Bayhorse Silver Inc, (TSXV: BHS) (OTCQB: BHSIF) (FSE: 7KXN) ("Bayhorse" or the "Company") is pleased to report that it has renewed its silvercopper concentrate Offtake Agreement with Ocean Partners UK Ltd and increased the proposed concentrate shipping volume under the Agreement to a minimum 400 tons of silvercopper concentrate.

As the Agreement can be filled with third party material, the Company, will now source third party mineralized material for processing at its permitted 50 ton/day flotation facility in nearby Payette, Idaho. Prior testing shows the flotation silver concentrate produced from the facility (BHS2020-12) is expected to be a minimum 2 tons per day, containing up to 10% copper, 12% antimony, 18% zinc along with the silver.

Bayhorse CEO Graeme O'Neill comments that, "the Bayhorse Silver Mine is planned for an up to 200 tons/day mining rate. Depending on mined grade, the Company's KSS100 Ore-Sorter ("sorter") can upgrade the mined tonnage silver content a minimum 4 times by removing over 75% of non-mineralized waste from the mining stream to produce a preconcentrate of between 20 to 50 tons/day, for shipping to its flotation mill. There is significant amount of copper, antimony, zinc and lead mined along with the silver, plus minor amounts of gold (BHS2204-04) in the Bayhorse mineralization. A 5 kg Ore-Sorter select sample with a head grade of 985 g/t (28.8 oz/t) silver, 1.16% copper and 1.87% zinc, was derived from a 200 kg mined sample that was passed through the Ore-Sorter, that reduces the volume of lower grade mineralization by between 80% to 95%. The testing achieved flotation silver concentrate recoveries of 86.7%, resulting in a silver grade of 9,700 g/t. (BHS2020-12). The dominant mineralization at the Bayhorse mine is Tetrahedrite."

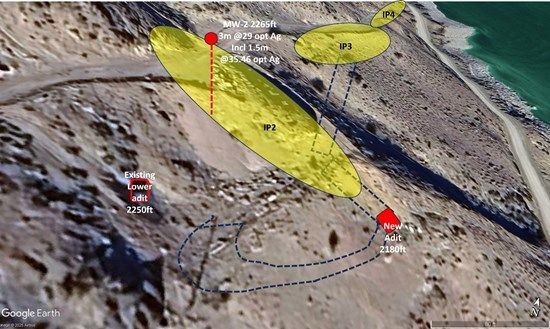

The discovery of the new, highly prospective, mineralized zones below the current workings has prompted a review of the current mine plan and permit application, to take into account access to the new mineralized zones. A new up to 65 feet long decline is planned underneath the existing mine road to intersect the approximately 140 ft long west to east zone with an estimated width of 70-80 foot and a 35 ft thickness where recent assays have shown a 3 m (10 foot intersection averaging 1103 g/t (35.46 oz/t) silver and 0.61% copper (BHS2025-16) over 1.5 m (5 ft) and 23.12 silver over 1.5m (5 ft) for an average grade of 911 g/t (29.29 opt) over 3 m (10ft).

The planned decline will then allow a decline access to two other highly prospective IP targets that extend another 76 m (250 feet) to the north of this new zone. Along with the existing underground development, the new zone(s) will permit up to three working faces to achieve the planned 200 tpd operation. The Company updates mining costs every three months by comparing it to other mines costs to ensure its mine planning can be realized.

Figure 1. New silver zone access schematic.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/264753_46f8966a241ffb64_001full.jpg

Figure 2. Steinert KSS 100 Ore-Sorter in place at the Bayhorse Silver Mine.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/264753_46f8966a241ffb64_002full.jpg

Cautionary statement

The Company is not basing any decision to produce on a feasibility study of mineral reserves demonstrating economic and technical viability and advises there is an increased uncertainty and specific economic and technical risk of failure with any production decision. These risks include, but are not limited to, (i) a drop in price of commodities produced, namely silver, copper, lead and zinc, from the pricing used to make a production decision; (ii) failure of grades of the produced material to fall within the parameters used to make the production decision; (iii) an increase in mining costs due to changes within the mine during development and mining procedures; and (iv) metallurgical recovery changes that cannot be anticipated at the time of production.

All statements herein, other than statements of historical fact, including, without limitation, plans for and intentions with respect to the Company's capitalization, preparation of technical reports, proposed work programs, budgets and proposed expenditures, permitting, construction and production timing are forward-looking statements. While the Company believes such statements are reasonable, no assurance can be given that any expectations will prove to be correct and the forward-looking statements are not guarantees of future results or performance and that actual results may differ materially from those in the forward-looking statements. Readers should not place undue reliance upon forward-looking statements and except as required under applicable securities law, the Company undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or others. All forward-looking statements and information herein are qualified by this cautionary statement

This News Release has been prepared on behalf of the Bayhorse Silver Inc. Board of Directors, which accepts full responsibility for its content. Mark Abrams, AIPG, a Qualified Person, and a Director of the Company, has prepared, supervised the preparation of, or approved the technical content of this news release.

On Behalf of the Board.

Graeme O'Neill, CEO

866-399-6539

About Bayhorse Silver Inc.

Bayhorse Silver Inc. is an exploration and production company with a 100% interest in the historic Bayhorse Silver Mine located in Oregon, USA with a National Instrument 43-101 inferred resource of 292,300 tons at a grade of 21.65 opt (673 g/t) for 6.3 million ounces of silver) (Turner et al. 2018) and the Pegasus Project, in Washington County, Idaho. The Bayhorse Silver Mine and the Pegasus Project are 44 km southwest of Hercules Metals' porphyry copper discovery. The Bayhorse Mine is a minimum environmental impact facility capable of processing at a mining rate up 200 tons/day that includes a state of the art 40 ton per hour Steinert Ore-Sorter that reduces waste rock entering the processing stream by up to 85%. The Company has established an up to 60 ton/day mill and standard flotation processing facility in nearby Payette County, Idaho, USA. The Company has an experienced management and technical team with extensive mining expertise in both exploration and building mines.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264753