- WORLD EDITIONAustraliaNorth AmericaWorld

October 05, 2021

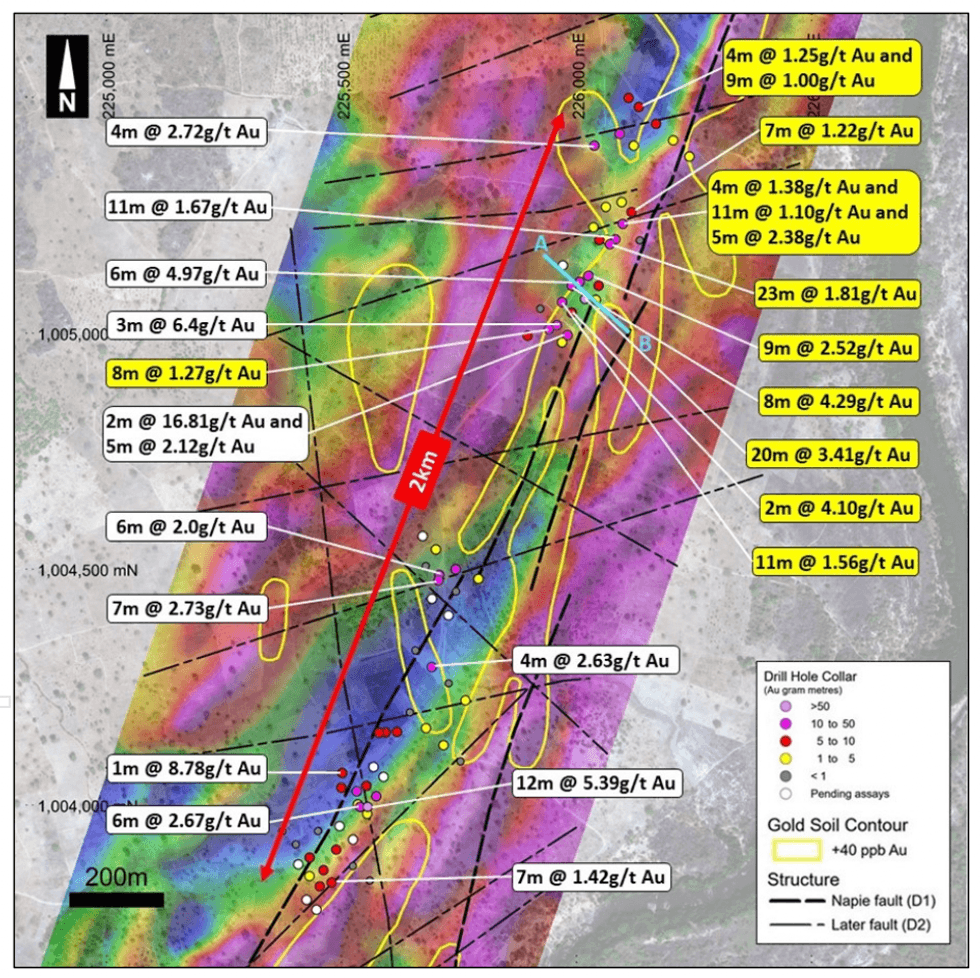

Mako Gold Limited ("Mako" or "the Company"; ASX:MKG) is pleased to advise that it has received assay results from 14 drill holes from the 10,000m drilling program at the Gogbala Prospect at the Company's flagship Napié Project in Côte d'Ivoire. Gogbala is located on a +23km soil anomaly and coincident 30km-long Napié Fault (Figure 3).

Highlights

- Best drill result returned to date from Gogbala Prospect with 20m at 3.41g/t Au

- Gogbala is located 5km to the south of the Tchaga Prospect (the core focus of exploration to date) and is one of several prospective zones located on the 30km-long Napié Fault. The shallow, wide and high- grade gold mineralisation demonstrated by exploration to date is similar to that identified at Tchaga

- 14 RC holes received from Gogbala with all holes intersecting significant mineralisation. Select results include:

- NARC531: 20m at 3.41g/t Au from 19m; including

- 1m at 6.70g/t Au from 22m and 2m at 14.12g/t Au from 37m

- NARC535: 23m at 1.81g/t Au from 19m; including

- 1m at 5.73g/t Au from 24m and 1m at 5.41 from 28m and 4m at 3.05g/t Au from 36m

- NARC532: 8m at 4.29g/t Au from 82m; including

- 3m at 8.45g/t Au from 86m

- NARC534: 9m at 2.52g/t Au from 55m; including

- 1m at 11.84g/t Au from 55m

- NARC530: 11m at 1.56g/t Au from 77m; including

- 1m at 4.27g/t Au from 77m and 1m at 8.60g/t Au from 87m

- NARC539: 4m at 1.38g/t Au from 71m and 11m at 1.10g/t Au from 79m and 5m at 2.38g/t Au from 125m; including

- 1m at 7.08g/t Au from 128m

- NARC528: 8m at 1.27g/t Au from 70m; including

- 1m at 5.02g/t Au from 77m

- NARC540: 4m at 1.25g/t Au from 9m and 9m at 1.00g/t from 17m

- NARC537: 7m at 1.22g/t Au from 9m

- NARC531: 20m at 3.41g/t Au from 19m; including

- 4,400m drilled of the planned 10,000m at Gogbala forming part of the larger 35,000m drill program on the Napié Project

- Further drill assay results are pending for the Gogbala and Tchaga prospects

Mako's Managing Director, Peter Ledwidge commented:

"After receipt of the best drill intercepts to date at Gogbala, we reiterate the similarities of mineralisation style between Gogbala and Tchaga. The wide and high-grade intercepts returned from Gogbala drilling is making Gogbala look more and more like "Tchaga 2.0". Both prospects have strong mineralisation outlined over a 2km strike length. This increases our optimism for delineating more deposits along the 30km-long Napié fault to target a multi-million-ounce resource. The next target will be the Tchaga North Prospect where we have a 10,000m drill program planned. We are growing the potential mineral inventory at Napié using our methodical approach to exploration and are funded to continue to do so. We look forward to providing more outstanding results from Tchaga and Gogbala as they come to hand."

Best Results To Date

At GogbalaResults are reported from 14 holes of the planned 10,000m drill program as announced to ASX on 12 August 2021 (Figure 1). All 14 holes intersected significant mineralisation including 20m at 3.41g/t Au from 19m in NARC531. This is the best drill intersect returned from Gogbala to date which is a 69 gram-metre intercept (grams/t Au X metre). The Company's strategy targeting high-grade areas identified from previous drilling and further expanding these zones is paying off as demonstrated by the positive drill results returned.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00