January 18, 2022

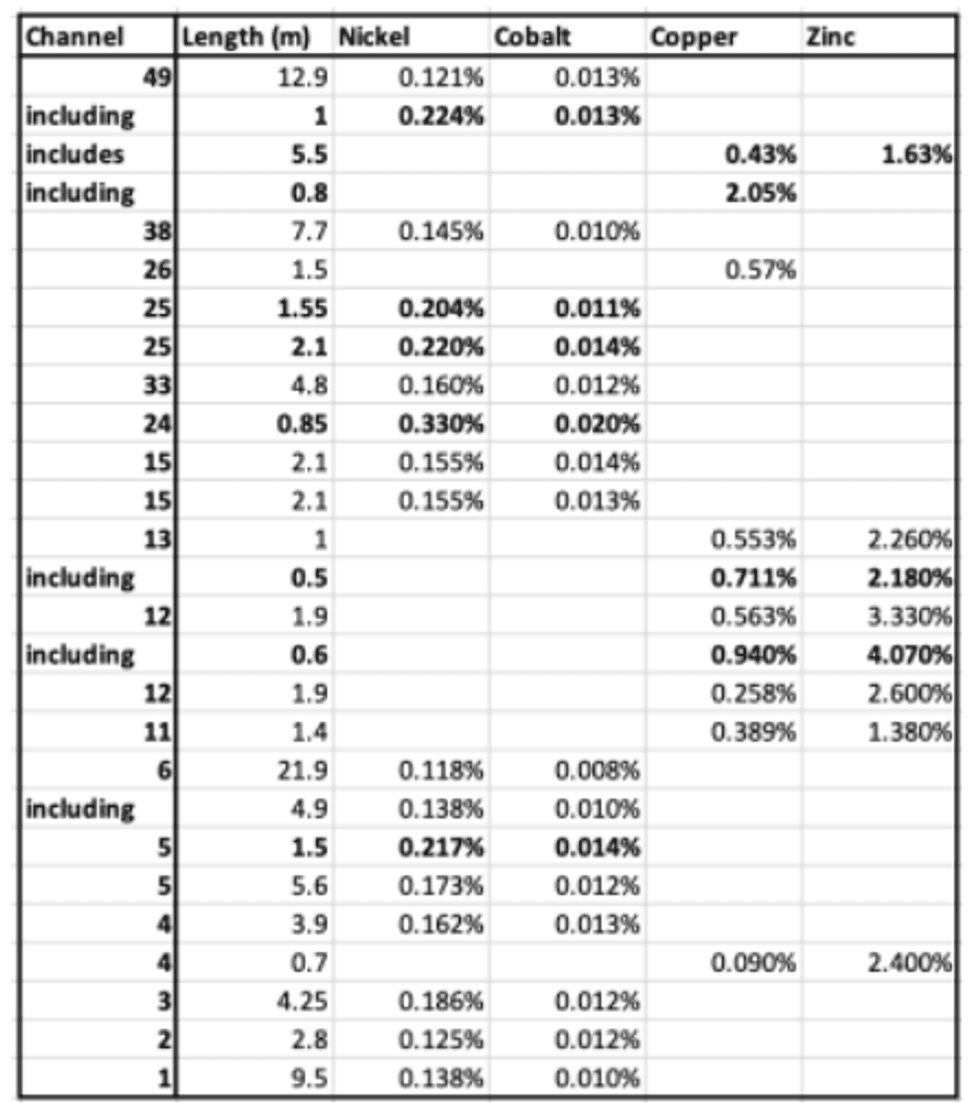

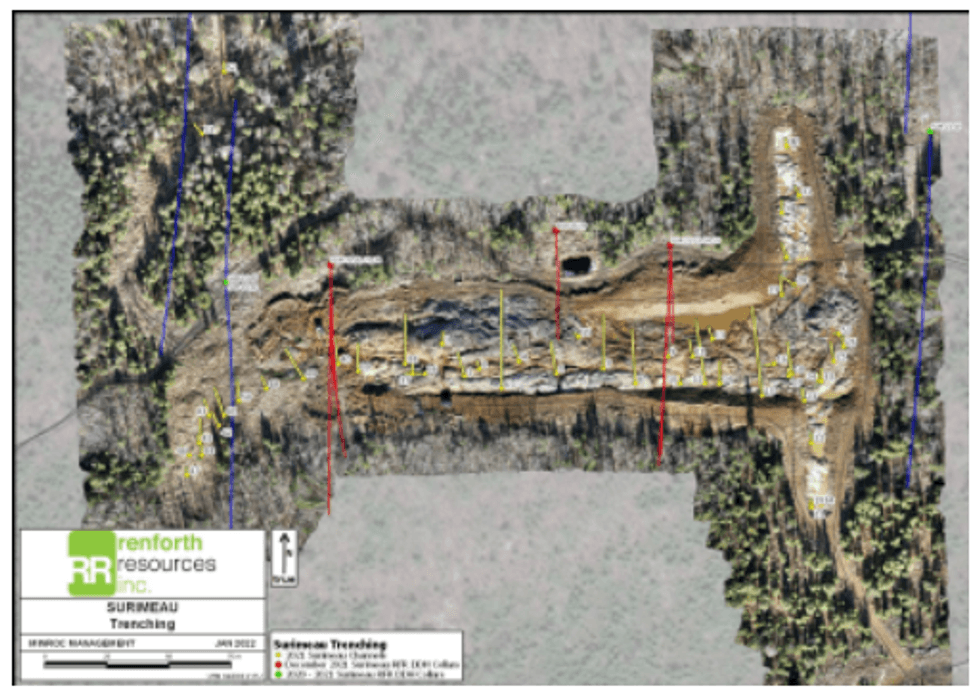

Renforth Resources Inc. (CNSX:RFR.CN) (OTC:RFHRF) (FSE:9RR) (“Renforth” or the “Company”) is pleased to share the consistent results of channel sampling across the ~275m stripped surface area of the ~5km Victoria West nickel/copper mineralized system within Renforth’s wholly owned ~30,000 hectare Surimeau District Property in NW Quebec. The channel samples demonstrate consistent elevated nickel and cobalt values, along with elevated copper and zinc values. In several locations the two mineralization types “mix”, the highlight of this “mixing” is a 12.9m section of Channel 49 which overall assays 0.121% Ni and 0.013% Co, including 0.224% Ni over 1m, which also includes 5.5m of 0.43% Cu and 1.63% Zn, within which 0.8m assays 2.05% Cu.

Mineralized Channel Sample Highlights

