(TheNewswire)

Vancouver, BC TheNewswire - September 7, 2022 Avrupa Minerals Ltd. (TSXV: AVU ) (OTC:AVPMF) (FRANKFURT:8AM) is pleased to announce that it has entered into an Option Agreement with Western Tethyan Resources ("WTR") for WTR to earn-in up to 85% of the Slivova Gold Project by funding and performing certain work programs to potentially advance the Slivova Project to a mining solution. WTR is a private exploration company based in London and Prishtina, Republic of Kosovo, and is 75% owned by London AIM-listed Ariana Resources.

Paul W. Kuhn, President and CEO, commented, "We are excited to begin working with Western Tethyan Resources to advance the new Slivova Gold Project. Previously we identified a NI 43-101 indicated mineral resource at Slivova of 640,000 mt @ 4.8 g/t gold and 14.68 g/t silver, or approximately 98,700 ounces of gold and 302,000 ounces of silver (1) . While the Project has been on hold since 2018, we now see a clear path for advancement at Slivova. The new 7-year exploration license is double the size of the original permit, and includes a number of new targets that may enhance the mineral inventory. WTR and Ariana Resources have a great deal of exploration experience in the greater Mediterranean Basin, and Ariana is a highly successful mine builder and operator."

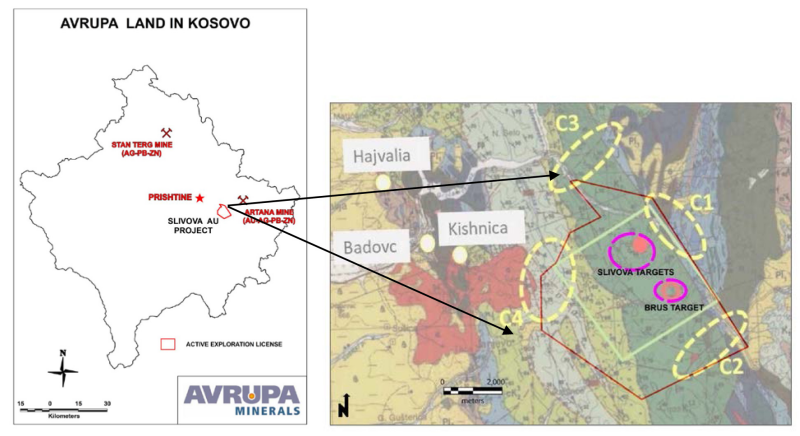

Figures 1 and 2. Maps showing location of Slivova in Kosovo, along with target areas to be upgraded. New license is shown as a red polygon. The names in northwest quadrant are historic Trepça base metal mines.

The Terms of the agreement are:

Due Diligence ("DD") Phase with exclusivity from September 1, 2022 ("Effective Date") to March 1, 2023

-

Euro 35,000 cash payment upon signing;

-

Euro 100,000 investment during DD Phase; however if WTR decides to vacate the Project before completion of 6-month DD, minimum of Euro 25,000 must be spent;

-

Euro 35,000 cash payment at the end of 6-month DD period;

-

Definitive Agreement to be completed and signed.

Earn-In Phases

-

Stage 1:

-

Euro 30,000 cash payment on September 1, 2023;

-

If WTR elects to enter the Definitive Agreement, it will invest total Euro 800,000 during first two years from the Effective Date (minimum of Euro 150,000 must be spent by September 1, 2023, post DD Phase), for exploration, drilling, baseline environmental and social surveys, landowners, etc., for 51% of the project

-

-

Stage 2: After completion of Stage 1, during the third year from the Effective Date, WTR will invest Euro 1,000,000 for NI 43-101 resource estimation, commencement of full Environmental Impact Statement ("EIS"), etc., for 75% of the project

-

Stage 3: During fourth and fifth year from the Effective Date, WTR must complete the EIS, Feasibility Study ("FS"), and Mining License application, for 85% of the project

-

Stage 4: WTR completes success payments to previous JV partner, Byrnecut International Ltd. ("BIL"):

Cash

-

Euro 125,000 within 30 days of the first to occur:

-

Completion of a positive FS (minimum 15% IRR)

-

Avrupa or related party making a decision to proceed with development of a mining operation within the license area

-

-

Euro 125,000 within 30 days of issuance of a mining license for the Slivova Project, and

-

Euro 125,000 within 30 days of commencement of mine construction within the license area.

Gold

-

100 troy ounces within 30 days of commencement of commercial production ("CCP");

-

175 troy ounces within 30 days of the first-year anniversary of CCP;

-

250 troy ounces within 30 days of the second-year anniversary of CCP;

-

325 troy ounces within 30 days of the third-year anniversary of CCP.

-

Stage 5: Avrupa participates in the mine build or dilutes to 1% NSR.

Western Tethyan Resources (WTR) is a UK-registered, mineral exploration and development company focused on South East Europe. The company has a strategic alliance with Newmont Corporation and Ariana Resources and is currently focused on exploration for major copper-gold deposits in the Lecce Magmatic Complex and Vardar Belt. The company is assessing several other exploration project opportunities across Eastern Europe, targeting copper-gold deposits across the porphyry-epithermal transition.

Avrupa Minerals Ltd. is a growth-oriented junior exploration and development company directed to discovery of mineral deposits, using a hybrid prospect generator business model. The Company holds one 100%-owned license in Portugal, the Alvalade VMS Project, presently optioned to Sandfire MATSA in an earn-in joint venture agreement. The Company now holds one 100%-owned exploration license covering the Slivova gold prospect in Kosovo, and is actively advancing four prospects in central Finland through the recently-announced acquisition of Akkerman Finland Oy. Avrupa focuses its project generation work in politically stable and prospective regions of Europe, presently including Portugal, Finland, and Kosovo. The Company continues to seek and develop other opportunities around Europe.

For additional information, contact Avrupa Minerals Ltd. at 1-604-687-3520 or visit our website at www.avrupaminerals.com .

On behalf of the Board,

"Paul W. Kuhn"

Paul W. Kuhn, President & Director

This news release was prepared by Company management, who take full responsibility for its content. Paul W. Kuhn, President and CEO of Avrupa Minerals, a Licensed Professional Geologist and a Registered Member of the Society of Mining Engineers, is a Qualified Person as defined by National Instrument 43-101 of the Canadian Securities Administrators. He has reviewed the technical disclosure in this release. Mr. Kuhn, the QP, has not only reviewed, but prepared and supervised the preparation or approval of the scientific and technical content in the news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2022 TheNewswire - All rights reserved.