March 05, 2023

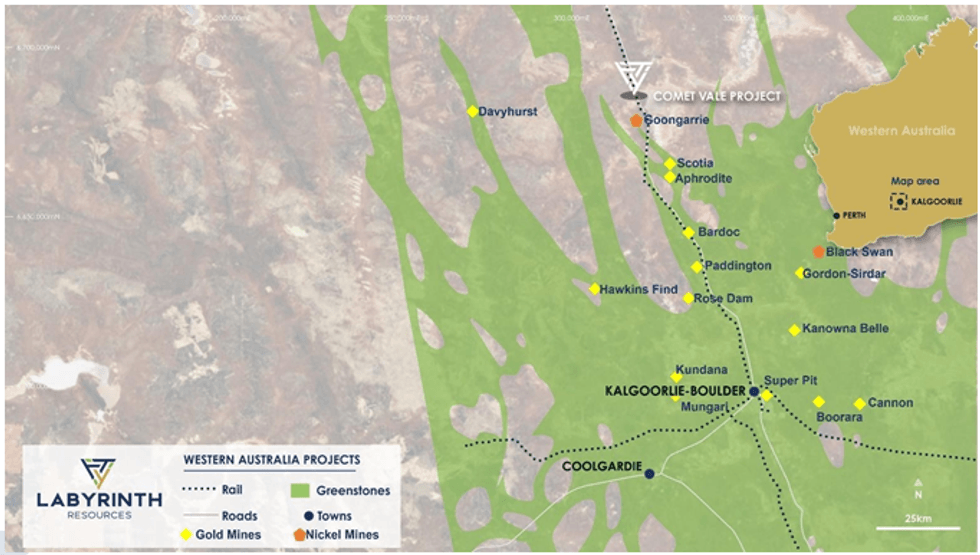

Located 100km north of Kalgoorlie, Comet Vale hosts extensive high-grade gold with existing underground development and infrastructure; Plus, planning advanced for the next drilling phase at Labyrinth Gold Project

Labyrinth Resources Limited (‘the Company’ or ‘Labyrinth’) (ASX: LRL) is pleased to advise that it is ramping up exploration at its Comet Vale gold-copper-nickel project in Western Australia and Labyrinth Gold Project in Canada.

Key Points

- Programme of Work approved for drilling on the M29/52 tenement at Comet Vale

- Drill rigs expected to mobilise in next six weeks

- Independent consultants preparing updated JORC 2012 Mineral Resource Estimate for Sovereign gold trend at Comet Vale, expected to be completed in current quarter

- At Labyrinth Gold Project in Canada, the drilling design for phase two Resource growth program is complete, paving way for tender submissions to commence

Both exploration programs are aimed at creating value for shareholders by testing the known extents and growing the Resources at the respective projects.

The Comet Vale drilling program is the first genuine surface exploration undertaken at the project for 15 years. This is despite the project hosting extensive high-grade gold and copper mineralisation and strong evidence of nickel laterite.

Labyrinth has recently completed a full review of the geology and known mineralisation and carried out an initial phase of on ground mapping. This process highlighted the significant potential but under-explored nature of the project.

Work during the current exploration phase will include an updated JORC 2012 mineral resource estimate (‘MRE’) for the Sovereign trend gold system which includes the Sand Queen, Sand Prince and Princess Grace lodes, with the existing MRE reflecting work completed in 2011 under the NI43-101 instrument and adapted to JORC 2012 in 2018 without any significant exploration works conducted.

To support the MRE, a 1,500m reverse circulation drill program will be conducted to test for extensions to the known lodes as well as gathering important geotechnical data.

Labyrinth Chief Executive Matt Nixon said: “We are about to embark on two significant exploration programs, both of which are aimed at extending known high-grade gold mineralisation.

“This drilling has the potential to create substantial value for shareholders because we are testing for extensions to known lodes and infill drilling in areas outside of the current Resource where we know there is a strong prospect of mineralisation”.

Comet Vale

Comet Vale is on the eastern limb of a regional-scale, north-south trending anticline: the Goongarrie-Mt Pleasant Anticline. The Goongarrie Monzogranite is in the core of this south plunging anticline and is enclosed by rocks of the Ora Banda Domain.

The mafic-ultramafic rocks in the Comet Vale area therefore are part of the same sequence that hosts the Grants Patch, Ora Banda and Mt Pleasant gold camps, as well as the Goongarrie and Highway nickel laterite deposits on the southern and western limbs of this anticline and consist of the Missouri Basalt, the Walter Williams Formation and the Siberia Komatiite. To the east of the property is the northern extension of the prolific Boulder-Lefroy Fault that hosts the world-class Superpit mine.

The Sovereign trend of gold deposits is made up of multiple quartz veins across 1.3km of strike hosted within the Missouri Basalt. The deposits have been exposed to minimal drilling over the past 15 years and the veins remain open to the north and south as well as at depth.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

22 January

Quarterly Activities and Cashflow Report - December 2025

Asara Resources (AS1:AU) has announced Quarterly Activities and Cashflow Report - December 2025Download the PDF here. Keep Reading...

22 January

Transition Metals Provides Corporate Update and 2026 Outlook

Transition Metals Corp. (TSXV: XTM) ("Transition" or "the Company") is pleased to report on key accomplishments in 2025 and outline its plans and value catalysts for 2026. Against the backdrop of improved market sentiment and broader commodity strengths, Transition's diversified, Canada-focused... Keep Reading...

22 January

Gold Price at New Record Over US$4,900; Silver Surges to All-time High Above US$96

Gold and silver prices are skyrocketing as investors flock to safe-haven assets.The spot price of gold rose as high as US$4,924.29 per ounce on Thursday (January 22), even as US President Donald Trump walked back his threats to take over Greenland by force in his Davos speech. That's because... Keep Reading...

22 January

What Was the Highest Price for Gold?

Gold has long been considered a store of wealth, and the price of gold often makes its biggest gains during turbulent times as investors look for cover in this safe-haven asset.The 21st century has so far been heavily marked by episodes of economic and sociopolitical upheaval. Uncertainty has... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00