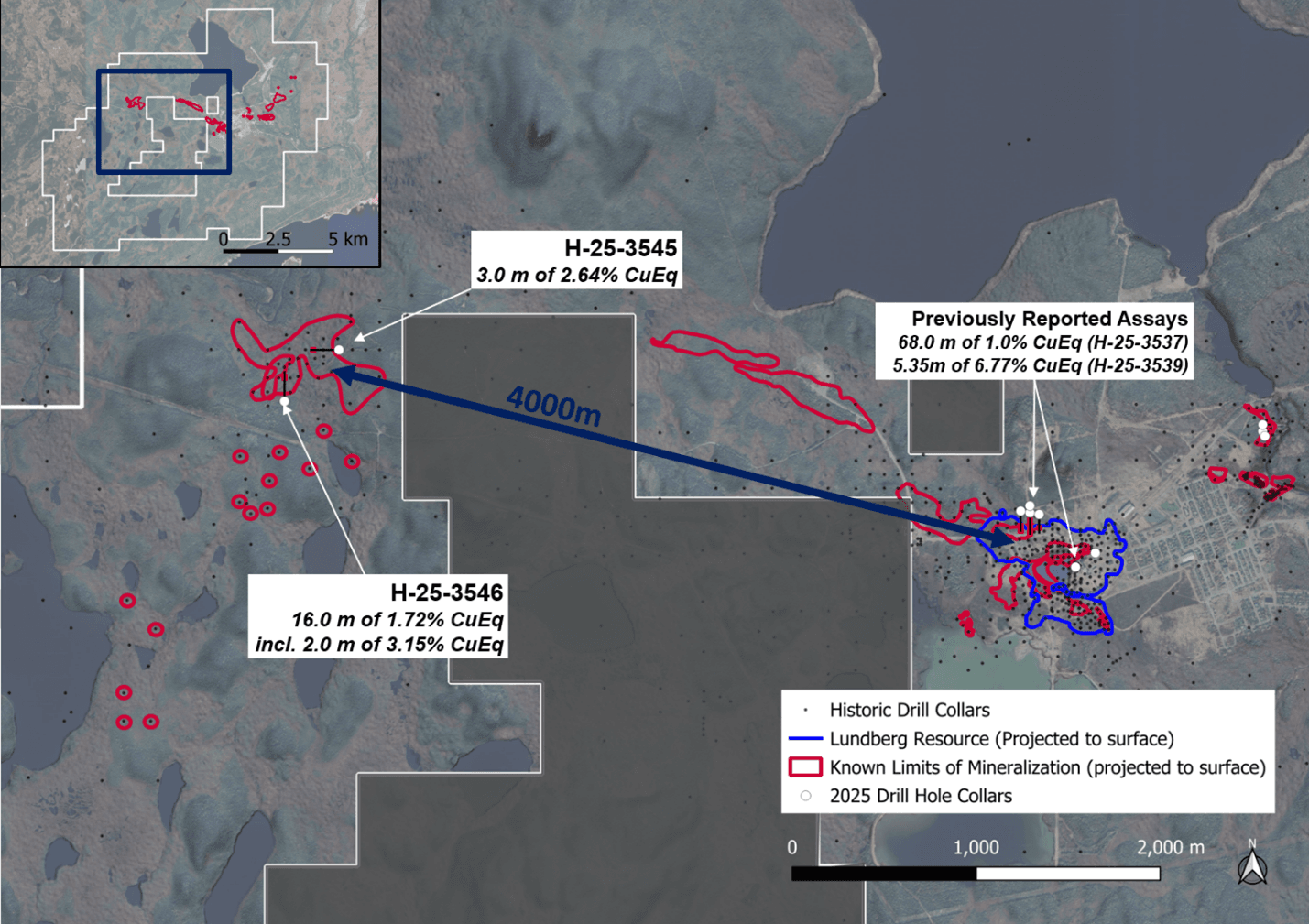

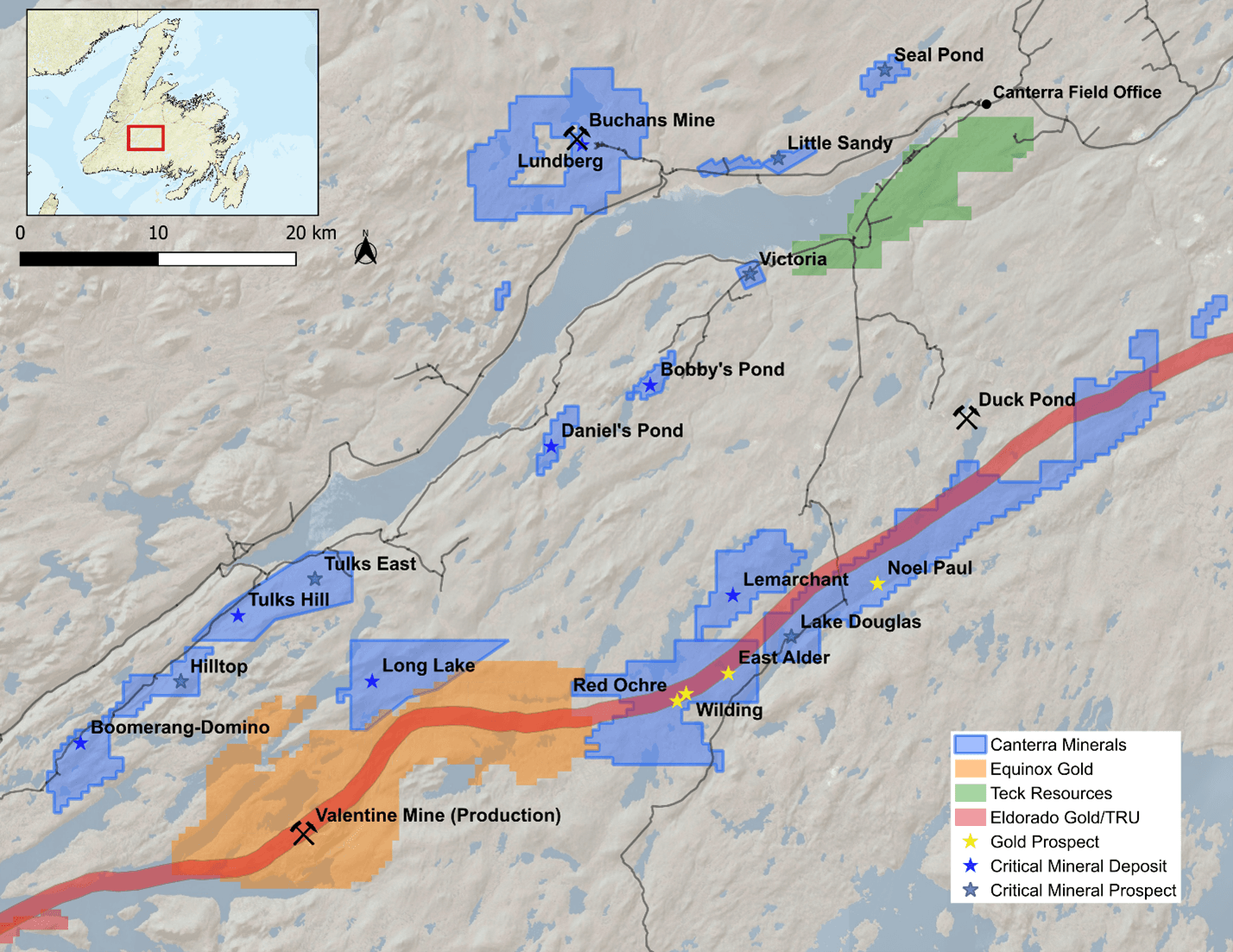

Canterra Minerals Corporation (TSXV:CTM) (OTCQB: CTMCF) (FSE:DXZB) ("Canterra" or the "Company") is pleased to announce its first drill results from the Clementine Prospect, part of its 100% owned Buchans Project in the Central Newfoundland Mining District. The Buchans Project is located 50 kilometres north of Equinox Gold's Valentine Gold Mine and 34 km northwest of Teck's past producing Duck Pond Mine. The Clementine Prospect is located 4 kilometres northwest of Canterra's Lundberg Deposit and the past-producing Buchans Mine.

