- WORLD EDITIONAustraliaNorth AmericaWorld

7 Biggest Lithium-mining Companies

Hydrogen Stocks: 9 Biggest Companies

Overview

Critical Elements Lithium Corporation's (TSXV:CRE,OTCQX:CRECF,FWB:F12) vision is to be a large, responsible supplier of lithium hydroxide to the emerging electric vehicle and energy storage industries. The company is well-positioned, wholly owning over 850 km² of prospective lands hosting one of the highest purity spodumene deposits globally. This deposit is in Quebec, one of the company's premier mining investment jurisdictions. The company aspires to achieve its goals with a minimal environmental footprint by drawing electricity from Quebec's established low-carbon power grid and in cooperation with the Cree Nation communities, with whom relationships have been formalized.

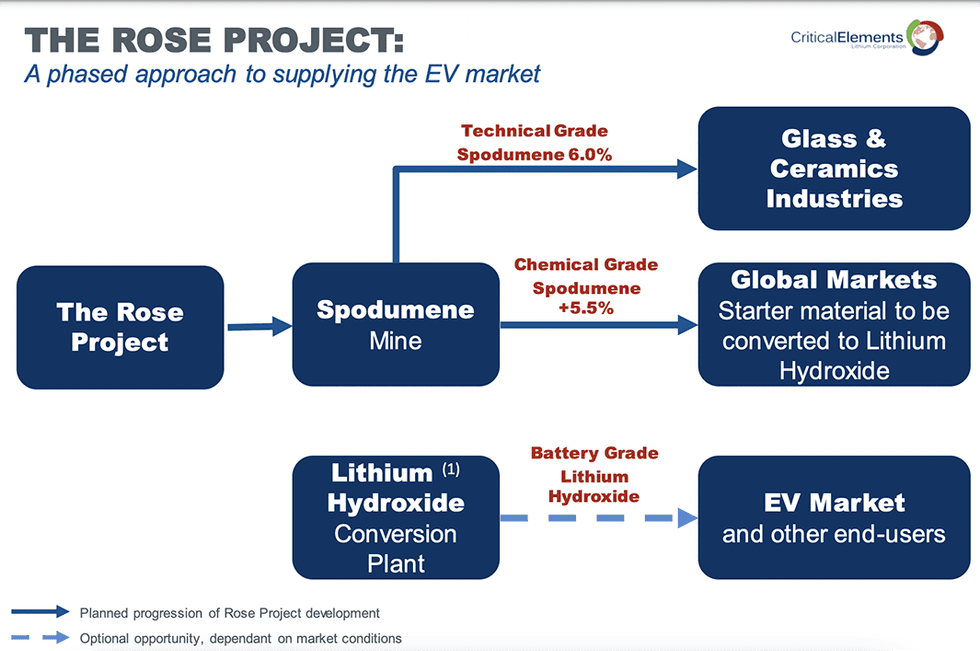

The Rose lithium-tantalum deposit, a high-purity lithium deposit, can supply multiple lithium markets because of its unique purity with low iron oxide and mica content. The Rose lithium-tantalum deposit has an updated NI 43-101 resource estimate that outlines an indicated resource of 31.9 million tonnes grading 1.04 percent lithium oxide equivalent or 0.93 percent lithium oxide and 148 ppm of tantalum pentoxide, with an inferred resource of 2.8 million tonnes grading 0.92 percent lithium oxide equivalent or 0.82 percent lithium oxide and 145 ppm of tantalum pentoxide. Positive feasibility study also showed 17 years of mine life with an average production of 173,317 tonnes of chemical grade 5.5 percent spodumene concentrate; 51,369 tonnes of technical grade 6.0 percent spodumene concentrate; and 441 tonnes of tantalum concentrate from year two up to year 16.

Critical Elements Lithium Corporation is focused on developing supply for these markets at its Rose lithium-tantalum project. The unique geological properties of this deposit give it the potential to supply multiple markets, including battery-grade materials, ceramics, glass and tantalum. Its 2022-2023 exploration program involves up to 25,000 meters of diamond drilling, which includes 10,000 meters for the expansion of the Rose Lithium-Tantalum deposit, 7,000 meters to delineate an initial mineral resource estimate at the Lemare Lithium project, and 8,000 meters to explore for and test new targets identified.

Critical Elements Lithium is a step closer to making a final investment decision for the Rose lithium-tantalum project after it has received:

- Favorable decision from the federal Minister of Environment and Climate Change rendered in August 2021

- Approval by Québec’s Minister of Natural Resources and Forests of the rehabilitation and restoration plan concerning the project in May 2022

- Receipt of the Certificate of Authorization pursuant to section 164 of Québec's Environment Quality Act from the Minister in November 2022

- Authorization of Hydro-Québec's connection and powerline relocation project in January 2023

Company Highlights

- Critical Elements Lithium is developing the Rose Lithium-Tantalum project in Eeyou-Istchee, James Bay, Québec.

- Rose is one of the highest-purity hard rock spodumene deposits with low iron and mica content and is expected to produce battery-quality lithium hydroxide.

- Strong management in place with previous lithium production experience

- The company has received approval from the federal and the provincial governments and is in the process of securing financing. The company also received approval of the rehabilitation and restoration plan for Rose from Quebec’s Minister of Energy and Natural Resources

- Critical Elements announced a positive feasibility study for the Rose Lithium Project Generating an after-tax net present value (NPV) of US$1,915 million (at an 8 percent discount rate) and an after-tax internal rate of return (IRR) of 82.4 percent.

- In 2023, the company initiated an aggressive exploration program of up to 25,000 meters on its property consisting of more than 1,050 square kilometers of exploration land. The 25,000-meter program is focused on delineating a maiden resource at Lemare and the expansion of the resource and reserve at the Rose Lithium-Tantalum deposit.

- Quebec is a premier location for mining, with access to a power line on site tapping into the province’s low-carbon – 94 percent hydroelectricity – and low-cost grid.

- Completion of an engineering study for a lithium hydroxide monohydrate plant based on a yearly production of 30,670 tonnes of high-quality, battery-grade lithium hydroxide monohydrate from 220,587 tonnes of spodumene concentrate.

- Critical Elements Lithium was one of the 2023 OTCQX Best 50, a ranking of top-performing companies traded on the OTCQX Best Market, and 10 performing mining stocks in the 2023 TSX Venture 50, which comprises the top 50 from more than 1,713 companies on the TSX Venture Exchange.

Get access to more exclusive Lithium Investing Stock profiles here