(TheNewswire)

August 22, 2023 TheNewswire - Vancouver, B.C. Carmanah Minerals Corp. (CSE:CARM), ( "Carmanah " or the "Company" ) is pleased to announce the commencement of a detailed regional and property specific structural geophysical interpretation of the corporation's Saskatchewan Uranium Project with its Joint Venture partner Marvel Discovery. The Interpretation includes using advanced technology leveraging machine learning to transform the mineral discovery process.

Fraser Rieche, Interim Chief Executive Officer, commented, "Carmanah's Walker Project presents a tremendous opportunity in Canada's Athabasca Basin. The project is perfectly situated along the Key Lake fault and is home to some of the largest Uranium Reserves in Canada. Using AI-drill-targeting allows us to get a better in-depth understanding of the structural traps which is vital to our drill-target selection process. We are pleased to be working with Marvel Discovery and their geological team, giving us an edge and a better chance for success with the common goal of a tier 1 discovery."

The claims coincide with a regional-scale NNE-trending shear zone that forms the tectonic boundary between the Mudjatik Domain and Wollaston Domain of the Hearne Province. The shear zone can be mapped from regional aeromagnetic images and has a strike length of at least 400 kilometres extending beneath cover rocks of the Athabasca Basin, approximately 60 km to the north. The highly prospective Athabasca Basin is home to numerous unconformity-type uranium deposits whose locations are controlled by the positions of major faults in the underlying crystalline basement rocks.

The pattern of structures within the claims, indicate that the two major rock groups are intensely polydeformed with complex fold interference patterns suggesting a regional east-dipping, sinistral transpressional belt that is now preserved as the Wollaston-Mudjatik Transition Zone (WMTZ), a prospective zone, along which the majority of known Uranium and REE occurrences are documented.

Like its neighbor to the west, the Arrow deposit, owned by NexGen Energy, lies along a similar structural corridor as the Carmanah property. The Arrow deposit, which has undergone a positive feasibility study with robust economics, contains probable reserves of 239.6 million pounds of U3O8 at an average of 2.37 per cent U3O8, and measured and indicated resources of 256.7 million pounds at an average grade of 3.1 per cent U3O8. The Arrow deposit is the largest undeveloped uranium deposit in Canada of 256.7 million lb at an average grade of 3.1 per cent U3O8. The Arrow deposit is the largest undeveloped uranium deposit in Canada.

Carmanah signed a joint venture agreement with Marvel Discovery on October 5, 2022, to earn a 50-per-cent interest in the Walker claims located in the Athabasca basin, Saskatchewan. Upon completion of the earn-in by Carmanah, Marvel and Carmanah would each own 50 per cent of the project.

