Bayhorse Silver Inc, (TSXV: BHS) (OTCQB: BHSIF) (FSE: 7KXN) (the "Company" or "Bayhorse") is pleased to announce the IP Survey results over its Bayhorse Silver Mine Property, Oregon, USA, that commenced in October 2025 and was completed in January 2026. These results will better guide both the surface and underground drilling programs as previously outlined in BHS2026-02.

Bayhorse CEO Graeme O'Neill, who along with the Company's Directors, will be attending the upcoming Vancouver Resource Investment Conference and the Cordilleran Roundup, comments, "We are very encouraged to have received the results of the IP survey undertaken at the Bayhorse Mine. The IP results, specifically the low resistivity areas in blue, that in the Bayhorse coincide with known mineralization, has significantly expanded the known mineralized zones and provided more drill targets over a wider area that will better guide both our surface our underground drilling programs that will commence shortly. The objective of these programs is to further refine our understanding of the extent, structure and mineralization of the Bayhorse Silver endowment and to increase inferred ounces to our National Instrument 43-101 Mineral Resource Estimate of 292,300 tons at a grade of 21.65 opt (673 g/t) for 6.3 million ounces of silver. (Turner et al. 2018) and to determine whether inferred ounces can be brought to an indicated category."

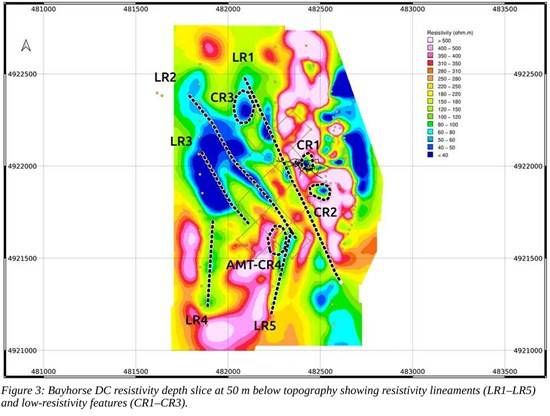

The IP low resistivity depth slice shown in Figure 1 lies 50 m (165 ft) below the surface and encompasses an area of over 914 m (3,000 ft) from east to west. The top of the Goldilocks zone in the extreme west of the main historic workings that were developed in 1984, lies at least 46 m (150 ft) below the IP depth slice shown in Figure 1 indicating a minimum110 m (350 foot) vertical mineralized extent, with the now enlarged zone extending a minimum 1,000 m (3,280 ft) from north to south.

Five prominent resistivity lineaments (LR1-LR5) (dotted black lines) are identified, including three trending NNW and two trending NNE to near north-south. When overlain with interpreted geology these lineaments show spatial correspondence with mapped faults (mineralized Sunshine, Railroad faults etc) and lithological contacts.

Figure 1.Bayhorse DC resistivity depth slice at 50 m below topography showing resistivity lineaments (LR1-LR5) and low-resistivity features (CR1-CR3).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/281091_c120ce5474b61829_001full.jpg

Three localized low-resistivity features CR1, CR2 and CR3 have been identified adjacent to lineament LR1. These features are laterally confined and exhibit limited vertical extent. The upper portion of CR1 coincides with the underground mine adits and workings and forms a sub-vertical feature dipping north. CR2 lies approximately 200 m southeast of CR1 and is smaller in size. Both CR1 and CR2 occur beneath a shallow resistive (pink) layer. CR3, located near the northwestern end of LR1, is elongated north-south and dips slightly west; its geometry is less well constrained due to proximity to the grid edge.

The IP results also indicate that the surface drill targets outlined by prior IP results (BHS2025-05). immediately to the east of the NI 43-101 compliant inferred resource appears to be far more extensive than initially believed. These targets lie under the Mine access road and extend from 73 m (240 ft) east of and up 130 m (426 ft) north of the inferred resource. One of these targets was intersected by groundwater test well MW2 at a depth of between 22 m and 33.5 m (72 -110 ft) from surface with a 3 m (10 ft) intersection of 1.5 m (5 ft) grading an average of 1104 g/t (35.46 opt) silver and 1.5 m (5 ft) averaging 770 g/t (23.12 opt) silver. This intersection lies at an elevation of 667 m (2190 ft) above sea level ("ASL") and 91 m (300 ft) NE and 60 m (200 ft) lower than the historic, mined, Sunshine Stope at an elevation of 728 m (2390 ft) ASL.

This News Release has been prepared on behalf of the Bayhorse Silver Inc. Board of Directors, which accepts full responsibility for its content. Mark Abrams, AIPG, a Qualified Person and Director of the Company has prepared, supervised the preparation of, or approved the technical content of this news release.

On Behalf of the Board.

Graeme O'Neill, CEO

866-399-6539, 604-684-3394

About Bayhorse Silver Inc.

Bayhorse Silver Inc. is an exploration and production company with a 100% interest in the historic Bayhorse Silver Mine located in Oregon, USA with a National Instrument 43-101 inferred resource of 292,300 tons at a grade of 21.65 opt (673 g/t) for 6.3 million ounces of silver. (Turner et al. 2018) and the Pegasus Project, in Washington County, Idaho. The Bayhorse Silver Mine and the Pegasus Project are 44 km southwest of Hercules Metals' porphyry copper discovery. The Bayhorse Mine is a minimum environmental impact facility capable of processing at a mining rate up 200 tons/day that includes a state of the art 40 ton per hour Steinert Ore-Sorter that reduces waste rock entering the processing stream by up to 85%. The Company has established an up to 60 ton/day mill and standard flotation processing facility in nearby Payette County, Idaho, USA with an offtake agreement in place with Ocean Partners UK Limited. The Company has an experienced management and technical team with extensive mining expertise in both exploration and building mines.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281091