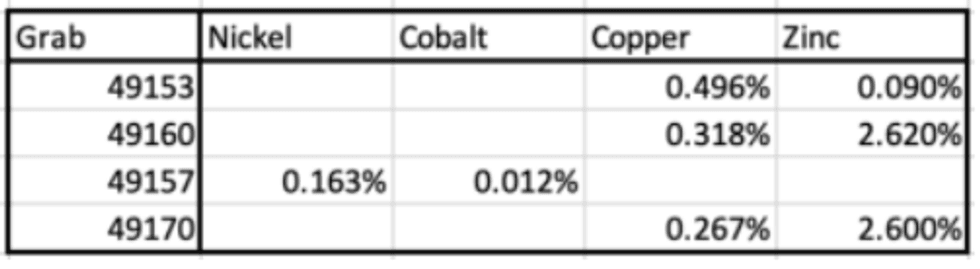

In addition to the channels cut there were several grab samples taken at the beginning of the program as stripping started but before channels could be cut. Grab samples are selected by the geologists and not representative of the whole of the mineralized system, highlights are presented below.

Grab Sample Assay Highlights

Victoria West Channel Map

The channel sampling, carried out after stripping overburden which varied between 0 and 3m in depth, has revealed consistent nickel/cobalt mineralization, similar to what has been seen in the near surface drilling to date, however, it has also resulted in a greater proportion of copper/zinc intersections than seen in drilling. Exploration continues on this >5km polymetallic system, located within a 20km magnetic anomaly, where Renforth has only drilled 5,626m.

