Overview

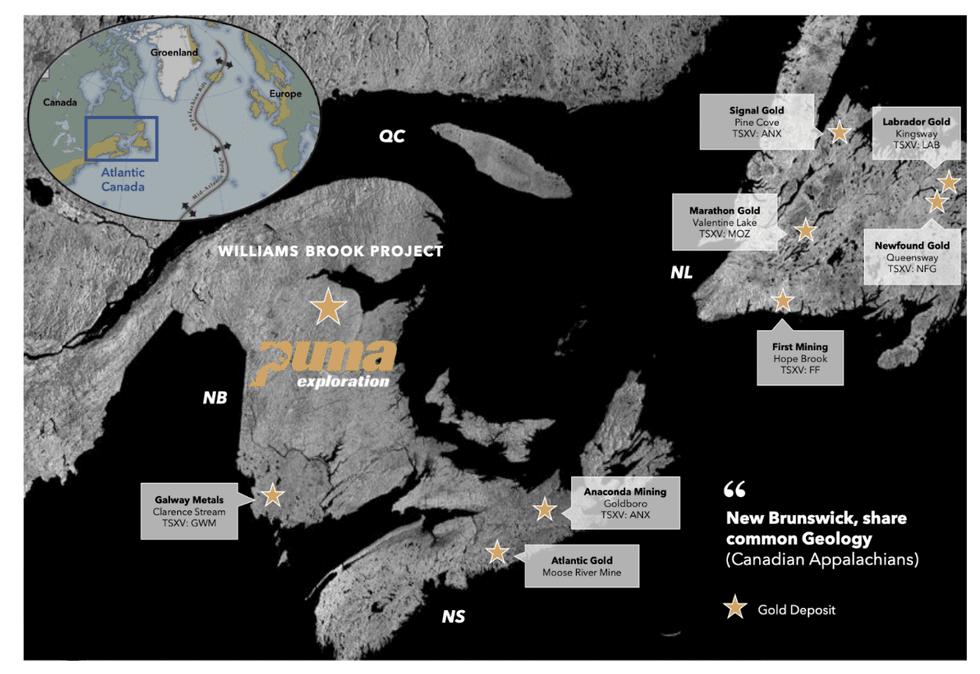

New Brunswick in Canada’s East Coast is a province rich in natural resources with mining-friendly policies, substantial infrastructure and a competitive tax regime. Consistently ranked among the top places in the world for mineral exploration in the Fraser Institute’s Annual Survey of Mining Companies, New Brunswick is home to the Bathurst Mining Camp (BMC), which is one of the most prolific mining camps for base metals in Canada.

The BMC hosts 46 mineral deposits of which 25 comprise reserves of 1 million tonnes or more. The BMC also hosted the Brunswick #12 mine, one of the largest underground zinc mines in the world. As a result, companies with mineral projects in New Brunswick’s BMC will likely be of particular interest to investors seeking upside potential.

Puma Exploration (TSXV:PUMA, OTCQB:PUMXF) is a Canadian mineral exploration company focused on developing a portfolio of high-grade, precious metals projects, in an up-and-coming gold camp located near the BMC. The company is led by a management team with decades of experience in mining exploration and development.

