Beyond Lithium Inc. (CSE: BY,OTC:BYDMF) (OTCQB: BYDMF) (the "Company" or "Beyond") is pleased to announce that it has applied for a multi-cell mineral claim encompassing approximately 1,566 hectares in an area of southwestern British Columbia hosting several significant porphyry deposits for copper-moly and copper-gold mineralizations, known as Owl Creek # 1 (the "Owl Creek Project"). The project is situated roughly 8 kilometers northeast of the town of Pemberton and benefits from excellent access via upgraded logging roads, including the Owl Creek Forest Service Road.

Allan Frame, CEO of Beyond, commented, "We are very excited that Beyond now holds three high-quality assets in our critical minerals exploration portfolio. The Ear Falls Project in Ontario has proven spodumene mineralization, the Rare One Project in British Columbia hosts rare earth and base metal mineralization, and our new Owl Creek Project shows extensive copper mineralization right from surface. In recent months, our technical team has carefully evaluated several prospective opportunities, prioritizing projects with strong geological fundamentals, significant upside potential, and good road access for extended exploration seasons. We remain committed to exploring for critical minerals in a disciplined geological approach to drive long-term value for our shareholders."

Regional Geology

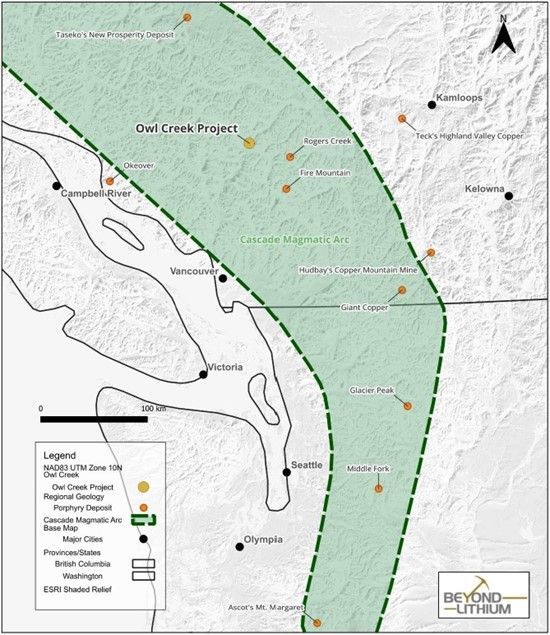

The Owl Creek Project is located within the regional Cascade Magmatic Arc that spans over 1,200 km from northern California to Canada (Hildreth 2007). The Cascade Magmatic Arc is a post-accretionary arc hosting several significant porphyry deposits for copper-moly and copper-gold mineralizations associated with Miocene intrusions including (Figure 1):

Mt. Margaret in southwestern Washington State (Ascot Resources Ltd.)8

Historical geological resources of 523.0 MT at 0.36% Cu, 0.011% Mo, and 0.24gpt Au (CIM Special Volume 37, 1986)

New Prosperity in south-central BC (Taseko Mines)7

Total Measured and Indicated Resources at 0.15% Cu cutoff grade with 1,109 MT at 0.24% Cu and 0.007% Mo

Figure 1. Owl Creek Project in Relation to Other Porphyry Projects in the Cascade Magmatic Arc

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8620/262141_beyondlithiumimg1.jpg

Historical Exploration Work & Highlights

Early 1900s

The Owl Creek showing was first discovered as early as 1913 referred as the Copper Queen prospect.

1960s to 1970s

A 70 meters long adit was developed at the Copper Queen prospect, and an underground chip sampling program resulted 0.33% Cu over 66 meters from the adit (Rastad & Pezzot 2006).

