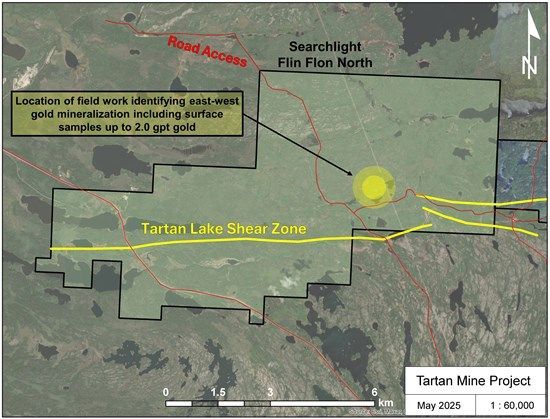

Canadian Gold Corp. (TSXV: CGC) ("Canadian Gold" or the "Company") is pleased to announce that it has entered into an assignment agreement dated May 28, 2025 (the "Assignment Agreement"), with Searchlight Resources Inc. ("Searchlight"), pursuant to which Searchlight has assigned to Canadian Gold its option pursuant to an underlying agreement to acquire 100% of the Flin Flon North property (the "Option"), that is immediately adjacent to the Company's Tartan Mine and recently optioned Tartan West property (Fig. 1 & 2). This Option, if exercised, will continue to build on the Company's regional presence along the Tartan Lake Shear Zone, which is the key structural host for gold mineralization at Tartan. As a result of the recently completed option agreement and the Assignment Agreement, the Company has now expanded its presence along the Tartan Lake Shear Zone from 8 to 29.5 kilometres in length, as it looks to add additional high-grade gold resources into its plans to restart the Tartan Mine.

"The securing of the Flin Flon North property, in addition to the recently optioned Tartan West property, significantly expands the geological potential of the Tartan project. The historic showings of gold mineralization along the length of the Tartan Shear Zone that Canadian Gold now controls portend a significantly enhanced opportunity to scale and extend the mine life of the Tartan Mine once it is placed back into production." - Michael Swistun, CFA, President & CEO

Highlights of Flin Flon North Property:

- Expands land position on the Tartan Shear Zone along strike to the west by 269%, from 8 to 29.5 kilometres (Fig. 1). The property encompasses a total area of 56.5 square kilometres (5,649 hectares).

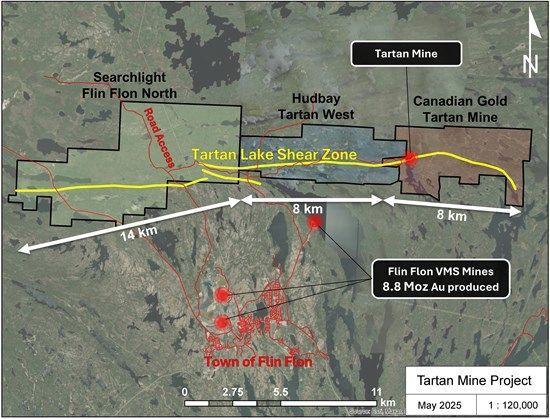

- Limited surface sampling from 1986 returned assay values grading 2 gpt gold(1) (Fig. 2). In addition, many anomalous gold trends were identified on the property, including strong east-west trends, where no follow-up exploration was completed.

- In 2019, Searchlight initiated airborne geophysical surveys that identified multiple geophysical targets exhibiting conductance and magnetic signatures typically associated with Volcanogenic Massive Sulphide ("VMS") mineralization.

- The property's location offers excellent infrastructure access, with Highway 106 running through the project, facilitating exploration and potential development activities, including the possible restart of the Tartan Mine.

Next Steps

The Company intends to begin exploration work at the Flin Flon North property during the 2025 field season. Initial work will consist of a detailed mapping, prospecting, and sampling program, which will aid with prioritization of areas for additional work such as trenching, stripping, and diamond drilling.

