Highlights

- Nine of first twelve holes with intervals of greater than 1% nickel

- First twelve holes confirm high grade mineralization over 400 metres of strike length that remains open to the north and at depth

- High grade intervals within thick mineralized sections include:

- Hole 22-03: 5.2 metres of 2.60% nickel within 21.0 metres of 1.22% nickel within 91.5 metres of 0.50% nickel from 58.5 metres

- Hole 22-06: 4.0 metres of 2.43% nickel within 12.0 metres of 1.45% nickel within 28.0 metres of 0.77% nickel from 76.5 metres

Canada Nickel Company Inc. (" Canada Nickel " or the " Company ") (TSXV: CNC) (OTCQX: CNIKF) today announced assay results from the first twelve holes of its initial drill program at the Texmont property that confirm high grade, near-surface nickel mineralization. Texmont is located 36 kilometres south of Timmins .

The Company has drilled a total of 39 holes and 9,670 metres, completing its initial phase to support the development of a mineral resource at Texmont expected to be delivered later this year.

Mark Selby , Chair & CEO of Canada Nickel Company, said, "We are excited by the results of our initial phase of drilling and assay results at Texmont which confirm our thesis of near-surface, high grade intervals of nickel that is present within thick mineralized sections, which support the potential for near-term, smaller scale, open pit production. This near-term production potential is highly complementary to our large-scale Crawford and regional nickel sulphide project."

Texmont Nickel Property

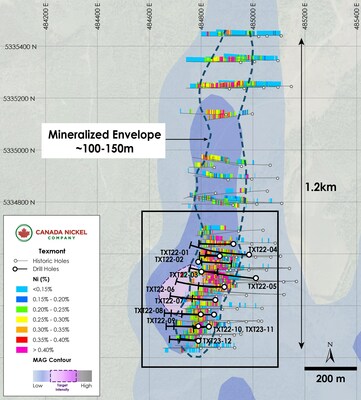

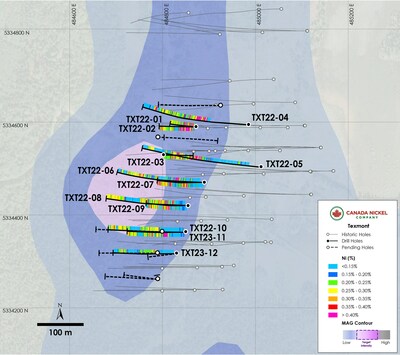

The Texmont Property is located 36 kilometres south of Timmins . It is considered to be a komatiite flow rather than a dunite sill with sections of highly mineralized peridotite and dimensions approximately 1.2 kilometres long by up to 150 metres wide (see Figure 1).

Canada Nickel has drilled 39 drill holes to date, 34 of which targeted the known mineralization and five of which targeted a possible north extension (Figure 2). This news release contains the assay results from the first 12 holes totaling 3,204 metres (see Tables 1,2). Historic drilling confirms the mineralization pinches out to the south but remains open to the north and at depth. Further drilling to the north of the former mine shaft intersected thick sections of mineralized peridotite but assay results are not yet available. This drilling is expected to be incorporated, along with historic drilling by Fletcher Nickel (which drilled 28,883 metres from 2006-2008) into an initial resource estimate to be released later this year.