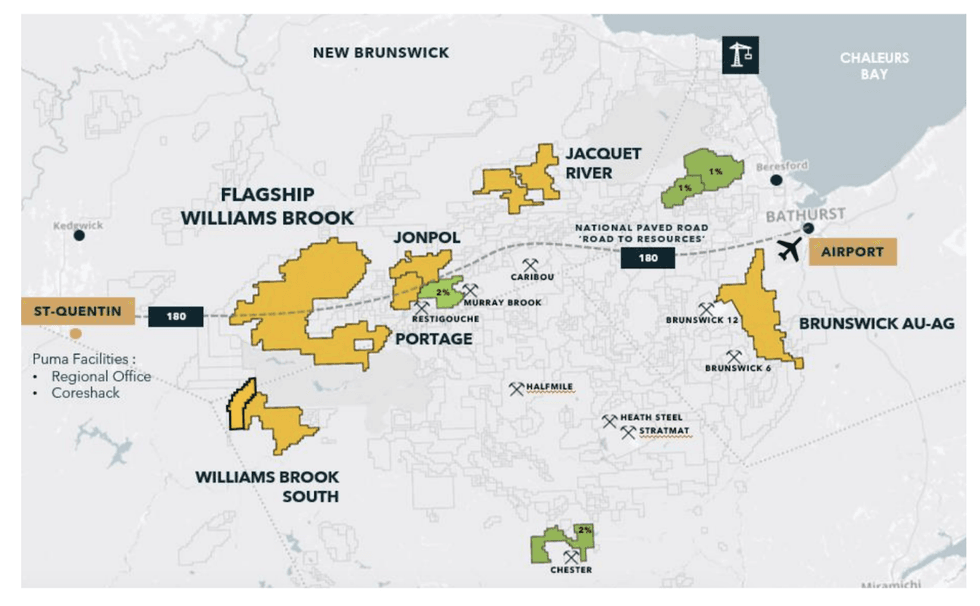

Puma Exploration controls more than 60,000 hectares of land, made up of three highly-prospective properties, approximately 60 kilometers west of the BMC. The company’s exploration program is currently focused on its flagship Williams Brook Gold Project. “We have found the best hole ever, it’s a dream come true,” said CEO of Puma Exploration Marcel Robillard.

In September 2021, the company announced impressive initial drill results of 5.55 grams per ton (g/t) of gold over 50.15 meters from the surface of its Williams Brook Gold property. The notable property is a major discovery for Puma Exploration and is fully controlled by the company. Puma completed a 10,000-meter drilling program at the O’Neil Gold Trend in 2022 with 97 short holes drilled for a total of 10,348 meters. The company intersected several new high-grade veins at shallow depth (from 0 to 50 meters), including 51.73 g/t gold over 1.85 meters and 10.70 g/t gold over 2 meters in hole WB22-66, and 35.09 g/t gold over 1.45 meters in hole WB22-39. A total of 2,170 core samples were sent to ALS CHEMEX for analysis.

Puma staked an additional 105 claims (2,300 hectares) contiguous to its Williams Brook South property in 2022 which now totals 8,290 hectares. The property is highly prospective for gold mineralization as it exhibits the same geology as the Lynx Gold Zone. The company recently reported up to 12.03 g/t gold over 1.50 meters in short (only 6 to 18 meters depth) HQ holes drilled last fall at the Lynx Gold Zone. The holes were drilled as part of an expanded metallurgical test announced on November 15, 2022. Static Acid Base Accounting and Total Sulphur testing also determined that the rock is non-acid-generating.

In 2023, Puma added silver exposure to its current precious metals assets in northern New Brunswick, with the acquisition of the Brunswick Au-Ag Property. With grab samples grading up to 1,300 g/t silver and 2.42 g/t gold, the newly acquired property adds 454 claims (10,554 hectares) to Puma's landholdings, now totalling 60,554 hectares.

The company is committed to its DEAR strategy (development, exploration, acquisition and royalties) to generate maximum value for shareholders with low shares dilution and follows robust ESG initiatives that ensure a sustainable approach to all its activities.

Company Highlights

- Puma Exploration is exploring more than 60,000 hectares of prime land in a new gold camp in New Brunswick, Canada close to the renowned Bathurst Mining Camp.

- Excellent infrastructure access includes paved roads, airports, rail and seaport

- Exploration work at the company’s flagship Williams Brook property to date has identified four different gold trends.

- Puma has completed 10,000 meters of drilling at the O’Neil Gold Trend under its aggressive 2022 exploration program

- Puma’s management team has a record of success in major exploration projects

- Record of strong financial management creating significant value for investors

Get access to more exclusive Gold Investing Stock profiles here