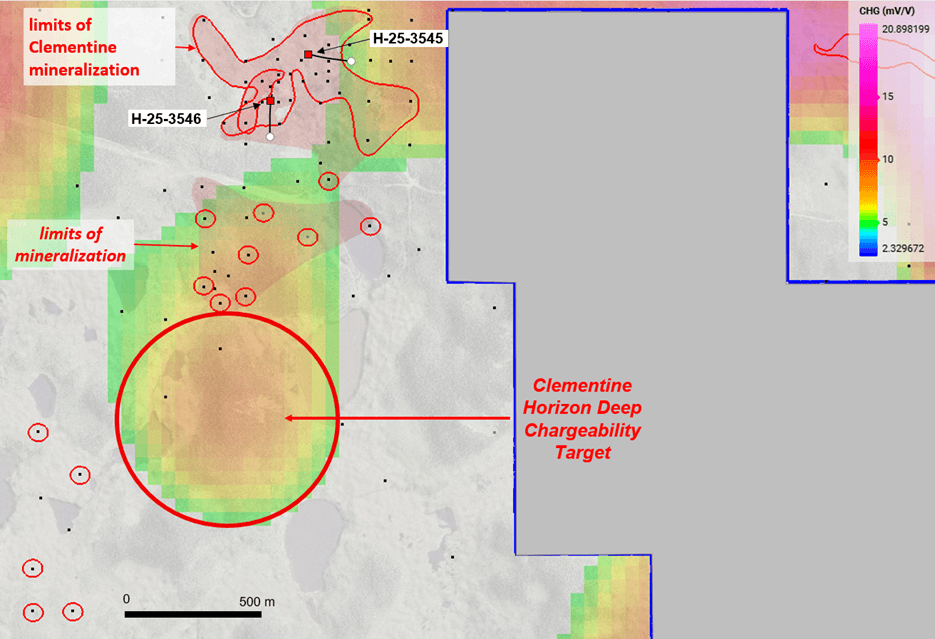

Initial drilling has successfully extended known high-grade, Buchans-style mineralization and confirmed significant grades at the margin of historic mineralization. Importantly, results coincide with a large, untested chargeability anomaly identified by Canterra's recently completed deep-penetrating 3D IP survey, suggesting potential for a larger, higher-grade zone immediately to the south.

In response to these positive results, the Company has mobilized a second drill rig to site as part of the ongoing 10,000-metre drill program at its Buchans Project.

Highlights:

- 1.72% CuEq over 16.0 m (H-25-3546, from 271.6m depth), including 3.15% CuEq over 2.0 m

- 2.64% CuEq over 3.0m (H-25-3545, from 332m depth), including 4.02% CuEq over 1.0 m

- Confirms high-grade, classic Buchans-style mineralization in an underexplored area

- Results include gold and silver credits which are common in Buchan-style mineralization

- Expands prospectivity south of the prospect where newly generated 3D IP geophysical anomalies identify priority targets for follow-up drilling.

Chris Pennimpede, President and CEO of Canterra commented: "These first results from Clementine validate our exploration model and belief that our Buchans Project has the potential to host multiple high-grade mineralized zones. We have confirmed thick, high-grade Buchans-style mineralization at the edge of the known system, with the potential for more continuous zones. Just as importantly, the correlation with a large IP anomaly to the south gives us a compelling large-scale target to test. This elevates Clementine on our priority list, and we are moving quickly to test the anomaly in the current phase of 2025 drilling."

Drill Result Analysis

The two holes reported tested extensions of historic drilling and successfully demonstrated true mineralized thickness exceeding 10 metres in hole H-25-3546. This style of transported, breccia-hosted sulphide mineralization was the primary source of the historic high-grade production at the Buchans Mine.

This thicker interval occurs in a southern portion of Clementine that corresponds with broad chargeability and resistivity anomalies identified in Canterra's recently completed 3D IP geophysical survey, providing strong evidence of a larger sulphide system.