Table 1: Texmont exploration drilling results high grade highlights

| Hole ID | From | To | Length* | Ni | Co | Pd | Pt | S |

| | (m) | (m) | (m) | ( %) | ( %) | (g/t) | (g/t) | ( %) |

| TEX22-01 | 22.0 | 44.1 | 22.1 | 0.52 | 0.01 | 0.042 | 0.036 | 0.34 |

| TEX22-02 | 10.5 | 56.2 | 45.7 | 0.55 | 0.02 | 0.041 | 0.033 | 0.45 |

| Including | 27.0 | 33.0 | 6.0 | 1.08 | 0.03 | 0.094 | 0.079 | 0.66 |

| TEX22-03 | 58.5 | 150.0 | 91.5 | 0.50 | 0.01 | 0.031 | 0.023 | 0.45 |

| Including | 129.0 | 150.0 | 21.0 | 1.22 | 0.03 | 0.108 | 0.070 | 1.09 |

| Including | 138.8 | 144.0 | 5.2 | 2.60 | 0.06 | 0.265 | 0.226 | 2.46 |

| And | 131.0 | 132.0 | 0.5 | 6.85 | 0.16 | 0.513 | 0.055 | 5.97 |

| TEX22-04 | 127.3 | 161.5 | 34.2 | 0.56 | 0.02 | 0.046 | 0.046 | 0.33 |

| Including | 145.5 | 151.0 | 4.4 | 0.99 | 0.03 | 0.073 | 0.056 | 0.61 |

| TEX22-05 | 201.0 | 226.0 | 25.0 | 0.48 | 0.02 | 0.036 | 0.028 | 0.54 |

| including | 219.0 | 226.0 | 7.0 | 0.74 | 0.02 | 0.063 | 0.048 | 0.85 |

| TEX22-06 | 76.5 | 105 | 28.5 | 0.77 | 0.02 | 0.065 | 0.071 | 0.91 |

| including | 82.5 | 94.5 | 12.0 | 1.45 | 0.04 | 0.137 | 0.156 | 1.74 |

| including | 88.0 | 92.0 | 4.0 | 2.43 | 0.06 | 0.246 | 0.314 | 2.94 |

| including | 90.1 | 90.6 | 0.5 | 10.6 | 0.25 | 1.200 | 1.680 | 12.4 |

| TEX22-07 | 106.5 | 132.0 | 25.5 | 0.50 | 0.02 | 0.030 | 0.024 | 0.61 |

| including | 106.5 | 114.0 | 7.5 | 0.79 | 0.02 | 0.068 | 0.046 | 0.97 |

| TEX22-08 | 70.7 | 84.0 | 13.3 | 0.51 | 0.02 | 0.033 | 0.024 | 0.48 |

| including | 70.7 | 74.0 | 3.3 | 1.12 | 0.03 | 0.097 | 0.065 | 1.13 |

| TEX22-11 | 93.0 | 139.5 | 46.5 | 0.57 | 0.02 | 0.036 | 0.033 | 0.67 |

| including | 94.5 | 109.5 | 15.0 | 1.06 | 0.03 | 0.081 | 0.073 | 1.32 |

| * True widths are unknown |

Table 2: Texmont exploration drilling results - downhole average

| Hole ID | From | To | Length* | Ni | Co | Pd | Pt | Cr | Fe | S |

| | (m) | (m) | (m) | ( %) | ( %) | (g/t) | (g/t) | ( %) | ( %) | ( %) |

| TEX22-01 | 8.3 | 249.0 | 240.7 | 0.29 | 0.01 | 0.015 | 0.014 | 0.17 | 6.01 | 0.44 |

| TEX22-02 | 6.0 | 126.0 | 120.0 | 0.34 | 0.01 | 0.021 | 0.019 | 0.12 | 5.35 | 0.47 |

| TEX22-03 | 1.8 | 150.0 | 148.2 | 0.40 | 0.01 | 0.021 | 0.017 | 0.14 | 5.26 | 0.39 |

| TEX22-04 | 127.3 | 307.5 | 200.2 | 0.31 | 0.01 | 0.019 | 0.017 | 0.15 | 5.72 | 0.33 |

| TEX22-05 | 39.0 | 401.8 | 362.8 | 0.18 | 0.01 | 0.010 | 0.010 | 0.14 | 6.75 | 0.25 |

| Including | 189.7 | 345.5 | 155.8 | 0.28 | 0.01 | 0.014 | 0.012 | 0.13 | 5.51 | 0.31 |

| TEX22-06 | 14.2 | 300.0 | 285.8 | 0.24 | 0.01 | 0.013 | 0.014 | 0.11 | 5.97 | 0.37 |

| TEX22-07 | 6.0 | 300.0 | 294.0 | 0.24 | 0.01 | 0.011 | 0.011 | 0.16 | 6.32 | 0.45 |

| and | 199.8 | 300.0 | 100.2 | 0.33 | 0.01 | 0.010 | 0.009 | 0.15 | 5.31 | 0.47 |

| TEX22-08 | 9.3 | 282.0 | 272.7 | 0.22 | 0.01 | 0.008 | 0.008 | 0.15 | 5.77 | 0.28 |

| Including | 61.5 | 163.5 | 102.0 | 0.31 | 0.01 | 0.010 | 0.009 | 0.15 | 5.27 | 0.33 |

| TEX22-09 | 9.0 | 252.0 | 243.0 | 0.20 | 0.01 | 0.010 | 0.010 | 0.14 | 6.68 | 0.34 |

| Including | 110.0 | 159.3 | 49.3 | 0.35 | 0.01 | 0.017 | 0.013 | 0.14 | 5.84 | 0.49 |

