Investor Insight

Rio Silver provides leveraged exposure to high-grade silver development through its Maria Norte project in one of Peru’s most productive mineral belts. With strong non-dilutive royalty income and milestone payments, the company offers meaningful upside with reduced dilution risk.

Overview

Rio Silver (TSXV:RYO,OTC:RYOOD) is a Canadian resource developer focused on advancing high-grade, silver‑dominant assets in Peru, one of the world’s most prolific and well‑established silver‑producing regions. With a deeply experienced in‑country technical and regulatory team, the company is positioned to execute a rapid, efficient development strategy centered on its flagship Maria Norte project and complemented by its recently acquired Santa Rita silver-lead-zinc project. Rio Silver continues to build value through a disciplined approach to acquisition, exploration and early‑stage development, supported by strong local relationships and a streamlined corporate structure.

Maria Norte property

The company also benefits from non‑dilutive financial strength through long‑term royalty income, milestone payments and equity interests tied to the sale of the Niñobamba project. Complementing its Peruvian portfolio, Rio Silver maintains a highly prospective critical metals asset in Ontario’s Ring of Fire, providing additional optionality and long‑term upside. Together, these assets reflect a balanced strategy aimed at near‑term development potential and sustained value creation.

Company Highlights

- High-grade, silver‑dominant development focus centered on the Maria Norte project in Peru.

- Strong insider alignment and seasoned management team with combined 150 years of discovery, mine development and operations history

- Robust royalty and milestone income, including ~US$150,000/year in advanced royalty payments.

- Strategic sale of Niñobamba delivering over US$2 million in milestones plus equity and a 2 percent NSR retained.

- District‑scale expansion potential with additional silver targets under evaluation near Maria Norte.

- Additional upside through a highly prospective critical‑metals project in Ontario’s Ring of Fire.

- Newly acquired Santa Rita silver-lead-zinc project enhances district-scale synergies with Maria Norte, strengthening Rio Silver’s pure-play silver development strategy in Peru.

