- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Overview

Volcanogenic massive sulfide (VMS) deposits are some of the world’s most prosperous base metal and precious metal deposits. This type of deposit is found across the globe and often forms in clusters. The oldest known VMS deposits date back three billion years, and new ones are still being formed. VMS deposits have impressive mineralization and high grades, but only 2.2 percent of global gold production and 6 percent of copper production currently come from VMS deposits.

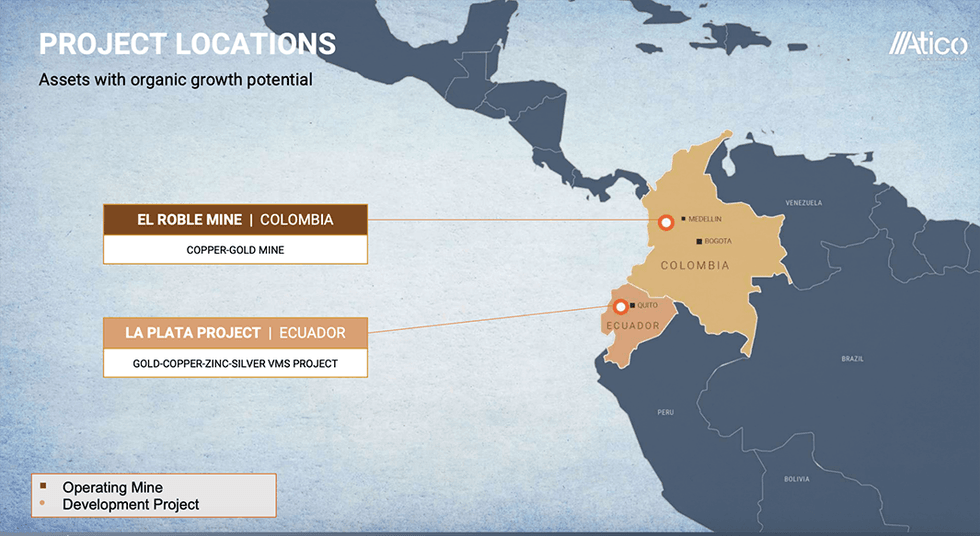

Atico Mining (TSXV:ATY,OTC:ATCMF), operating in Colombia and Ecuador, has two VMS-style projects surrounded by large land packages. Such strategic positioning gives Atico the potential to mimic successes seen with the Fortuna Silver Mines (TSX:FVI,NYSE:FSM), a company with an estimated market cap of US$1 billion, and was founded by the same family currently leading Atico.

“We have a very strong production profile along with a pipeline of growth prospects for a small company. And we generate a robust, free cash flow from which we can finance all of our exploration plans,” commented Igor Dutina, the company’s corporate development lead.

The stable mining jurisdictions of Latin America have proven to be a premier place for acquisition and mining development for Atico. The company is also looking at other avenues of growth in the possible acquisition of a third project.

https://investingnews.com/stocks/tsxv-aty/atico-mining/

The company’s flagship El Roble mine has proven to be an extremely valuable asset. The gold-copper mine generates roughly 16 million lbs of copper and 11,000 oz of gold per year, with a life-of-mine of about four years. This VMS asset primes the company on its path to become a mid-tier producer.

El Roble Mine’s total production for the three months ending June 30, 2023, totaled 2.8 million pounds of copper and 2,294 ounces of gold in concentrates, a decrease of 22 percent for copper and 18 percent for gold, over the same period in 2022.

The company’s second asset, its 100-percent-owned La Plata project in Ecuador, is a pre-development-stage asset with a mineralized profile containing high-grade gold, copper, zinc and silver. Past exploration campaigns and a completed preliminary economic assessment (PEA) have also aided in advancing this highly prospective asset. In 2023, Atico Mining received approval of the environmental impact assessment (EIA) for the construction, operation, maintenance and closure of the 69 kV powerline and substation required for the La Plata mining project.

Atico Mining has a world-class team of mine developers and mine operators, with several generations of mining experience in Latin America and extensive expertise in the industry and regional networking sectors.

Company Highlights

- Atico Mining is a Canada-based mining exploration and development company operating out of Latin America. The company is headed by the founders of mining heavyweight Fortuna Silver Mine.

- The company is primarily focused on its robust flagship El Roble Mine project in Colombia, as well as the La Plata project in Ecuador. Both assets are volcanogenic massive sulfide (VMS) deposits with high-grade copper and gold mineralization clustering.

- Atico Mining’s well-engineered business model primes the company for self-financing potential benefiting shareholders and future investors. This model helps to focus on free cash flow generation and reduce dilution.

- The El Roble project currently generates roughly 16 million pounds (lbs) of copper and around 11,000 ounces (oz) of gold per year. The mine has a projected three-year mine life and high-margin potential.

- In 2023, Atico Mining initiated a regional drill campaign at its El Roble Mine project in Colombia.

- The La Plata project has a completed preliminary economic assessment (PEA) and hosts highly prospective exploration targets. The company is currently working on a feasibility study.

- The company acquired the remaining 40 percent of the issued and outstanding shares of Compañia Minera La Plata S.A., which owns the concessions comprising the La Plata project

Get access to more exclusive Copper Investing Stock profiles here