| and | 180.0 | 244.5 | 64.5 | 0.28 | 0.01 | 0.008 | 0.008 | 0.18 | 5.60 | 0.39 |

| TEX22-10 | 7.5 | 255.0 | 247.5 | 0.18 | 0.01 | 0.007 | 0.007 | 0.16 | 6.19 | 0.66 |

| Including | 86.5 | 151.7 | 65.2 | 0.25 | 0.01 | 0.006 | 0.006 | 0.16 | 5.20 | 0.22 |

| TEX22-11 | 6.6 | 222.8 | 216.2 | 0.28 | 0.01 | 0.013 | 0.014 | 0.18 | 6.37 | 0.41 |

| including | 93.0 | 222.8 | 129.8 | 0.37 | 0.01 | 0.017 | 0.017 | 0.16 | 5.90 | 0.44 |

| and | 236.1 | 303.0 | 66.9 | 0.25 | 0.01 | 0.008 | 0.009 | 0.15 | 5.51 | 0.28 |

| TEX22-12 | 62.0 | 141.6 | 79.6 | 0.23 | 0.01 | 0.007 | 0.007 | 0.15 | 5.27 | 0.21 |

| and | 164.0 | 211.0 | 47.0 | 0.21 | 0.01 | 0.006 | 0.005 | 0.18 | 6.12 | 0.37 |

TEX22-01 was collared directly over komatiite, and intersected a thick sequence of mineralized peridotite, ending in strongly serpentinized dunite, with minor dykes encountered near the top of the hole. The hole averaged 0.29% Ni over 240.7 metres, including a higher-grade section of 0.52% Ni over 22.1 metres (see Table 3 for all high grade composites, and Table 4 for whole mineralized lengths).

TEX22-02 was collared 100 metres northeast of TEX22-01 and intersected mineralized komatiite 6 metres below surface, intersecting mineralized peridotite for a length of 120.0 metres until encountering gabbro at the lower contact. The hole averaged 0.34% nickel over 120.0 metres, including 0.55% nickel over 45.7 metres from 10.5 metres downhole.

TEX22-03 was collared with an east azimuth 20 metres southwest of the existing mining shaft and intersected mineralized peridotite from 1.8 meters to the end of hole at 150.0 metres. The hole averaged 0.40% nickel over 148.2 metres, including 1.22% nickel and 0.18 g/t Pt+Pd over 21.0 metres.

TEX22-04 was collared within the hanging wall intersecting mafic volcanics and then gabbro before encountering mineralized peridotite. The mineralized peridotite averaged 0.31% Ni over 200.2 metres, including 0.56% Ni over 34.2 metres. The hole intersected the footwall, ending in mafic volcanics and giving a good indication of the overall thickness of the mineralized ultramafics.

TEX22-05 was collared in hanging wall mafic volcanics and was aimed to cut across the strike length of the mineralized komatiite. The hole intersected 362.8 metres of peridotite averaging 0.18% Ni over 362.8 metres, including 42.0 metres of 0.41% nickel. A few minor dykes were encountered within the hole.

TEX22-06 was drilled 100 m southeast of TEX22-03 in komatiite and intersected mineralized peridotite, with minor intersections of late dykes. The hole averaged 0.24% nickel over 285.8 metres, including a high-grade section of 1.45% nickel and 0.28 g/t Pt+Pd over 12.0 metres.

TEX22-07 was collared 100 southeast of TEX22-03, intersecting komatiite followed by a moderate to strongly mineralized peridotite, interrupted by minor diabase dykes. The hole averaged 0.24% Ni over 294.0 metres including 0.33% Ni over 100.2 metres and 0.41% Ni over 43.5 metres.

TEX22-08 was collared 50 metres south of TEX22-07 and drilled to the west. The hole started in komatiite and continued into peridotite, ending in peridotite. The hole averaged 0.22% Ni over 272.7 metres including 0.31% Ni over 100.2 metres.

TEX22-09 was collared at the same location as TEX22-08 but at a steeper dip (-70 o versus -50 o ). The hole started in komatiite and continued into peridotite, ending in peridotite. Mineralization averaged 0.20% Ni over 243.0 metres, including 0.28% Ni over 64.5 metres and 0.35% Ni over 49.3 metres.

TEX22-10 was collared 50 metres south of TEX22-08 and intersected a thick section of mineralized peridotite interrupted by a minor sliver of metasedimentary rocks. The hole averaged 0.18% Ni over 247.5 metres including 0.24% over 75.0 metres.