Key Project

Maria Norte Silver Project

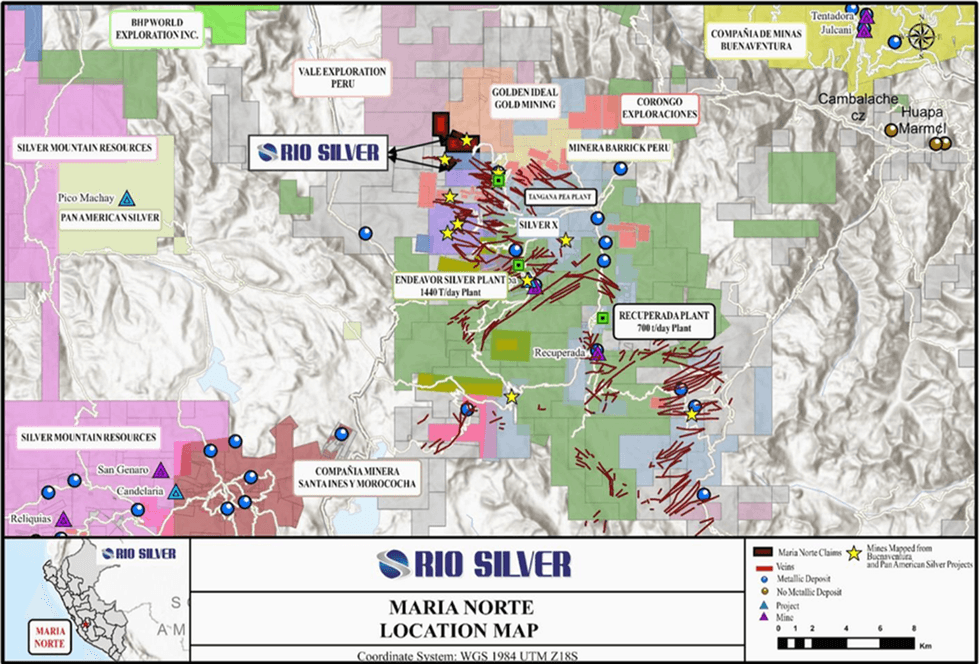

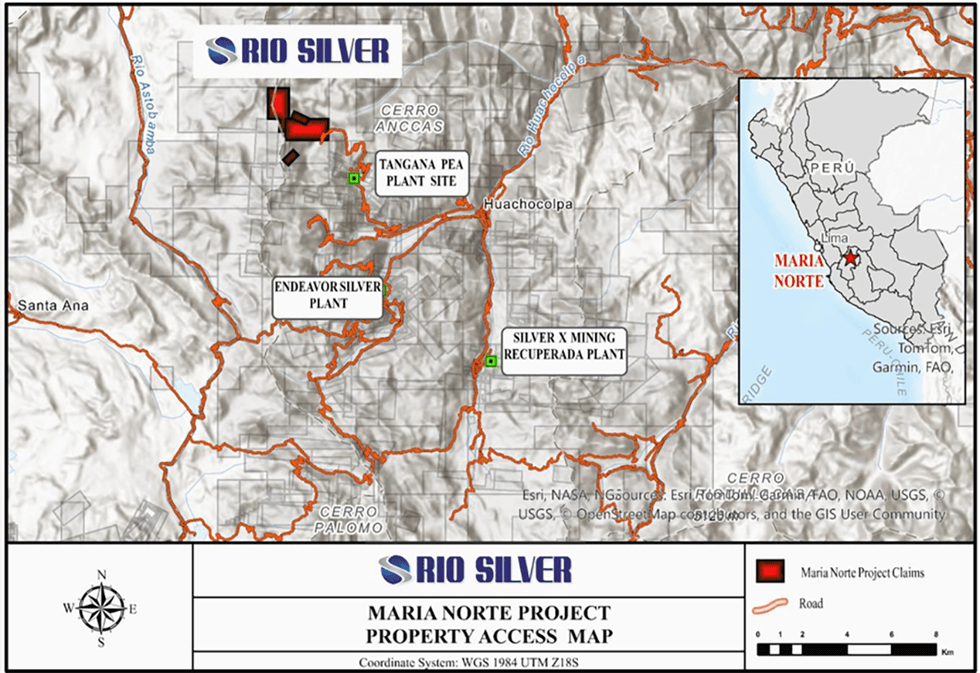

The Maria Norte project is the company’s primary near-term development focus, located within the prolific Huachocolpa mining district – one of Peru’s most established silver-producing regions. Historically prepared for production and surrounded by multiple operating and past-producing polymetallic mines, Maria Norte benefits from excellent regional infrastructure, including two nearby processing plants within trucking distance.

A recent multidisciplinary site review conducted by Rio Silver’s in-country technical team confirmed strong mineralized structures, clear development sequencing, and a rapid execution pathway immediately upon regulatory approval of the acquisition. Preparations are underway for high-altitude camp construction, portal-access upgrades, and underground drift advancement along known gold-silver-lead-zinc structures. The company is also advancing explosives permitting and stakeholder access agreements, which continue to progress positively.

Maria Norte’s geology demonstrates significant high-grade potential, including historical sampling from the Castor vein system with values up to 16.5 grams per ton (g/t) gold and 1,128 g/t silver, alongside significant lead and zinc grades. The project lies on‑strike with nearby deposits supported by a positive preliminary economic assessment, reinforcing both grade continuity and development viability. Rio Silver is concurrently evaluating several additional silver-dominant targets within trucking distance, positioning Maria Norte as the foundation of a broader district-scale growth strategy.

Santa Rita Silver-Lead-Zinc Project

The Santa Rita project is a 570-hectare, high-grade carbonate-replacement (CRD) silver-lead-zinc system located within one of Central Peru’s most productive polymetallic belts, approximately 55 km from Rio Silver’s Maria Norte project. Acquired through a clean, closed-bid process granting full ownership with no underlying royalties, Santa Rita hosts more than 20 steeply dipping veins and multiple shallow-dipping mantos historically explored by previous operators. The project benefits from direct road access and proximity to producing mines and regional processing facilities, providing a cost-effective pathway for advancement. Metallurgical testing and field verification programs are underway as Rio Silver advances Santa Rita as a complementary asset to Maria Norte.