Table 1. Assay Highlights . Copper Equivalents (CuEq%) as per metal prices of September 16, 2025 (see notes 1 & 2 at end of release).

| Hole | From (m) | To (m) | Width (m) | Cu% | Zn% | Pb% | Ag g/t | Au g/t | CuEq (%) | (Cu+Zn +Pb)% |

| H-25-3546 | 271.60 | 287.60 | 16.00 | 0.23 | 2.85 | 1.48 | 25.8 | 0.16 | 1.72 | 4.57 |

| incl. | 271.60 | 282.60 | 11.00 | 0.26 | 3.25 | 1.67 | 27.2 | 0.18 | 1.92 | 5.18 |

| incl. | 271.60 | 274.60 | 3.00 | 0.41 | 4.40 | 2.15 | 38.0 | 0.24 | 2.64 | 6.96 |

| incl. | 271.60 | 273.60 | 2.00 | 0.50 | 5.39 | 2.54 | 42.5 | 0.24 | 3.15 | 8.42 |

| incl. | 279.60 | 282.60 | 3.00 | 0.31 | 4.61 | 2.38 | 31.7 | 0.20 | 2.57 | 7.31 |

| incl. | 279.60 | 281.60 | 2.00 | 0.35 | 5.55 | 2.79 | 36.5 | 0.23 | 3.02 | 8.68 |

| incl. | 279.60 | 280.60 | 1.00 | 0.36 | 6.66 | 3.16 | 31.0 | 0.21 | 3.37 | 10.18 |

| H-25-3545 | 332.00 | 335.00 | 3.00 | 0.26 | 4.45 | 2.77 | 34.2 | 0.37 | 2.64 | 7.48 |

| incl. | 333.00 | 335.00 | 2.00 | 0.30 | 5.45 | 3.51 | 41.6 | 0.44 | 3.23 | 9.26 |

| incl. | 334.00 | 335.00 | 1.00 | 0.32 | 6.91 | 4.77 | 43.0 | 0.61 | 4.02 | 12.00 |

Figure 1. Plan Map of Clementine Prospect, showing 2025 drillhole locations and assay highlights. Red line - limits of known mineralization. Blue outline – Lundberg Mineral Resource outline. Details for previously released results (H-25-3537 & 3539) available in June 23, 2025 news release.

Figure 2 . Plan Map Highlighting Clementine Drill Locations relative to deep 3D IP Geophysical Anomalies targeted in the ongoing 2025 drill campaign. Limits of known mineralization projected vertically to surface. Limits of known mineralization projected vertically to surface. Map shows chargeability response at ~700m below surface.

Next Steps

Following these successful results, Canterra is planning immediate follow-up drilling to test the continuity and extent of mineralization at the Clementine Prospect. A key focus will be the Clementine South area, where recent 3DIP surveys have identified several promising, untested targets characterized by strong chargeability response anomalies similar to those associated with the mineralization in hole H-25-3546 (Figure 2). The Company's ongoing 10,000-metre drill program will also continue to test other high-priority targets across the wider Buchans Project.

Buchans Project

Canterra's Buchans Project is a brownfield project covering 95 km² near the town of Buchans. The project hosts the world-renowned, past-producing Buchans Mine, which was operated by Asarco from 1928 to 1984 and was one of the world's highest-grade base metal mines. Adjacent to this legacy operation, the property also hosts the undeveloped Lundberg deposit, a significant near-surface resource of stockwork sulphide mineralization well-suited for open-pit development.

Figure 3. Map of Canterra's Central Newfoundland Mining District properties.

| Notes: | ||

| (1) | True widths estimated to be ~80-90% of reported core lengths. Copper equivalents (CuEq) based on total contained copper, zinc, lead, silver and gold and metal prices as of September 16, 2025 (Cu - US$4.54/lb, Zn - US$1.35/lb, Pb - US$0.88/lb, Ag - US$42.55/oz and Au - US$3692.80/oz). | |

| (2) | Copper Equivalent % = Cu% + ((Pb% * 22.046 * Pb Rec.* Pb price) + (Zn% * 22.046 * Zn Rec. * Zn price) + (Ag g/t/31.10348 * Ag Rec. * Ag price) + (Au g/t/31.10348 * Au Rec. * Au Price))/(Cu Price * 22.046 * Cu Rec.).). Metal recoveries (Rec.) to concentrate are 90.41% Zn, 91.32% Pb, 91.14% Cu, 32.12% Au & 72.87% Ag based on "Centralized Milling of Newfoundland Base Metal Deposits - Bench Scale DMS and Flotation Test Program" (Thibault & Associates Inc., 2017). | |

