PFS Plant Location Study Results in Decision to Locate Carbonation Plant in Mining Centre of Copiapó

CleanTech Lithium PLC (AIM:CTL)(Frankfurt:T2N)(OTCQX:CTLHF), an exploration and development company advancing sustainable lithium projects in Chile, announces the results of a plant location study completed as part of the ongoing pre-feasibility study (PFS) for the Laguna Verde Project, which is due to complete later this year. The PFS is being led by Worley, a global professional services company of energy, chemicals and resources experts, from its Santiago office which has high-level experience in the lithium sector. Xi´an Lanshen New Material Technology Company ("Lanshen") has been selected to provide the lithium processing plant design and equipment, and Worley to design the balance of plant and infrastructure

Highlights:

A plant location study was completed by Worley, which evaluated the optimal plant location configuration for the Laguna Verde project, based on a capacity of 20,000 tonnes per annum of battery grade lithium carbonate equivalent (LCE)

This provided a trade-off analysis between locating the entire plant at Laguna Verde versus splitting plant facilities between Laguna Verde and the nearby mining centre of Copiapó

The option of locating the DLE plant and eluate concentration stages at the Laguna Verde site, and the carbonation plant at Copiapó is highly favourable, resulting in the decision to proceed with this option

A concentrated eluate with 6% lithium, the maximum concentration before lithium salts begin to precipitate, will be transported to Copiapó for impurity removal and carbonation stages

This configuration results in a minor increase in volumes transported while taking advantage of Copiapó's well-developed infrastructure and better access to a skilled workforce

According to the Lanshen plant design, approximately 70% of the operational workforce will be employed at the carbonation plant, locating it in Copiapó provides major advantages in hiring a local work force including diversity outcomes such as greater female participation, while contributing to the local economy

The footprint at the project site, which is at 4300m above sea level, will be greatly reduced, from power supply, storage, camp and plant facilities, construction phase impacts, and environmental impacts

The carbonation plant in Copiapó would eventually be expanded to also treat concentrated eluate from the Viento Andino project

The PFS, now due for completion before the end of Q4 this year, will include updated capex and opex estimates and will further determine the optimal production development strategy

Steve Kesler, Executive Chairman and Interim Chief Executive Officer, CleanTech Lithium PLC, said:

"We undertook a plant location study as part of our ongoing PFS for the Laguna Verde project resulting in the decision to locate the DLE and eluate concentration stages at the project site, and the carbonation plant in Copiapó. This will have various benefits such as reducing the footprint and impacts at Laguna Verde, and taking advantage of existing infrastructure, power supply and skilled workforce in Copiapó. The plant at Copiapó can then be expanded to treat material from our Viento Andino project and potentially others. The decision on plant configuration will feed directly into the wider PFS which is due to be completed later this year."

Further Information

The Company engaged Worley, utilising its local Santiago based office, to undertake the PFS for the Laguna Verde project, and selected Lanshen as designer and supplier of the entire DLE processing plant. Worley recently performed various trade-off or options studies to consider the most favourable configuration of the project and a plant location option study which assessed three scenarios for location of the plant, of which two of the scenarios, labelled Scenario 1 and Scenario 3 in the report, provided the relevant trade-off comparison:

Scenario 1: Locating the entire plant based at the Laguna Verde project site

Scenario 3: Locating DLE and eluate concentration stages at the project site, and the impurity removal and carbonation (downstream plant) at Copiapó

Laguna Verde is connected to Copiapó via a 270km paved international highway, as shown in Figure 1. Copiapó is a major regional mining centre in Chile with a population of 175,000, having well established infrastructure, a skilled workforce, and existing supply hubs for reagents and other materials. While basing the entire plant at the project site is feasible and most lithium projects in the lithium triangle are proceeding on such a basis, the good transport link and relative proximity to Copiapó made a trade-off study valuable.

Figure 1: Regional Map

An analysis of the difference in transport volumes was undertaken showing a minimal overall difference between the two scenarios. For Scenario 3 where impurity removal and carbonation stages are in Copiapó, there will be no transport of reagents or bulk chemicals to Laguna Verde which has a positive environmental and community impact.