Niñobamba Silver-Gold Project (Optioned in 2025)

The Niñobamba project, located in Ayacucho, remains an important value contributor through milestone payments, equity ownership, and a 2 percent NSR royalty retained by Rio Silver. Historically, the project demonstrated significant silver and gold mineralization across its North and South zones. While now optioned, Niñobamba continues to enhance Rio Silver’s financial stability and long‑term upside.

Ring of Fire Critical Metals Project

Rio Silver also holds a prospective critical‑metals property in Ontario’s Ring of Fire, where airborne EM data identified one of the region’s strongest anomalies. Historical drilling and ongoing Indigenous engagement support its long‑term strategic potential.

Management Team

Chris Verrico - President, CEO and Director

Chris Verrico has extensive experience with rural-remote infrastructure construction and contract mining throughout BC, the Yukon, Alaska and Nunavut. He has been a director for a dozen startup junior mining companies, most of which have become public companies. Verrico has managed numerous exploration projects in North America, Mexico and throughout western South America. He is currently the director of Juggernaut Exploration.

Steve Brunelle - Chairman

Steve Brunelle is the former officer and director of Corner Bay Silver, which was acquired by Pan American Silver. He has 35 years of experience in mineral exploration throughout the Americas and is currently an Officer and Director for several TSXV companies.

Jim McCrea – Adviser

Jim McCrea has more than 30 years’ experience in exploration, mining geology and mineral resource estimation. McCrea has experience in a range of commodities, but primarily gold, silver and copper, with particular focus on North and South America. He has performed ore body modeling and resource estimation for the successfully targeted takeover company Cumberland Resources by Agnico-Eagle Mines. More recently, McCrea completed many mineral resource estimations underpinning acquisitions such as Minera San Cristóbal S.A. of Bolivia, Arena Minerals and Montan Mining, to mention a few.

Richard Mazur - Director

Richard Mazur is the co-founder and past managing director of RLG International, operating in over 30 countries worldwide with more than 300 employees.

Jeffrey J. Reeder - Advisor

Jeffrey J. Reeder, P. Geo., holds a B.Sc. (Honours) in Geology from the University of Alberta and has been a registered professional geologist with the Association of Professional Engineers and Geoscientists of British Columbia since 1992. With 25 years of experience working in Peru and fluency in Spanish, Reeder has played a key role in identifying and acquiring significant mineral projects, including the Aguila Copper-Moly deposit, which is now being developed by Mexican mining giant Industrias Peñoles, and the Pinaya copper-gold project, currently under exploration by Kaizen Discovery. Reeder is the president and CEO of Peruvian Metals, which operates a successful and expanding toll milling plant in northern Peru.

Eric H. Hinton - Advisor

Eric Hinton holds degrees from Haileybury School of Mines, Queen’s University, and Laurentian University and is a registered professional engineer in Ontario and Manitoba. A Fellow of the Canadian Institute of Mining, Metallurgy, and Petroleum, he is also designated as a Qualified Person (QP) in underground mining by the Mining and Metallurgical Society of America and is recognized as a QP under National Instrument 43-101.

Christopher Hopton - CFO and Advisor

Christopher Hopton is a seasoned financial management professional with 25 years of experience. He has led financial operations for resource and biotech companies across Canada and South America. Since 2019, Hopton has served as chief financial officer (CFO) of the company, bringing expertise in financial planning, accounting policy, and business process optimization. In addition to his current role as CFO at Rio Silver, Hopton previously served as CFO of Central Resources, a junior mineral exploration company. He also played a key role in the successful restructuring of 360 Networks, a network communications firm, which ultimately led to its strategic acquisition by Bell Canada.