Pine Lake Mining completed diamond drillings, soil sampling, and magnetometer and induced polarization surveys (Naylor and Scott 1973)

Diamond drill hole around the adit intersected 0.2% Cu over 182m

Diamond drill hole in the northwestern area intersected 0.4% Cu over 91.4m

2010-2012

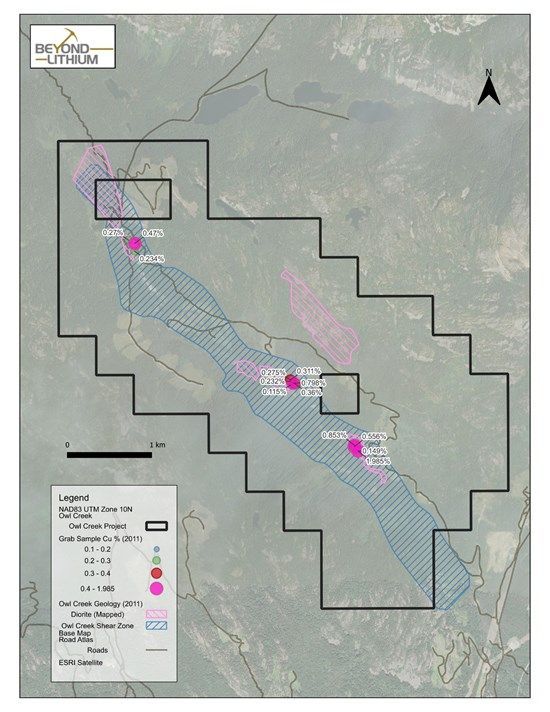

Surface mapping, grab sampling, and airborne magnetometer survey based on Goldsmith 2011's assessment report and Pezzot 2011's geophysics report (Figure 2.)

Grab samples from mapped diorite assayed up to 1.99% Cu

Magnetometer survey outlined the NW striking trend and delineated several anomalies in relation to the magnetic signature of mapped mineralized diorite

Figure 2. Owl Creek Property Map with Surface Grab Samples and Mapped Diorites and the Main Shear Zone from 2011 assessment report #32271 (Goldsmith 2011)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8620/262141_e3d73088f4239bbe_003full.jpg

B.C. Mineral Claims Consultation Framework

In March 2025, the Province of British Columbia introduced the Mineral Claim Consultation Framework in response to a BC Supreme Court ruling, which affirmed the government's duty to consult Indigenous communities prior to registering any mineral claims. Beyond has submitted a mineral claim application for the Owl Creek Project and it is anticipated that the consultation process will be underway by early September 2025.

- Goldsmith, Locke B. 2011. Owl Creek Mineral Claims Geological, Rock Geochemical, and Airborne Magnetic Surveys Report. Geological Survey Branch Assessment Report #32271.

- Hildreth, Wes, 2007. Quaternary Magmatism in the Cascades - Geologic Perspectives. https://pubs.usgs.gov/pp/pp1744/

- Naylor, H. and Scott, J.S. 1973. Pine Lake Mining Co. Ltd., Geological Report, Owl Creek BC Geological Survey Branch Assessment Report #04623.

- Pezzot E. Trent. 2011. Geophysical Interpretation Report on an Airborne Magnetometer Survey. Clear Mountain Resource Corp. Geological Survey Branch Assessment Report #32271.

- Rastad, S., and Pezzot, E. T., 2006. 3D induced polarization on the Gold King Property, Tenquille Lake grid, Pemberton, BC, Goldking Mining Ltd. Geological Survey Branch Assessment Report #28607.

- BC Government Mineral Exploration and Mining. May, 2025. https://www2.gov.bc.ca/gov/content/industry/mineral-exploration-mining/mineral-claims-consultation-framework

- https://www.tasekomines.com/properties/new-prosperity/reserves-and-resources

- https://ascotgold.com/projects/non-gold-assets/mt-margaret/

Second Amended Offering Document

As a result of the Company's application for the Owl Creek Project, the Company has filed a second amended offering document (the "Amended Offering Document") in respect of the non-brokered private placement of up to 10,000,000 units of the Company (the "Units") at a price of $0.03 per Unit for aggregate gross proceeds of up to $300,000 (the "Amended Offering") announced on July 29, 2025. Each Unit will consist of one common share of the Company (a "Share") and one-half of one common share purchase warrant, with each whole warrant entitling the holder thereof to purchase one Share at an exercise price of C$0.10 for 24 months following the date of issuance, subject to customary adjustment provisions. The Amended Offering Document with the updated disclosure respecting the Owl Creek Project can be accessed under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.beyondlithium.ca. Prospective investors should read the Amended Offering Document before making an investment decision.