TEX22-11 was collared at the same location as TEX22-10 but drilled at a steeper angle. The hole intersected two sections of mineralized peridotite, 0.28% Ni over 216.2 metres and 66.9 metres of 0.25% Ni, with the intervals separated by metasedimentary rocks. The upper mineralized interval included a higher-grade section of 129.8 metres of 0.37% and 19.5 metres of 0.96% Ni.

TEX22-12 was collared 50 metres south of TEX22-10 and intersected 2 sections of mineralized peridotite separated by metasediments, the upper section averaging 0.23% Ni over 79.5 metres, and the lower section averaging 0.21% Ni over 47.0 metres.

Table 1: Texmont Drillhole Orientation

| Hole ID | Easting (mE) | Northing (mN) | Azimuth (⁰) | Dip (⁰) | Length (m) |

| TXT22-01 | 484872 | 5334590 | 270 | -78 | 249 |

| TXT22-02 | 484872 | 5334590 | 270 | -50 | 126 |

| TXT22-03 | 484802 | 5334530 | 90 | -65 | 150 |

| TXT22-04 | 484985 | 5334595 | 270 | -50 | 345 |

| TXT22-05 | 485012 | 5334504 | 270 | -50 | 420 |

| TXT22-06 | 484890 | 5334471 | 270 | -50 | 300 |

| TXT22-07 | 484890 | 5334471 | 270 | -70 | 300 |

| TXT22-08 | 484855 | 5334421 | 270 | -50 | 282 |

| TXT22-09 | 484855 | 5334420 | 270 | -70 | 252 |

| TXT22-10 | 484850 | 5334364 | 270 | -48 | 255 |

| TXT23-11 | 484850 | 5334364 | 270 | -65 | 303 |

| TXT23-12 | 484830 | 5334318 | 270 | -52 | 222 |

Assays, Quality Assurance/Quality Control and Drilling and Assay

Edwin Escarraga , MSc, P.Geo., a "qualified person" as defined by National Instrument 43-101, is responsible for the on-going drilling and sampling program, including quality assurance (QA) and quality control (QC). The core is collected from the drill in sealed core trays and transported to the core logging facility. The core is marked and sampled at 1.5 metre lengths and cut with a diamond blade saw. One set of samples is transported in secured bags directly from the Canada Nickel core shack to Actlabs Timmins, while a second set of samples is securely shipped to SGS Lakefield for preparation, with analysis performed at SGS Burnaby or SGS Callao ( Peru ). All are ISO/IEC 17025 accredited labs. Analysis for precious metals (gold, platinum, and palladium) are completed by Fire Assay while analysis for nickel, cobalt, sulphur and other elements are performed using a peroxide fusion and ICP-OES analysis. Certified standards and blanks are inserted at a rate of 3 QA/QC samples per 20 core samples making a batch of 60 samples that are submitted for analysis.

Qualified Person and Data Verification

Stephen J. Balch P.Geo . (ON), VP Exploration of Canada Nickel and a "qualified person" as is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

The magnetic images shown in this press release were created from Canada Nickel's interpretation of datasets provided by the Ontario Geological Survey.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless-steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero Nickel TM , NetZero Cobalt TM , NetZero Iron TM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp. For more information, please visit www.canadanickel.com.

For further information, please contact:

Mark Selby

Chair and CEO

Phone: 647-256-1954

Email: info@canadanickel.com

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, drill and exploration results relating to the target properties described herein (the "Properties"), the potential of the Crawford Nickel Sulphide Project and the Properties, timing of economic studies and mineral resource estimates, the ability to sell marketable materials, strategic plans, including future exploration and development results, and corporate and technical objectives. Forward-looking information is necessarily based upon several assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Factors that could affect the outcome include, among others: future prices and the supply of metals, the future demand for metals, the results of drilling, inability to raise the money necessary to incur the expenditures required to retain and advance the property, environmental liabilities (known and unknown), general business, economic, competitive, political and social uncertainties, results of exploration programs, risks of the mining industry, delays in obtaining governmental approvals, failure to obtain regulatory or shareholder approvals, and the impact of COVID-19 related disruptions in relation to the Company's business operations including upon its employees, suppliers, facilities and other stakeholders. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Canada Nickel disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, except as required by law.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-confirms-high-grade-near-surface-mineralization-at-texmont-301763829.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-confirms-high-grade-near-surface-mineralization-at-texmont-301763829.html

SOURCE Canada Nickel Company Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/March2023/06/c0216.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/March2023/06/c0216.html