October 30, 2024

Basin Energy Limited (ASX:BSN) (‘Basin’ or the ‘Company’) is pleased to provide an overview of activities for the period ending 30 September 2024 (‘Quarter’, ‘Reporting Period’) and an accompanying Appendix 5B.

Key Highlights

- Elevated uranium and extensive alteration identified at Preston Creek from phase 2 drilling at the Geikie project

- Significant unconformity uranium target identified through ground EM at the 100% Basin owned Marshall Project

- Continued engagement and consultation with stakeholder groups culminating in the signing of an exploration agreement with The English River First Nation

- Extensive complimentary project acquisition reviews and due diligence completed, culminating in the acquisition of Normetco AS subsequent to the quarter

- U3O8 spot price1 stable in US$80/Lb - US$85/Lb range

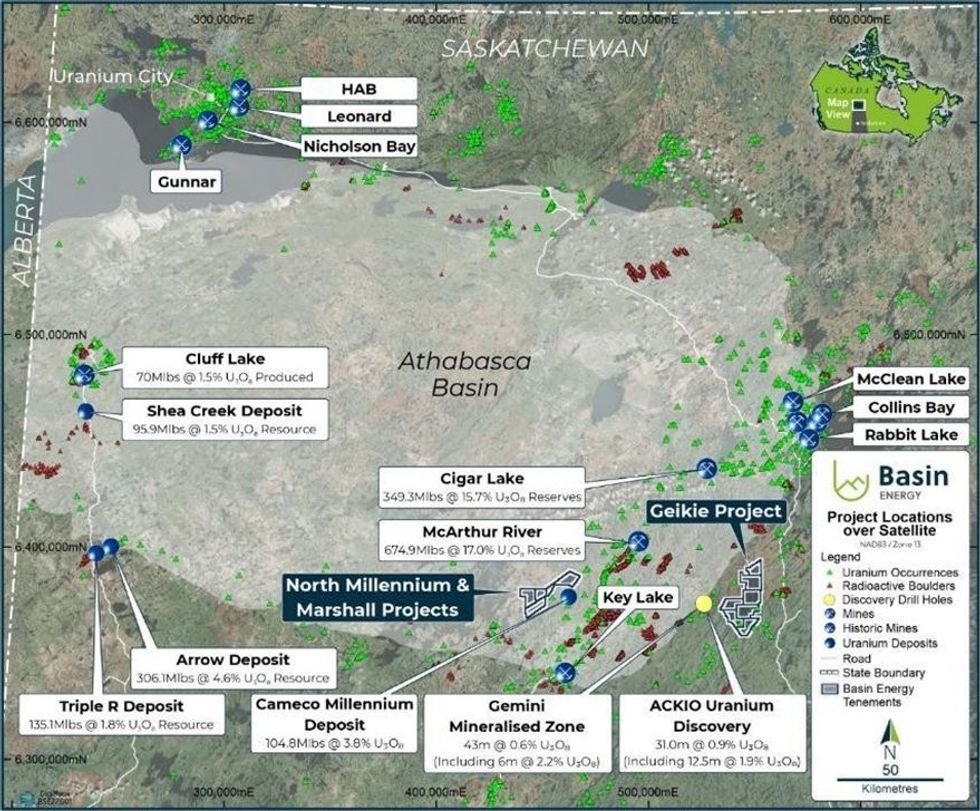

Final results from the winter exploration programs were announced for all three of the Company’s Athabasca Basin uranium projects (the ‘Projects’) (Figure 1).

Phase 2 exploration drilling at the Geikie Project (‘Geikie’) identified a 1.5km zone of alteration typical of basement-hosted mineralisation comparable to multiple world class uranium deposits. Results from the maiden ground electromagnetic surveys at the North Millennium and Marshall projects (‘North Millennium’, ‘Marshall’) were received, with significant conductive anomalies identified at Marshall, located above and below the unconformity, consistent with the regional exploration model.

Basin finalised an Exploration agreement that formalises the Company's relationship with the English River First Nation (‘ERFN’) in respect to Basin’s exploration and evaluation activities at its Marshall uranium project

The Company has spent significant time evaluating and assessing complimentary projects to supplement the existing portfolio, utilising the companies extensive inhouse exploration experience to identify opportunities that may have been recently overlooked. This has cumulated in the Company entering into a binding agreement to acquire the Normetco AS Uranium and Green Energy Metals portfolio, which occurred after the Reporting Period.2

The quarter saw the resignation of non-executive directors Peter Bird and Ben Donovan. The Company’s cash balance was $2.11 million at the end of the Reporting Period.

Basin’s Managing Director, Pete Moorhouse, commented:

“We are proud to have executed an exploration agreement with the English River First Nation, building on our existing exploration agreement with the Ya’ thi Néné, and look forward to building these relationships as our exploration campaigns mature on our exciting Athabasca Basin projects.

The company has spent extensive time assessing complimentary assets that meet our strict technical criteria for exploration merit and have a clear pathway for value addition to shareholders.

Whilst we are excited to commence assessment of early stage works on our Scandinavian acquisition, we remain committed to the Athabasca portfolio. Further drilling is required to fully test the initial discovery at Geikie, and the compelling deeper unconformity geophysical targets at Marshall. Our expenditure to date ensures that these assets are in good standing for the near-term future, ensuring that these valuable assets are safeguarded and advanced at a suitable pace.”

Figure 13: Project locations in relation to the Athabasca Basin

Click here for the Appendix 5B Cash Flow Report

Click here for the full ASX Release

This article includes content from Basin Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSN:AU

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

31 August 2025

Basin Energy

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland.

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland. Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

17 December 2025

Completes phase one drilling and expands Sybella-Barkly

Basin Energy (BSN:AU) has announced Completes phase one drilling and expands Sybella-BarklyDownload the PDF here. Keep Reading...

30 November 2025

Expands REE and Uranium Footprint at Sybella-Barkly

Basin Energy (BSN:AU) has announced Expands REE and uranium footprint at Sybella-BarklyDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00