November 29, 2022

Blue Star Helium (ASX:BNL,OTCQB:BSNLF,OTCQB:BSNLF) is a pure helium play with a large-scale land position in Colorado. The company is exploring new and undeveloped low-cost sources of high-grade helium.

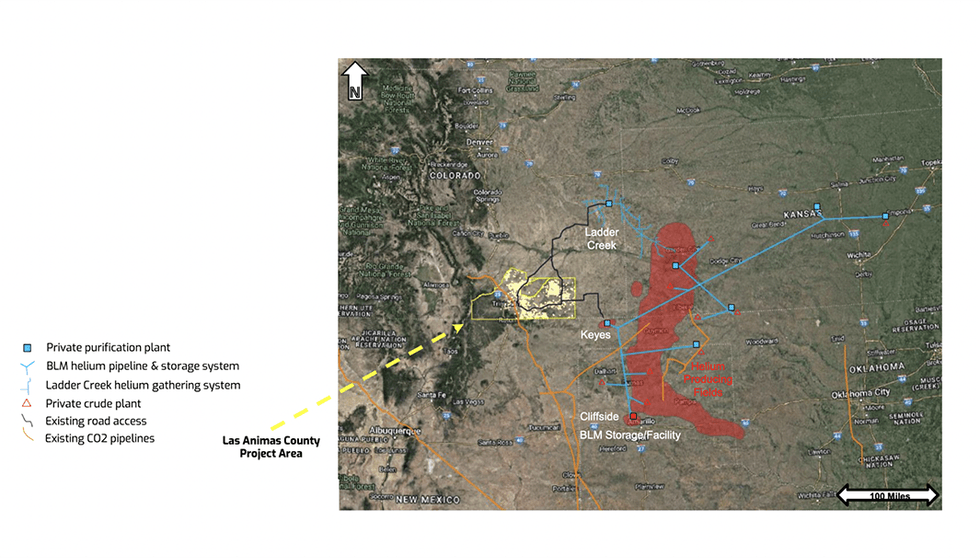

Blue Star Helium’s first-mover flagship assets are within the county of Las Animas in Colorado, with nearby vital infrastructure and the world’s largest helium marketplace. An experienced management team with expertise throughout the natural resources industry leads Blue Star Helium toward its goals.

Blue Star Helium benefits from a clear commercialization pathway resulting from an under-supplied helium market. Blue Sky Helium’s assets are categorized into the proven Lyons helium play and a range of secondary targets with highly prospective potential projects.

An experienced management team leads Blue Star to capitalize on its first-mover advantage and realize its assets' potential. Trent Spry, CEO, brings expertise in geoscience, exploration and project development in Australia and the United States. Ross Warner, executive chairman, has held executive leadership roles in ASX and AIM-listed companies and was previously a corporate finance lawyer in the UK and Australia. Neil Rinaldi, non-executive director, has a successful track record throughout the finance sector spanning over twenty years.

Company Highlights

- Blue Star Helium is an Australia-headquartered helium exploration and production company with large-scale operations in North America.

- The company’s strategy targets low-cost exploration and underdeveloped helium sources to move into production.

- Blue Star’s assets are within the county of Las Animas in Colorado, close to the government-acquired historic Model Dome helium field.

- The company recently announced a significant discovery at the Galactica/Pegasus prospect, with a new drill hole registering 6.06 percent helium concentration.

- Another new discovery at the Voyager project intersected a 134-foot gas column with 8.8 percent helium concentration, directly comparable to the Model Dome field. Representing one of the highest helium grades in the US and globally.

- A management team with directly relevant expertise in the natural resources industry leads the company toward its goals.

This Blue Star Helium profile is part of a paid investor education campaign.*

BNL:AU

The Conversation (0)

28 November 2022

Blue Star Helium

Developing High-Grade Helium Assets in Colorado

Developing High-Grade Helium Assets in Colorado Keep Reading...

06 March

Syntholene Energy Corp. Announces Completion of Conceptual Design Report and Technoeconomic Analysis

Report Validates Pathway to Industrial Scale Synthetic Fuel Production Targeting Cost Competitiveness with Fossil FuelsSyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces the completion of its Conceptual Design Report ("CDR") and integrated... Keep Reading...

06 March

Angkor Resources Announces Closing of Evesham Oil and Gas Sale

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 6, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of all final payments and closing of the sale of its 40% participating interest (the "Assets") in the Evesham Macklin oil and gas... Keep Reading...

05 March

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00