July 25, 2023

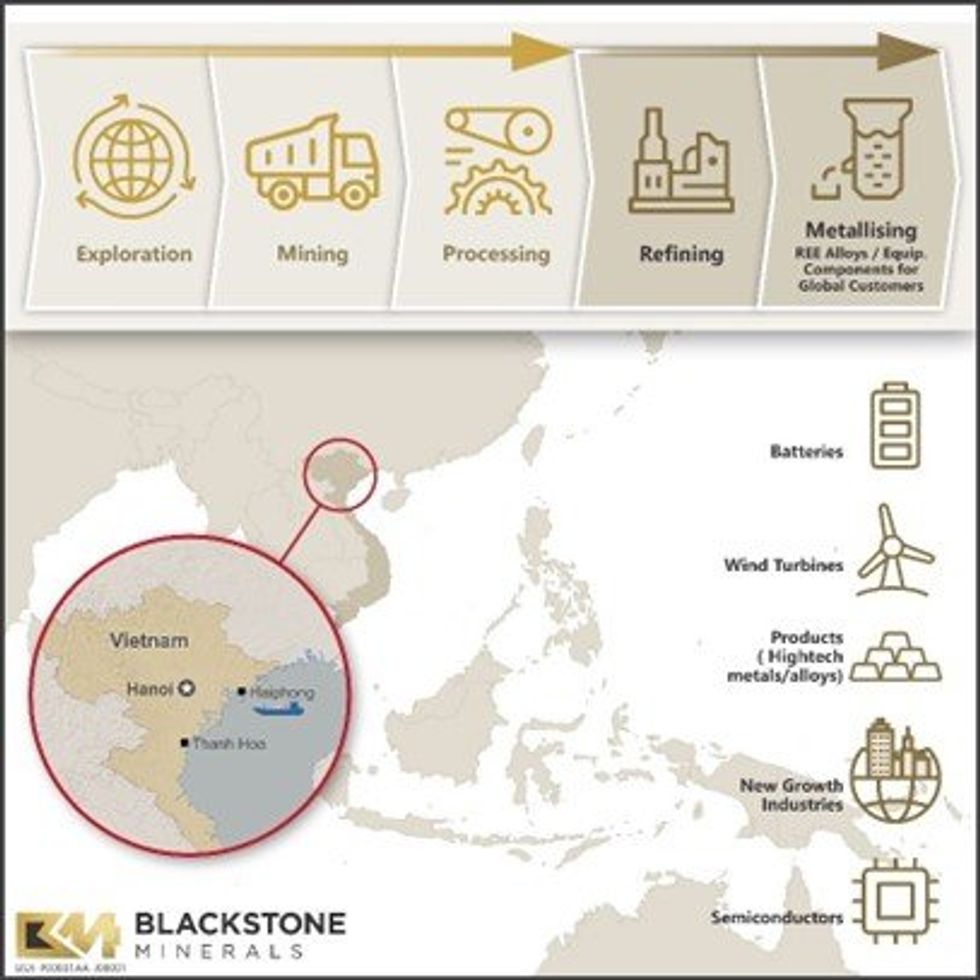

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to announce the Company has entered into a three-way Memorandum of Understanding (“MOU”) with Vietnam Rare Earths JSC (“VTRE”) and ASX listed, Australian Strategic Materials (“ASM”) to cooperate on opportunities to develop a fully integrated rare earths mine to metals value chain in Vietnam

- VTRE owns and operates the only Vietnamese midstream rare earths refinery and is seeking a strategic partner to develop upstream mining and processing capability;

- Blackstone has upstream mining and processing experience, with a world class in- country team located within the Northwest Vietnam rare earth district;

- ASM is an emerging vertically integrated producer of critical metals for advanced and clean technologies with a deep understanding of downstream processing of rare earths and the rare earth market.

The MOU was executed on the 25th July 2023, at the Australian Embassy in Hanoi, Vietnam and was witnessed by His Excellency Andrew Goledzinowski, Australian Ambassador to Vietnam.

Vietnam has the world’s largest Rare Earth Element ("REE") Reserves outside of China.1 The majority of Vietnam’s REE resources are located in the Northwest Region of Vietnam, in close proximity to Son La Province where Blackstone’s Ta Khoa Nickel Project is located. A number of potentially very high grade REE deposits are available to be permitted and developed by companies that can demonstrate a full value chain capability and deliver a “mine to metal” REE hub in Vietnam.

VTRE has owned and operated the only midstream REE refinery in Vietnam for the past 12 years with the vision to become a prestige producer and supplier of Rare Earth products and expand the product ranges to deliver multi options for customer needs whilst focussing on researching and using advanced technology for production.

On the 30th April 2023, VTRE entered into a binding agreement with ASM for the supply of Rare Earth Oxides with the intention to progress long term supply agreements potentially utilising Vietnam's natural resources.

Under the MOU with Blackstone, VTRE and ASM agree to collaborate on the following initiatives, with the objective to enter into further binding agreements;

1. Blackstone and VTRE to assess existing REE licensed concessions and if appropriate, apply to secure the mining licenses under a Joint Venture Arrangement. The immediate focus will be a mining licence for one of the world class Dong Pao Deposits;

2. Blackstone agrees to allow VTRE access to the Company’s laboratory and piloting facilities located at the Ta Khoa Nickel Project at Ban Phuc Nickel Mines and with technical assistance from ASM to conduct a pilot flotation program for the beneficiation of REE concentrates from the Dong Pao deposit;

3. Blackstone, VTRE and ASM will explore a commercial model that can support a fully integrated mine to metals rare earth business.

The MOU has presented itself through the Company’s stakeholder development program, established to progress the Ta Khoa Project in Vietnam. In doing so, the Company has created a strategic position of having the required ‘know-how’ in Vietnam to progress mining and mineral processing opportunities. As such, VTRE has engaged Blackstone to explore an entry into the Rare Earth Market. The potential experience and knowledge gained through this REE project development program will be invaluable in advancing our flagship Ta Khoa Project.

Through Blackstone’s Ta Khoa Project partnership search process, the Company has engaged with a number of electric vehicle car manufacturers which have indicated an interest in securing REE’s for their supply chain. The Company’s primary focus continues to be the completion of the Ta Khoa Refinery DFS and securing a partnership for the Ta Khoa Project. Blackstone will ensure that no capital is required to be allocated to the REE strategy in the short to medium term.

For VTRE and ASM, this MOU is an extension of their existing relationship and their commitment to continue to explore long term supply agreements and manufacturing opportunities.

Chairman of Vietnam Rare Earths Joint Stock Company Luu Anh Tuan said: "I welcome the opportunity to work with Blackstone on this MOU and building a long term relationship and extending my existing relationship with ASM, this is a great opportunity to develop the full value chain for Rare Earths in Vietnam".

ASM Managing Director & CEO Rowena Smith, said: “This MOU has the potential to drive a more collaborative approach within the rare earth elements and critical minerals sector and deliver positive outcomes for all parties involved.”

His Excellency Andrew Goledzinowski, Australian Ambassador to Vietnam commented: “Glad to see Australian and Vietnamese companies partnering together to form new critical minerals supply chains. Both countries are playing a role in diversifying and de-risking the availability of rare earth elements. This agreement leverages Australia’s world-leading regulatory frameworks for mining and resources, and Vietnam’s abundant labour supply and strong manufacturing base.”

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00