March 22, 2022

Commander Resources Ltd. (TSXV: CMD) ("Commander") is pleased to provide results from a sampling program on the Sabin project (the "Sabin Property") located in northwest Ontario, Canada, some ten kilometres north of the community of Savant Lake. Work was conducted in the fall of 2021 and focused on follow-up prospecting of the newly recognized intrusive-hosted Quarry Gold Zone. The Sabin property is centered on extensive VMS-style alteration and mineralization and where work in 2020-2021 has also outlined a potential bulk tonnage-style gold target within the Patterson Lake Stock.

Highlights:

- Follow-up sampling of the Quarry Gold Zone returns grab samples up to 1.5 g/t gold.

- Intrusive-hosted gold is now documented over an area of 1 km2.

- Up to 20 line-km of Induced Polarization survey are planned to cover the new gold zones as well as the nearby Kash VMS zones.

Quarry Gold Zone

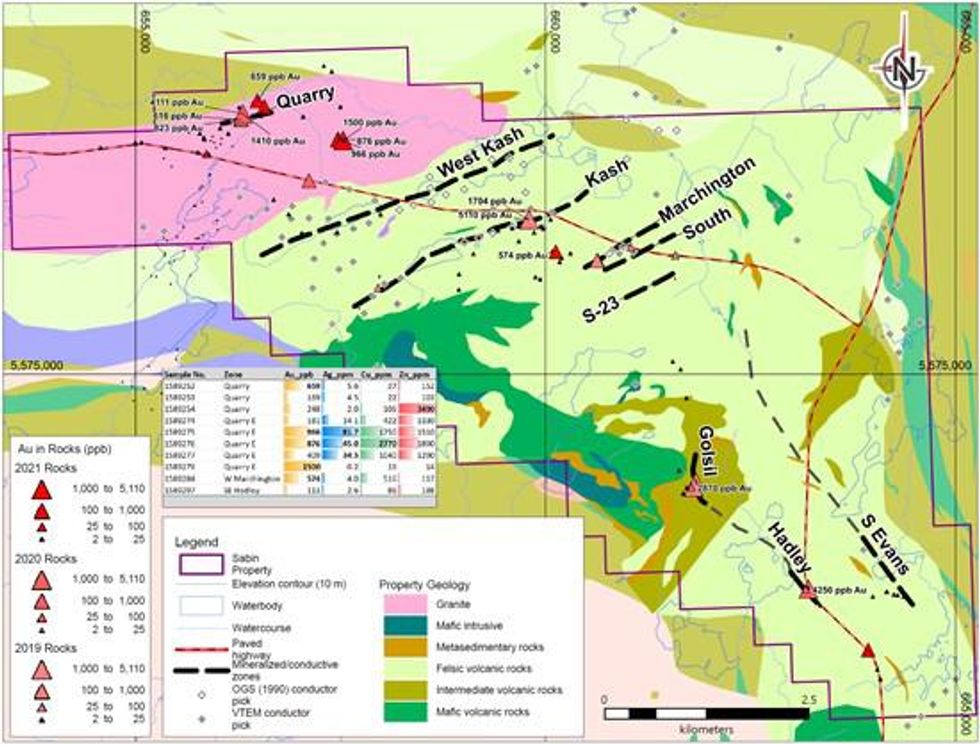

The original Quarry Gold Zone has limited historical work comprising surface sampling and two short, small-diameter (winkie) prospecting holes. Outcrop occurs in the bottom of a gravel pit where 10-15 m of strike is exposed and a minimum width of 25-35 m. The target coincides with a single VTEM conductor within a broad area of low resistivity. The showing, hosted within a granodiorite, comprises sheeted intensely altered (quartz-sericite-pyrite-iron carbonate) shear zones with extension quartz veins emanating from the shears.

Eight additional grab samples collected in 2021 expanded the target some 150 m to the northeast and outlined a second zone 1 km to the east. Four samples were greater than 0.5 g/t gold with a high value of 1.5 g/t gold. Bedrock exposure is extremely poor and, where present, is dominated by fresh granodiorite. Gold mineralized rocks are associated with sheared and veined granodiorite in recessive exposures adjacent to larger prominent outcrops. (Figure 1)

Future work planned for 2022 at Sabin will include an expanded prospecting and sampling program and up to 20 line-km of Induced Polarization survey to cover the newly discovered gold zones and the nearby Kash VMS zones.

About the Sabin Property

The Sabin property is in the Sturgeon Lake greenstone belt which hosts significant polymetallic VMS deposits and past-producing mines some 60 km to the south. The Sabin property is underlain by intermediate and felsic volcanic units that exhibit widespread alteration comprised of garnet, staurolite, sillimanite and sericite, metamorphic mineralogy typical of metamorphosed VMS environments. The Quarry Showing is an occurrence that opens the potential for intrusion-hosted orogenic gold mineralization within the large Patterson Lake Stock.

Commander (formerly Major General) acquired the property through a purchase agreement with UMEX Mining Corp. in 1990 and holds a 100% interest in the property except for two small internal claim parcels that are subject to a participating interest with Glencore Canada Corporation (formerly Noranda) who currently hold 41.5% and 33.3%. UMEX retains a partially capped 2.5% NSR over the core of the property that would be reduced to 1% following $225,000 of royalty payments. The Quarry Gold Zone is 100% owned by Commander and is unencumbered by participating or royalty interests.

CMD News March 22, 2022

Figure 1: Sabin property Geology and Samples

QA/QC

Grab rock samples are selective by nature and may not represent the true grade or style of mineralization. Samples were collected in the field by Stephen Wetherup P. Geo. Analytical work was completed by Activation Laboratories in Dryden, Ontario. Gold was analyzed by fire assay fusion of a 30-gram aliquot and other elements by ICP-MS from a 4-acid digestion.

Historical work on the Sabin property was conducted by exploration professionals working for a major company (UMEX Mining Corp.) widely reputed as competent, utilizing methodology accepted and relied upon as standard industry practice at the time. Commander has an extensive database of original exploration data including assay certificates, drill logs and geological mapping and observations. Work and sampling by Commander have relocated some drill collars and surface sampling by Commander is generally in line with original sample data. Historical drill core is not available, and the Company is treating this data as valid for exploration purposes, but not compliant with NI43-101 Standards of Disclosure for use in future resource estimates. See news dated December 17, 2012, February 27th, 2019, July 29th, 2019, January 15th, 2021, posted on SEDAR for Commander Resources.

Robert Cameron, P. Geo. is a qualified person within the context of National Instrument 43-101 and has read and takes responsibility for the technical aspects of this release.

About Commander Resources:

Commander Resources is a Canadian focused exploration company that has leveraged its success in exploration through partnerships and sale of properties, while retaining equity and royalty interests. Commander has a portfolio of base and precious metal projects across Canada. Commander also retains royalties from properties that have been partnered, optioned, or sold.

On behalf of the Board of Directors,

Robert Cameron, P. Geo.

President and CEO

For further information, please call:

Robert Cameron, President and CEO

Toll Free: 1-800-667-7866

info@commanderresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

Click here to connect with Commander Resources Ltd. (TSXV: CMD) to receive an Investor Presentation

CMD:CA

The Conversation (0)

09 November 2018

Commander Resources

Prospect Generator with Joint Venture Opportunities

Prospect Generator with Joint Venture Opportunities Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00