March 21, 2024

Burley Minerals Limited (ASX: BUR, “Burley” or “the Company”) advises that a heritage protection agreement has been signed with Yindjibarndi Aboriginal Corporation over the Broad Flat Well exploration license area. Heritage surveys are planned for late-April/early-May 2024.

HIGHLIGHTS

- Broad Flat Well

- Heritage Agreement signed with Yindjibarndi Aboriginal Corporation. Heritage survey planned for the second quarter of 2024.

- Additional Channel Iron Deposit (CID) areas identified within the Broad Flat Well tenement.

- Cane Bore

- The Cane Bore Conservation Management Plan was submitted and is now under review by the Department of Biodiversity, Conservation and Attractions.

- Flora and fauna surveys were completed in 2023.

- More than 30km of potential remnant Channel Iron Deposits (CID) identified.

Burley also advises that the Conservation Management Plan (CMP) developed for the Cane Bore (CID) Iron Project is now under review by the Department of Biodiversity, Conservation and Attractions (DBCA). Once the CMP is reviewed and approved, the DBCA will make its recommendations to the Conservation and Parks Commission, who will ratify the CMP and refer to the Minister of the Environment to provide Consent for exploration. The Ministerial Consent will be provided to the Department of Energy, Mines, Industrial Regulation and Safety (DEMIRS) for approval of the Exploration License application. Drilling permits, as Programmes of Work (PoW), may be pursued from DEMIRS once the exploration license is granted. The PoW will be subject to the recommendations of the DBCA and conditions of the CMP.

Burley Minerals Managing Director and CEO, Stewart McCallion commented:

“The signing of the Heritage Protection Agreement with the Yindjibarndi Aboriginal Corporation is an important step towards exploring the Broad Flat Well tenement. Burley has applied for drilling permits at Broad Flat Well, and now we will be working with the Yindjibarndi on implementing heritage surveys.

“The review of the Cane Bore Conservation Management Plan by the DBCA is also a significant milestone and we are confident with veracity and completeness of the document. Once the Conversation Management Plan is approved, we anticipate a clear path through to the grant of the exploration license by DEMIRS. We will submit our plans for drilling thereafter. In the meantime, we intend to complete additional data collection and any site work possible. There are extensive, mesa- forms throughout the Cane Bore exploration area as seen in the historic sampling. These Channel Iron Deposits are high-lying, and readily accessible; we intend to commence RC drilling when statutory approvals are received.

“The development of the Conservation Management Plan, and execution of agreements with aboriginal corporations underscores Burley’s commitment to mitigating environmental impacts of our work and ensuring protection of aboriginal heritage.”

BROAD FLAT WELL – 100% INTEREST

Locations and Setting

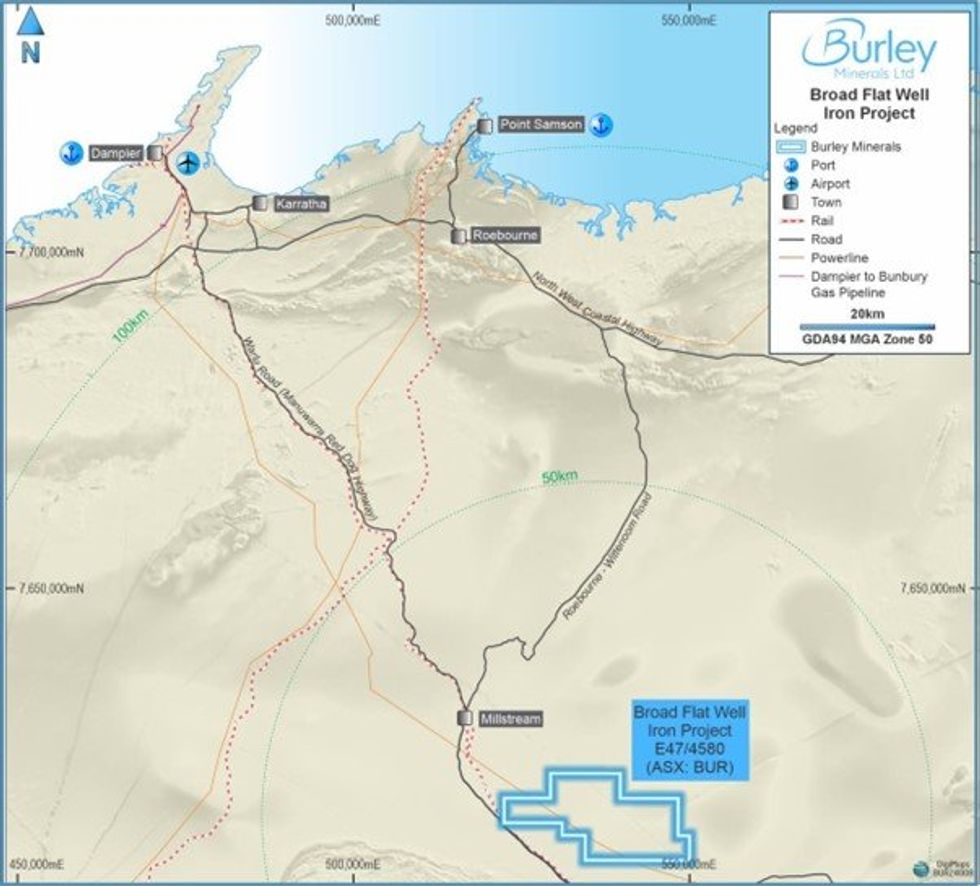

The Broad Flat Well exploration license, E47/4580, is located approximately 115 km from Karratha and is accessible by the sealed Roebourne - Wittenoom Road, as illustrated in Figure 1. Broad Flat Well is also only 260kms from Port Headland.

Rock Chip Sampling and Geology

A mapping and rock chip sampling programme was completed in 20231. Thirty-six (36) rock chip samples were collected from the tops of mesa-form hills which are interpreted as remnant mid- Miocene Channel Iron Deposits (CID) related to the Fortescue River palaeo-drainage system. An earlier sampling programme was completed by API Management between 2006 and 2008.

Click here for the full ASX Release

This article includes content from Burley Minerals Ltd., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00