The Units to be issued under the Amended Offering will be offered to purchasers pursuant to the listed issuer financing exemption (the "LIFE" or "LIFE Exemption") under Part 5A.2 of National Instrument 45-106 - Prospectus Exemptions in all provinces of Canada, except Quebec. The Units offered under the LIFE Exemption will not be subject to resale restrictions pursuant to applicable Canadian securities laws.

The Company plans to use the net proceeds from the Amended Offering for general working capital purposes, mineral property exploration activities and expenditures, marketing and advertising, and as otherwise described in the Amended Offering Document. The Amended Offering is scheduled to close on or about August 29, 2025, and is subject to certain conditions customary for transactions of this nature, including, but not limited to, the listing of the Shares issued and issuable under the Amended Offering on the Canadian Securities Exchange. Closing of the initial tranche of the Amended Offering is subject to the condition that the Company raise a minimum of C$150,000.

The Company may pay finders' fees in connection with the Offering in cash, shares, warrants or a combination thereof.

The offered securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

Qualified Person and Third-Party Data

The scientific and technical information in this news release has been reviewed and approved by Lawrence Tsang, P.Geo., VP Exploration of the Company. Lawrence Tsang is a "qualified person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The potential grades of exploration targets disclosed in this news release are conceptual in nature. There has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

About Beyond Lithium Inc.

Beyond Lithium Inc. is a critical minerals exploration company with the Ear Falls spodumene-bearing pegmatite exploration project in Ontario and two exploration projects in British Columbia exploring for rare earths and base metals. Beyond Lithium is advancing the projects with its exploration team. The Company will continue to seek to stake, to acquire, or to option other properties to expand the Company's portfolio. Also, Beyond will seek for potential joint ventures partner on projects as it is a source of non-dilutive working capital through partner-funded exploration and long-term residual exposure to exploration success.

Please follow @BeyondLithium on Twitter, Facebook, LinkedIn, Instagram and YouTube.

For more information, please refer to the Company's website at www.beyondLithium.ca.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, anticipated content, commencement, and cost of exploration programs in respect of the Company's projects and mineral properties, anticipated exploration program results from exploration activities, resources and/or reserves on the Company's projects and mineral properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking information. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward-looking information can be identified by words such as "pro forma", "plans", "expects", "will", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In stating the forward-looking information in this news release, the Company has applied several material assumptions, including without limitation, that market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration of the Company's properties, the availability of financing on suitable terms, and the Company's ability to comply with environmental, health and safety laws.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the statements of forward-looking information. Such risks and other factors include, among others, statements as to the anticipated business plans and timing of future activities of the Company, the proposed expenditures for exploration work on its properties, the ability of the Company to obtain sufficient financing to fund its business activities and plans, delays in obtaining governmental and regulatory approvals (including of the Canadian Securities Exchange), permits or financing, changes in laws, regulations and policies affecting mining operations, risks relating to epidemics or pandemics such as COVID-19, the Company's limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading "Risk Factors" in the Company's prospectus dated February 23, 2022 and other filings of the Company with the Canadian securities regulatory authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward-looking information. The Company undertakes no obligation to update any of the forward-looking information in this news release except as otherwise required by law.

For further information, please contact:

Allan Frame

President and CEO

Tel: 403-470-8450

Email: allan.frame@beyondLithium.ca

Jason Frame

Manager of Communications

Tel: 587-225-2599

Email: jason.frame@beyondLithium.ca

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262141