Canagold Resources Ltd. (TSX: CCM,OTC:CRCUF) (OTCQB: CRCUF) (FSE: CANA) ("Canagold" or the "Company") is pleased to announce positive results from antimony (Sb) flotation testing for its 100% owned New Polaris gold-antimony project located in northwest British Columbia, Canada.

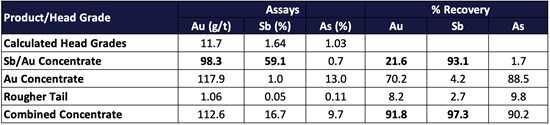

Antimony Flotation Locked Cycle Test Results

High quality and High recovery Sb-Au Concentrate

- Sb-Au Concentrate assaying 59.1 % Sb and 98.3 gpt Au

- 93.1 % Sb recovery in Sb-Au concentrate and overall, 91.8% Au recovery in the combined Au and Sb-Au concentrates

"The Feasibility Study ("FS") completed in July 2025 has already demonstrated exceptional economics, with low Capex and low AISC for the New Polaris Gold-Antimony Project," stated Canagold's Chief Executive Officer, Catalin Kilofliski. "Although antimony mining was included in the FS, no revenue from antimony has been accounted for at this stage. These new results highlight the project's ability to produce a very high-grade gold-antimony concentrate, which has the potential to create significant additional value on top of the already outstanding economics."

Table 1: Antimony Locked Cycle Flotation Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11878/268594_a2325c5da452ea50_002full.jpg

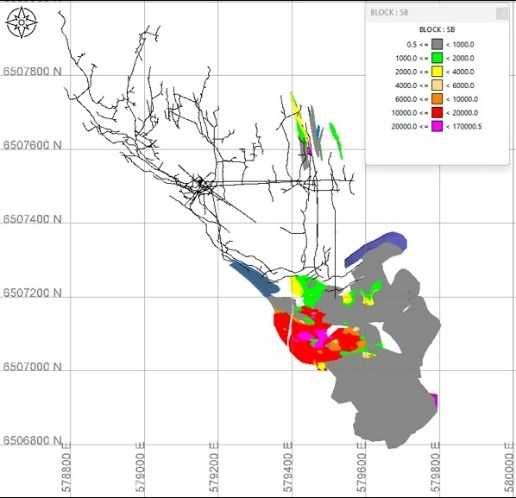

Flotation testing commenced in April 2025 at Blue Coast Research Ltd. in Parksville, B.C., utilizing a 110-kilogram composite sample derived from 47 diamond drill core samples across 17 drill holes in the high-grade antimony zone. This zone is delineated in the January 22, 2025, resource model, referenced in the Image 1 below:

Image 1. Antimony Mineralization Plan View

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11878/268594_a2325c5da452ea50_003full.jpg

Critical Metals/Antimony

- A total of 5,630 tonnes of Sb grading 0.6% is included in the Company's Indicated MRE dated April 2, 2025

- A total of 5,173 tonnes Sb is included in the FS mine plans

The Feasibility Study does not currently account for any revenue from antimony, as the process flowsheet outlined in the study was specifically designed to produce a bulk sulphide concentrate.

While antimony has been known to occur at New Polaris since the early mining activities of the 1940s and 1950s, its economic importance has increased significantly in recent years due to global supply constraints and sharply rising prices.

The Company will continue further metallurgical test work and economic assessments to evaluate the potential for including antimony revenue in the project's financial model.

Should future studies confirm its viability, the addition of antimony revenue will further enhance overall project economics, particularly since the associated mining costs are already largely supported by gold production. Nonetheless, there can be no assurances that ongoing work will ultimately support this outcome.

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Garry Biles, P.Eng., President & COO is the Qualified Person for the Company and has prepared, validated, and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting activities on its projects. The samples have been analyzed by Blue Coast Research laboratory.

About Canagold

Canagold Resources Ltd. is an advanced development company dedicated to advancing the New Polaris Project through feasibility, permitting, and production stages. Additionally, Canagold aims to expand its asset base by acquiring advanced projects, positioning itself as a leading project developer. With a team of technical experts, the Company is poised to unlock substantial value for its shareholders.

"Catalin Kilofliski"

_____________________

Catalin Kilofliski, Chief Executive Officer

Canagold Resources Ltd

Catalin@canagoldresources.com, 604-685-9700

LinkedIn: https://ca.linkedin.com/company/canagold-resources

Facebook: https://www.facebook.com/CCMGold/

X: https://x.com/CCMGoldLtd

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain "forward-looking information" and "forward-looking statements" ("collectively forward-looking statements") within the meaning of applicable Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; and other statements regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs (sustaining and non-sustaining) and operating costs, including projected cash operating costs and AISC; future or estimated mine life, metal price assumptions, ore grades or sources, gold recovery rates, throughput, ore processing; statements regarding anticipated future plans, development, construction, permitting and other activities or achievements of Canagold; and including, without limitation: planned gold production; the results and estimates in the FS, including the project life, average annual gold production, total gold production, processing rate, capital cost, net present value, after-tax net cash flow and payback; and the potential to develop the New Polaris Project as an underground gold mine. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond Canagold's control, including risks associated with or related to: the volatility of metal prices and Canagold's common shares; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in Canagold's feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; the availability of financing; financing and debt activities, including potential restrictions imposed on Canagold's operations in Canada; community support for Canagold's operations.

Canagold's forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to Canagold's ability to carry on current and future operations, the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the availability and cost of inputs; the price and market for gold and antimony; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits from government and First Nations; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Canagold's forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date hereof. Canagold does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268594