. (masl) | Azimuth (°) | Dip (°) | Depth (m) |

| SCK-25-477 | 379882 | 6359167 | 934 | 290 | -60 | 321.3 |

| SCK-25-478 | 379969 | 6358781 | 950 | 270 | -70 | 488.8 |

| SCK-25-479 | 380409 | 6358960 | 1078 | 265 | -60 | 290.4 |

| SCK-25-480 | 380135 | 6358284 | 1002 | 270 | -60 | 300.4 |

| SCK-25-481 | 380003 | 6358661 | 957 | 270 | -60 | 396.2 |

The drillhole locations in the above table are based on UTM_NAD83_9N_GPS; Elev. (masl)=elevation in meters above sea level.

Discussion of Mineralized Drillhole Results

DDH SCK-25-478 was drilled to the west and intersected two significant intervals of copper mineralization approximately 100m south of the Liard zone. The upper mineralized core interval (28.50-244.00m) includes a 15.5m core interval (68.50-84.00m) of higher-grade copper mineralization that returned a weighted average of 0.673% copper, 0.005% molybdenum, 0.10g/t gold and 1.25g/t silver. The lower mineralized interval (357.00-425.00m) includes an 11.50m core interval (408.50-420.00m) of copper-gold mineralization that averaged 0.381% copper, trace molybdenum, 9.352g/t gold and 2.67g/t silver. The maximum gold value within this mineralized interval is 14.55g/t gold over a 1.5m core interval.

DDH SCK-25-479 located at the south end of the Liard zone intersected an upper interval (26.50-122.50m) of copper mineralization with low concentrations of silver, molybdenum and gold.

DDH SCK-25-480 was drilled to the west and intersected two intervals of significant copper mineralization approximately 500m south of the Liard zone. The upper mineralized core interval (21.00-202.50m) contains a 15.00m core interval (110.90-125.90m) of higher-grade copper mineralization that returned a weighted average of 0.562% copper, 0.009% molybdenum, 0.131g/t gold and 1.70g/t silver. The lower mineralized interval (217.50-300.00m) intersected copper mineralization with low gold-silver concentrations and trace molybdenum.

DDH-SCK-25-481 was drilled to the west and intersected a near surface core interval (18.20-170.80m) of copper mineralization approximately 200m south of the Liard zone containing low concentrations of molybdenum, gold and silver.

Drilling and Sampling Procedures

Orientated diamond drilling was completed using HQ diameter core. Overall core recovery was estimated to be greater than 95%. After cutting with a diamond saw, one half of the core was collected for sample preparation and analysis, and the other half was retained onsite for future reference. Sample intervals selected do not cross major lithological or hydrothermal alteration changes and ranged from 0.65 to 3.00m in length, with most sample intervals in the 2.0 to 2.5m range.

Quality Control

The SCJV follows a rigorous Quality Assurance/Quality Control program. In total 753 core samples were submitted as part of the drill core analysis including 753 split-core samples, 45 commercial certified reference material ("CRM") standards, 27 field blanks, 18 pulp duplicates, 27 field duplicates and 18 crush duplicates. The matrix material of the CRM's is matched to the Schaft Creek deposit geology. All standards used are certified for 4-acid digestion and Au by fire assay. On average, 9 standards, 5 field blank, and 13 duplicates (crush, field, and pulp) were inserted into each batch of approximately 181 samples (5 batches in total). The insertion rate of the CRM's during 2025 was 15:1.

Analytical data for each standard was reviewed on a batch-by-batch basis. Only the performance of Au (by Au-ICP21), Cu, Mo, and Ag (ME-MS61) were considered in the failure criteria. The performance of non-economic elements As, Fe, Mg (ME-MS61), Total S by IR08, and Total Cu by sequential leach (Cu-PKG06LI) were used to monitor digestion and method specific failures. ALS Limited ("ALS") located in North Vancouver, British Columbia completed the analysis of the samples provided. ALS has a 9001:2008 International Standard Organization rating for Quality Management Systems. ALS has an ISO/IEC 17025:2017 UKAS (ref 4028) accreditation.

The drillholes from the 2025 program were analyzed using analytical package; Au-ICP21(30g), ME-MS61(0.75g): Four acid digestion followed by ICP-MS measurement. Total C was measured using C-IR07 and total S by S-IR08, Cu-PKG06LI (Seq. Leach Cu) + S-IR06a).

Qualified Person

Elmer B. Stewart, MSc. P. Geol., President and CEO of Copper Fox, is the Company's non-independent, nominated Qualified Person pursuant to National Instrument 43-101, Standards for Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information disclosed in this news release.

About Copper Fox

Copper Fox is a Canadian resource company focused on copper development and exploration in the United States and Canada. Copper Fox and its subsidiaries own 100% of the Van Dyke ISCR project, a development stage, potential near term, mid-size copper mine in Arizona and a 25% interest in the Schaft Creek Joint Venture with Teck Resources Limited (75% interest and Operator) which hosts the Schaft Creek copper-gold-molybdenum-silver project in British Columbia's Golden Triangle. In addition, Copper Fox owns 100% of the resource stage Eaglehead polymetallic porphyry copper project in northwestern British Columbia and the Sombrero Butte and Mineral Mountain advanced exploration stage porphyry copper projects located in the prolific Laramide age copper province in Arizona. For more information on Copper Fox's mineral properties and investments, visit the Company's website at www.copperfoxmetals.com.

On behalf of the Board of Directors,

Elmer B. Stewart

President and Chief Executive Officer

For additional information, contact: Lynn Ball at 1-844-464-2820; investor@copperfoxmetals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the Canadian securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "budgets", "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes statements regarding drilling; mineralization south of the Liard zone; weighted average grade of mineralized intervals, and CuEq calculations.

In connection with the forward-looking information contained in this news release, Copper Fox and its subsidiaries have made numerous assumptions, regarding, among other things: the geological, metallurgical, engineering, financial and economic advice that Copper Fox has received is reliable and is based upon practices and methodologies which are consistent with industry standards. While Copper Fox considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk factors which could cause Copper Fox's actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: the mineralized intervals may not represent porphyry style mineralization; the weighted average grade of mineralized intervals may not be correct or significant; the CuEq calculations may not be accurate; the need to obtain additional financing; uncertainty as to the availability and terms of future financing.

A more complete discussion of the risks and uncertainties facing Copper Fox is disclosed in Copper Fox's continuous disclosure filings with Canadian securities regulatory authorities at www.sedarplus.ca. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Copper Fox disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281562