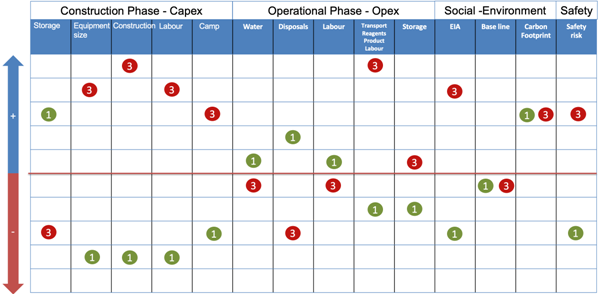

A qualitative assessment was then undertaken by the Company across the range of metrics as shown in Figure 2. There are only two metrics in which Scenario 1 where the entire plant is located at site has a significantly positive comparison. The first one is storage during the construction phase, in that it will require a single storage facility rather than storage at both locations for tools, materials and spare parts. The second is disposal of solids, which is largely Sodium Chloride (NaCl or table salt) that is dissolved in the eluate and removed in the impurity removal stage before carbonation. In Scenario 1, these would be re-dissolved in the spent brine and re-injected. In Scenario 3, the report assumed NaCl would need to be disposed in Copiapó at a cost. However there should be a ready market for NaCl and further evaluation of this is required.

Figure 2: Qualitative Comparison- All on site (1) and split plants (3)

Across a range of other metrics the Scenario 3 of locating the downstream plant at Copiapó has major advantages. According to Lanshen, approximately 70% of the operational labour force will work at the downstream plant, which provides a far superior option for skilled workforce based in Copiapó. The footprint at the project site will be greatly reduced, from power supply, storage, camp and plant facilities, construction phase impacts, and environmental impacts. The Board has accepted the study and the decision to split the plant facilities between the project site and Copiapó will be the basis for the PFS.

For further information contact: | |

Steve Kesler/Gordon Stein/Nick Baxter | Jersey office: +44 (0) 1534 668 321 Chile office: +562-32239222 |

Or via Celicourt | |

| Celicourt Communications Felicity Winkles/Philip Dennis/Ali AlQahtani | +44 (0) 20 7770 6424 |

| Beaumont Cornish Limited (Nominated Adviser) Roland Cornish/Asia Szusciak | +44 (0) 20 7628 3396 |

| Fox-Davies Capital Limited (Joint Broker) Daniel Fox-Davies | +44 (0) 20 3884 8450 |

| Canaccord Genuity (Joint Broker) James Asensio | +44 (0) 20 7523 4680 |

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

Notes

CleanTech Lithium (AIM:CTL),(Frankfurt:T2N),(OTCQX:CTLHF) is an exploration and development company advancing sustainable lithium projects in Chile for the clean energy transition. Committed to net-zero, CleanTech Lithium's mission is to produce material quantities of sustainable battery grade lithium products using Direct Lithium Extraction technology powered by renewable energy. The Company plans to be a leading supplier of 'green' lithium to the EV and battery manufacturing market.

CleanTech Lithium has two key lithium projects in Chile, Laguna Verde and Viento Andino, and hold licences in Llamara and Salar de Atacama, located in the lithium triangle, a leading centre for battery grade lithium production. The two major projects: Laguna Verde and Viento Andino are situated within basins controlled by the Company, which affords significant potential development and operational advantages. All four projects have direct access to existing infrastructure and renewable power.

CleanTech Lithium is committed to using renewable power for processing and reducing the environmental impact of its lithium production by utilising Direct Lithium Extraction with reinjection of spent brine. Direct Lithium Extraction is a transformative technology which removes lithium from brine, with higher recoveries than conventional extraction processes. The method offers short development lead times with no extensive site construction or evaporation pond development so there is minimal water depletion from the aquifer. www.ctlithium.com

**ENDS**

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com .

SOURCE: CleanTech Lithium plc

View the original press release on accesswire.com