April 03, 2024

IX columns working precisely to plan, marking completion of the final technical milestone in the Honeymoon re-start strategy

Boss Energy Limited (ASX: BOE; OTCQX: BQSSF) is pleased to announce that it has successfully passed the final technical milestone in its Honeymoon re-start strategy, paving the way for the first drum of uranium to be filled in the next two weeks.

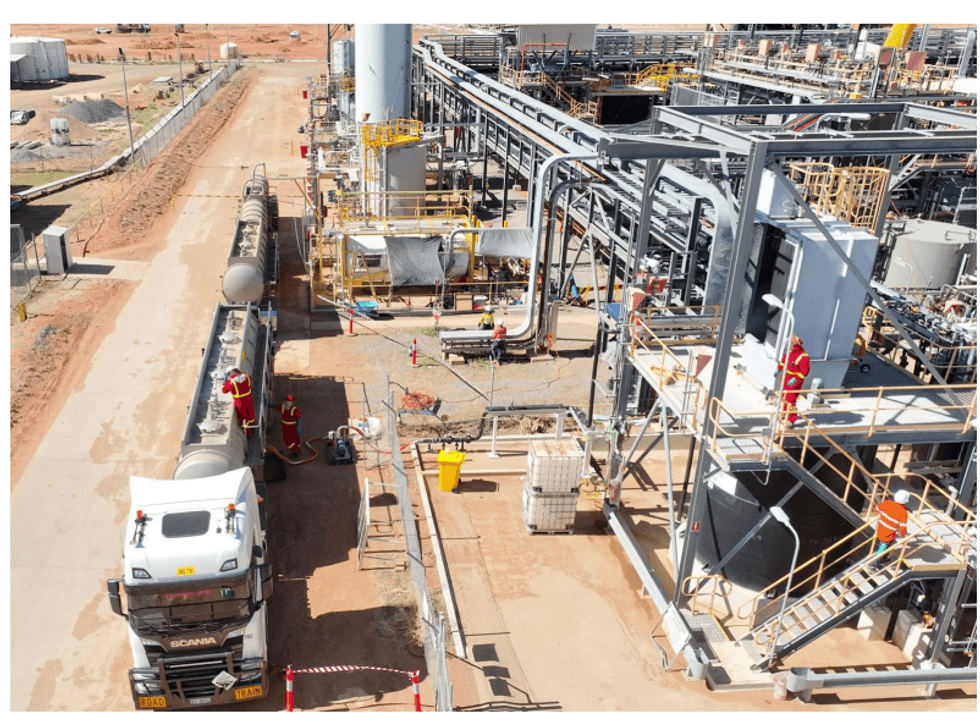

As part of this critical phase, uranium-rich lixiviant from the wellfields has filled the processing plant Ion-Exchange (IX) column, where loaded resin will result in production of concentrated high-grade eluate.

Boss Managing Director Duncan Craib said: “Since acquiring Honeymoon, Boss’ strategy has been to increase the uranium tenor in the wellfield feed solution to the plant and develop a larger processing facility utilising Ion Exchange technology.

“This approach is to improve the economics of the project by increasing production rates and reducing operating costs.

“We have now achieved both of these key goals and as a result are set to fill our first drum with uranium in coming days”.

Commencement of production activities

Honeymoon mining activities are ramping up to support the production profile. Lixiviant (a leaching fluid) is now being optimised and continuously injected into the orebody through the injector wells. The lixiviant moves through the ore zones within that horizon, dissolving the uranium mineralisation at its origin (i.e. “in situ”) and producing a uranium-rich fluid which is then pumped to the surface through the extractor wells. The installed pipelines at surface are now transporting the pregnant, uranium-rich lixiviant from the wellfields to the Honeymoon processing plant and being fed into the IX circuit for uranium recovery.

The IX circuit adsorption columns have been filled with resin to effectively recover the high tenors of uranium from the pregnant leach solution (PLS). The loaded resin is being transferred to the elution columns where the resin is eluted to recover uranium to a concentrated high-grade eluate.

Next week, the concentrated high-grade eluate will be recovered through the upgraded precipitation circuit to produce UO4, and then calcined to produce a high-quality saleable uranium oxide (U3O8) product. This final stage is expected to take two weeks.

During the IX production process, uranium is being chemically extracted until the solution is said to be “barren”, or no longer rich in uranium. The remaining barren liquor will be refortified with acid and oxidant before it is recycled back to the wellfield to repeat the dissolution process.

Click here for the full ASX Release

This article includes content from Boss Energy Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BOE:AU

The Conversation (0)

27 June 2024

Boss Energy Limited

Multi-mine uranium producer in Australia and the US

Multi-mine uranium producer in Australia and the US Keep Reading...

28 January 2025

December 2024 Quarterly Results Presentation

Boss Energy Limited (BOE:AU) has announced December 2024 Quarterly Results PresentationDownload the PDF here. Keep Reading...

28 January 2025

Quarterly Cashflow Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Cashflow Report - December 2024Download the PDF here. Keep Reading...

28 January 2025

Quarterly Activities Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Activities Report - December 2024Download the PDF here. Keep Reading...

14h

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00