Terms of the Assignment Agreement

Under the terms of the Assignment Agreement, and subject to the approval of the TSX Venture Exchange, over a four-year period Canadian Gold will be required to make the following cash and share payments outlined in Table 1 to exercise the Option. Upon exercise of the Option, which requires Canadian Gold to keep the Flin Flon North property in good standing during the Option period, Canadian Gold will hold a 100% interest in the Flin Flon North property, subject to a pre-existing 2.0% NSR.

Table 1. Option Terms

| Date | Cash Payments | Share Payments |

| Upon Exchange Approval | C$30,000 | 111,111 |

| 1 Year Anniversary | C$20,000 | 111,111 |

| 2 Year Anniversary | C$25,000 | 148,148 |

| 3 Year Anniversary | C$25,000 | 185,185 |

| 4 Year Anniversary | C$30,000 | 185,185 |

Settlement of Stock Options

Subject to approval from the TSX Venture Exchange, the Company proposes to enter into a cash settlement transaction with two of its directors (together, the "Option Holders"), pursuant to which the Option Holders have agreed to cancel an aggregate of 1,125,000 outstanding stock options (the "Settlement Options") in exchange for an aggregate of $114,375 in cash (the "Settlement Amount"). The cash settlement was offered to all holders of outstanding options, and only the Option Holders availed themselves of the offer. The Company clarifies that the Option Holders are not receiving the Settlement Amount to offset any debts owing to them and confirms that it does not intend to re-grant any incentive stock options to the Option Holders. The Company will fund the Settlement Amount from its current working capital and believes that the use of the Settlement Amount is in the best interests of the Company, given that the Settlement Options are currently in the money.

The payment of the Settlement Amount to the Option Holders constitutes a Related Party Transaction under TSX Venture Exchange Policy 5.9 and Multilateral Instrument 61-101 ("MI 61-101"). The Company availed itself of the exemptions contained in section 5.5(a) of MI 61-101 for an exemption from the formal valuation requirement and Section 5.7(1)(a) of MI 61-101 for an exemption from the minority shareholder approval requirement of MI 61-101, as the fair market value of the transaction involving payment of the Settlement Amount does not exceed 25% of the Company's market capitalization.

For Further Information, Please Contact:

Michael Swistun, CFA

President & CEO

Canadian Gold Corp.

(204) 232-1373

info@canadiangoldcorp.com

Social Media Accounts:

Qualified Person and QAQC

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the Company, and a Qualified Person as defined under National Instrument 43-101.

The Qualified Person has not completed sufficient work to verify the historical data for the Flin Flon North property, and it remains uncertain whether further exploration will define a mineral resource on the property. The Company has not independently verified the third-party data referenced and cannot guarantee its accuracy or completeness and investors should therefore use caution in placing reliance on such information. However, the Qualified Person believes that the analytical results referenced were completed to industry standard practices. Overall, the information highlights the exploration potential of the Flin Flon North property but may not reflect actual results.

Historical Exploration References

(1) Koziol, M. and Drever, G., 1986. Saskatchewan Mining Development Corporation. Nesootao Lake Project 1986 Exploration Program. Saskatchewan Mineral Assessment Report 63K13-0058.

About Canadian Gold Corp.

Canadian Gold Corp. is a Canadian-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). The Company also holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada's largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). McEwen Mining Inc. (NYSE & TSX: MUX) holds a 5.7% interest in Canadian Gold, and Robert McEwen, the founder and former CEO of Goldcorp, and Chairman and CEO of McEwen Mining, holds a 32.9% interest in Canadian Gold.

About Searchlight Resources Inc.

Searchlight Resources Inc. (TSXV: SCLT) (OTCQB: SCLTF) is a Canadian mineral exploration and development company focused on Saskatchewan, Canada, which has been ranked as the top location for mining investment in Canada by the Fraser Institute. The Company's exploration model of Project Generation coupled with Targeted Exploration, focuses on battery minerals and gold throughout the province.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of the Company contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Canadian Gold's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.

Figure 1. Location of the Flin Flon North property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/254134_d0f36c3c94d44896_002full.jpg

Figure 2. Location of historic gold occurrences on the Flin Flon North property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/254134_d0f36c3c94d44896_003full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254134