May 26, 2024

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to announce a material increase in the contingent resources booking for its 100% owned ATP 2044 in Queensland (Project Grandis).

HIGHLIGHTS

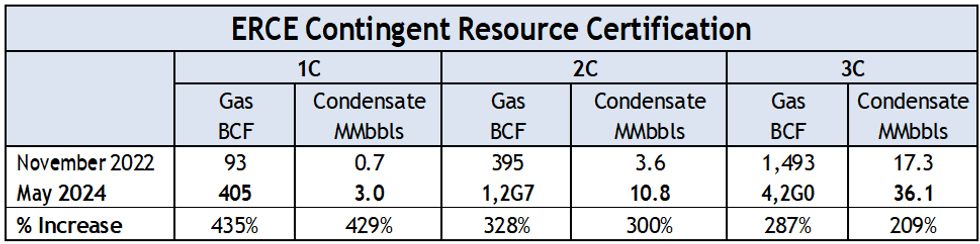

- Daydream-2 drilling results have led to a significant upgrade in contingent resources

- Independent expert certifies 2C increase of 328% to 1,297 billion cubic feet

- Final results post stimulation and flow testing in the coming months will feed into another independent certification

The updated estimate of contingent resources in ATP 2044 is as set out in the table below. The subclass of Contingent Resources (as defined under the PRMS – illustrated in Appendix 1) is “Development Unclarified”.

These estimates have been independently certified by international firm ERC Equipoise (“ERCE”).

Notes:

These are unrisked contingent resources that have not been risked for the chance of development and there is no certainty that it will be economically viable to produce any portion of the contingent resources.

These contingent resources are classified as “Development Unclarified”.

Detailed notes on the background to the preparation of the contingent resources report are set out in Appendix 1.

These contingent resources estimates are for the sandstones only in the gas bearing Permian section, and do not include the prospective coal resources, which will be the subject of stimulation and production testing in the coming months.

This upgrade in contingent resources is largely due to:

1. The lowering of the Lowest Known Gas (LKG) from Daydream-1 to Daydream-2 as a result of the successful Lorelle sandstone testing; and

2. The overall improved sandstone reservoir development and resulting increasing net to gross from Daydream-1 to Daydream-2.

Elixir’s technical team and ERCE analyzed drilling, logging and test data to make these estimates. Specific analysis including seismic interpretation, core analysis, wireline petrophysics, chromatographic gas analysis, DFITs, production test analysis and gas sampling have all been incorporated in the resources estimates. The key contingency for Project Grandis is the flowrate. Whilst the Company has achieved a flowrate of 1.3 million cubic feet per day from the lower-most Lorelle Sandstone, the upper zones have not yet been tested.

The Daydream-2 appraisal program is expected to resume in the next month or so. Further updates on more specific time-frames are expected to follow shortly, as current negotiations with various sub- contractors are finalized.

Elixir’s Managing Director, Mr Neil Young, said: “We are naturally delighted with the ongoing material build-up of the very significant contingent resources in our exceptionally well located Project Grandis project. As our appraisal program resumes in the next month or so, the success case should deliver yet more substantial increases.”

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00