Table 2. Drill collar locations

| Hole | Length (m) | Azimuth | Dip | Northing (UTM NAD83 Zone 21) | Easting (UTM NAD83 Zone 21) | |

| H-25-3545 | 361 | 270 | -65 | 5,409,032 | 505,970 | |

| H-25-3546 | 340 | 0 | -62 | 5,408,752 | 505,674 | |

Newfoundland and Labrador Junior Exploration Assistance

Canterra would like to acknowledge financial support it may receive from the government of Newfoundland and Labrador's Junior Exploration Assistance Program related to completion of its 2025 exploration programs at Buchans.

About Canterra Minerals

Canterra is a diversified minerals exploration company focused on critical minerals and gold in central Newfoundland. The Company's projects include six mineral deposits located in close proximity to the world-renowned, past producing Buchans Mine and Teck Resources' Duck Pond Mine, which collectively produced copper, zinc, lead, silver and gold. Several of Canterra's deposits support current and historical Mineral Resource Estimates prepared in accordance with National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Mineral. Canterra's gold projects are located on-trend of Equinox Gold's Valentine mine currently under construction and cover a ~60 km extension of the same structural corridor that hosts mineralization within Equinox Gold's mine project. Past drilling by Canterra and others within the Company's gold projects intersected multiple occurrences of orogenic-style gold mineralization within a large land position that remains underexplored.

QA/QC Protocols

Samples consist of saw-cut (NQ drill core) with one-half retained for reference and one-half submitted for analyses. Samples were submitted in sealed plastic bags delivered by Canterra personnel to SGS Canada's preparatory facility in Grand Falls-Windsor, Newfoundland. Sample batches consisted of core samples, control standards, blanks and duplicates. Once prepared, pulps (SGS procedure code PRP89) were shipped to SGS Canada's laboratory in Burnaby, BC to be homogenized and subsequently analyzed for multi-element assays (including Cu, Pb, Zn, Ag and Au) using sodium peroxide fusion with ICP-OES finish (codes GE_ICP90A50 for Cu, Pb, Zn, Ag, GE_AAS42E50 for Ag by-4-acid digestion by AAS, and GE_FAA30V5 for Au by 30g Fire Assay by AAS). Overlimit assays were completed as necessary by pyrosulphate fusion/XRF for Cu, Pb, Zn (code GO_XRF70V) and Ag by 30g Fire Assay, gravimetric (code GO_FAG37V). SGS Natural Resources analytical laboratories operate under a Quality Management System that complies with ISO/IEC 17025. SGS CANADA's minerals laboratory in Burnaby is accredited by the Standards Council of Canada (SCC) for specific mineral tests listed on the scope of accreditation to the ISO/IEC 17025 standard. Further details regarding SGS procedures are available at SGS Analytical Methods . Canterra also submits representative pulps to ALS Geochemistry's laboratory in Moncton New Brunswick for additional independent check assays.

Qualified Person

Paul Moore MSc. P.Geo. (NL), Vice President of Exploration for Canterra Minerals Corporation, a Qualified Person within the meaning of National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

ON BEHALF OF THE BOARD OF Canterra Minerals CORPORATION

Chris Pennimpede

President & CEO

Additional information about the Company is available at www.canterraminerals.com

For further information, please contact: +1 (604) 687-6644

Email: info@canterraminerals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, including statements with respect to estimated mineral resources, the opening of avenues for substantial discoveries within the belt, the Buchans Project being ripe for a modern approach with significant exploration potential for high grade VMS mineralization, the Company anticipating being strongly positioned to unveil the next mineral discovery in central Newfoundland. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company's business and prospects.; as well as those risks and uncertainties identified and reported in the Company's public filings under its SEDAR+ profile at www.sedarplus.ca. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3fd09418-8edc-4336-9a6b-07090bae1ff5

https://www.globenewswire.com/NewsRoom/AttachmentNg/306ddc01-bf3f-4910-b4bf-7f4950de9ec0

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6c218b3-f179-4ab5-b112-1dbe581605d7