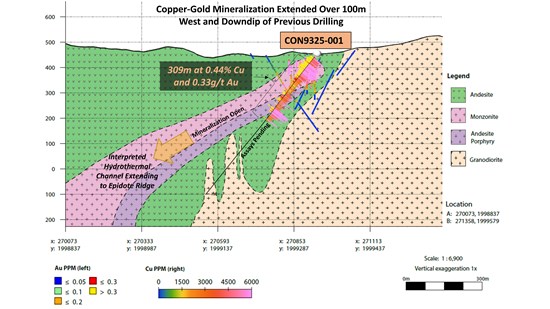

C3 Metals Inc. (TSXV: CCCM) (OTCQB: CUAUF) ("C3 Metals" or the "Company") is pleased to announce it has intersected 309 metres at 0.44% Cu and 0.33 gt Au beginning 15 metres down hole. This result is from 330 metres of a 703 metre drill hole at the Company's 100% owned Bellas Gate Project in Jamaica. Two additional holes have been completed at the Epidote Ridge target (assays pending) within Bellas Gate. The total program is anticipated to be 5,000 metres. Bellas Gate, as well as C3 Metals' other projects in Jamaica, sit within the highly prospective Crawle River-Rio Minho Fault Porphyry and Epithermal District ("CRF District").

Figure 1: Map showing C3 Metals' mineral tenure within the CRF District in Jamaica.

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/2661/136725_b96682f30467a86e_001full.jpg

Dan Symons, President & CEO, of C3 Metals stated, "Although these assay results represent less than half the first drill hole of a five-hole program, we felt it prudent to immediately announce the results given the outstanding continuity and grades of the copper and gold minerilzation reported to date. The Bellas Gate Project sits within the CRF District, a major structural break which cuts across Jamaica and is known to host multiple porphyry systems. Our understanding of the Epidote Ridge system within Bellas Gate has been significantly advanced by our recent geological mapping and geophysics interpretations, and we believe the target has tremendous potential. These partial assays of the first hole drilled in this target supports our thesis. We look forward to completing the ongoing 5,000m program and receiving all assays."

Drilling Highlights:

- Partial assays received for the first 330m of hole CON9325-001 returned 309.0m @ 0.44% Cu and 0.33 g/t Au from 15.0m.

- Cu-Au grades comparable to many porphyry deposits currently being mined.

- Drilling confirms mineralization is open to the west and at depth.

- Gold rich-porphyry mineralization confirmed and is associated with strong magnetite alteration.

- Geophysics (mag and IP) strongly supports downplunge continuity of mineralized body.

- Two additional holes completed into the Epidote Ridge target (assays pending).

- Drill rig mobilizing to northern end of Epidote Ridge to test a coincident magnetic and IP chargeability anomaly.

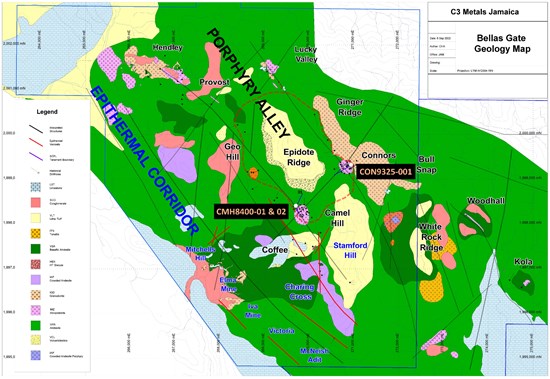

To date, three holes have been completed to test the porphyry potential at the Epidote Ridge target, which is centrally located to five porphyry systems: Connors, Camel Hill, Geo Hill, Lucky Valley and Ginger Ridge (Figure 1). The first hole, CON9325-001, tested an interpreted hydrothermal channel way plunging to the east of Connors under Epidote Ridge (Figure 2). The Company is well-advanced on a 5,000-metre core drilling program to test several compelling, high-priority copper and gold porphyry targets.

Figure 2: Epidote Ridge target area (dashed polygon) and the two drill collars at Connors and Camel Hill.

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/2661/136725_b96682f30467a86e_002full.jpg

Figure 3: Cross section through CON9325-001 showing assays and interpreted geology.

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/2661/136725_b96682f30467a86e_003full.jpg

QP Statement

Stephen Hughes, P.Geo. is Vice President Exploration and a Director for C3 Metals and is a Qualified Person as defined by National Instrument 43-101. Mr. Hughes has reviewed the technical information in this news release and approves the written disclosure contained herein.

For additional information, contact:

Dan Symons

President and CEO

+1 416 716 6466

dsymons@c3metals.com

ABOUT C3 Metals Inc.

C3 Metals Inc. is a junior minerals exploration company focused on creating substantive value for its shareholders through the discovery and development of large copper and gold deposits. The Company's holds the Jasperoide project is located in the prolific high-grade Andahuaylas-Yauri Porphyry-Skarn belt of Southern Peru and covers 27,200 hectares. Mineralization at Jasperoide is hosted in a similar geological setting to the nearby major mining operations at Las Bambas (MMG), Constancia (Hudbay) and Antapaccay (Glencore). C3 Metals also holds a 100% interest in five licenses covering 20,700 hectares of highly prospective copper-gold terrain within the CRF District in Jamaica, where mining history dates to the 1500's and 1800's when Spanish and British mining companies targeted high grade copper in veins. C3 also holds a 2% royalty in Tocvan's Rogers Creek project.

Related Link: www.c3metals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution Regarding Forward Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to, among other things, the exploration operations of the Company and the timing which could be affected by the current global COVID-19 pandemic. Those assumptions and factors are based on information currently available to the Company. Although such statements are based on reasonable assumptions of the Company's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While the Company considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions and the COVID-19 pandemic, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this release is made as of the date hereof, and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/136725