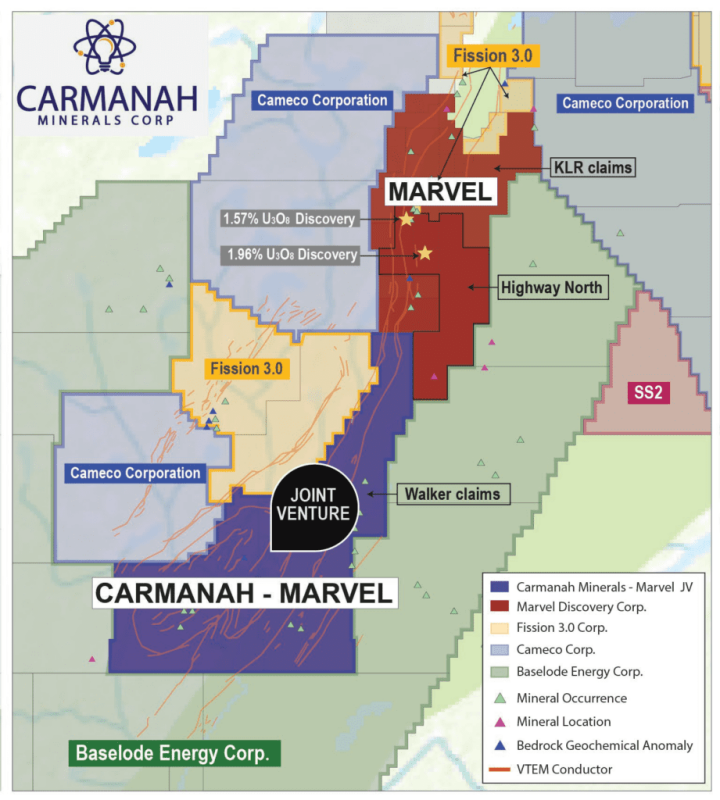

Figure 1.

Location of Walker JV, the Highway North and KLR claim groups along the Key Lake Fault with prominent VTEM conductor trends.

Qualified Person

Mike Kilbourne, P. Geo, an independent qualified person as defined in National Instrument 43-101, has reviewed, and approved the technical contents of this news release on behalf of the Company.

About Carmanah Minerals Corp.

Carmanah Minerals Corp. is a Canadian junior exploration company focused on a diversified portfolio covering Precious Metals, Energy, and Critical Elements. The Company recently signed a Joint Venture agreement with Marvel Discovery Corp. to earn a 50% interest in the Walker Claims located along the prolific Key Lake fault adjacent to Cameco's Mine and Mill in the Athabasca Basin, Saskatchewan. The Walker Properties lie within the Wollaston‐Mudjactic transition zone (WMTZ) of the eastern Athabasca basin, which is host to the highest‐grade uranium mines in the world. The company also holds a 100% interest in the Hare Hill Pluton Rare Earth Project. This project comprises 162 claims totaling 4,050 hectares in Central Newfoundland and is directly contiguous to the "Bottom Brook Acquisition" by York Harbour Metals Inc. Carmanah has also entered an option agreement to acquire the Baie Verte Brompton Project in Central Newfoundland. This project is strategically located on a peninsula that hosts all of Newfoundland's current gold production, including Anaconda Mining Inc.'s Point Rousse gold mine and Rambler Metals Mining operations.

For further information, please view the Company's filings at www.sedar.com .

ON BEHALF OF THE BOARD

Fraser Rieche

Chief Executive Officer and Director

Email: info@carmanahcorp.ca

Telephone: +1 (604) 716-1036

Disclaimer for Forward-Looking Information:

This news release includes certain forward‐looking statements and forward‐looking information (collectively, "forward‐looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, anticipated content, commencement, and cost of exploration programs in respect of the Company's projects and mineral properties, anticipated exploration program results from exploration activities, resources and/or reserves on the Company's projects and mineral properties, the anticipated business plans and timing of future activities of the Company, anticipated completion of the Private Placements, including the approval of the Canadian Securities Exchange for the Private Placements, are forward‐looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "will", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward‐looking statements in this news release, the Company has applied several material assumptions, including without limitation, that market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration of the Company's properties, that the COVID19 global pandemic will not affect the ability of the Company to conduct the exploration program on its mineral properties, the availability of financing on suitable terms, and the Company's ability to comply with environmental, health and safety laws.

Forward‐looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward‐looking statements. Such risks and other factors include, among others, statements as to the anticipated business plans and timing of future activities of the Company, including the Company's proposed expenditures for exploration work on its mineral projects, the ability of the Company to obtain sufficient financing to fund its business activities and plans, delays in obtaining governmental and regulatory approvals (including of the Canadian Securities Exchange), permits or financing, changes in laws, regulations and policies affecting mining operations, risks relating to epidemics or pandemics such as COVID–19, as well as those factors discussed under the heading "Risk Factors" in the Company's prospectus dated April 4, 2022, and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward‐looking statements. The Company undertakes no obligation to update any of the forward‐looking statements in this news release except as otherwise required by law.

Neither the Canadian Securities Exchange nor its regulation services provider accepts responsibility for the adequacy or accuracy of this news release.

Copyright (c) 2023 TheNewswire - All rights reserved.