“I am happy to deliver results to shareholders which demonstrate that our discovery of a polymetallic, nickel/cobalt and copper/zinc, mineralized system at Victoria West, stretching over >5km and hiding in plain sight, is a surface system. This gives Victoria West another advantage, in addition to numerous road access options and hydro-electric power, we are dealing with easily, and cost effectively, accessed mineralization. For Renforth the multiple metals present, the location and the jurisdiction of this discovery mean we can consider grades which, while they may appear low when compared to other projects around the world and under deeper cover, are in fact very interesting to us. In addition, Surimeau is located approximately 70km from Glencore’s Horne Smelter in Rouyn-Noranda, Canada’s only copper smelter which also engages in recycling of strategic and precious metals, shipping anode to their Montreal refinery, also Canada’s own copper/nickel refinery. If Renforth is fortunate to have an asset in Victoria West which is proven, in the future, to warrant being mined the solution is sitting within an hour from our doorstep. To be clear, Victoria West is not a mine yet, and we do not know if it will be. But we look forward to aggressively pursuing the answer to that question” states Nicole Brewster, President and CEO of Renforth.

Renforth’s Annual General meeting was held, the voting recommendations were passed.

At year end Renforth closed an additional $200,000 in flow through funding, a second close to the previously announced financing. Each Flow-Through Unit was priced at $0.10 and consists of one common share in the capital of the Company issued on a ‘flow-through’ basis, and one-half of one common share purchase warrant. Each whole warrant issued with the Flow Through Unit, entitles the holder to purchase one common share in the capital of the Company at a price of $0.13 for a period of 12 months following closing. All securities issued under the Offering are subject to a four-month statutory hold period in Canada.

Technical disclosure in this press release has been reviewed and approved by Francis R. Newton P.Geo (OGQ#2129), a “qualified person” pursuant to NI 43-101.

For further information please contact:

Renforth Resources Inc.

Nicole Brewster

President and Chief Executive Officer

C:416-818-1393

E: nicole@renforthresources.com

#Unit 1B – 955 Brock Road, Pickering ON L1W 2X9

Follow Renforth on Facebook, LinkedIn and Instagram!

About Renforth

Renforth wholly owns the ~260 km2 Surimeau District Property, which hosts numerous areas of polymetallic and gold mineralization, each with various levels of exploration, as well as a significant amount of unexplored ground. Victoria West has been drilled over a strike length of 2.2km, within a 5km long mineralized structure, proving nickel, copper, zinc and cobalt mineralization, in the western end of a 20km magnetic anomaly. The Huston target, during initial reconnaissance, resulted in a grab sample grading 1.9% Ni, 1.38% Cu, 1170 ppm Co and 4 g/t Ag. In addition to this the Lalonde, Surimeau and Colonie Targets are all polymetallic mineralized occurrences which, along with various gold showings, comprise the areas of potential of this NSR free property.

In addition to the Surimeau District battery metals property Renforth wholly owns the Parbec Gold deposit, a surface gold deposit contiguous to the Canadian Malartic Mine property in Malartic, Quebec. In 2020/21 Renforth completed 15,569m of drilling which successfully twinned certain historic holes, filled in gaps in the resource model with newly discovered gold mineralization and extended mineralization deeper. Based upon the success of this significant drill program the Company considers the spring 2020 MRE, with a resource estimate of 104,000 indicated ounces of gold at a grade of 1.78 g/t Au and 177,000 inferred ounces of gold at a grade of 1.78 g/t Au to be out of date. With the new data gained Renforth will undertake to complete the first ever structural study of the mineralization at Parbec, as well as additional total metallic assay work in order to better contextualize the nugget effect on the gold mineralization.

Renforth also holds the Malartic West property, the site of a copper/silver discovery, and Nixon-Bartleman, west of Timmins Ontario, with gold present on surface over a strike length of ~500m.

No securities regulatory authority has approved or disapproved of the contents of this news release.

Forward Looking Statements

This news release contains forward-looking statements and information under applicable securities laws. All statements, other than statements of historical fact, are forward looking. Forward-looking statements are frequently identified by such words as ‘may’, ‘will’, ‘plan’, ‘expect’, ‘believe’, ‘anticipate’, ‘estimate’, ‘intend’ and similar words referring to future events and results. Such statements and information are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the risks of obtaining necessary approvals, licenses and permits and the availability of financing, as described in more detail in the Company’s securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and the reader is cautioned against placing undue reliance thereon. Forward-looking information speaks only as of the date on which it is provided and the Company assumes no obligation to revise or update these forward-looking statements except as required by applicable law.

RFR :CC

The Conversation (0)

07 March 2022

Renforth Resources

District Scale Battery Metals Discovery in Quebec Backed by the Parbec Gold Deposit

District Scale Battery Metals Discovery in Quebec Backed by the Parbec Gold Deposit Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00